Some investments are like strong oak trees, rooted deep in the ground, unshaken by wind or storm. They may not grow the fastest, but they endure, offering shade and security for decades. Others resemble fast-growing vines, climbing quickly but vulnerable to sudden breaks. The XLP ETF belongs firmly in the first category. It is built on the foundations of consumer staples: food, beverages, household products, and essentials that people keep buying regardless of economic ups and downs.

In 2025, when global markets are swinging between optimism and anxiety, many investors are asking how to invest in the XLP ETF in a way that captures its defensive strength without missing broader opportunities. To answer that, we need to understand what this ETF holds, how it behaves across cycles, and what strategies can make it a resilient part of a long-term portfolio.

What Is the XLP ETF?

The XLP ETF is the Consumer Staples Select Sector SPDR Fund. It is one of the original sector ETFs launched by State Street Global Advisors, designed to track the performance of the consumer staples sector within the S&P 500 Index. In simpler terms, it gives investors direct exposure to U.S. companies that sell life’s essentials, items people buy even when the economy is in recession.

As of 2025, the XLP ETF holds around 30 to 40 stocks, covering industries such as food and beverage producers, household and personal care companies, supermarkets, tobacco, and non-durable consumer goods. Some of its largest holdings include Procter & Gamble, Coca-Cola, PepsiCo, Walmart, Mondelez International, and Colgate-Palmolive. These are firms with global scale, strong brands, and products that fill shopping carts every single day.

XLP is known for its low expense ratio compared with many actively managed mutual funds, keeping costs down for long-term holders. It also has deep liquidity, with tens of billions in assets under management, making it one of the largest consumer staples ETFs and a popular choice for investors seeking defensive exposure. High daily trading volumes ensure tight bid-ask spreads for investors.

Why Focus on Consumer Staples in 2025?

Every sector has its season. Technology shines when innovation accelerates, energy thrives when commodities boom, and industrials rally when global trade expands. But consumer staples tend to shine when uncertainty rises.

In 2025, investors face a mix of opportunities and risks. On one hand, artificial intelligence, clean energy, and healthcare innovation are creating powerful growth stories. On the other, persistent inflation, interest rate uncertainty, and geopolitical instability weigh heavily on market sentiment. For many portfolios, this means adding a defensive core, an anchor that can help smooth returns during turbulent periods.

Consumer staples are naturally defensive because people cannot postpone toothpaste, soap, or food in the same way they can delay buying a new car or upgrading a phone. This non-cyclical demand makes companies in the XLP ETF less sensitive to recessions. At the same time, staples often carry strong pricing power, which helps them protect margins during inflationary periods.

For Muslim investors or those seeking ethical allocations, the sector also aligns relatively well with many Shariah-compliant filters, as most of the companies avoid heavily prohibited industries like gambling, alcohol distribution, or conventional financial services.

Historical Performance of the XLP ETF

To understand how to invest in the XLP ETF in 2025, it helps to look back at how it has performed across past cycles.

2008 Global Financial Crisis: While the S&P 500 fell more than 35 percent in 2008, the XLP ETF declined only about 15 percent. This showed its defensive qualities.

2011 Debt Ceiling Crisis: During U.S. political uncertainty, staples outperformed as investors rotated into safety.

2020 Pandemic Shock: Initially, XLP fell sharply with the broad market in March, but it recovered quickly as investors realised staples companies were among the first to stabilise revenues when lockdowns hit.

2022 Inflation and Rate Hikes: Rising costs squeezed margins across sectors, but historically, XLP has delivered steady returns, particularly during volatile markets, as consumer staples tend to outperform in defensive cycles.

