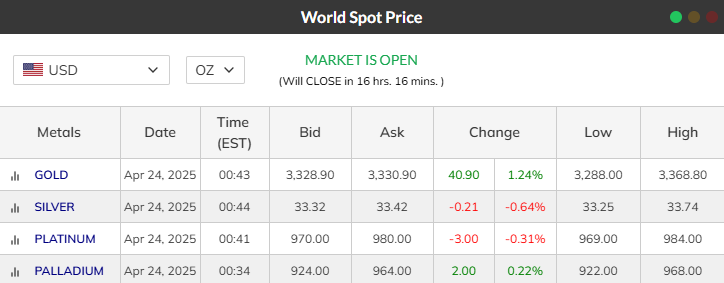

As we progress through 2025, silver has garnered significant attention from investors and analysts alike. As of April 2025, silver is trading at around $32.70 per ounce, reflecting a 15% increase year-to-date.

With its dual role as an industrial metal and a store of value, silver's price movements are influenced by many factors. This article delves into the current state of the silver market, the key drivers affecting its price, and forecasts for the remainder of 2025 and beyond.

Current Silver Market Overview

In early 2025, silver prices have shown notable strength. Starting the year at approximately $29.29 per ounce, silver has climbed to around $32.75, marking a 12% increase. This upward trajectory is attributed to several factors, including heightened demand from industrial sectors and investor interest amid economic uncertainties.

Notably, silver reached a peak of $33.41 per ounce, its highest level since late October of the previous year, and is poised to challenge a 10-year peak near $35. This surge aligns with gold's bullish run, as both metals often move in tandem due to their safe-haven appeal.

Technical analysis indicates that silver will hover between immediate support at $32.34 and resistance at $33.12, suggesting a potential breakout in either direction.

Key Drivers Influencing Silver Prices in 2025

1) Industrial Demand

Silver's extensive use in various industries significantly impacts its price. The metal is a critical component in solar panel production, with demand from this sector at 232 million ounces annually.

Moreover, the electric vehicle (EV) industry consumes about 80 million ounces of silver yearly. As the global push for renewable energy and electric mobility continues, these sectors are expected to drive sustained demand for silver.

2) Economic and Geopolitical Factors

Economic uncertainties, such as potential recessions and trade tensions, influence investor behaviour. Silver, like gold, is often viewed as a safe-haven asset during turbulent times. For instance, concerns over U.S. import tariffs have spurred a 14% gain in silver prices this year.

Such geopolitical developments can increase investor interest in silver as a hedge against economic instability.

3) Supply Constraints

As reported by the Silver Institute, the silver market has experienced a fifth consecutive annual supply deficit. Factors contributing to this deficit include environmental scrutiny of mining operations and geopolitical tensions affecting key regions.

These supply challenges can lead to price volatility but also present opportunities for investors anticipating higher prices due to constrained availability.

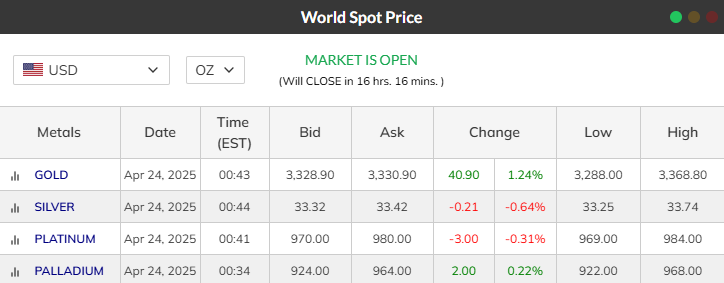

Comparison with Other Precious Metals

Gold

The precious metal has surged 28% year-to-date, reaching a record high of $3,506 per ounce. It also significantly outperformed the S&P 500, which went down 9%. Thus, investors have turned to gold due to growing uncertainty around economic conditions, tariffs, inflation, and political instability.

Analysts such as Michael Brown of Pepperstone and Rania Fule of XS.com attribute gold's continued strength to its resilience against market and political fluctuations.

Wall Street forecasters remain bullish, with Goldman Sachs projecting a rise to $3,700 by year-end, while Ed Yardeni anticipates gold could hit $4,000 in 2025 and potentially $5,000 by 2026.

Platinum

Platinum prices fluctuated in 2024, trading between US$900 and US$1,100 per ounce. Some of the gains were due to strong demand from the automotive sector, which reached a seven-year high during the first quarter, and rate cut speculation in May, which prompted a run on base and precious metals.

Platinum reached its year-to-date high of US$1,094 on May 17. The metal's price also benefited from a supply shortfall of more than 450,000 ounces for the year.

Palladium

The palladium price trend is mixed in 2025. ANZ Research forecasted palladium prices to increase to $1,080/oz, up from an estimated $983 in 2024. In contrast, Trading Economics' palladium price projections show the metal could continue its downtrend, trading lower at $774.57/oz in Q1 2025 compared to $798.78/oz expected in Q4 2024.

Meanwhile, Fitch Ratings' palladium price forecast for 2025 saw the metal's price remain unchanged at $1,050 from its 2024 level.

