VOO’s dividend is the S&P 500’s cash flow, passed through to shareholders. It is paid quarterly and moves with corporate profits, payout decisions, and the index’s shifting sector mix, rather than following a preset schedule like a bond coupon.

For income planning, use the trailing 12-month distribution. In the past year, VOO paid approximately $7.07 per share, resulting in a yield of about 1.12% at a share price near $631.

VOO Stock Dividend Key Takeaways

Paid quarterly, with dates typically clustering around late March, late June, late September, and late December.

Trailing 12-month distributions were $7.0678 per share, implying a current distribution yield of about 1.12%.

The 30-day SEC yield, a standardized income snapshot, was about 1.08% as of late January 2026.

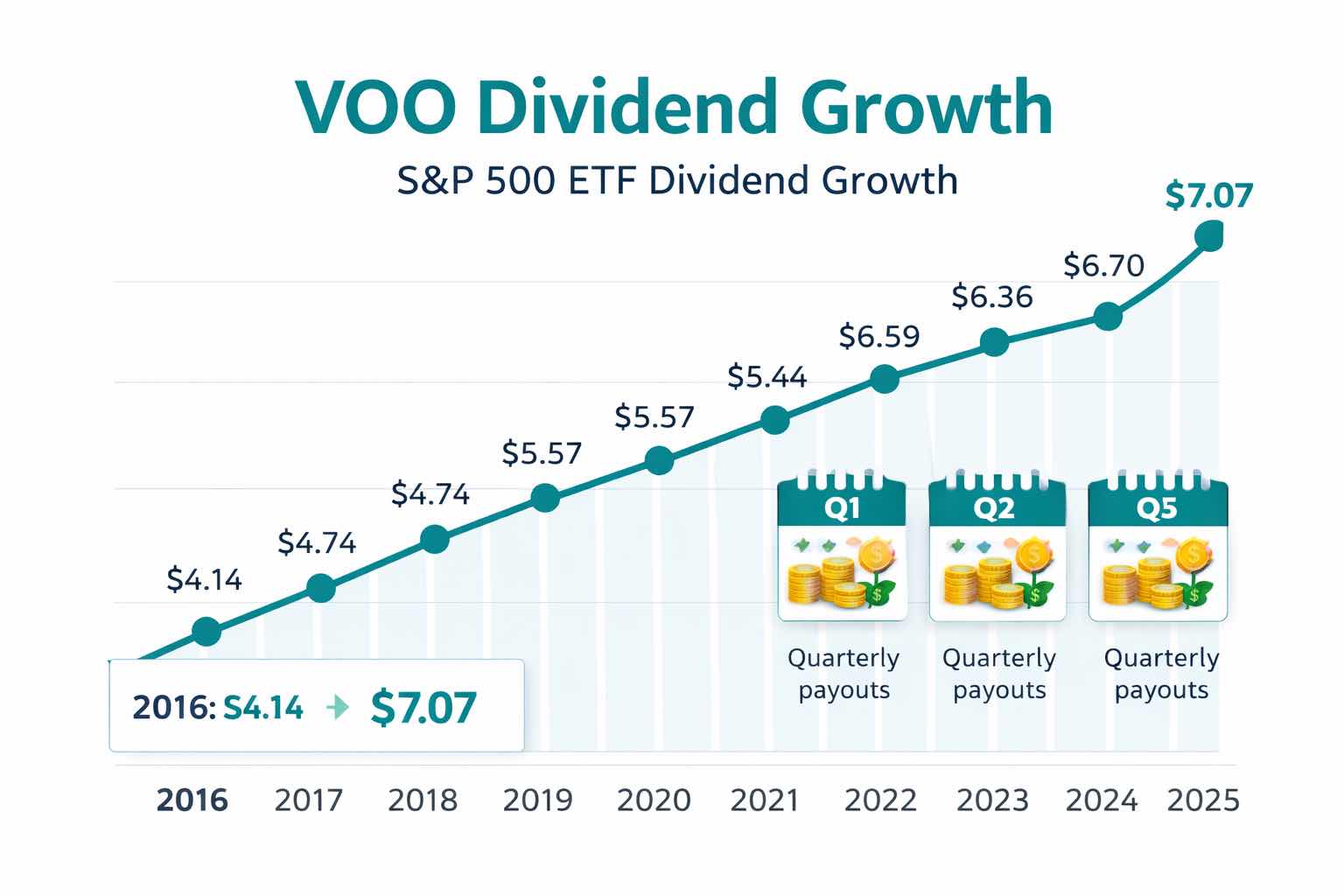

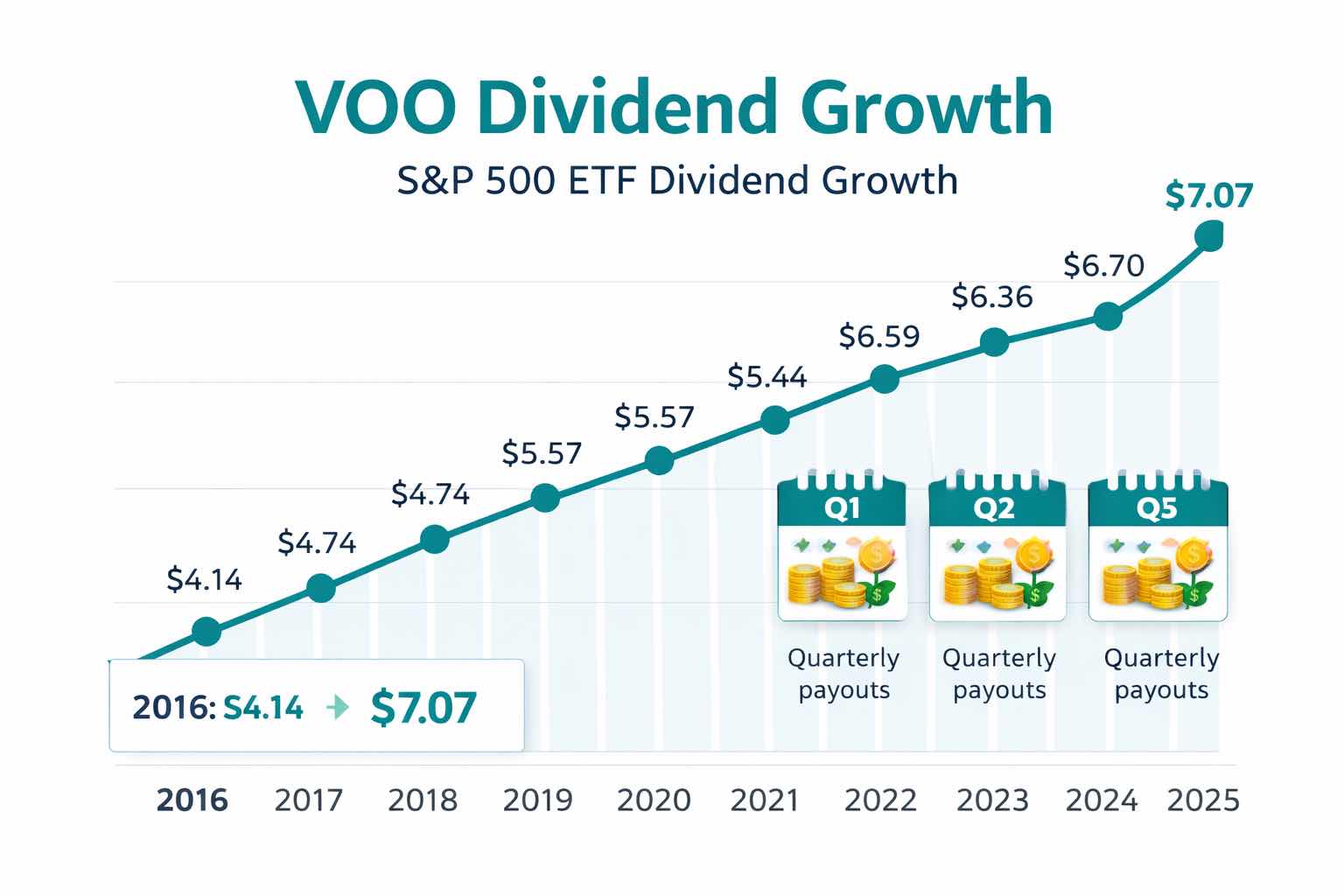

Annual cash distributions rose from $4.1380 per share in 2016 to $7.0678 in 2025, at a compounded annual growth rate of about 6%, with a pandemic-era dip in 2020.

Costs are minimal: the expense ratio is 0.03%.

How The VOO Stock Dividend Is Generated

VOO is an exchange-traded share class of the Vanguard 500 Index Fund. It seeks to track the S&P 500 using a full-replication approach, meaning dividends are sourced from a broad basket of large-cap U.S. companies and distributed to ETF shareholders after expenses.

