Understanding the Market Cycle: The Rhythm Beneath the Noise

Markets, much like human behaviour, move in patterns — not perfectly predictable ones, but recognisably cyclical. Prices rise and fall, confidence waxes and wanes, and optimism alternates with despair.

In Mastering the Market Cycle, Howard Marks reminds us that the most successful investors are not those who forecast the future with precision, but those who recognise the rhythm of cycles and adjust their positioning accordingly.

To "master" the market cycle does not mean timing every turn. It means cultivating the judgment to distinguish between favourable and unfavourable conditions — when the crowd is euphoric, when caution is ignored, and when fear has created genuine opportunity.

The market, like a pendulum, never rests at equilibrium; it constantly swings from one extreme to another. Marks's insight lies in helping investors interpret that motion.

The Mathematics of Odds: Investing as a Game of Probabilities

At the core of Marks's philosophy is the idea of "getting the odds on your side." Investing is not about certainty but probability — about stacking the conditions such that, over time, success becomes more likely than failure.

The best investors think in terms of expected value rather than prediction. A trade or investment can be correct even if it loses money, provided it was made under favourable odds.

Conversely, a profit made from reckless conditions is merely luck, not skill. By assessing where we stand in the cycle, investors can tilt the probability distribution — choosing moments when risk is under-priced and avoiding those when euphoria blinds judgment.

This probabilistic mindset replaces the illusion of control with the discipline of preparation. It reminds us that superior investing is less about being right and more about avoiding being wrong too often.

The Anatomy of a Cycle: From Euphoria to Despair

Every market cycle follows an emotional and financial arc. It typically begins in scepticism, grows into confidence, peaks in exuberance, collapses under its own excess, and eventually recovers through healing and rebuilding.

Marks describes this as a pendulum of investor psychology: from too pessimistic to too optimistic, and back again. The extremes of both fear and greed create the conditions for the next reversal. While no two cycles are identical, their anatomy often rhymes:

Recovery: Prices stabilise after crisis; value investors enter.

Expansion: Fundamentals improve, optimism grows.

Euphoria: Valuations detach from reality; risk is ignored.

Collapse: Reality reasserts itself; leverage unwinds.

Despair: Opportunity returns, but confidence is absent.

Recognising where we are in this sequence does not guarantee accuracy, but it helps investors avoid the madness of crowds and anticipate the return to equilibrium.

Forces That Drive Cycles: Economics, Credit, and Psychology

No single force drives markets in isolation. Economic growth, credit availability, and human behaviour intertwine to form the foundation of every market cycle. Marks highlights how these components interact:

| Type of Cycle |

Core Drivers |

Typical Signs |

Investment Implications |

| Economic Cycle |

Growth, inflation, policy shifts |

GDP trends, interest rates |

Guides long-term asset allocation |

| Credit Cycle |

Leverage, lending standards, liquidity |

Credit spreads, default rates |

Signals systemic risk appetite |

| Psychological Cycle |

Sentiment, confidence, narrative |

Media tone, fund flows |

Reflects behavioural excesses |

Economic expansion fuels optimism; easy credit amplifies risk-taking; and psychology drives both to excess. Eventually, rising costs, tightening credit, or faltering confidence trigger a reversal. Understanding these dynamics helps investors see the hidden architecture beneath market prices.

The Psychology of Booms and Busts: Behaviour as the True Driver

Marks's most persistent message is that psychology dominates markets. Fundamentals set the stage, but emotion writes the script. Investors swing from excessive confidence to excessive fear — each reinforcing price trends until they overshoot.

At market peaks, risk appears invisible. Investors rationalise inflated valuations, convinced that "this time is different." At market troughs, opportunity abounds, yet fear paralyses action. The paradox is that the greatest risk often lies when perceived risk is lowest, and vice versa.

Mastery, therefore, requires emotional discipline — the courage to act when others will not, and the restraint to hold back when greed surrounds you. Contrarian thinking is uncomfortable, but it is the essence of long-term success.

