I believe many people must have seen the word ETF very often when they are researching investment and financial commodities. In fact, compared with traditional funds and stocks, it has many advantages and has thus gradually become a necessary tool for asset allocation for many investors. However, for ordinary investors, the advantages and disadvantages of ETFs are still very vague, and they do not know how to buy them. Therefore, this article will be carefully summarized for you to explain the ETF trading rules, fees, and purchase guide.

What does ETF mean?

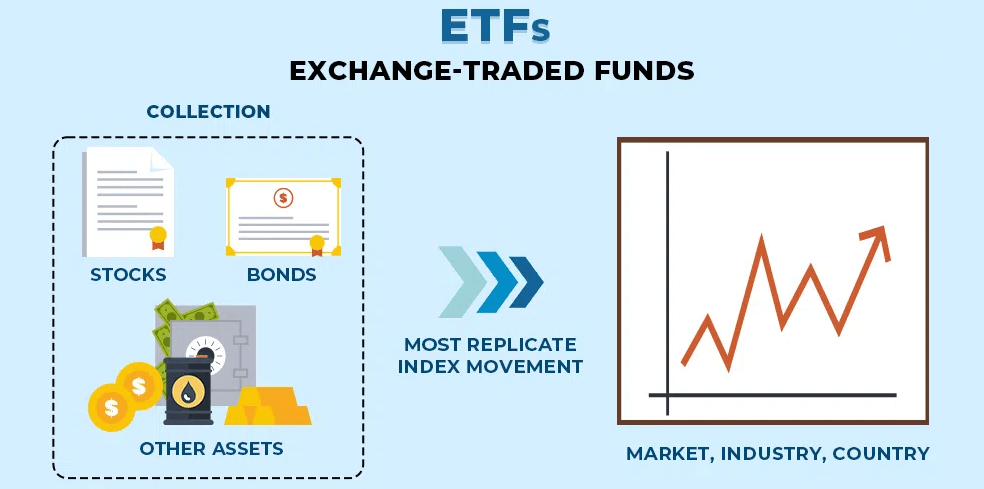

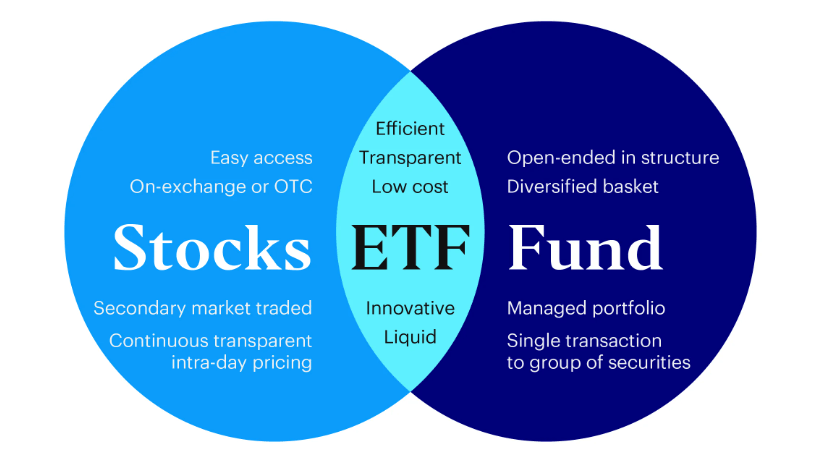

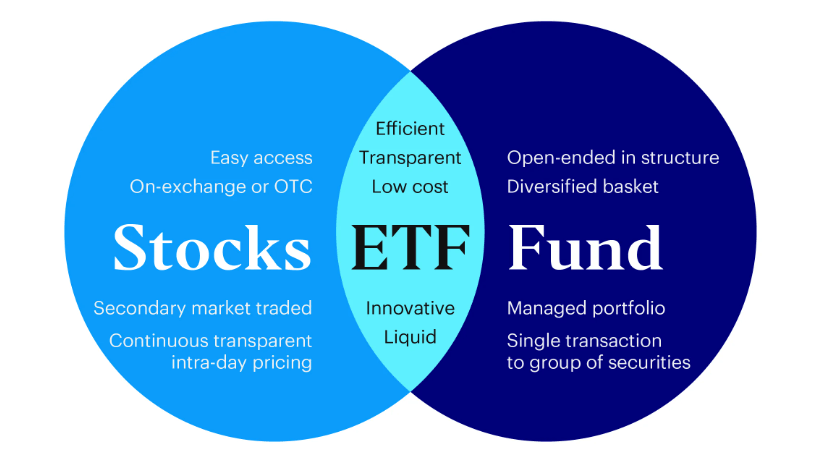

Its full name is Exchange Traded Fund, which means Exchange Traded Fund. It is an investment tool that is a product of traditional funds and stocks. It is used to track the performance of a specific index, such as a stock market index, sector index, etc., and achieve investment returns similar to the index by purchasing the index's constituent stocks.

Its investment size is similar to that of a mutual fund in that both package the assets in the portfolio (e.g., stocks, bonds, commodities, etc.) proportionally into a single security that is listed and traded on an exchange. However, unlike ordinary funds, it is somewhat passive.

An ETF is an investment vehicle that directly matches a portfolio of stocks based on some special conditions (i.e., an index). An index is compiled based on various rules, such as Market Capitalization, industry classification, etc. The stocks included in the index are called index constituents. Index tracking is achieved by buying and holding these constituent stocks and adjusting the percentage of holdings according to the index weightings.

Because its objective is to track the performance of a specific index, the fund manager operates in a relatively passive manner, only adjusting the fund's holdings according to the changes in the index rather than actively selecting stocks as traditional fund managers do. This also makes it more transparent in terms of who it invests in, and investors can get a clearer picture of the composition of the assets in the fund.

There's also the fact that its price fluctuates with market supply and demand, determined by investors buying and selling on the exchange, and may deviate somewhat from the fund's net asset value, whereas the price of an ordinary fund is calculated by the fund company in accordance with the fund's net asset value. Then, as far as fees are concerned, it has lower management fees and sales commissions but incurs trading commissions. In contrast, the fees of a general fund may include management fees, sales commissions, subscription fees, etc. The fee structure is more complicated.

