The recent decline in UnitedHealth’s stock is not a typical post-earnings fluctuation. Instead, it reflects a market reassessment based on the company’s decision to reduce certain business segments to safeguard profitability amid increasingly challenging reimbursement and medical cost conditions. The stock recently traded near $283, representing a single-day decrease of approximately 20%, a magnitude sufficient to alter market positioning, volatility, and short-term technical dynamics.

A critical consideration for UnitedHealth is distinguishing between surface-level perceptions and underlying operational changes. While revenue is projected to decline in 2026, both earnings and margins are forecasted to improve. This scenario suggests that management is prioritizing higher-quality, higher-margin membership and enforcing stricter pricing discipline. The investment thesis now centers on execution and policy risk rather than headline growth.

UNH stock key takeaways after the drop

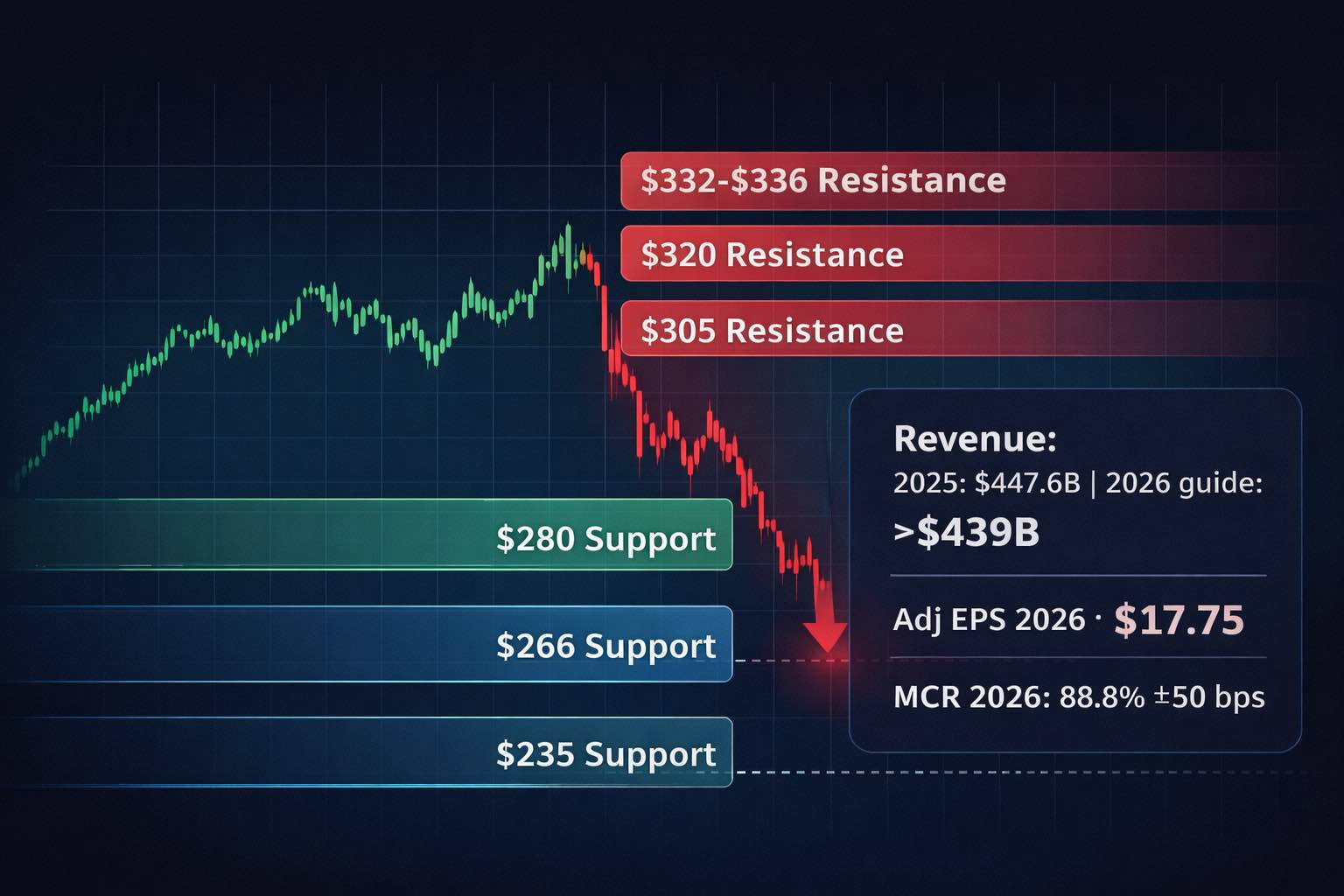

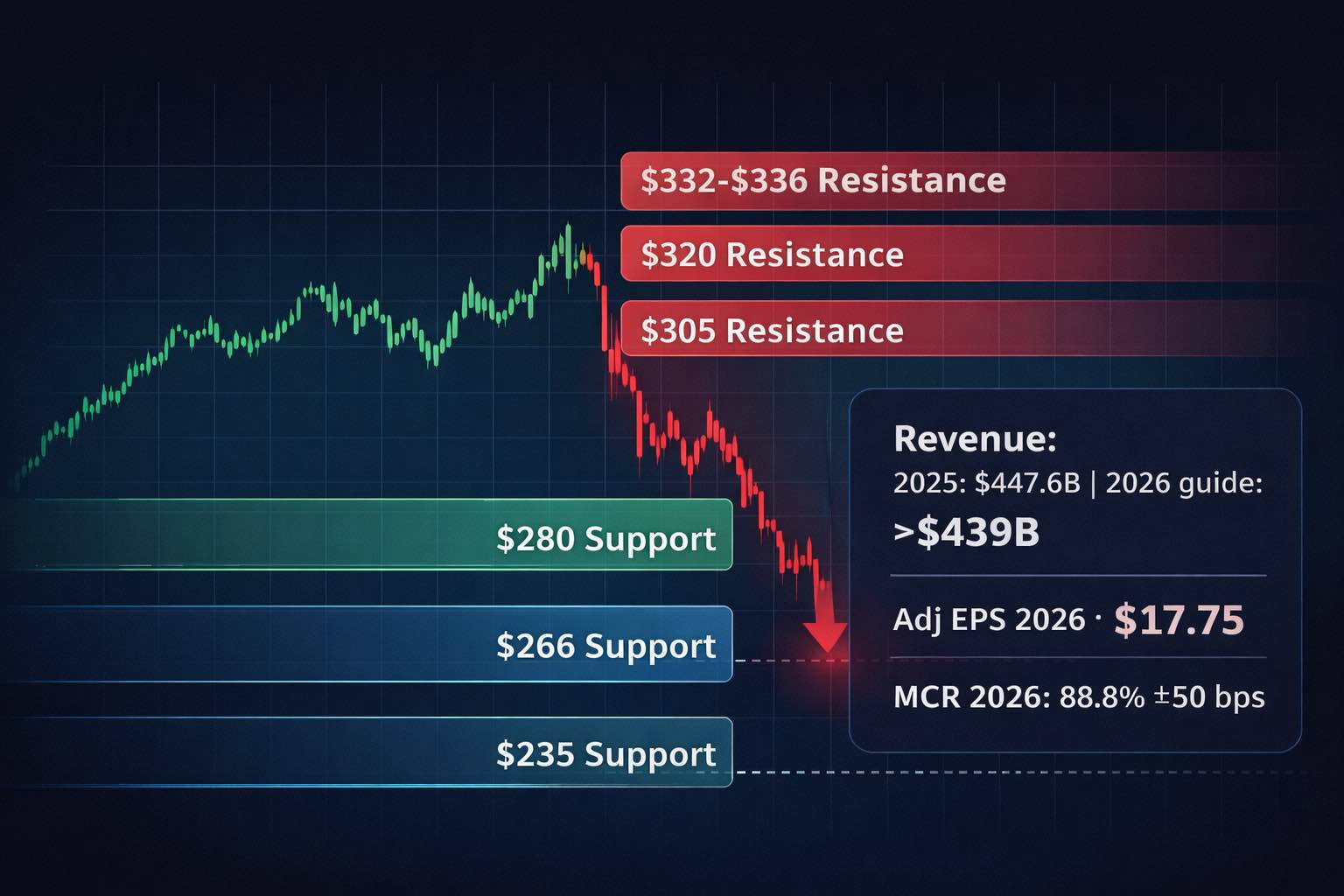

UnitedHealth is intentionally shifting toward a "quality over quantity" strategy. The company has projected 2026 revenue above $439.0 billion, indicating a 2% year-over-year decline attributed to "right-sizing," while also guiding for adjusted EPS above $17.75 and increased operating earnings.

Margin improvement is central to the company’s strategy. UnitedHealth anticipates a net margin of approximately 3.6% in 2026, up from 2.7% in 2025, and projects a medical care ratio (MCR) of 88.8% ± 50 basis points, a slight improvement over the 89.1% reported for 2025.

Membership contraction is a significant aspect of the company’s outlook. For 2026, UnitedHealth projects serving 46.9 to 47.5 million individuals, a decrease from 49.8 million in 2025, with Medicare Advantage membership expected to decline by approximately 1.3 to 1.4 million.

Policy challenges are both immediate and substantial. The Centers for Medicare & Medicaid Services (CMS) has proposed a 0.09% net average year-over-year payment increase for Medicare Advantage in calendar year 2027, if finalized, along with risk-adjustment modifications that could adversely affect plan economics.