VOO’s dividend differs from individual stocks because the fund distributes the index’s aggregate dividends rather than making its own payout decisions. This diversification reduces single-company risk but does not eliminate the risk of lower dividends during weak profit years.

VOO Dividend Yield: What It Means And How To Read It

Trailing 12-Month Distribution Yield

The trailing distribution yield is calculated by dividing the cash paid over the last 12 months by today’s price. With $7.0678 paid over the last year, VOO’s distribution yield has been about 1.12% recently.

Trailing yield is useful for budgeting, but it can be misleading if taken as a forecast. Price moves first, dividends adjust later. When the market re-rates higher, yield compresses even as dividend dollars grow. When the market sells off, yields rise mechanically, even if future dividends are under pressure.

30-Day SEC Yield

The 30-day SEC yield annualizes a fund’s income over the last 30 days using a standardized formula. For equity ETFs, it is a rolling estimate of portfolio dividend income after expenses. Recent data put VOO’s 30-day SEC yield around 1.08%.

Why VOO’s Yield Is Modest

Yield reflects both payout policy and valuation. VOO’s portfolio trades at about 28 times earnings, implying an earnings yield near 3.5%. If companies pay out roughly one-third of earnings as dividends, a yield near 1% is expected.

VOO Dividend Schedule And Key Dates

VOO’s dividend schedule is quarterly. The key dates are:

Ex-dividend date: shares trade without the right to the upcoming distribution.