In terms of trading methods, it is similar to a stock in that it can be listed and traded on an exchange. Investors can buy and sell on the exchange through stockbrokers, and trading hours are the same as the stock market. The only thing to note is that it can also be bought and sold on the same day. However, due to the implementation of T+2 trade settlement formulation, the transaction is completed after two trading days after the settlement day.

There is also the fact that, compared with stocks, ETFs represent a fund rather than a company, so there is no information such as the company's financial report for reference. When choosing this product, investors should pay more attention to the trend and characteristics of the index itself than to the financial status of the company, as in the case of stocks.

And its price is related to the total value of assets within the fund, with fluctuations depending on fluctuations in the value of its holdings and market supply and demand. Stocks, on the other hand, represent ownership of a company, and their price is mainly affected by factors such as market supply and demand and company performance. Investors hold stocks in order to share in the company's performance and possible dividend income.

Also, compared to stocks, it usually has lower transaction costs and less transaction tax. It is therefore more suitable for investors who wish to diversify their investments and operate through exchange trading, whereas stocks are suitable for investors who wish to invest in specific companies and seek returns on a single asset.

While it has many advantages as an investment vehicle, it also has some disadvantages that are often overlooked. Firstly, it is usually a passive performer, with its price being affected by the ups and downs of a particular index. Therefore, when the overall market fluctuates, it will also follow the fluctuations and cannot completely avoid market risks. Secondly, there is also the possibility that it could be liquidated and taken off the market because it is too small, which means investors need to keep an eye on the size of the ETF.

It also suffers from discount and premium, i.e., the difference between the market price and the net value, and investors need to pay attention to whether the market price is reasonable. In addition, if it contains foreign constituent stocks, there may be no limit on the upward or downward movement, which involves greater market risk. Also, its fees and charges need to be considered, as well as the fact that buying and selling the product may not be able to take advantage of compounding investments such as share placements. Finally, the unstable liquidity of chips makes their trading behavior difficult to judge and requires careful analysis by investors.

