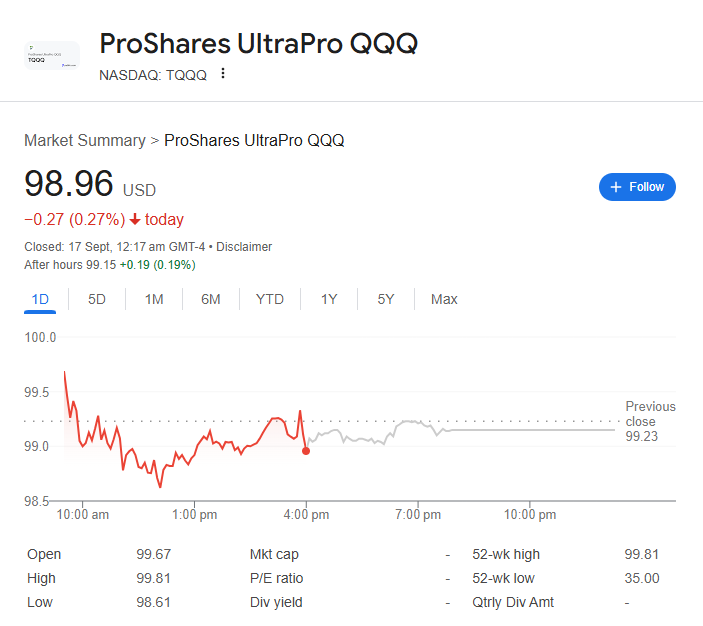

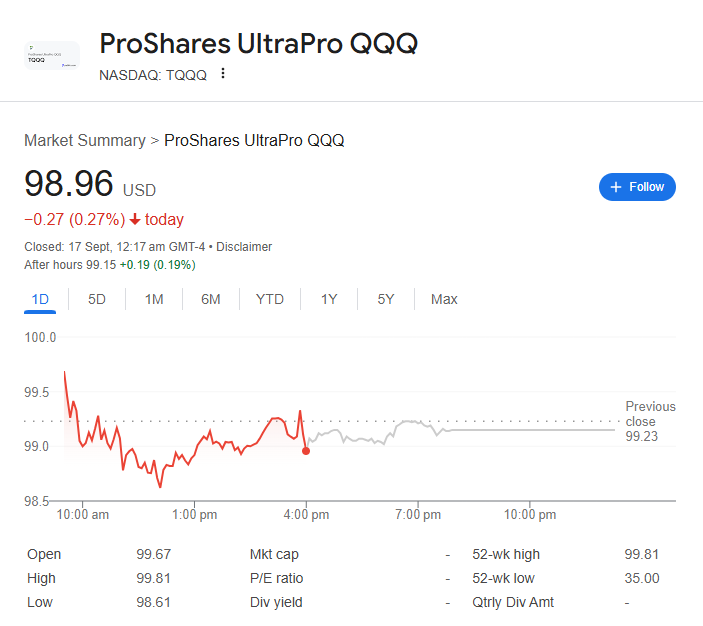

The idea of multiplying your returns by three is intoxicating. That is exactly what the ProShares UltraPro QQQ (TQQQ ETF) promises: triple the daily performance of the QQQ ETF, which tracks the Invesco QQQ Trust and the tech-heavy Nasdaq-100 Index. When the market is surging, the TQQQ ETF can deliver extraordinary gains in just days. Yet this promise comes with an equally powerful threat — if the market turns against you, losses mount three times as fast.

This guide walks you through how to invest in the TQQQ ETF without taking excessive risk. Instead of treating it like a lottery ticket, you will learn how to approach it like a professional trader: with strict discipline, tight risk management, and a clear plan.

What Is the TQQQ ETF and How It Works

The TQQQ ETF is a 3x leveraged exchange-traded fund. It aims to deliver three times the daily performance of the Nasdaq-100 Index. This means that if the Nasdaq-100 rises 1% in a single day, the TQQQ ETF is designed to rise 3%. If the Nasdaq-100 falls 1%, the TQQQ ETF should fall about 3%.

This leverage is achieved through financial derivatives such as swaps and futures. Importantly, the TQQQ ETF resets its leverage daily. That daily reset is what makes it so different from a normal ETF. Over multiple days, the returns are not simply three times the index’s cumulative gain or loss because of the effects of compounding.

Here is a simple example to show why:

Day 1: QQQ rises 10% → TQQQ ETF rises 30%

Day 2: QQQ falls 10% → TQQQ ETF falls 30%

After these two days, QQQ ends up roughly at −1% (1.1 × 0.9 = 0.99).

But TQQQ ETF ends up at −9% (1.3 × 0.7 = 0.91).

Even though QQQ only lost 1% over the two days, the TQQQ ETF lost 9%. This happens because the 3x leverage magnifies both gains and losses on a daily basis, and those daily moves compound over time. This phenomenon is called volatility decay and it becomes extremely important the longer you hold TQQQ ETF positions.

Why the TQQQ ETF Is So Risky

To use the TQQQ ETF safely, you must first understand what makes it risky. The main dangers are volatility decay, compounding drag, gap risk, and psychological traps.

