John C. Bogle reshaped the investment world by championing simplicity, low cost and investor first principles. His work made broad market exposure accessible to ordinary savers and forced the industry to reckon with fees, transparency and fiduciary duty. The following article examines his life, ideas and lasting influence.

Introduction to John C. Bogle and His Investment Ethos

John C. Bogle emerged as a singular voice for the retail investor in a profession that too often prioritised sales and short-term performance. He argued that investors fare best when they adopt a long-term perspective, minimise costs and resist the noise of market fashion. These tenets formed the backbone of his life's work and remain central to many modern portfolios.

Early Life, Education and Formative Influences on John C. Bogle

John Clifton Bogle was born in 1929 and came of age during an era that taught powerful lessons about capital preservation and economic cycles. He studied at Princeton, where he developed an early interest in investment theory and corporate behaviour. His formative years at Wellington Management exposed him to the inner workings of the mutual fund industry and seeded his scepticism about high fees and frequent trading.

Founding of The Vanguard Group and the Vanguard Model of John C. Bogle

In 1974 Bogle founded The Vanguard Group. He structured Vanguard as a mutual organisation owned by its funds and therefore by the shareholders themselves. This ownership model aligned the company with the interests of investors rather than outside shareholders. Vanguard's structure made possible a relentless focus on low operating costs, transparent governance and product innovation, most notably the broadly accessible index fund.

