The canadian dollar firmed on Tuesday around its five-month high as investors

turned their attention to a BOC interest rate decision this week.

Growing recession risks from the US-led trade war will push policymakers to

cut interest rates at least twice more this year, according to a Reuters poll,

although they are expected to stand pat on Wednesday.

Speculators have reduced their bearish bets on the Canadian dollar to the

lowest since October, CFTC data showed on Friday, ass the continued weakness of

the greenback rattled loonie bears.

Last week Canada says it has started imposing a 25% tariff on certain vehicle

imports from the US. Trump's car tariffs are particularly painful for Canada,

whose car industry is entwined with that of its neighbour.

The country's manufacturing activity contracted at a steeper rate in March as

a widening global trade war triggered the sharpest decline in new orders since

shortly after the start of the COVID-19 crisis.

Trade unexpectedly flipped to a deficit in February but both exports and

imports stayed at near record levels. Exports of energy products posted the

first decrease since September 2024.

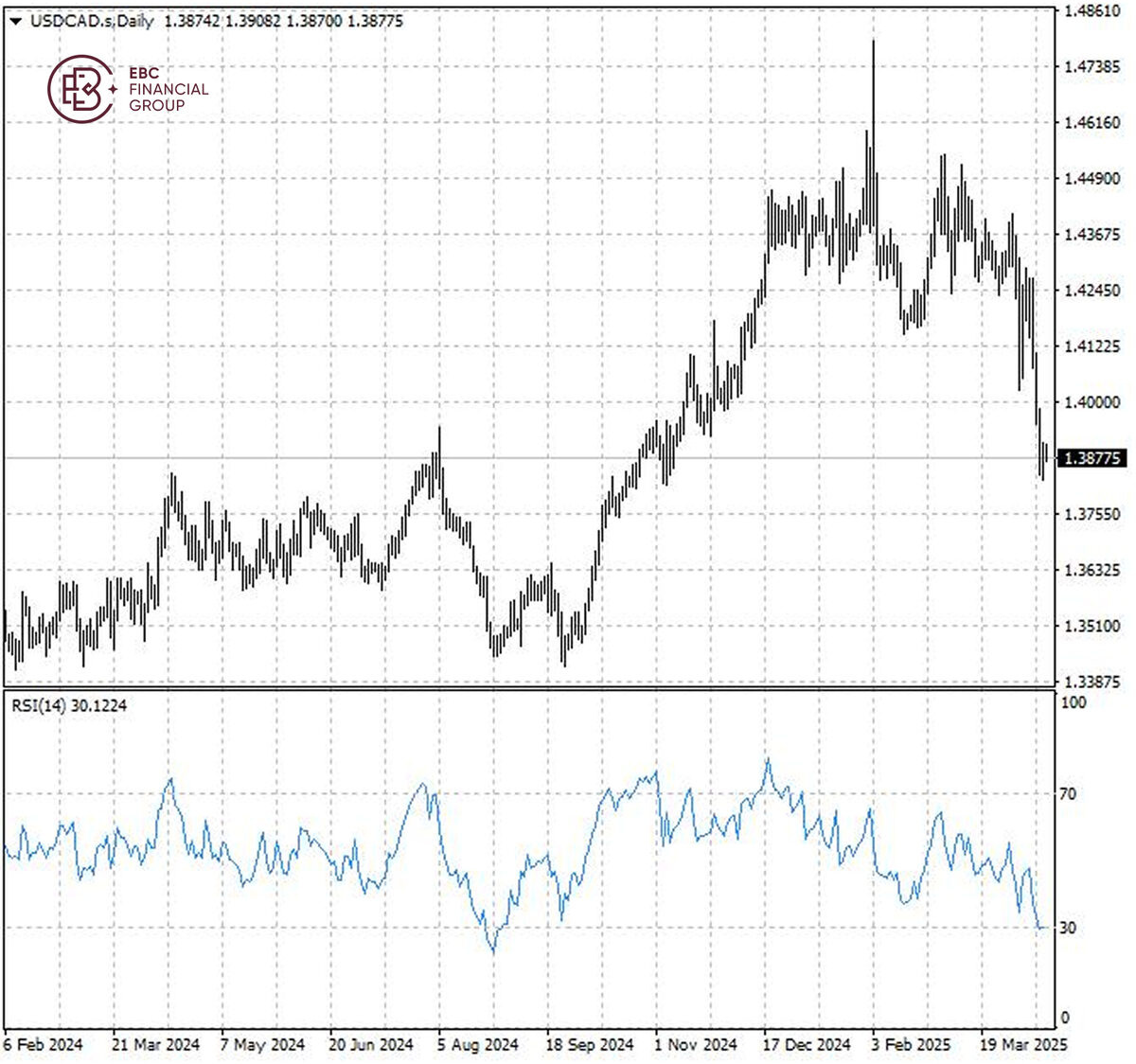

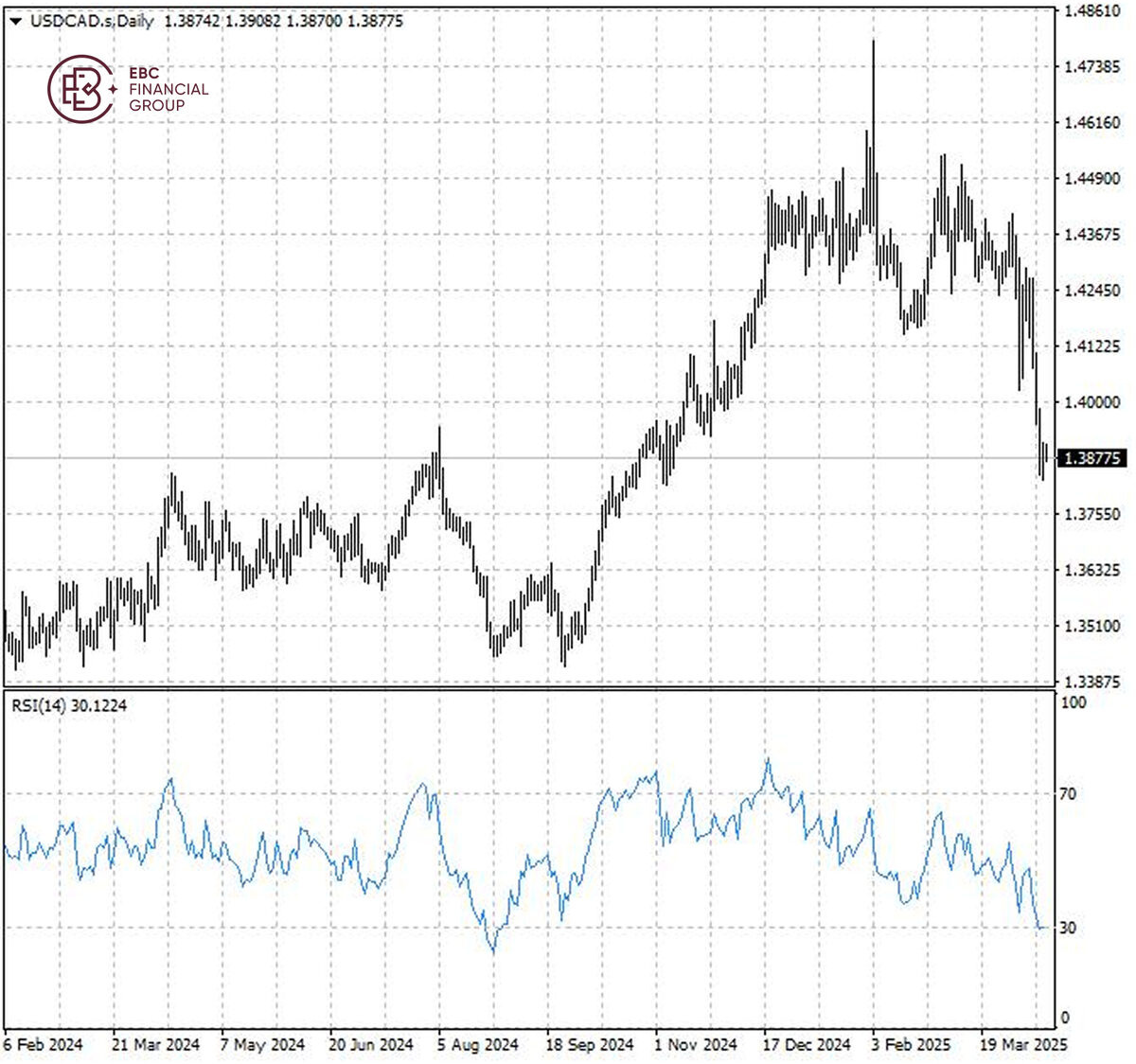

RSI suggests the Canadian dollar has flirted with the overbought territory,

which is at odds with plunging oil prices. As such a push lower towards 1.3930

per dollar seems likely.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.