Record date: the fund confirms which shareholders are eligible.

Payable date: cash is delivered or reinvested.

Buying on or after the ex-dividend date means the distribution is no longer payable to the seller.

2025 VOO Dividend Calendar And Amounts

Quarter |

Ex-Dividend Date |

Payable Date |

Cash Amount Per Share |

Q1 2025 |

3/27/25 |

3/31/25 |

$1.8121 |

Q2 2025 |

6/30/25 |

7/2/25 |

$1.7447 |

Q3 2025 |

9/29/25 |

10/1/25 |

$1.7400 |

Q4 2025 |

12/22/25 |

12/24/25 |

$1.7710 |

VOO Dividend History: Annual Payouts And Growth

Quarterly distributions are lumpy because hundreds of underlying companies pay on different schedules. Annual totals are the cleanest way to judge growth.

Year |

Total Cash Distributions Per Share |

Year-Over-Year Change |

2016 |

$4.1380 |

|

2017 |

$4.3679 |

5.6% |

2018 |

$4.7367 |

8.4% |

2019 |

$5.5709 |

17.6% |

2020 |

$5.3027 |

-4.8% |

2021 |

$5.4367 |

2.5% |

2022 |

$5.9467 |

9.4% |

2023 |

$6.3572 |

6.9% |

2024 |

$6.7035 |

5.4% |

2025 |

$7.0678 |

5.4% |

Two observations stand out. First, VOO has delivered persistent dividend growth across cycles. From 2016 to 2025, distributions grew at approximately a 6% compound annual growth rate, turning a low starting yield into a steadily rising cash stream. Second, the growth path is not smooth. 2020 shows the key risk of any equity-income strategy: dividends can stall when profits contract, then recover as earnings power returns.