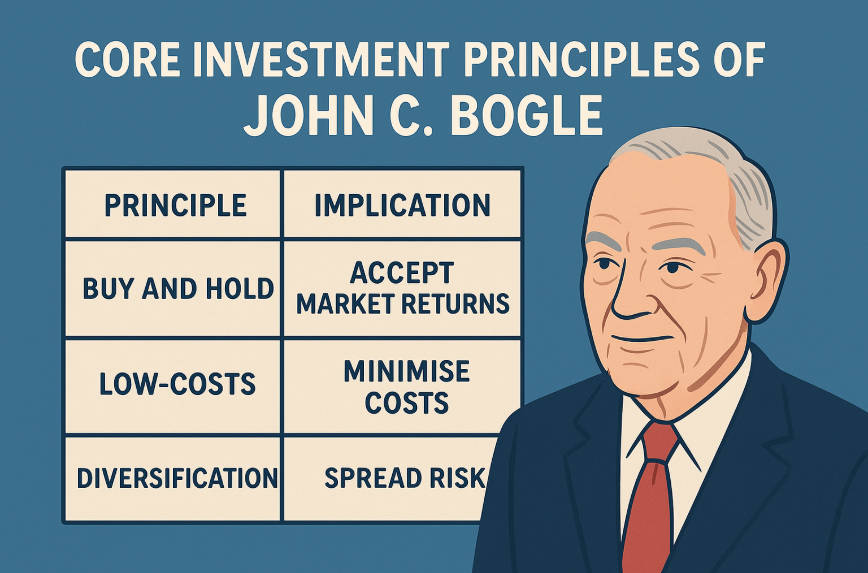

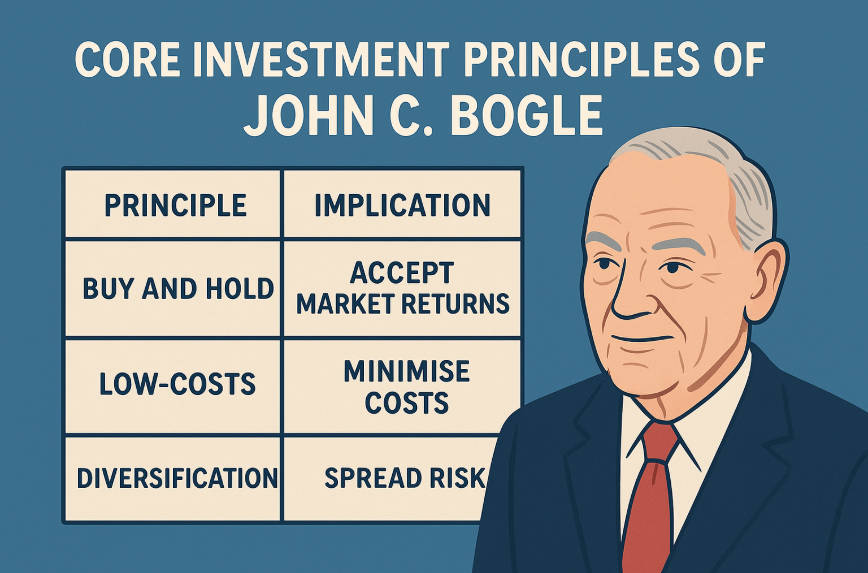

Core Investment Principles of John C. Bogle

John C. Bogle distilled investing into a handful of practical, disciplined rules. He emphasised that investors should accept the market's returns rather than chase outperformance, because the cumulative effect of costs, taxes and trading often erodes the gains sought through active management. Below is a compact table that summarises his principal rules and their investor implications.

| Principle of John C. Bogle |

Practical Investor Implication |

| Low cost is paramount |

Select funds with minimal expense ratios to preserve compounded returns. |

| Broad diversification |

Hold market-wide funds to reduce idiosyncratic risk and benefit from general economic growth. |

| Long-term perspective |

Avoid frequent trading and market timing; allow compounding to work. |

| Investment over speculation |

Focus on owning businesses rather than betting on short-term price moves. |

| Fiduciary alignment |

Prefer fund structures that prioritise shareholder interests and transparent governance. |

These principles are interrelated. Low costs magnify the benefits of diversification and a long time horizon. An investor who follows these rules reduces the risk of being outmanoeuvred by fees or prohibited by behavioural biases.

Major Contributions and Industry Legacy of John C. Bogle

Bogle's most visible legacy is the popularisation of index funds. He demonstrated that a low-cost, passive approach could deliver superior net returns for many investors when compared with the majority of actively managed funds. Beyond product innovation, he insisted on ethical conduct, clearer disclosure and a stronger fiduciary duty across the industry. His advocacy pressured competitors to cut fees and improve alignment with clients.

Critiques, Challenges and the Evolution of John C. Bogle's Thought

Bogle encountered scepticism in his early career and continued to engage with critics throughout his life. Some commentators argued that passive investing could exacerbate market concentration or weaken corporate governance. Bogle acknowledged certain limitations but maintained that, for most investors, the balance of evidence favoured low-cost indexing. He also encouraged continual scrutiny of index construction and corporate stewardship as passive strategies grew.