Technical analysis now centers on mitigating further losses. The recent gap-style decline raises questions about whether UnitedHealth can maintain stability above long-term support levels near the previous 52-week low, or if continued selling will result in a more pronounced retracement.

What triggered the UnitedHealth stock selloff

The catalyst is straightforward: the company set expectations for lower revenue in 2026 while describing a broad operational reset. Full-year 2025 revenue was $447.6 billion (+12% year-over-year), but 2026 revenue is guided to above $439.0 billion, explicitly reflecting planned right-sizing.

At the same time, the company highlighted the financial clean-up already embedded in 2025 results. A fourth-quarter charge of $1.6 billion net of taxes (or $1.78 per share) captured restructuring, divestitures, and cyberattack-related impacts, with final cyberattack costs of $799 million included in the breakdown.

The market’s response is logical and reflects a fundamental shift in UnitedHealth’s growth narrative. Historically, the company was valued for its ability to simultaneously expand enrollment, revenue, and earnings. The projected revenue decline now compels investors to adopt a more utility-like perspective, in which near-term stability depends on pricing discipline, management of medical cost trends, and regulatory considerations rather than sheer scale.

Fundamental analysis: the real story is the medical cost curve

2025 showed cost pressure, not demand weakness

UnitedHealth continued to grow, but its cost structure shifted. The company’s adjusted medical care ratio was 88.9% in 2025, up from 85.5% in 2024, a material deterioration that signals higher utilization and/or less favorable pricing versus claims.

This dynamic represents the core economic challenge for managed care organizations. While premium revenue is predominantly contracted and regulated, medical costs remain susceptible to healthcare inflation, utilization rates, provider pricing, and coding practices. When medical cost trends accelerate faster than pricing adjustments, margins are compressed rapidly.

2026 is guided as a margin-rebuild year

Management is effectively telling investors that it can reprice and reconfigure the balance sheet quickly enough to improve profitability even as revenue declines. For 2026, the company guides:

Medical care ratio: 88.8% ± 50 bps

Operating cost ratio: 12.8% ± 50 bps

Cash flow from operations: above $18.0 billion

Dividends paid (at current rate): about $8.0 billion

Share repurchase: about $2.5 billion

This combination is significant for investors, as it positions UnitedHealth as a cash-generative entity focused on underwriting cycles rather than solely on growth.

UnitedHealthcare is shrinking risk, Optum must re-accelerate profit

UnitedHealthcare served 49.8 million people in 2025 and generated $344.9 billion of revenue (+16%). But earnings from operations were $9.4 billion, down from $15.6 billion in 2024, and operating margin fell to 2.7% from 5.2%.

Optum increased revenue to $270.6 billion (+7%) in 2025, but the internal mix was significant. Optum Health reported a sharp earnings swing (reported operating earnings negative in 2025, with “adjusted” figures notably higher), while Optum Rx expanded revenue and delivered higher operating earnings.

A distinctive aspect of UnitedHealth’s current strategy is the effort to realign its business segments. UnitedHealthcare is now managed with an emphasis on underwriting quality and margin improvement, while Optum is expected to assume a greater share of earnings growth as the company restructures operations and prioritizes value-based care integration.

Policy and macro backdrop: why Medicare Advantage math is tightening

The policy setup is now more restrictive. CMS’s CY 2027 Advance Notice projects a 0.09% net average payment increase (if finalized), and highlights risk model and diagnosis-source changes that can reduce risk-score tailwinds across the industry.

From an economist’s perspective, this matters for two reasons:

Healthcare inflation is sticky. Provider wages, drug mix, and elective/outpatient intensity tend to re-accelerate after periods of deferred care. That pushes medical trend higher, especially in senior populations where utilization elasticity is low.

Regulated revenue lags cost reality. Medicare Advantage benchmarks and risk adjustment update on administrative timelines. If medical costs rise faster than the pricing model allows, plans must respond by narrowing benefits, exiting counties, or shrinking membership.

The projected contraction in UnitedHealth’s Medicare Advantage membership appears to be a strategic capital allocation decision rather than a retreat. If marginal members are unprofitable in the current reimbursement and cost trend environment, reducing membership may be the most efficient way to restore acceptable returns.

Valuation and balance sheet: what the market is pricing

At roughly $283, UNH is trading at a multiple that implies investors no longer trust a smooth earnings path. Using the company’s 2026 adjusted EPS guide above $17.75, the stock is around 16x that forward earnings floor, before any premium for execution upside.

The balance sheet posture appears managed rather than stressed. The company reported $19.7 billion in 2025 operating cash flow and continues to target a 40% long-term debt-to-capital ratio, with expectations of reaching that level in 2026.

For long-term investors, the combination of a margin-rebuilding strategy, consistent cash generation, and an ongoing capital return program provides a foundation for stability, even if headline revenue remains flat or declines.

