The canadian dollar firmed on Tuesday, as investors grew risk-averse ahead of

US trade tariffs expected to be unveiled this week. Oil prices jumped on fears

Trump will impose more sanctions on Russia and Iran.

Speculators have reduced their bearish bets on the currency to the least

since October, CFTC data released on Friday showed. Loonie has been flat so far

this year after the greenback's recent rally.

New Canadian PM Carney has called a snap election for 28 April, saying he

needed a strong mandate to deal with the threat posed by Trump, who "wants to

break us so America can own us."

The comments highlighted that relations between the two countries

significantly deteriorated since Trump imposed tariffs on Canada and threatened

to annex it as the 51st state.

The country's GDP grew by 0.4% on a monthly basis in January as economic

activity continued the momentum of the last few of months. A series of rate cuts

has helped boost consumer spending and investment.

The mining, quarrying, and oil and gas extraction and manufacturing sectors

were the largest contributors to growth. The oil and gas extraction subsector

registered the biggest growth amongst them with 2.6% expansion in January.

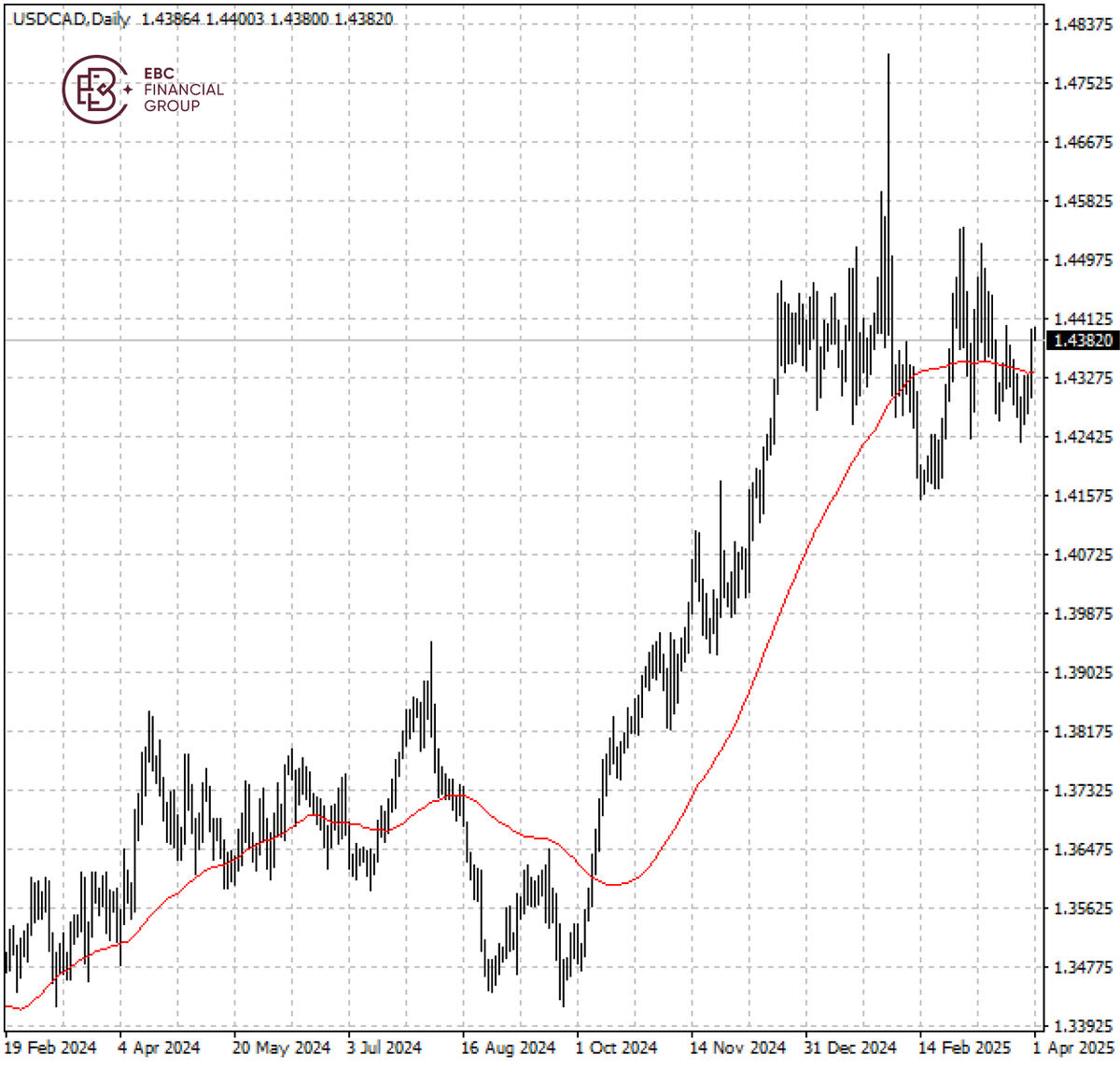

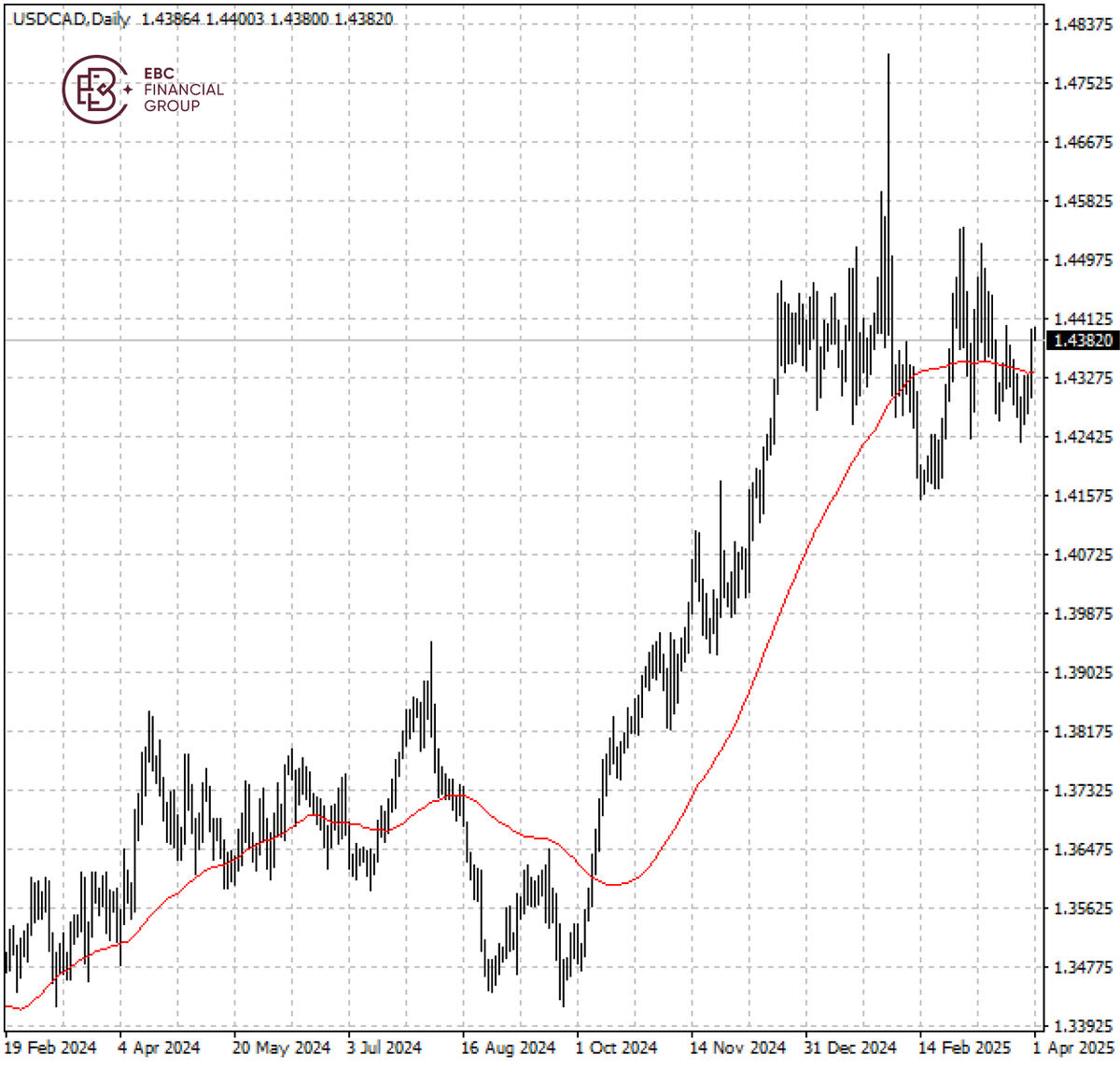

The Canadian dollar dipped below 50 SMA, but it seemed to find some support

at 1.440 per dollar hit on 20 March. If it holds above the level, a rally

towards 1.430 per dollar is likely.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.