Richard Dennis proved that disciplined, rule-based trend following could produce extraordinary returns and that trading skills can be taught.

His Turtle Traders experiment created a template for systematic trading that still influences quant funds and discretionary traders today.

Early Career and Rapid Ascent of Richard Dennis

Richard Dennis began on the trading floor in Chicago and rose rapidly by exploiting large, persistent commodity trends in the 1970s and early 1980s.

He transformed a modest stake into a very large personal fortune by systematically buying breakouts and pyramiding into winners while cutting losses quickly when markets reversed.

His style contrasted sharply with intraday scalpers because he held positions for intermediate to long durations to capture major moves.

The Philosophy Behind Richard Dennis's Trading Strategy

At its heart, Dennis's approach was straightforward. He believed that markets produce sustained trends and that clear, repeatable rules could capture them.

The method combined mechanical entries on breakouts, exits on defined signals, volatility-based position sizing, and strict risk limits. Psychology was important but secondary to system design; traders must follow objective rules rather than act on impulse. This blend of rules, risk control and discipline formed the foundation for the Turtle experiment.

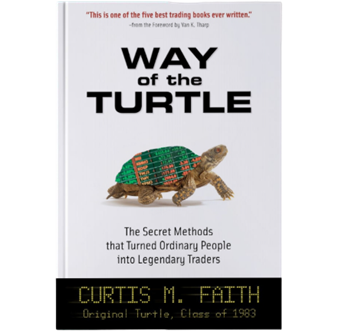

The Turtle Traders Experiment: Design, Training and Outcomes

In 1983 Dennis and William Eckhardt ran a live experiment to test whether trading success was innate or teachable. They recruited novices, trained them in a concise rule set over a short period, and provided trading capital for those who passed the trial.

The participants were nicknamed Turtles. Over the following five years the group reportedly generated substantial aggregate profits for Dennis, demonstrating that disciplined novices could implement a mechanical, trend-following system. The Turtle story became a key case study in systematic trading.

Key Moments in the Turtle Experiment

| Year |

Event |

Significance |

| 1983 |

First Turtle training cohort recruited |

Proof of concept: rule teaching begins |

| 1984 |

Second cohort trained |

Experiment expanded; additional managers funded |

| 1983–1988 |

Turtles traded Dennis’s capital |

Reported aggregate profits of the order often cited as c. $175 million |

| Late 1980s |

Market regime shifts and drawdowns |

Demonstrated system susceptibility to changed market conditions |

The Core Rules and Techniques Taught by Richard Dennis

The Turtle rules were explicit and mechanical. They encompassed:

Entry Logic: Buy on breakouts above a lookback high and short on breakouts below a lookback low.

Exit Logic: Close positions on opposite breakouts or defined trailing stops.

Position Sizing: Scale risk according to market volatility so that position size reflects the instrument’s typical movement.

Pyramiding: Add to profitable positions in measured increments as trends developed.

Risk Limits: Risk only a small fixed percentage of total capital per trade to survive inevitable losing streaks.

These components formed a cohesive system. When markets trend, the system captures large moves. When markets are rangebound, the system produces frequent small losses. Adherence to the rules determined long-term success more than individual market calls.

How Dennis's Core Elements Work Together

| Element |

Purpose |

Practical Effect |

| Breakout Entries |

Catch new trends early |

Captures directional moves, accepts many small false signals |

| Volatility Sizing |

Normalise risk across markets |

Prevents oversized exposure to volatile instruments |

| Trailing Exits |

Protect profits |

Lets winners run but locks in gains when trends reverse |

| Pyramiding |

Increase exposure to confirmed trends |

Amplifies returns during strong trends, increases drawdown risk if trend fails |

Advantages and the Known Limitations of Dennis's Approach

The clear advantage of Dennis's approach is its ability to capture extended, profitable trends without relying on discretionary judgement. The method scales across many markets and can be implemented mechanically. The main limitation is performance dependence on market regime.

Trend-following tends to underperform during prolonged sideways markets, producing a string of small losses that test the trader's resolve. Historically, the system's performance declined after the mid-1980s when market behaviour changed, underlining the need for robust risk controls and regime awareness.

Challenges and Strategic Adjustments in Richard Dennis's Career

Dennis experienced major setbacks in the late 1980s, notably during and after the 1987 stock market crash, when he suffered significant losses and later settled investor complaints about rule adherence. These events highlighted operational and behavioural risks: systems can be undermined by scale, leverage and human deviation from stated rules.

In response, Dennis and others emphasised system refinement, better record keeping and clearer risk governance. The episode is instructive because it shows that strong historical performance does not guarantee immunity to future structural changes or to mistakes in execution.

The Enduring Influence of Richard Dennis on Modern Trading

Dennis's experiment seeded ideas that endure in modern systematic trading. Many quant funds and trend-following CTAs trace lineage to the Turtles' principles: mechanical rules, volatility scaling, diversification across markets, and robust position sizing.

Even discretionary managers borrow the philosophy of letting winners run and cutting losses promptly. Though markets and technology have evolved, the central insight—that clear systems plus disciplined execution can outcompete vague intuition—remains highly influential.

Practical Lessons from Richard Dennis for Today's Traders

Traders who want to learn from Dennis should focus on these takeaways:

Design clear, testable rules and document them in writing.

Use volatility-based position sizing to equalise risk across instruments.

Expect and plan for long losing streaks; survival is paramount.

Test systems across multiple regimes and perform out-of-sample validation.

Maintain operational discipline; execution and record keeping matter as much as strategy.

Applying these lessons requires humility, rigorous testing and consistent adherence to the trading plan.

Frequently Asked Questions

1. What Was the Core Idea Behind Richard Dennis's Turtle Experiment?

The Turtle experiment tested whether trading skill could be taught through a concise, rule-based system. Dennis trained novices in trend-following rules and funded their accounts. The results showed disciplined followers could generate substantial profits.

2. How Did Richard Dennis Manage Risk and Position Size?

Dennis used volatility to determine position size, risking a small fixed percentage of capital per trade. This approach reduced the chance of ruin, allowed diversification across markets, and ensured that no single position could destroy the portfolio.

3. Why Did Dennis Suffer Large Losses in the Late 1980s?

Large losses arose from rapid regime changes, high leverage and instances where rules were reportedly not followed. The 1987 crash and subsequent drawdowns exposed limits in execution and risk governance at scale.

4. Can Retail Traders Use Dennis's Methods Today?

Yes. The principles of trend detection, volatility sizing and strict risk limits are transferable. Retail traders should back-test, adapt lookback parameters to modern markets and control leverage to suit their capital and psychological tolerance.

Closing Summary

Richard Dennis left a durable imprint on trading theory and practice. His core message was simple and profound: design robust rules, size risk intelligently and execute with discipline. The Turtle experiment demonstrated that structured education and a mechanical approach can produce professional traders.

The subsequent setbacks he faced are equally instructive because they remind modern practitioners that robust systems require careful implementation, sound risk governance and ongoing adaptation to new market regimes. Traders who internalise both his successes and his challenges will be better equipped to build resilient strategies for today's markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.