Technical analysis: UNH stock key support and resistance levels

The recent selloff has likely established a new technical environment. The primary objective is to determine the point at which selling pressure subsides, and value-oriented investors are prepared to absorb available shares.

Key support zones

$280 area (psychological support): The stock is currently trying to stabilize around this zone.

$266 to $267 (intermediate support): This region aligns with widely tracked technical thresholds near prior moving-average cross levels.

$235 to $235.6 (major support): The 52-week low is $234.60, a natural reference point for longer-term buyers. A clean break below it would signal the market is pricing a deeper earnings-risk cycle.

Key resistance zones

$305 area: Prior 13-week low zones often flip from support into resistance after a breakdown.

$320 area: A prior one-month low area that can act as a magnet if the bounce is orderly, but also as supply if trapped holders sell rallies.

$332 to $336 (moving-average band): Pre-drop 50-day and 200-day averages were clustered in the low-to-mid $330s, and that zone is likely to cap rebounds until fundamentals re-earn confidence.

From a technical perspective, the most favorable scenario would involve the stock establishing a base above the mid-$260s, followed by a recovery into the low-$300s accompanied by increased trading volume and reduced volatility. A less favorable scenario would be a brief rebound that fails to surpass $305 and subsequently retests lower support levels.

Scenario framework for what’s next

Base case: UNH forms a volatile base between the high-$260s and low-$300s while investors wait for evidence that medical trend is normalizing and membership actions are stabilizing margins.

Bull case: Pricing discipline and operating execution deliver MCR improvement toward guidance, Optum profitability rebuilds, and the stock reclaims moving-average resistance in the low-$330s.

Bear case: Medical trend re-accelerates, or policy changes bite harder than expected, forcing additional membership exits and keeping the stock pinned near its 52-week low.

Key UNH fundamentals at a glance

| Metric |

2024 |

2025 |

2026 outlook |

| Revenue (US$ bn) |

400.3 |

447.6 |

>439.0 |

| Diluted EPS (US$) |

15.51 |

13.23 |

>17.10 |

| Adjusted EPS (US$) |

27.66* |

16.35 |

>17.75 |

| Net margin (attributable) |

3.6% |

2.7% |

~3.6% |

| Medical care ratio |

n/a |

89.1% |

88.8% ± 50 bps |

| Adjusted medical care ratio |

n/a |

88.9% |

88.8% ± 50 bps |

| Adjusted operating cost ratio |

12.9% |

12.9% |

12.8% ± 50 bps |

| Cash flow from operations (US$ bn) |

n/a |

19.7 |

>18.0 |

| Debt to total capital |

43.9% |

43.9% |

targeting 40.0% |

FAQ

Why did UnitedHealth stock drop so sharply?

UNH sold off after the company guided to a 2026 revenue decline tied to right-sizing, even as it guided higher earnings and margin improvement. The move signals a strategic shift away from low-margin membership and forces investors to reprice the growth narrative.

What is the most important fundamental metric to watch now?

The medical care ratio. It rose meaningfully in 2025, and management’s 2026 outlook depends on modest improvement through repricing and disciplined underwriting. If the medical trend runs hotter than expected, earnings durability becomes the central risk.

How do Medicare Advantage rates affect UNH stock?

Medicare Advantage profitability depends on how reimbursements and risk adjustment translate into per-member revenue versus actual claims. CMS’s proposed 0.09% net payment increase for CY 2027, alongside risk-model changes, can tighten industry margins if medical costs remain elevated.

What are the key technical levels for UNH stock?

Near-term, $280 is the first stabilization zone. Below that, the mid-$260s matter, and the 52-week low around $234.60 is the major downside reference. On rebounds, the low-$300s and then the low-$330s are likely resistance zones.

Is UNH still fundamentally strong despite the selloff?

The company remains a large, cash-generative platform, with guided 2026 operating cash flow projected at above $18.0 billion and ongoing dividends and share repurchases. The debate is not on scale. The question is whether margins can be rebuilt reliably under tighter reimbursement and higher medical costs.

Conclusion

The decline in UnitedHealth’s share price should be interpreted as a recalibration of expectations rather than a failure of the business model. The company is intentionally prioritizing profitability over revenue by reducing riskier or less attractive membership, enforcing stricter pricing discipline, and focusing on margin enhancement. The near-term trajectory of the share price will depend on whether medical cost trends align with guidance and how Medicare Advantage policy develops as rates are finalized.

For investors and traders, the roadmap is clear. Fundamentally, watch the medical care ratio and segment-level margin cadence. Technically, watch whether UNH can hold the high-$260s and reclaim the low-$300s as the structure improves. If it can, the selloff can mature into a base. If it cannot, the 52-week low region becomes the next battleground.

Sources:

https://www.unitedhealthgroup.com/content/dam/UHG/PDF/investors/2025/unh-reports-2025-results-and-issues-2026-outlook.pdf