Overall, the advantages and disadvantages of ETFs are equally prominent. However, as a flexible and transparent investment tool, it has the security of a fund and the trading method of a stock. If investors are already familiar with stocks and funds, they may consider further research and understanding them as part of their investment portfolio.

ETF trading rules and fees

Its trading rules and fees can vary depending on different stock exchanges and products. Generally, its trading rules are similar to those of stock trading, and its fees are similar to those of mutual funds, but there are some peculiarities.

For example, because it can be listed and traded on a stock exchange, its trading hours are usually the same as those of the stock market. It's all within the trading hours of the trading day, but the exact hours may vary by exchange and region. For example, in the United States, most ETFs are traded on the New York Stock Exchange (NYSE) or the NASDAQ Stock Exchange (NASDAQ). Their trading hours are Monday through Friday, 9:30 a.m. to 4:00 p.m. (Eastern Time).

Its trading method is similar to stocks; investors can buy and sell through stockbrokers listed on the stock exchange, but also through the online trading platform to place a buy or sell commission. Mandates can be of the market price mandate (to buy or sell at the current market price), limit mandate (to buy or sell at a specified price), and other types and are traded according to the investor's choice.

Trading such products usually incurs a trading commission, similar to stock trading. Investors may also be required to pay fees related to fund management, such as management fees and transaction fees. And the clearing and settlement process of their trades is similar to that of stock trading, which usually takes place on T+2 (trading day plus two business days) after the end of the trading day.

And speaking of fees, it is also known as the ETF commission. It not only includes buying and selling commissions and management fees; there will also be spread costs as well as redemption fees. Of these, the trading commission is paid to stockbrokers and is one of the most significant fees for trading this type of product. The amount of trading commission varies depending on factors such as the size of the transaction, the broker's rates, and the method of trading, and is usually charged as a percentage of the transaction amount.

The management fee is also one of the fees that investors need to pay for holding this type of product, which is used by the fund manager to manage and operate the fund. It is usually expressed as an annualized percentage and is deducted from the fund's assets. The level of management fees varies from product to product and is generally lower than other types of mutual funds.

Spread cost is the difference between the bid and ask prices, and it is also a cost that investors need to take into account. Spread costs can affect the actual transaction costs, especially when market liquidity is low. The bid-ask spread may fluctuate due to factors such as market supply and demand and liquidity. Investors should pay attention to the bid-ask spread when trading so as not to increase the transaction cost as a result.

Or there is a tracking error, which is the difference between its net asset value (NAV) and the index it tracks. Although the product is designed to track the performance of a particular index, tracking errors may arise due to factors such as transaction costs, cash holdings, and reinvestment.

And in some cases, exchanges may charge additional fees for trading such products, usually as part of a market transaction. Alternatively, additional fees may be incurred upon redemption, such as redemption fees or transaction costs.

It should be noted that the above fees and rules are for reference only. Specific ETF trading rules and fees may vary depending on the ETF product, exchange, stockbroker, and investor's location. Investors are advised to carefully understand the relevant trading rules and charges of various types of products, as well as the characteristics and risks of the investment products, before trading in such products.

