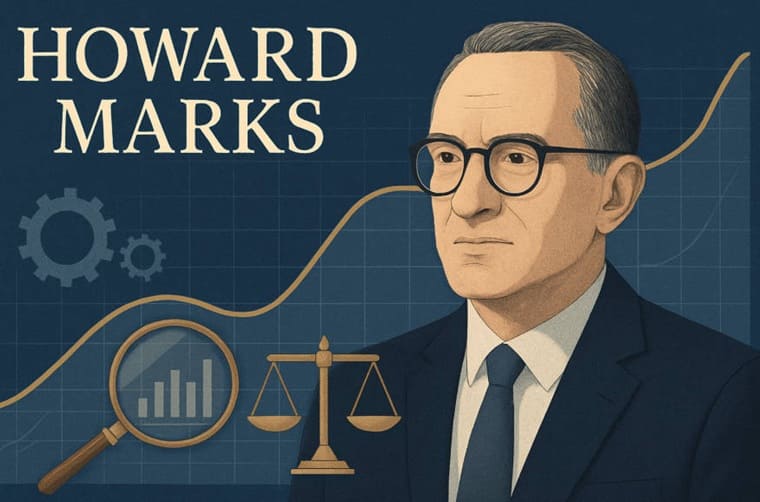

Understanding Howard Marks: The Architect of Modern Value Investing

Howard Marks stands among the most respected voices in global finance. As the co-founder and co-chairman of Oaktree Capital Management, he has built a career defined by rationality, discipline, and intellectual humility.

His investment memos, widely circulated and avidly read by Warren Buffett and countless professionals, have shaped how investors think about risk, cycles, and market behaviour.

This article explores the intellectual foundation and practical framework of Howard Marks' investment philosophy—his principles on risk control, market psychology, and long-term consistency. It also highlights the enduring relevance of his work in today's volatile financial environment.

The Early Formation of Howard Marks' Investment Mindset

Howard Marks was born in 1946 and raised in Queens, New York. His academic excellence led him to the Wharton School at the University of Pennsylvania, where he earned a degree in finance and later an MBA in accounting and marketing from the University of Chicago Booth School of Business.

Early in his career, Marks joined Citicorp, where he specialised in high-yield bonds—assets that were then viewed as "junk." This early exposure to unconventional, misunderstood investments profoundly influenced his thinking. It demonstrated that markets often misprice risk, and that real opportunity lies where consensus is uncertain or fearful.

His later move to TCW Group allowed him to refine these ideas further, managing portfolios in high-yield and distressed debt. These experiences laid the foundation for what would later become Oaktree Capital's signature focus: disciplined, risk-controlled investing in less efficient markets.

Howard Marks and the Creation of Oaktree Capital Management

In 1995. Howard Marks co-founded Oaktree Capital Management alongside Bruce Karsh and several colleagues from TCW. The firm's mandate was distinct from its peers—it would prioritise risk management, transparency, and consistency over speculative returns.

Oaktree quickly became synonymous with distressed debt and alternative credit strategies. Marks' philosophy of cautious opportunism—taking bold action only when the odds are favourable—proved especially successful during crises, including the Asian Financial Crisis, the Global Financial Crisis, and subsequent market dislocations.

The firm's client-first culture, coupled with Marks' commitment to intellectual integrity, propelled Oaktree to become one of the world's largest alternative investment managers, overseeing tens of billions in assets.

The Core of Howard Marks' Investment Philosophy

At the heart of Howard Marks' thinking lies one central idea: controlling risk is more important than maximising return. In his words, "If you avoid the losers, the winners take care of themselves."

Several principles form the backbone of his philosophy:

Risk control comes first. Investors should focus on avoiding major losses rather than chasing extraordinary gains.

Asymmetry matters. Good investments offer limited downside but significant potential upside.

Second-level thinking. Successful investors think differently and more deeply—questioning assumptions, analysing behavioural dynamics, and identifying what others overlook.

Humility and patience. Markets are uncertain; the best investors accept what they do not know and act cautiously when conviction is low.

For Marks, success in investing is not about bold predictions but about consistent decision-making that compounds advantage over time.

Howard Marks on Risk, Return, and Market Behaviour

Howard Marks draws a sharp distinction between risk and volatility. While volatility measures short-term price movements, real risk is the potential for permanent loss of capital.

He argues that investors often conflate the two, mistaking price fluctuations for danger. In reality, volatility can present opportunity if the investor understands intrinsic value. Marks believes the best opportunities arise when markets are fearful, and assets trade below their true worth.

In his view, superior returns are not generated through aggressiveness but through the thoughtful management of risk exposure. His philosophy emphasises preparation for uncertainty—because markets, like weather, can never be forecasted with precision.

The Psychology of Markets: Howard Marks' Lessons on Investor Behaviour

Marks is deeply influenced by behavioural finance. He views market cycles as reflections of human emotion—oscillating between greed and fear.