Silver Prices Forecast 2025

Analysts have provided various forecasts for silver prices in 2025, reflecting optimism and caution. JP Morgan anticipates that silver prices could reach $39 per ounce by the end of the year, following a "catch-up window" in the second half of 2025.

This projection considers the potential for silver to align more closely with gold's performance, specifically if industrial demand strengthens.

Other analysts predict silver prices to range between $28 and $32 per ounce, citing factors such as inflationary pressures and currency dynamics. These projections underscore the importance of monitoring economic indicators and industrial trends when assessing silver's price trajectory.

Silver Prices Projections for 2026–2030

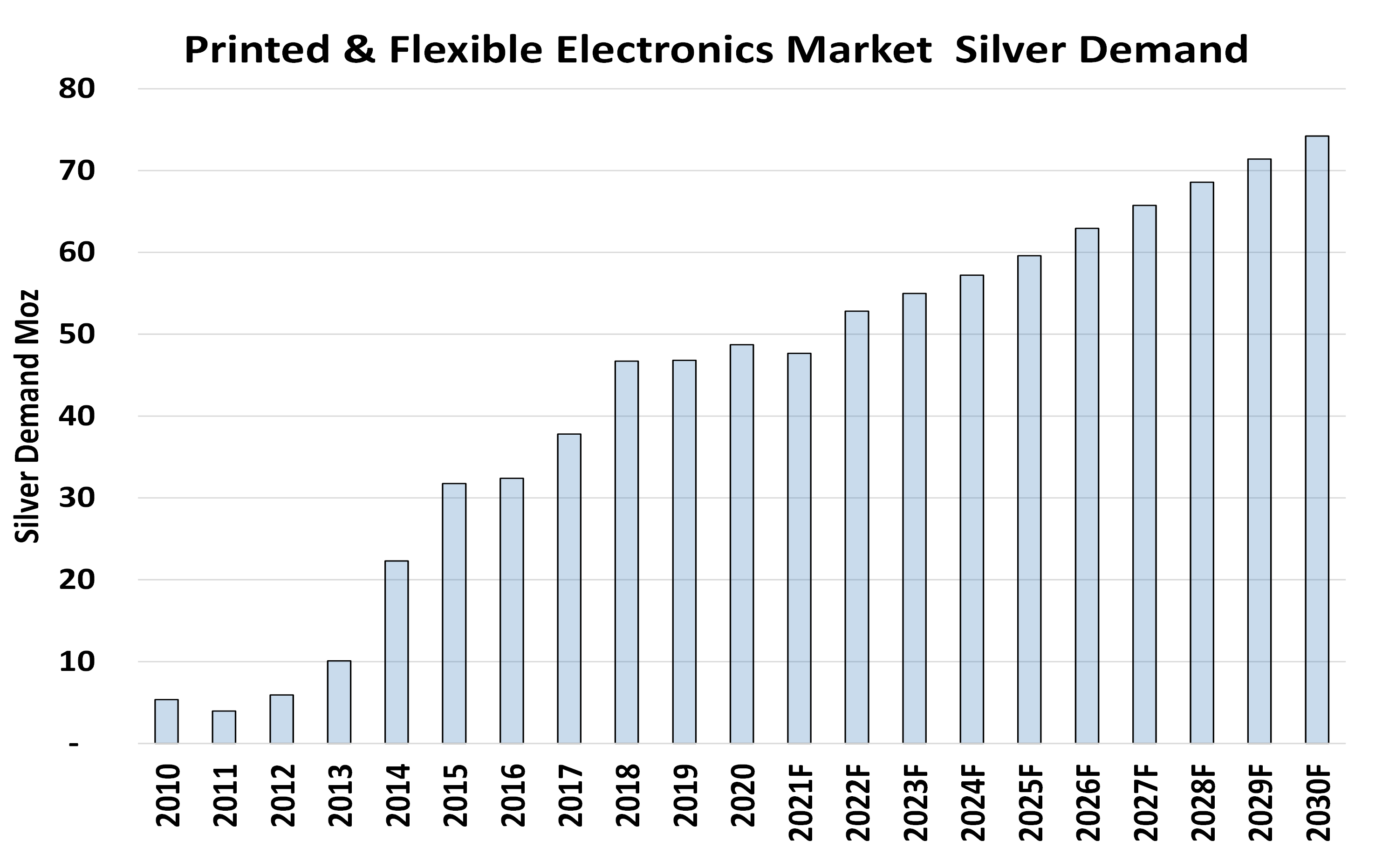

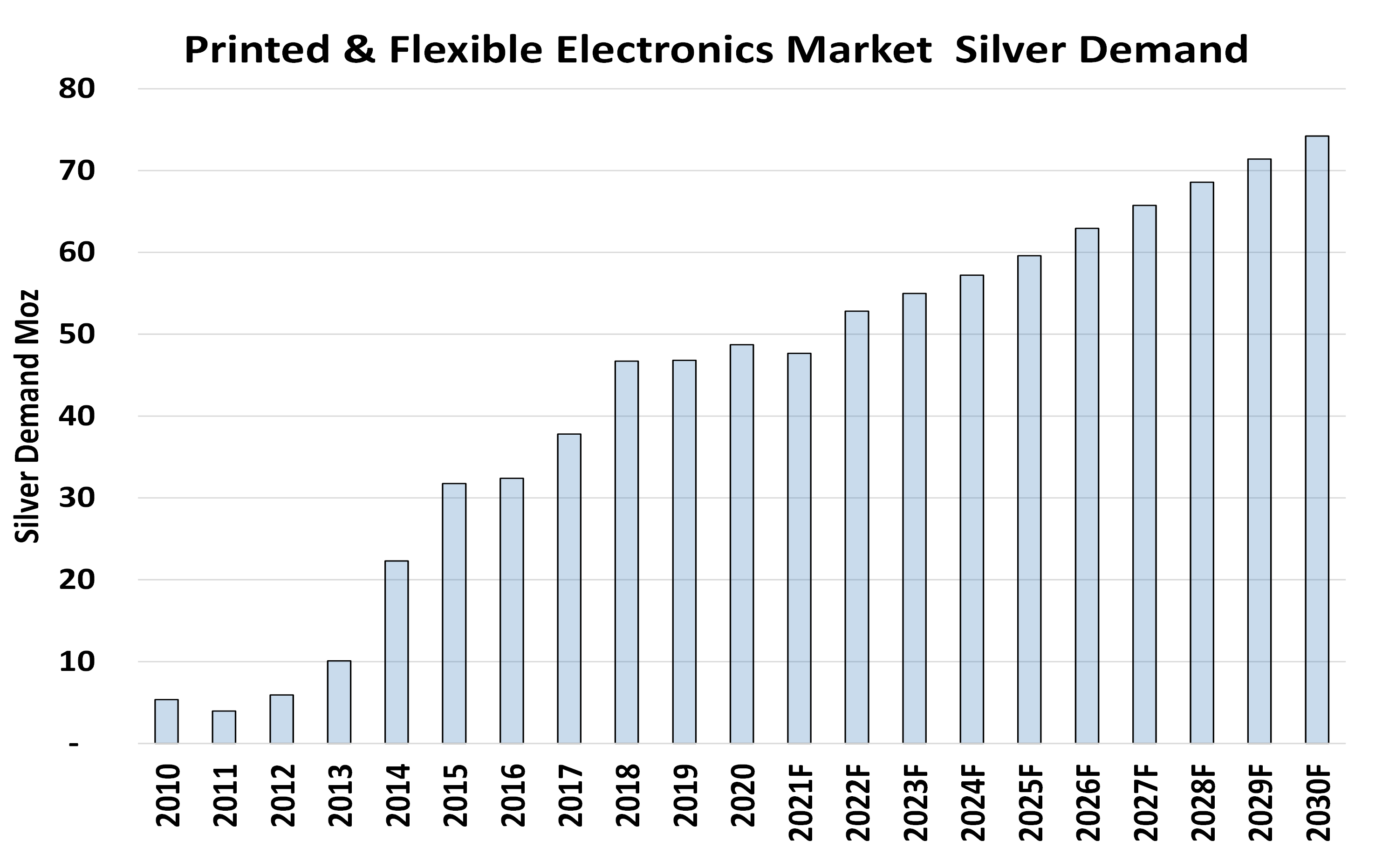

As we look beyond 2025, silver's trajectory will continue to follow structural shifts in global industries, continued geopolitical developments, and evolving investment behaviours. While short-term volatility is likely to persist, many analysts and institutions remain optimistic about silver's long-term upside potential, especially as it plays an increasingly critical role in clean energy technologies and electronics manufacturing.

Price predictions vary widely, but many long-term forecasts suggest a bullish trend. Here's a look at a range of projections from analysts and institutions:

The Silver Institute has noted the potential for sustained demand pressures through 2030, which could support silver prices well above historical averages.

Bloomberg Intelligence has suggested that silver could reach the $50 per ounce mark by the decade if industrial demand and monetary uncertainty continue to converge.

JP Morgan has proposed a scenario where silver could climb to between $45 and $55 per ounce by 2028–2029 in tandem with gold's rally toward $5,000 per ounce.

Goldman Sachs projects a more moderate increase, with silver prices averaging around $35–$40 by 2027, supported by renewable energy buildout and constrained supply.

Of course, these projections are subject to change based on evolving macroeconomic conditions, currency strength, interest rate policies, and unforeseen global events. However, the structural case for silver remains strong, and its dual identity as both an industrial commodity and a precious metal gives it a unique appeal.

Conclusion

In conclusion, while challenges exist, the overall outlook suggests potential for silver price appreciation, with forecasts indicating a range between $39 and $50 per ounce by year's end.

Looking past 2025, silver's future appears increasingly bright. For long-term investors seeking a hedge against inflation, exposure to clean energy growth, or a diversified alternative to gold, silver remains one of the most compelling assets to watch through 2030 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.