How To Use The VOO Stock Dividend In A Portfolio

Income Estimation Starts With Shares, Not Yield

Using the latest trailing 12-month distribution of about $7.07 per share:

100 shares imply roughly $707 in cash distributions per year.

500 shares imply approximately $3,535 in annual dividends.

1,000 shares implies roughly $7,070 per year.

Those are backwards-looking figures that update each quarter.

Reinvestment Is The Dividend Growth Accelerator

Reinvesting distributions increases the share count, which in turn generates additional future dividends. This is the most straightforward way to grow income without adding new capital. VOO’s prospectus states there is no transaction fee for reinvested dividends through the sponsor, though brokerage policies may differ.

When VOO Works Best For Income

VOO is best suited for investors seeking income growth aligned with U.S. corporate earnings and who can tolerate equity volatility. It is less appropriate as a sole high-income solution. The S&P 500’s sector composition, especially its technology weighting, keeps the yield moderate despite strong long-term dividend growth.

Taxes And Qualified Dividends

VOO distributions are reported on Form 1099-DIV and can include both qualified and ordinary dividends. Qualified dividends can be taxed at long-term capital gains rates if the holding period rules are satisfied, including the 61-day requirement around the ex-dividend date.

For most investors, qualified dividends face 0%, 15%, or 20% federal rates depending on taxable income, while ordinary dividends are taxed at ordinary income rates. Annual thresholds shift over time, and tax-advantaged accounts can simplify the outcome.

VOO Stock Dividend FAQ

What Is The Current VOO Dividend Yield?

VOO’s distribution yield has been about 1.12%, based on roughly $7.07 per share of trailing 12-month distributions and a share price near $631. Yield moves daily with price and changes as new quarterly payments replace older ones.

How Often Does VOO Pay Dividends?

VOO pays quarterly. In recent years, ex-dividend dates have typically fallen in late March, late June, late September, and late December, with payments shortly after.

What Were The 2025 VOO Dividend Payments?

In 2025, VOO paid $1.8121, $1.7447, $1.7400, and $1.7710 per share across the four quarters. The final 2025 ex-dividend date was 12/22/25, with payment on 12/24/25.

Has The VOO Stock Dividend Grown Over Time?

Yes. Annual cash distributions rose from $4.1380 per share in 2016 to $7.0678 in 2025, representing about a 6% compounded annual rate. The path includes down years, such as 2020, which highlights that equity dividends are not guaranteed.

Is VOO A Good ETF For Dividend Income?

VOO can be strong for income that grows over time, but it is not designed to maximize yield. The starting yield is modest because large-cap U.S. valuations are high and many firms return cash through buybacks and dividends.

Are VOO Dividends Qualified?

Many shareholders receive a meaningful qualified dividend component, but the exact mix varies by year and is reported on Form 1099-DIV. Qualified treatment depends on meeting the fund's holding-period rules around its ex-dividend dates.

Conclusion

The VOO Stock Dividend provides the S&P 500’s dividend stream through a low-cost ETF with quarterly payments. While the current yield is near 1.1%, the more important measure is distribution growth: annual payouts have increased by about 6% per year since 2016, despite periodic interruptions.

For investors seeking to build a growing income base, VOO offers diversification, low costs, and strong compounding potential through reinvestment. For those needing a higher immediate cash yield, VOO is best used as a core equity holding alongside dedicated income investments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(Vanguard Fund Docs)(Companies Market Cap)(Vanguard)(Vanguard)