Gold hovered around record high above $3,200 mark on Monday, as the US dollar

was still near a three-year low. Investors have flocked to the safety of the

yellow metal in a bruising week.

Traders now bet that the Fed will resume cutting rates in June and see around

90-bp cuts by the end of 2025. It is set to keep interest rates on hold to

minimise tariff risks, even if the labour market softens further.

Trump exempted smartphones, computers, and other tech devices and components

from his reciprocal tariffs – a cheering news for the global tech sector, new

guidance from the CBP issued Friday shows.

The White House said it ensures that companies have time to move production

to the US. Many analysts still expect the administration's increased use of

tariffs will bring both higher inflation and slower economic growth.

Physically backed gold ETFs registered the largest quarterly inflow in three

years in January-March, 2025, data from the WGC showed. The odds are that it

enjoys a second consecutive year of net inflow.

The demand for gold in both jewellery and bullion forms is expected to remain

strong. Retailers that can adapt to consumer preferences and market conditions

are well-positioned to thrive in this environment.

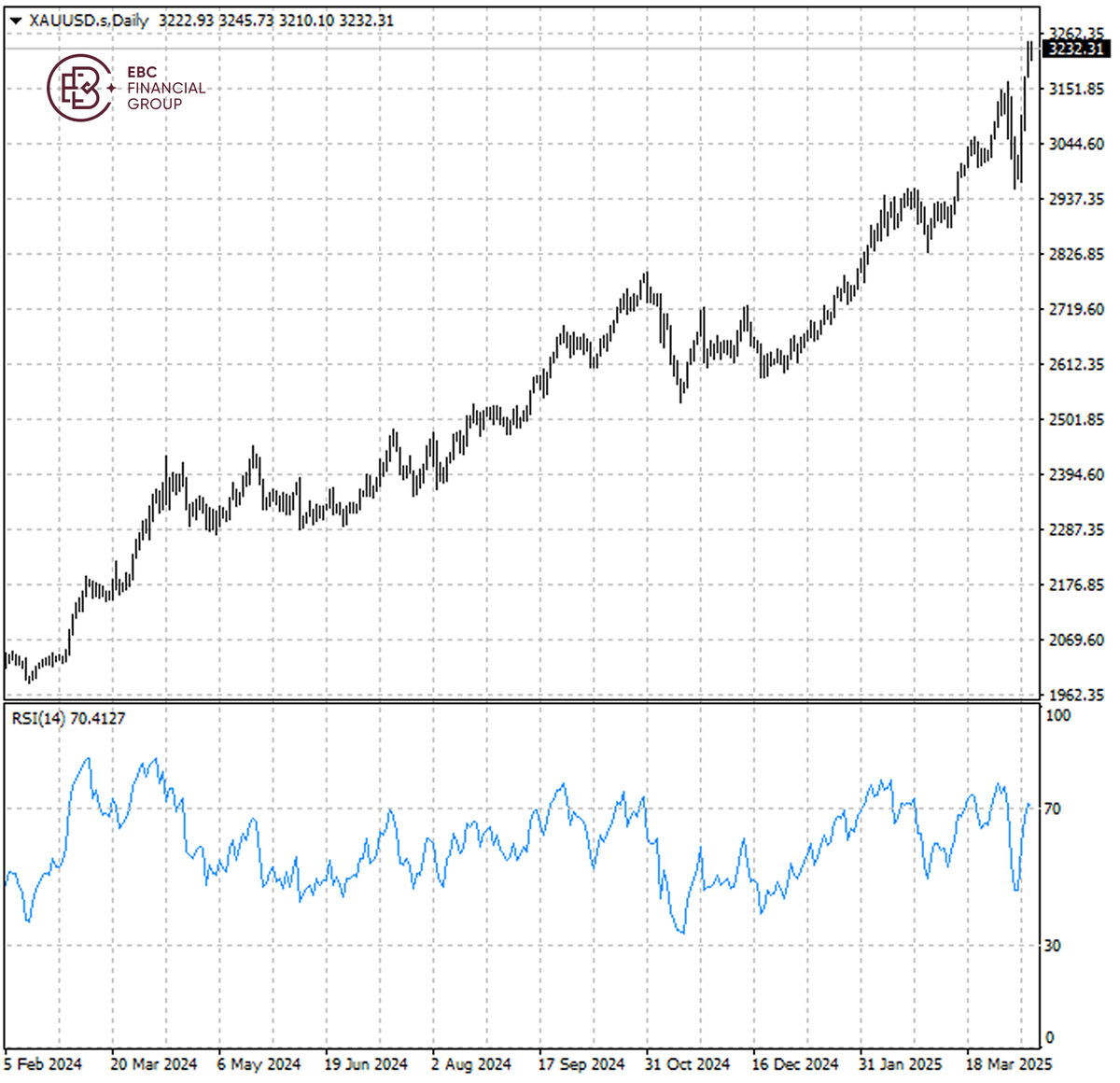

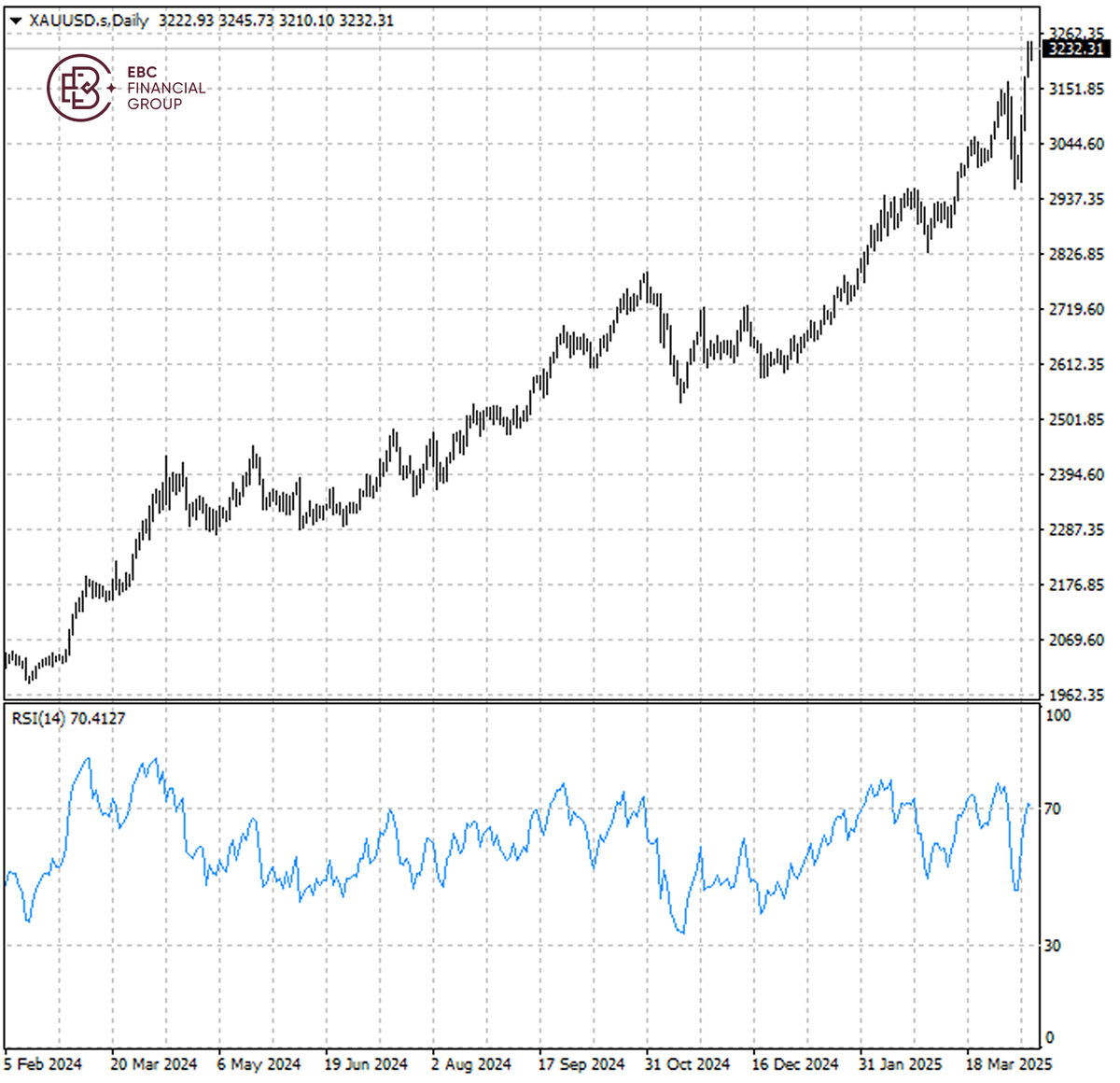

Bullion remains in the overbought territory, though technical indicators have

been outweighed by Trump's mood change. A steep pullback is likely if the price

fails to hold above $3,210.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.