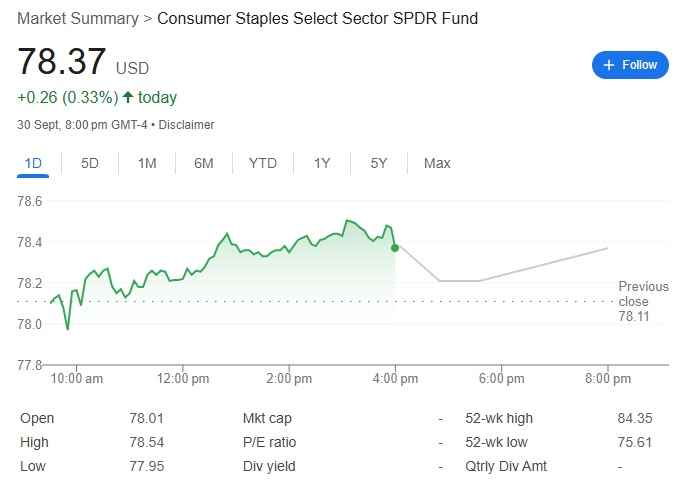

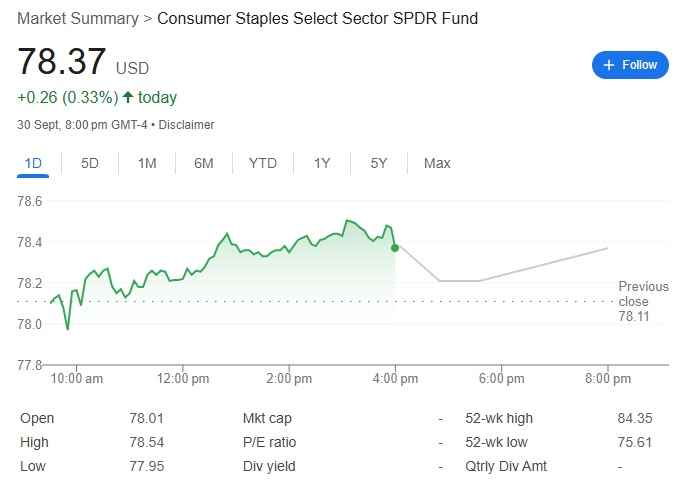

From 1999 (its launch year) through 2024, the XLP ETF delivered an annualised return of roughly 7 to 8 percent, slightly lower than the S&P 500, but with much lower volatility. That’s the trade-off: less upside during roaring bull markets, but far greater resilience when the tide turns.

How the XLP ETF Works in Practice

At its core, the XLP ETF uses a market-cap weighted approach. That means larger companies carry more weight in the index. XLP is heavily weighted toward household names such as Procter & Gamble, Coca-Cola, and PepsiCo, which consistently rank among its largest holdings, showing how concentrated the fund can be.

This concentration can be a double-edged sword. On the positive side, investors gain exposure to the most powerful consumer brands in the world. On the downside, the fund is less diversified than something like a broad consumer staples index with equal weighting. Still, for most investors, this approach offers a simple, liquid, and cost-effective way to capture sector leadership.

The ETF pays dividends quarterly, reflecting the stable cash flow of its holdings. XLP typically offers a dividend yield that is higher than the broader S&P 500, which appeals to income-seeking investors.

Case Studies About the XLP ETF

Case Study 1: Procter & Gamble – The Defensive Giant

Procter & Gamble (P&G) is often called the backbone of the XLP ETF. Its brands, including Tide, Pampers, Gillette, and Olay, reach households across 180 countries. For decades, P&G has delivered consistent revenue growth, driven not by rapid innovation, but by brand strength, distribution power, and incremental product improvements.

During recessions, demand for P&G products rarely collapses. Even if consumers trade down to cheaper brands, many remain loyal because of quality perceptions. For XLP investors, P&G provides earnings stability that supports the ETF’s defensive appeal.

In 2020, for instance, while many discretionary companies saw revenues fall, P&G reported growth in cleaning and hygiene categories. In 2022, when inflation surged, P&G raised prices without losing significant market share, demonstrating pricing power. This resilience shows why the company remains one of the ETF’s heaviest weights and why it anchors investor confidence.

At the same time, P&G’s risks include foreign exchange headwinds (since more than half its sales are international) and regulatory scrutiny over consumer goods. But in the context of the ETF, those risks are diversified by other holdings, allowing P&G to play its stabilising role.

Case Study 2: Coca-Cola – Brand Power in Every Market

Coca-Cola represents another cornerstone of the XLP ETF. The brand is recognised almost everywhere on earth, with more than 1.9 billion servings of its beverages consumed daily. Unlike high-tech firms that depend on product cycles, Coca-Cola’s model is built on distribution scale and marketing.

For XLP investors, the value lies in Coca-Cola’s ability to generate steady cash flows. Its franchise bottling system lowers capital intensity while maintaining brand dominance. This allows the company to pay dividends consistently, which flow through to the ETF. Coca-Cola is recognised as a Dividend King, with decades of uninterrupted dividend growth, making it a reliable holding inside XLP.

