What is SPYG? — Fund Objective & Index Tracked

The SPDR® Portfolio S&P 500 Growth ETF (ticker: SPYG) is a low-cost exchange-traded fund designed to provide investors with exposure to large-capitalisation growth companies within the United States. It seeks to track the performance of the S&P 500® Growth Index, an index constructed by S&P Dow Jones Indices. This benchmark identifies the growth segment of the S&P 500 using factors such as sales growth, the ratio of earnings change to price, and momentum.

Launched in 2000. SPYG has become a popular choice for those who want a diversified basket of US growth stocks without picking individual companies.

How SPYG Selects Stocks — Growth Factors in Action

The S&P 500 Growth Index is not a subjective stock-picking exercise. Instead, it uses a rules-based methodology. Companies are scored on three primary growth factors:

Sales Growth: The rate at which a company's revenue is increasing.

Earnings-Change/Price Ratio: The pace of earnings improvement relative to the share price.

Momentum: The trend in a stock's price movement over time.

The index then includes the highest-scoring companies within the S&P 500. As a result, SPYG's portfolio tilts heavily toward sectors such as technology and consumer discretionary, where growth characteristics are often strongest.

Key Stats at a Glance

As of mid-2025. SPYG has:

Assets Under Management (AUM): Around $39.48 billion.

Expense Ratio: 0.04% annually — one of the lowest in its category.

Number of Holdings: Around 230 companies.

Dividend Yield: Approximately 1% (variable depending on market conditions).

Structure: Physically replicates its index (holds the actual shares, not derivatives).

Its large size and low cost make it a core holding for many long-term investors seeking US growth exposure.

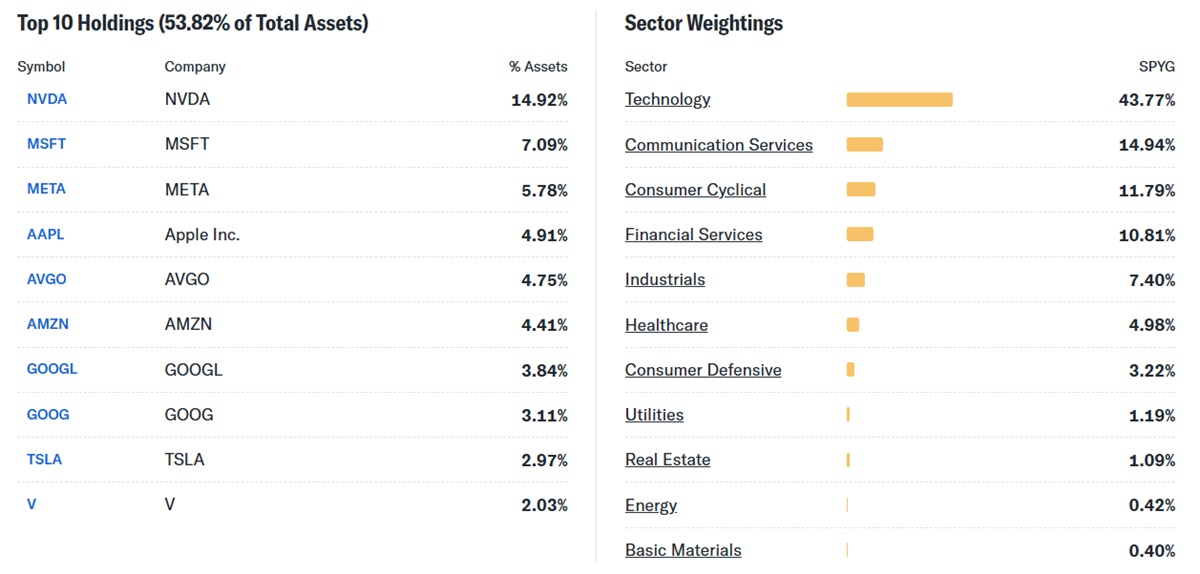

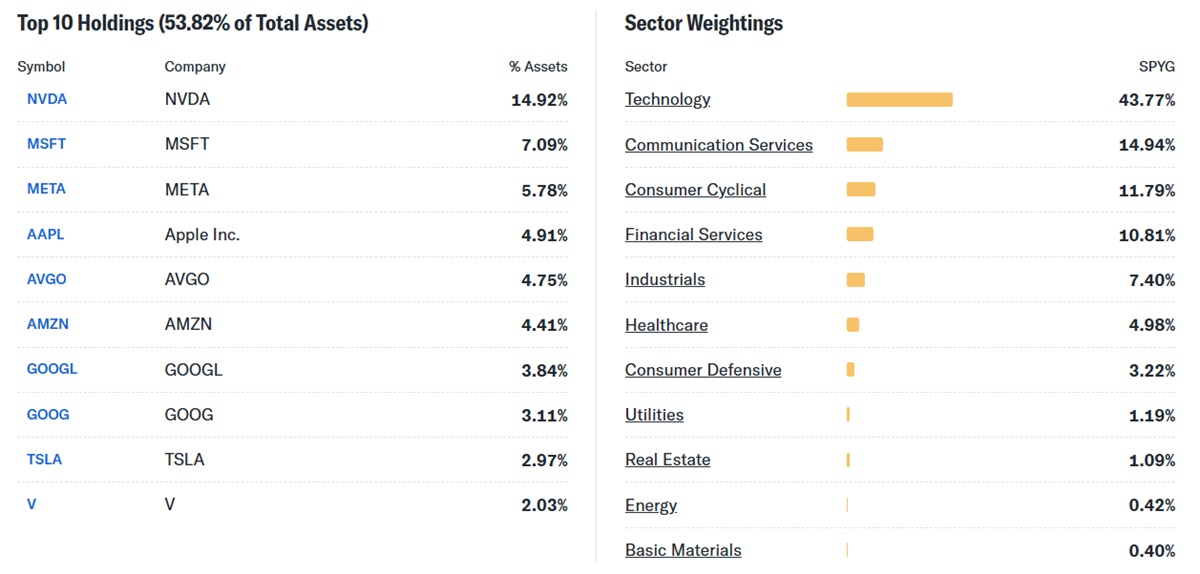

Top Holdings & Sector Allocation

SPYG is dominated by some of the world's most influential companies. Its top holdings typically include:

These top ten holdings often make up more than 50% of the ETF's total weight. Sector-wise, information technology generally leads, followed by consumer discretionary and communication services. This concentration means investors benefit from the growth potential of leading tech giants but also face sector-specific risks.