How to buy and trade ETF

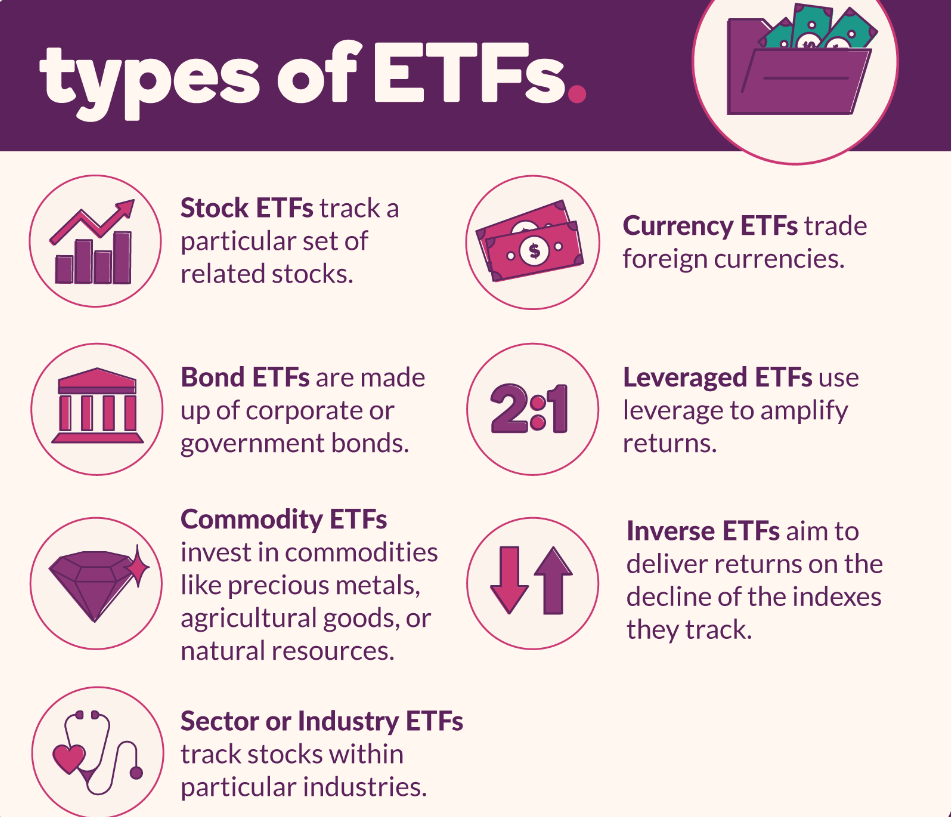

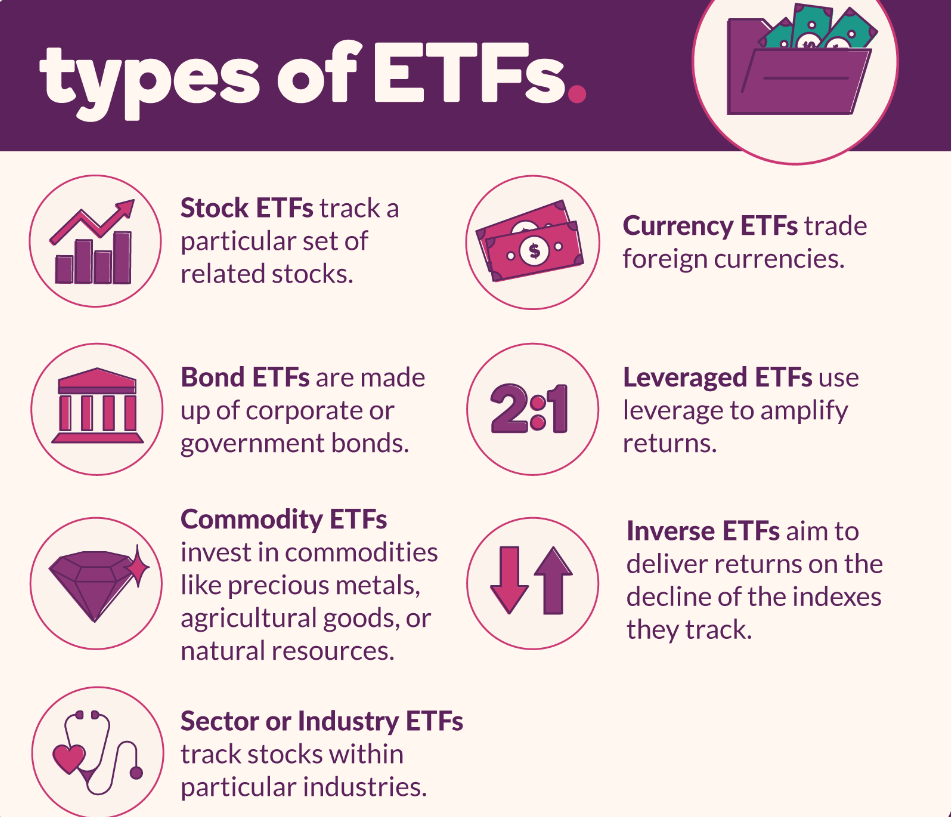

Before purchasing, it is important to choose the right product first. This selection can start by first choosing the asset class according to the types in the chart above; not only that, but also consider factors such as industry and region, as well as choosing a product that meets the investment objectives and risk appetite. In general, to choose the right product, one must pay attention to the issuer, fees, and historical performance.

First of all, it is very important to choose a reputable and strong issuer. The strength and reputation of the issuing institution directly affect the quality and operational efficiency of that product. Good issuers usually have better investment management and risk control capabilities and will choose their portfolios more carefully to better balance risk and return.

In contrast, some lesser-known or less reputable issuers may make risky investment decisions that can lead to underperformance. Selecting industry-leading issuers can increase their quality and liquidity, thereby increasing investment returns.

Fees are an important factor to keep in mind. This mainly refers to the commissions as well as the management fees of the product, which are usually calculated on an annual basis. Low fees can help reduce investment costs and increase returns. Generally, fees below 0.1% are considered very low management fees, and anything below 0.4% is reasonable. If you come across fees higher than this, you need to consider their historical performance. Fees over 1% are not very meaningful, and fees over 2% are basically dangerous and can have big ups and downs.

When choosing a product, it is also important to look at its historical performance. This type of product trades with a high degree of transparency, and information can be found online. It is usually more valuable to focus on the average annual return over 5 or 10 years to get an idea of its overall strength. It is also not recommended to focus only on short-term returns, as short-term performance may be affected by a number of factors and is not stable and reliable enough.

After the comprehensive need to consider a number of factors, including investment objectives, asset allocation, industry distribution, and other aspects, the appropriate product can be selected. After that, you need to open a Securities account, and you can choose to open a securities account at a securities company, bank, or online brokerage.