Coca-Cola also adapts to shifting consumer preferences, expanding into low-sugar drinks, bottled water, and energy beverages. This adaptability ensures its role as a stabiliser within the ETF remains intact, even when tastes change.

The main risks include currency fluctuations, given its global reach, and regulatory pressures around sugar consumption. However, for XLP ETF investors, Coca-Cola’s strengths in brand equity and dividend consistency far outweigh those concerns.

Case Study 3: Walmart – Retail Scale and Everyday Essentials

Walmart brings a different kind of strength to the XLP ETF. While it is technically a retailer rather than a manufacturer, it dominates the U.S. grocery landscape, with more than 4,600 stores across America and a growing online presence.

For the ETF, Walmart contributes scale and reach. When consumers cut back on discretionary spending, they often shift to Walmart for lower prices on essentials. That counter-cyclical behaviour boosts Walmart’s role as a stabiliser in downturns. During inflationary periods, Walmart’s ability to negotiate with suppliers and offer lower costs helps it retain customers.

Walmart is also investing heavily in e-commerce and logistics. In 2024, it became the second-largest U.S. online retailer after Amazon, with billions in digital sales. This transformation ensures Walmart’s relevance for decades to come.

The risk side includes thin profit margins and competition from both traditional retailers and online platforms. Still, for XLP ETF holders, Walmart represents resilience through scale and adaptability, making it one of the ETF’s most important holdings.

Advantages of Investing in the XLP ETF

Defensive Exposure: Provides stability during recessions and market volatility.

Global Brands: Exposure to companies with products in nearly every household worldwide.

Dividend Income: Regular quarterly payouts backed by stable earnings.

Low Cost: An expense ratio that remains among the lowest in the sector ensures minimal drag on returns.

Liquidity: Easy to buy and sell with high trading volumes and tight spreads.

Risks of Investing in the XLP ETF

Limited Growth: Staples grow slower than technology or healthcare.

Concentration: Heavy weight in a handful of companies like P&G, Coca-Cola, and Walmart.

Inflation Pressures: While companies can pass on costs, margins may still tighten.

Regulatory Scrutiny: Governments increasingly monitor health and environmental impacts of consumer goods.

Currency Exposure: Many holdings earn revenues abroad, making them sensitive to exchange rate movements.

Portfolio Strategies for Using the XLP ETF

1. As a Defensive Core

Investors who want to protect against volatility often allocate a percentage of their portfolio to XLP as a stabiliser. For example, a balanced portfolio might include 10 to 15 percent in consumer staples.

2. As a Counterweight to Growth

Pairing the XLP ETF with technology-heavy funds such as QQQ can smooth returns. When growth stocks fall sharply, staples often cushion the blow.

3. Dollar-Cost Averaging

Because XLP does not swing as wildly as growth sectors, dollar-cost averaging works well. Investors can steadily accumulate shares over time without fear of missing major rallies.

4. Dividend Reinvestment

Reinvesting dividends from XLP can compound returns, especially for long-term investors who hold through multiple cycles.

Global Relevance of the XLP ETF

While the XLP ETF tracks U.S. companies, its brands are global. Procter & Gamble’s Pampers, Coca-Cola’s beverages, and Colgate’s toothpaste dominate shelves in Asia, Africa, and Latin America. This global reach ensures that investors are not just betting on U.S. consumers, but on consumption patterns across emerging markets.

For example, Coca-Cola derives more than half of its revenue outside the United States, while Procter & Gamble earns more than 50 percent internationally. This diversification adds another layer of resilience to the ETF.

FAQs About the XLP ETF

Q1. Is the XLP ETF a good investment in 2025?

Yes. With inflation risks, rate uncertainty, and geopolitical challenges, the XLP ETF offers defensive stability and exposure to global brands that people buy regardless of the economy.

Q2. Does the XLP ETF pay dividends?

Yes. The fund pays quarterly dividends, with a yield that is typically higher than the broader S&P 500, supported by strong cash flow from its consumer staples holdings.

Q3. How much should I allocate to the XLP ETF?

This depends on your risk profile. Conservative investors may allocate 15 to 20 percent of equities to staples, while aggressive investors may keep exposure at 5 to 10 percent as a counterbalance to growth.

Conclusion

The question of how to invest in the XLP ETF in 2025 is really about how to balance stability and growth in a portfolio. The ETF is not designed to shoot the lights out during bull markets, but it shines when uncertainty rises. It captures the earnings resilience of consumer staples companies whose products people buy in good times and bad.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.