Volatility decay occurs because the TQQQ ETF rebalances daily. If the Nasdaq-100 is volatile but goes nowhere overall, TQQQ ETF holdings will still lose value over time. For instance, imagine a period where QQQ alternates +5% and −5% every day for ten days. QQQ will end close to flat. But the TQQQ ETF, rising 15% then dropping 15% repeatedly, will lose value because each percentage loss happens on a growing or shrinking base. Over many swings, this erodes capital.

How to Reduce Risk When Investing in the TQQQ ETF

The good news is that you can still harness the TQQQ ETF’s upside while containing the downside. The key is strict risk management. Here is how to do it:

1. Keep position size small

Never put more than a tiny portion of your portfolio into the TQQQ ETF. For most people, that means 2–5% of total capital. This way, even if it collapses, your overall portfolio stays intact.

2. Always use stop-losses

Before entering a trade, decide at what price you will cut your losses. Set a hard stop-loss order or use a trailing stop that moves up with price gains. This prevents a small loss from snowballing into a catastrophe.

3. Trade only during clear uptrends

Because of volatility decay, sideways markets destroy leveraged ETFs. Wait for confirmed uptrend conditions — higher highs, strong momentum, positive market breadth. Do not buy the TQQQ ETF just because it looks cheap.

4. Use short holding windows

Plan to hold the TQQQ ETF only for days or a few weeks, not months. The longer you hold, the more likely volatility will erode returns. Treat it like a short-term tactical instrument, not an investment.

5. Avoid major event risk

Big data releases such as CPI, jobs reports, or Federal Reserve meetings can cause violent gaps. If you are holding the TQQQ ETF, consider exiting or reducing size before major news.

By following these principles, you reduce your exposure to the very risks that make the TQQQ ETF dangerous. Instead of letting the market control you, you take control of your risk.

How to Build a Disciplined TQQQ ETF Trading Plan

Having rules is not enough — you must actually follow them. A disciplined trading plan turns the TQQQ ETF from a gamble into a controlled strategy. Use technical signals to confirm when momentum is on your side, such as the 20-day moving average crossing above the 50-day, the RSI breaking above 50, or price breaking out of a multi-week range on high volume. Only trade when conditions are strongly bullish, and enter with clear logic rather than impulse.

Just as important is knowing when to get out. Before you enter, decide where you will exit both for profit and loss — for example, take profits if price rises 20% or cut losses if it falls 10%. Log every TQQQ ETF trade with its entry, exit, size, reason, and result, and review these records to identify mistakes and improve discipline. Begin with paper trading to test your rules, then risk only small amounts of real capital until you have proven your plan works. Gradually scale position size only when your results are consistently positive.

Common Mistakes to Avoid with the TQQQ ETF

Many traders blow up with the TQQQ ETF not because it is inherently impossible, but because they make predictable and preventable mistakes. One of the most common is holding too long — the TQQQ ETF is built for short-term use, and keeping it for months exposes you to volatility decay that can quietly erase earlier gains. Oversizing positions is another major error; putting 20%, 50%, or even 100% of your portfolio into the TQQQ ETF is reckless, as a single bad week can wipe out years of progress. Some traders also ignore market context, jumping in during sideways or declining conditions when the TQQQ ETF only performs well in strong, sustained uptrends.

Emotional trading and forgetting about time decay can be just as damaging. Revenge trading after losses, chasing missed rallies, or doubling down to recover quickly often leads to poor decisions and rapid losses. Meanwhile, treating the TQQQ ETF like a long-term holding is equally dangerous, as it is not designed to compound over time the way normal ETFs do. Recognising these pitfalls and avoiding them is half the battle, and discipline will protect you where emotion destroys.

FAQs About TQQQ ETF

Q1. Is the TQQQ ETF suitable for beginners?

The TQQQ ETF is rarely suitable for beginners because it requires precise timing, strict discipline, and an understanding of leverage mechanics. Beginners often lack the experience to handle large daily price swings and the emotional resilience to stick to stop-losses. Those who still wish to try it should only risk tiny amounts of capital and focus on learning how the TQQQ ETF behaves before using meaningful sums.

Q2. Can I hold the TQQQ ETF long-term?

No, holding the TQQQ ETF long-term is risky because of volatility decay. Over time, even if the Nasdaq-100 rises moderately, the daily compounding of gains and losses can erode the ETF’s value. Its design is to magnify daily moves, not to compound over months or years. Long-term investors who ignore this risk often see their gains disappear after a few volatile weeks.

Q3. How much of my portfolio should be in the TQQQ ETF?

The TQQQ ETF should only be a very small slice of your overall portfolio. A range of 2–5% is generally considered the upper limit for those who understand its risks. This keeps potential losses contained if the trade goes wrong. The goal is to use the TQQQ ETF as a tactical tool, not a core holding that your long-term financial plan depends on.

Conclusion

The TQQQ ETF can be thrilling. It offers the possibility of tripling your returns when the Nasdaq-100 goes on a tear. But it is also unforgiving. Losses can snowball with shocking speed, wiping out gains in days. The difference between success and disaster comes down to discipline.

To invest in the TQQQ ETF without taking excessive risk, treat it like a loaded weapon. Understand how its daily leverage works. Respect its risks. Use small positions, tight stops, and short holding periods. Monitor your trades daily and stick to your plan without exception.

Handled recklessly, the TQQQ ETF is little more than gambling. Handled with strict discipline, it can be a powerful tactical tool — one that boosts your returns while keeping your portfolio safe.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.