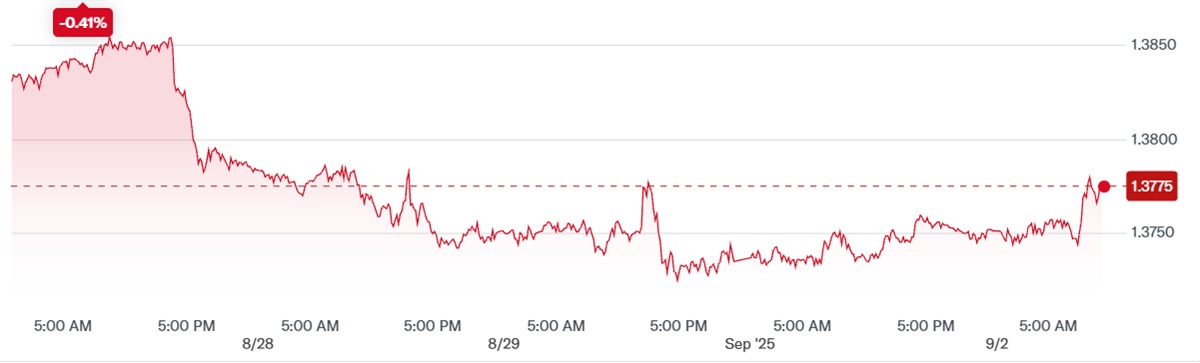

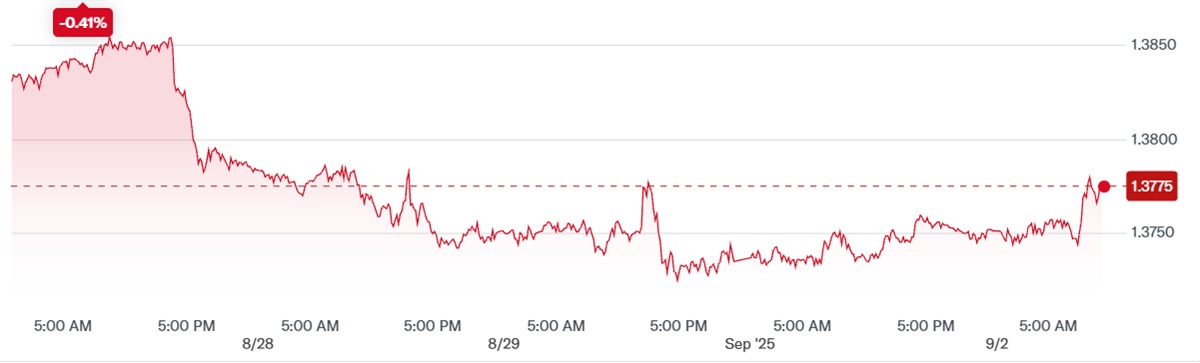

USD/CAD extended its upward trajectory on Tuesday during the Asian session, trading near 1.3750. The recent rally in the US dollar is largely driven by the July PCE price index, which confirmed persistent inflationary pressures in the United States. This has injected uncertainty into market expectations regarding a potential Fed rate cut in September.

Investors are also keeping a close eye on the upcoming August ISM Manufacturing PMI, which could influence the short-term direction of the dollar and, consequently, USD/CAD. Despite the dollar's recent strength, momentum may face limitations. According to the CME FedWatch tool, the probability of a 25-basis-point rate cut by the Federal Reserve in September has risen to 89%, up from 84% last week.

This week, several key US economic indicators—including ADP employment change, average hourly earnings, and non-farm payrolls—will be released. These figures are expected to play a decisive role in USD/CAD's short-term movement, depending on whether they indicate robust labour market performance or signal economic softness.

Canadian Dollar Under Pressure

On the Canadian side, economic data has been weaker than expected. Statistics Canada reported that real GDP fell by 0.4% quarter-on-quarter in Q2. with weak exports and sluggish business investment being the main contributors.

Trade tensions between the US and Canada, alongside the lingering impact of US tariffs, continue to weigh on economic growth. These factors have led the market to anticipate that the Bank of Canada might ease monetary policy in the near term, providing support for the USD/CAD pair.

From an analytical standpoint, USD/CAD is currently supported by a combination of US inflation pressures and Canadian economic slowdown. In the short term, strong US employment data could further lift the dollar, pushing USD/CAD higher. Conversely, weaker data could intensify rate cut expectations, limiting upward momentum and keeping USD/CAD oscillating within the 1.3700–1.3800 range. Traders should closely monitor Fed policy signals and Canadian economic releases to anticipate future volatility.

Global Risks Add Pressure

The US dollar also faces headwinds from escalating US-China trade tensions, which have renewed concerns about global economic slowdown. Recently, China's Ministry of Finance announced a sharp increase in tariffs on US goods, raising them from 84% to 125%, following President Trump's earlier move to hike tariffs to 145%.

Additional economic data has heightened market caution. The University of Michigan Consumer Sentiment Index fell to 50.8 in April, while one-year inflation expectations surged to 6.7%. Meanwhile, the US Producer Price Index (PPI) rose 2.7% year-on-year in March, down from 3.2% in February, with core inflation falling to 3.3%. Initial jobless claims increased slightly to 223.000. although continuing claims declined to 1.85 million, highlighting the complexity of the US labour market.

Minneapolis Fed President Neel Kashkari noted the economic impact of trade tensions as "the largest confidence shock I've seen in my 10 years at the Fed, apart from the initial COVID outbreak in March 2020." He emphasised that the economic consequences largely depend on how quickly trade disputes are resolved.

Although a 90-day trade truce offers some hope for renegotiation, broad concerns over the US economic outlook have prompted capital flows towards Canada, strengthening the Canadian dollar.

However, Canada's status as a major oil exporter ties the CAD to commodity markets. Weak crude prices, with WTI trading around $60.70 per barrel, may constrain the Canadian dollar, as fears of a slowing global economy could reduce fuel demand.

Conclusion

USD/CAD is currently navigating a landscape shaped by US inflation pressures, Canadian economic weakness, and global trade uncertainties. Short-term movements are likely to be influenced by upcoming US employment data, Fed policy developments, and Canadian economic releases. While the dollar retains support from strong inflation data, global trade tensions and subdued oil prices may temper its upward momentum, keeping USD/CAD trading within a cautious range.

Traders and investors should remain vigilant, as USD/CAD reflects a delicate balance between macroeconomic indicators, monetary policy expectations, and geopolitical developments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.