His concept of the market pendulum describes how optimism and pessimism swing excessively in both directions. Investors often buy when confidence peaks and sell when despair prevails. Recognising these behavioural extremes allows Marks to act contrarily, buying when assets are cheap and unloved.

He often reminds investors that success requires both insight and courage: the insight to see when the crowd is wrong, and the courage to act when fear dominates. Emotional discipline, in his view, is as essential as analytical skill.

Howard Marks' Market Cycle Framework

In his book Mastering the Market Cycle, Marks presents one of his most comprehensive frameworks. He explains that markets move in recurring patterns driven by economic fundamentals, investor psychology, and credit conditions.

He categorises cycles into phases—ranging from excessive optimism and easy credit to panic and retrenchment. The investor's task is not to predict exact turning points but to understand where we are in the cycle and adjust risk exposure accordingly.

This adaptive, cyclical awareness is a cornerstone of Marks' strategy and a major reason for Oaktree's resilience through crises.

The Intellectual Tools That Define Howard Marks' Thinking

Howard Marks advocates for a structured intellectual approach to investing. His most cited tools include:

Second-Level Thinking: Going beyond surface reasoning—asking not "What's the outlook for a company?" but "What's already priced in, and how might others be wrong?"

Margin of Safety: Buying only when assets trade below intrinsic value, ensuring a buffer against error.

Probabilistic Thinking: Acknowledging uncertainty by thinking in ranges and probabilities rather than certainties.

Independent Judgement: Valuing contrarian insight over consensus opinion.

These tools combine rational analysis with psychological awareness, forming the foundation of his enduring investment success.

Howard Marks' Writings and Memos: Wisdom in Practice

Howard Marks' memos are among the most anticipated publications in finance. They combine accessible prose with profound insight, addressing themes such as risk, cycles, inflation, and the psychology of investing.

Two of his books—The Most Important Thing and Mastering the Market Cycle—distil decades of experience into practical lessons. In The Most Important Thing, Marks identifies key investing virtues such as patience, scepticism, and awareness of cycles.

Warren Buffett once remarked that "When I see a memo from Howard Marks in my inbox, it's the first thing I read." This endorsement underscores the respect Marks commands across generations of investors.

Performance, Critique, and Enduring Relevance of Howard Marks

Oaktree's track record demonstrates the effectiveness of Marks' philosophy: consistent long-term returns, minimal drawdowns, and strong crisis resilience. The firm's performance during market downturns—when others suffered large losses—proved the value of risk control and patience.

Critics, however, argue that a conservative stance can lead to underperformance during exuberant bull markets. Marks acknowledges this trade-off, asserting that "you cannot predict, you can prepare." He views short-term underperformance as a necessary cost of long-term stability.

In today's world of high volatility, geopolitical uncertainty, and changing interest rates, his approach remains as relevant as ever. It prioritises discipline over speculation and understanding over prediction.

Howard Marks' Influence and Legacy in Global Finance

Beyond performance, Howard Marks' true legacy lies in education. His memos and books have become timeless guides for professionals and students alike.

He has influenced not only the value investing community but also modern approaches to risk assessment, behavioural finance, and cyclical awareness. Many leading investors now incorporate his principles into their own frameworks.

Through Oaktree and his public writings, Marks has shaped an entire generation's understanding of what it means to invest intelligently, ethically, and patiently.

Key Lessons from Howard Marks for the Modern Investor

Howard Marks teaches that successful investing is a blend of analysis, psychology, and temperament. His lessons can be summarised as follows:

Focus on risk control before chasing returns.

Think independently and avoid herd mentality.

Recognise market cycles and adjust accordingly.

Be humble—accept uncertainty and act cautiously.

Maintain emotional discipline and patience.

The ultimate takeaway from Howard Marks' philosophy is timeless: investors do not need to be geniuses—they only need to avoid the major mistakes that others make repeatedly. In a world driven by speculation and noise, his message of calm rationality is a rare and enduring asset.

Frequently Asked Questions

Q1: Who is Howard Marks?

A: Howard Marks is the co-founder and co-chairman of Oaktree Capital Management, renowned for his investment memos, value investing expertise, and market cycle insights.

Q2: What is Howard Marks' investment philosophy?

A: His philosophy emphasises risk control, second-level thinking, contrarian opportunities, and understanding market cycles, rather than chasing short-term gains.

Q3: What are Howard Marks' most influential writings?

A: The Most Important Thing, Mastering the Market Cycle, and his widely-read memos provide practical lessons on investing, risk, and market behaviour.

Q4: What is the significance of Howard Marks' memos?

A: They distil decades of experience into actionable insights on risk, cycles, and investor psychology, often influencing professional investors worldwide.

Q5: How can individual investors apply Howard Marks' principles?

A: Focus on risk management, maintain patience, avoid herd behaviour, and adjust strategy based on market cycles rather than speculation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.