World shares edged higher on Tuesday as investors mulled whether a recent

rally in stocks has legs to run further.

Treasury yields drifted higher as traders pared bets that U.S. rate cuts are

on the horizon given sticky price pressures. The dollar ticked up and gold

prices traded in a tight range in wait-and-see mode.

Oil eased about 1% as worries that sluggish global economic growth could

reduce energy demand outweighed saudi arabia's pledge to deepen output cuts.

Commodities

A stronger dollar can weigh on oil demand by making the fuel more expensive

for holders of other currencies. The mood was further dented by data showing

German industrial orders fell unexpectedly in April.

The EIA projected U.S. crude output will rise from 11.9 million bpd in 2022

to 12.6 million bpd in 2023 and 12.8 million bpd in 2024, That compares with a

record 12.3 million bpd in 2019.

It also projected U.S. petroleum demand would rise from 20.3 million bpd in

2022 to 20.4 million bpd in 2023 and 20.7 million bpd in 2024.

The Saudi supply cut is unlikely to achieve a sustainable price increase into

the high $80s and low $90s due to weaker demand, stronger non-OPEC supply,

slower economic growth in China and potential recessions in the U.S. and Europe,

Citi analysts said in a note.

Forex

Fed funds futures traders see the Fed as likely to then resume rate

increases, with a 65% chance of an at least 25 basis-point increase in July,

according to the CME Group's FedWatch Tool.

A report showed that the U.S. services sector barely grew in May as new

orders slowed, pushing a measure of prices paid by businesses for inputs to a

three-year low.

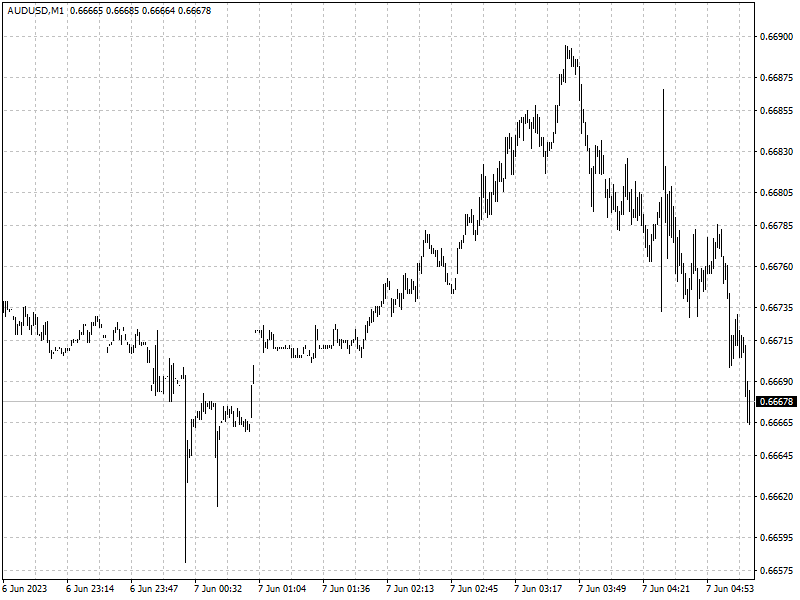

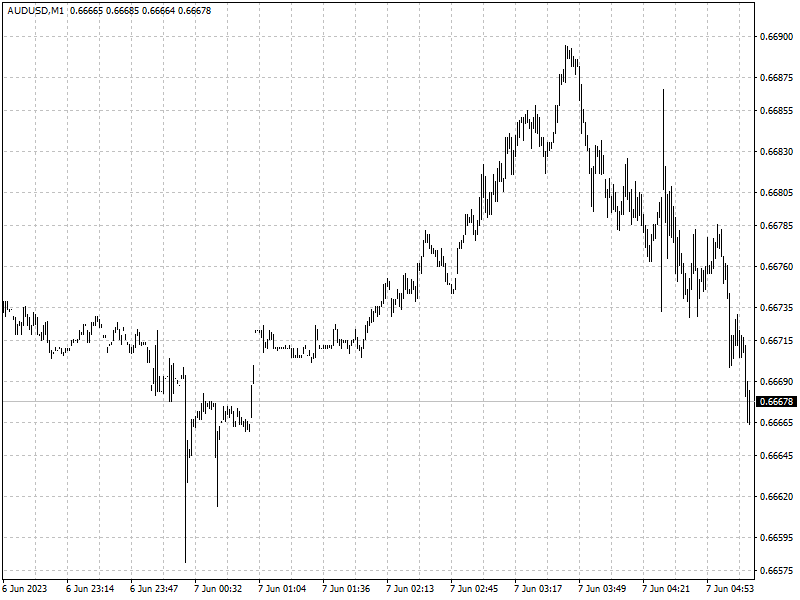

The Aussie hit its highest since mid-May after the RBA raised interest rates

by a quarter-point to an 11-year high of 4.1%, and warned that further

tightening may be required to ensure that inflation returns to target.