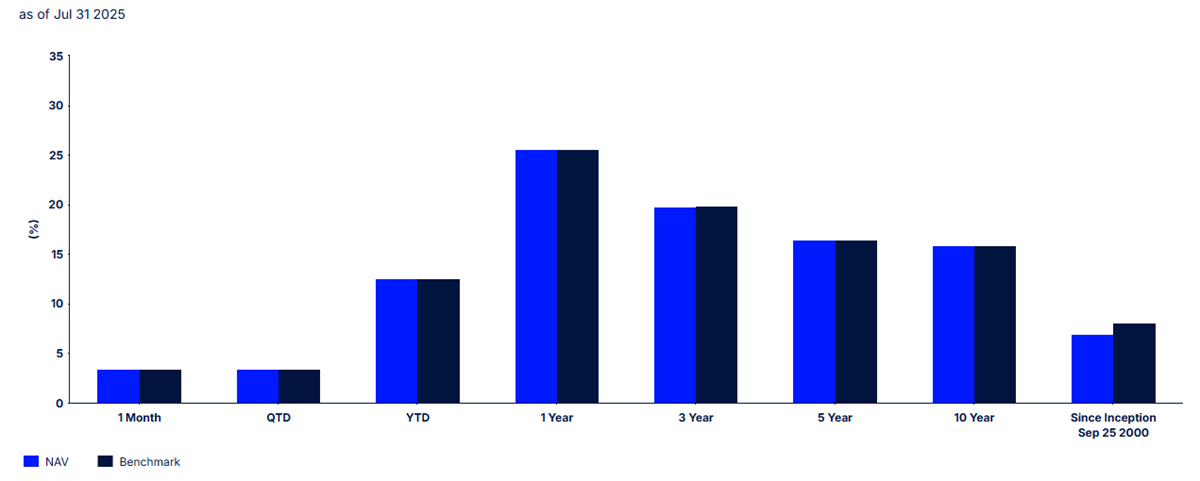

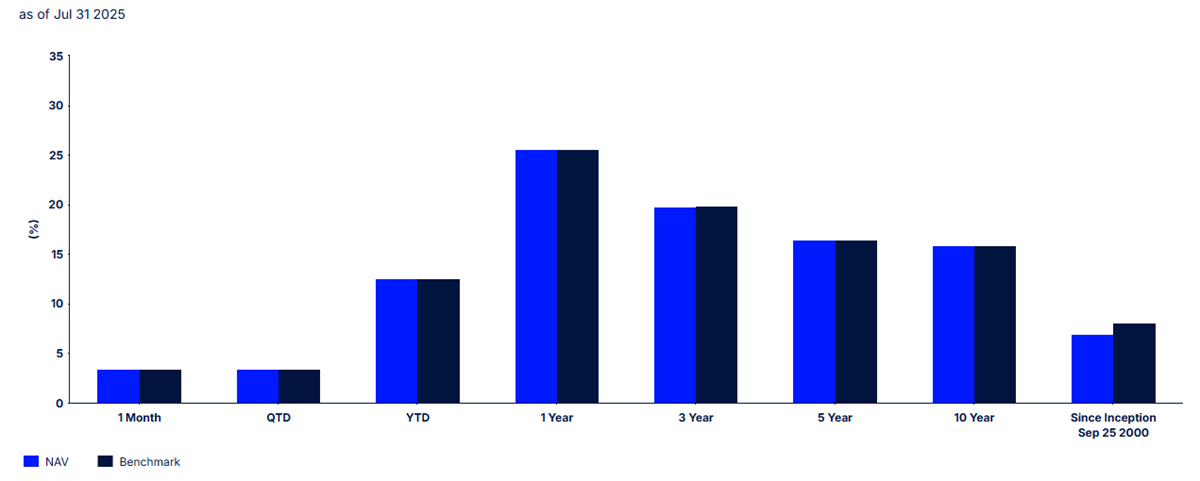

Performance History

Over the past decade, SPYG has delivered strong returns, outperforming the broader S&P 500 during periods when growth stocks have led the market. Its performance tends to be more volatile than the S&P 500. with larger drawdowns during market downturns, but greater upside during bull markets, especially in technology-driven rallies.

For example, in the 2020–2021 period, SPYG significantly outpaced value-oriented funds, but in 2022. when interest rates rose sharply, it underperformed as high-growth stocks declined.

How to Buy and Practical Tips

SPYG trades like any other stock on the NYSE Arca exchange. Investors can purchase shares through any brokerage account, either as a lump sum or via a regular investment plan.

Tips for investors and traders:

Ensure it aligns with your risk tolerance, as it is more volatile than value or blend ETFs.

Consider pairing with a value-oriented ETF to balance market styles.

Review tax considerations, especially for non-US investors who may face withholding on dividends.

Use limit orders for precise execution in volatile markets.

Conclusion

SPYG offers an efficient, low-cost route to owning a slice of America's largest and fastest-growing companies. For long-term investors with a growth bias, it can serve as either a core equity holding or a satellite position to complement a diversified portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.