Positioning Through the Cycle: Strategy over Forecasting

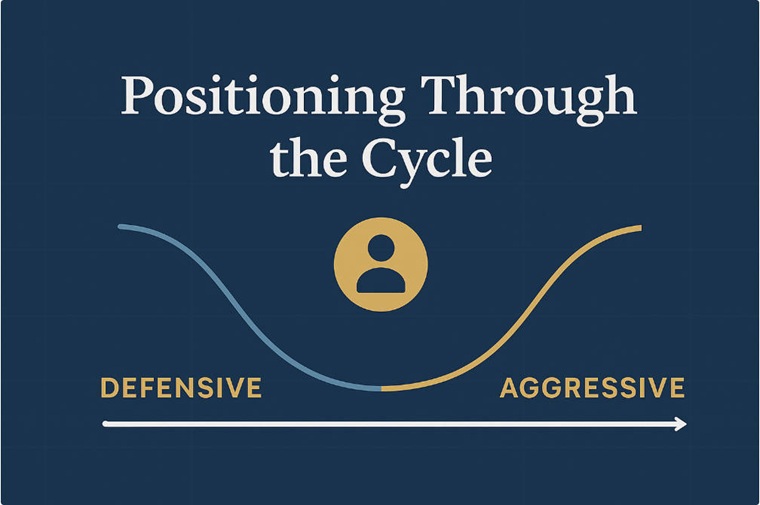

Instead of predicting market turns, Marks advocates calibrating your posture according to where you believe the cycle stands. Investing is not binary — it is a continuum between aggressive and defensive positioning.

When valuations are stretched and optimism prevails, lean defensive: hold higher-quality assets, reduce leverage, and prioritise capital preservation.

When fear dominates and prices reflect despair, lean aggressive: increase risk exposure, expand buying, and seize bargains.

This balance avoids the peril of "all-in" or "all-out" timing. The goal is not perfection but prudence — adjusting exposure to align with the probability of success. By staying patient and deliberate, investors can compound advantage across multiple cycles.

Indicators of Cycle Extremes: Reading the Market's Pulse

Identifying the market's mood requires both data and intuition. Marks suggests that investors learn to read indicators of extremes, including:

Valuation metrics — price-to-earnings ratios, credit spreads, and yield differentials.

Credit conditions — whether lenders are reckless or cautious.

Investor sentiment — the tone of commentary, fund inflows, and IPO activity.

Historical analogues — recurring patterns that echo previous tops or bottoms.

Extreme conditions rarely persist. By recognising when markets are too hot or too cold, investors can resist the urge to follow the herd and instead prepare for the inevitable reversion.

Mastering Cyclical Thinking: The Marks Framework

Cyclical thinking requires humility and perspective. Marks offers a mental model that blends observation with restraint:

Observe without overreacting — monitor the market's tone, but do not chase it.

Recognise cognitive biases — avoid extrapolating recent trends indefinitely.

Integrate cycles into long-term planning — not as trading signals, but as context for valuation and risk.

Embrace patience and discipline — the twin virtues of compounding advantage.

Learn from history — each cycle is unique, yet every one teaches the same lessons.

His approach is less a formula than a mindset: an awareness that markets are driven by human nature, and human nature does not change.

Managing Uncertainty: Humility as an Investment Tool

No framework can eliminate uncertainty. What separates the great investor from the average one is the acceptance of not knowing. Marks warns against the illusion of precision — the belief that complex models can outsmart randomness.

True mastery involves building resilience, not clairvoyance. It means preparing for multiple outcomes, maintaining liquidity, and avoiding overconfidence. As he puts it, "You can't predict, but you can prepare." That humility, paradoxically, becomes a form of strength.

The Essence of Mastery: Seeing the Big Picture

To master the market cycle is to see investing as a lifelong game of odds, temperament, and discipline. It is about understanding where we are, how others feel, and what that implies for risk and reward. Success does not come from foresight alone, but from contextual awareness — knowing when conditions are favourable and when caution is required.

Ultimately, Marks teaches that cycles are not enemies to be defeated, but guides to be understood. They remind investors to stay humble in victory, calm in crisis, and rational throughout. By recognising their rhythm and respecting their power, one truly gets the odds on their side.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.