Then choose a suitable trading method, such as purchasing through an online broker or a stockbroker. Or if you choose to trade online, you need to register your account with a suitable securities trading platform. Then log in to the securities account and enter a purchase order using the trading platform or online broker. In the purchase order, you need to specify the ETF code, quantity, and price (if you choose a Limit Order) of the ETF to be purchased.

Then confirm the purchase order, double-checking the details of the order to make sure there are no errors. If everything is correct, confirm the submission of the order. After the purchase order is successfully executed, make sure there are sufficient funds in the securities account to cover the purchase. Based on the purchase order, funds will be deducted from the securities account in the appropriate amount.

Once the product has been purchased, the investment can be tracked and monitored through the securities account or the relevant investment platform. It is important to note that the performance of the product, as well as changes in the market and the relevant industry, need to be monitored on a regular basis to make investment decisions accordingly.

What can be seen is that ETFs are traded in a similar manner as stocks, characterized by liquidity and ease of trading. Before purchasing, it is advisable to conduct sufficient research and study to understand the relevant trading rules, fees, and risks.

Who Should Invest in ETF Funds

| Type |

DESCRIPTION |

Advantages |

| Beginner Investor |

Simple beginner investing. |

Provides an easy way to get started. |

| Long-term investor |

Hold for market growth gains. |

Eliminates the need for frequent trading. |

| Risk Diversifier |

Diversify your investment risk. |

Reduces risk by holding multiple assets |

| Low-cost investor |

Cost-effective way to invest |

Low management and transaction costs |

| Liquidity seekers. |

Highly liquid |

Equity-like liquidity |

| Market enthusiasts. |

Tracks market performance |

Simple access to overall market performance |

| Investment avoiders. |

Passively managed investments |

Save time by avoiding portfolio management. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.