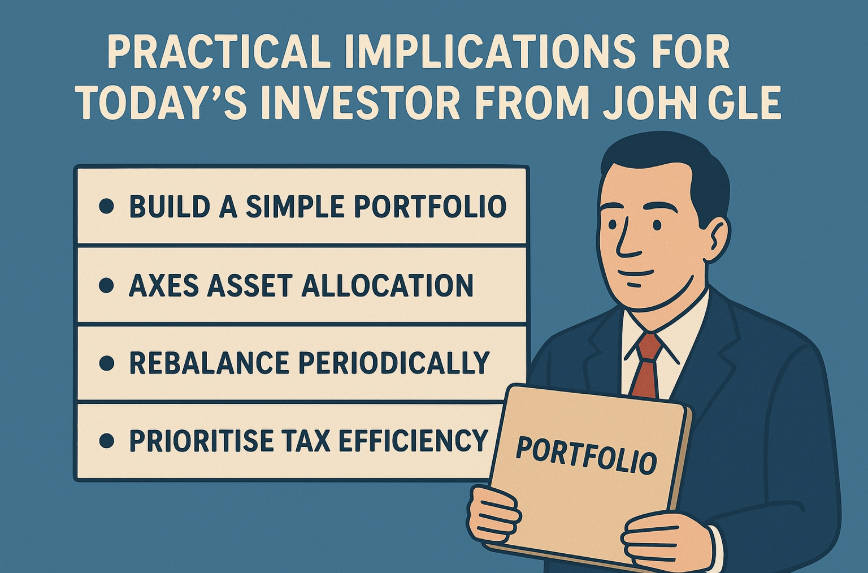

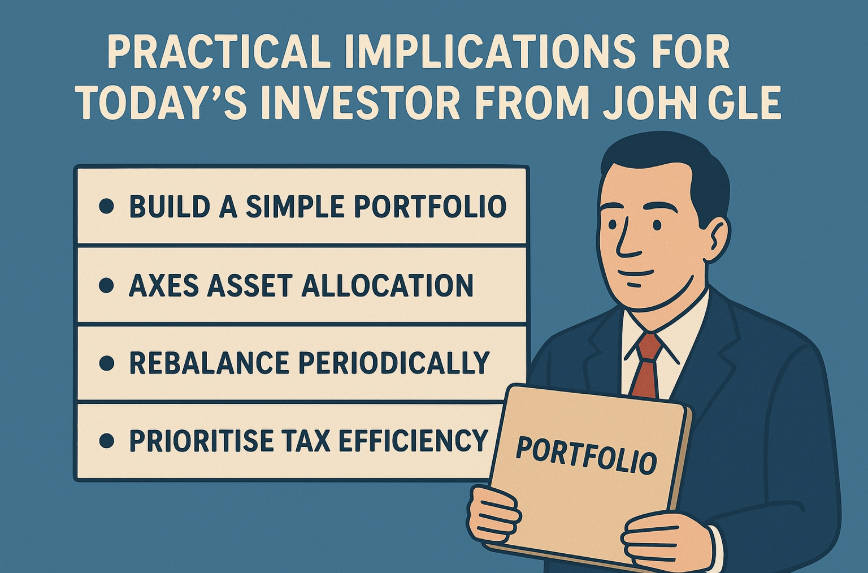

Practical Implications for Today's Investor From John C. Bogle

For an individual investor, Bogle's guidance translates into several concrete steps. Build a simple portfolio of broadly diversified, low-cost index funds; keep asset allocation aligned with objectives and risk tolerance; rebalance periodically rather than chase recent winners; and prioritise tax efficiency and minimised fees. These measures increase the probability that investment returns compound effectively over decades.

John C. Bogle's Books, Writings and Scholarly Contributions

Bogle was a prolific writer and an outspoken commentator. His books and essays are practical and often plainspoken. They provide a sustained argument for a modest, evidence-based approach to investing. The table below lists several of his most influential works and the central lesson of each.

| Book by John C. Bogle |

Year |

Key Lesson |

| Common Sense on Mutual Funds |

1999 |

Mutual fund investors should favour low cost, broadly diversified funds and long-term discipline. |

| The Little Book of Common Sense Investing |

2007 |

Owning the market through index funds is the simplest and most effective path for most investors. |

| Enough: True Measures of Money, Business, and Life |

2009 |

Wealth is a means, not an end; ethical business conduct and balance matter. |

Readers new to Bogle should start with The Little Book of Common Sense Investing for a concise, practical exposition, and then explore his longer works for historical context and moral critique.

Conclusion: The Enduring Relevance of John C. Bogle's Vision

John C. Bogle's contribution endures because it addresses immutable elements of investing: fees reduce returns, diversification mitigates risk, and time is a powerful ally. His values of transparency, service and restraint remain relevant as markets evolve. Investors who internalise his teachings position themselves to avoid common pitfalls and to pursue steady, long-term progress toward financial goals.

Frequently Asked Questions

Q1: What was John C. Bogle's most important contribution?

John C. Bogle's most important contribution was founding Vanguard and popularising low-cost index investing, enabling ordinary investors to access broad market exposure while minimising fees, thereby improving net returns and promoting investor-centred fund governance.

Q2: Why did John C. Bogle emphasise low fees?

Bogle emphasised low fees because investors cannot control markets but can control costs. Lower fees magnify compound returns over time, preserving a greater portion of gross returns for shareholders and reducing performance drag from expenses.

Q3: How can an investor apply Bogle's principles today?

Apply Bogle's principles by choosing diversified, low-cost index funds, maintaining a long term horizon, avoiding unnecessary trading, rebalancing prudently, and focusing on net returns rather than short-term performance or marketing claims from active managers.

Q4: Did John C. Bogle believe active managers cannot ever beat the market?

Bogle did not claim active managers could never outperform. He argued that, after costs and taxes, most active funds underperform over time, making low-cost indexing a more reliable strategy for ordinary investors seeking consistent net returns.

Q5: What criticisms did John C. Bogle raise about the financial industry?

Bogle criticised the industry for prioritising profit over clients, charging excessive fees, encouraging short-term speculation, poor corporate governance, and weakening fiduciary standards. He urged greater transparency, accountability and a return to serving shareholders' interests above salesmanship.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.