The Mexican peso (MXN) and the United States dollar (USD) share one of the most vital currency exchange relationships in the Western Hemisphere.

Regardless of a trader or investor, it's crucial to comprehend the dollar's value in Mexico, the changes in the USD/MXN rate, and the factors that affect future trends.

This article will comprehensively analyse the dollar's value in Mexico, its historical evolution, economic factors, and forecast for 2025 and future years.

How Much Is the Dollar in Mexico? Current Rates

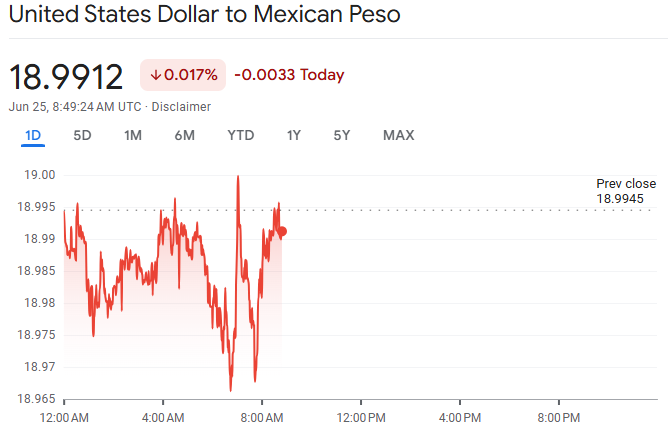

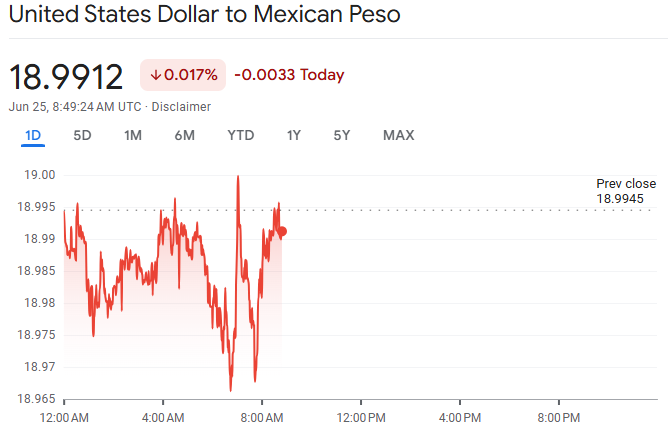

As of June 25, 2025, the U.S. dollar is trading at approximately USD 1 = 18.99 MXN, marking a modest 0.017% decline from the previous day. Over the past week, the peso has remained stable around ₱19.0 per dollar, fluctuating between ₱18.95 and ₱19.31.

It marks a relatively stable range compared to past years, though short-term fluctuations are common due to trade tensions, interest rate changes, and economic releases.

The Bank of Mexico (Banxico) and the U.S. Federal Reserve both play massive roles in how this rate behaves. Their policy shifts on inflation, interest rates, and international investment capital flow directly influence the strength or weakness of the peso against the dollar.

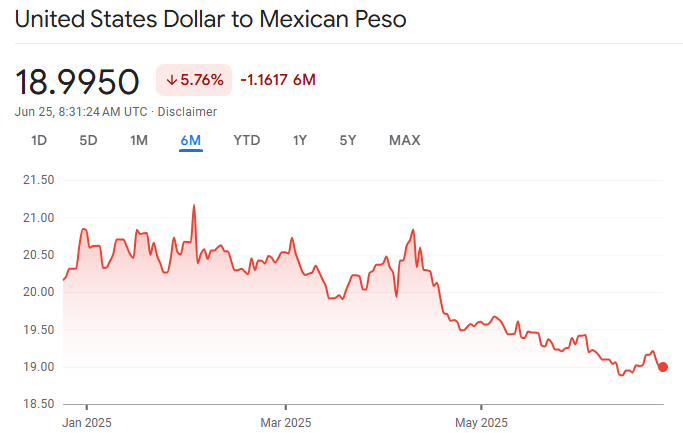

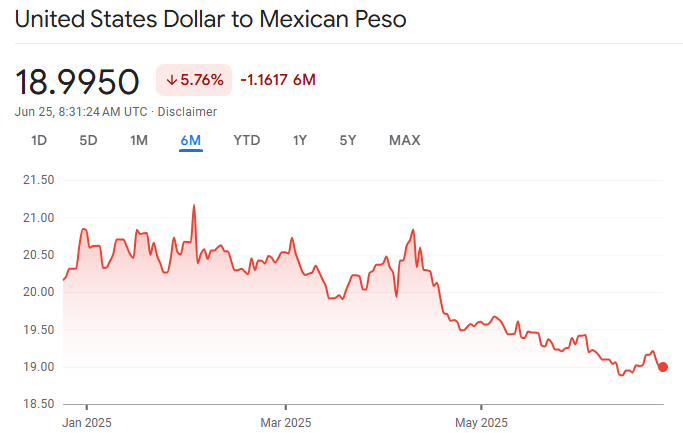

Monthly USD/MXN Trends in 2025

January: Averaged around ₱20.57, with intra-month highs near ₱20.84.

February: Held around ₱20.45, with similar highs and lows.

March: Averaged near ₱20.23, slipping below ₱20 for the first time.

April: Shifted to around ₱20.00, marking the first month under ₱20.

May: Further strengthened to approximately ₱19.44.

June: Averaged ₱19.06, reaching as low as ₱18.89 on June 12.

This trend illustrates a nearly 10% y‑t‑d appreciation of the peso—an impressive rebound from weak levels earlier in the year.

Brief History of USD/MXN Exchange Rate

To understand the current dynamics, it helps to look back at the peso's historical journey:

Pre-1990s: Pegged Currency

Before 1994, Mexico maintained a semi-fixed exchange rate regime, where the peso was loosely pegged to the dollar. The economy often faced high inflation and recurring currency devaluations, which created distrust in the peso.

1994: The Peso Crisis (Tequila Crisis)

In December 1994, the Mexican government devalued the peso suddenly, triggering a financial crisis and capital flight. The USD/MXN rate surged from 3.4 to over 7 pesos per dollar within weeks. This crisis caused Mexico into a free-floating exchange rate regime.

2000s: Transition to Stability

Throughout the early 2000s, the peso gradually stabilised amid improving fiscal policy, oil exports, and NAFTA trade growth. The USD/MXN rate fluctuated within 9 to 14 pesos per dollar, influenced by global demand and emerging market sentiment.

2008–2009: Global Financial Crisis

In the context of the global recession, increased risk aversion led to the peso significantly falling. The USD/MXN rate hit a high of over 15 pesos per dollar, driven by falling oil prices and investor withdrawals from emerging markets.

2016–2020: Trump Era and COVID-19

Fears regarding NAFTA renegotiation, border regulations, and trade tariffs led the peso to decline to approximately 20–21 MXN for every USD. In 2020, COVID-19 shocks pushed the exchange rate above 24 pesos per dollar, a historical high.

2021–2024: Recovery and Volatility

As global markets recovered and Mexico's central bank raised interest rates to fight inflation, the peso regained strength. The rate trended downward, averaging 19.0 to 18.0 MXN per USD during most of 2023 and 2024.

Factors That Affect the Dollar in Mexico

Several overlapping factors affect the dollar's value in Mexico:

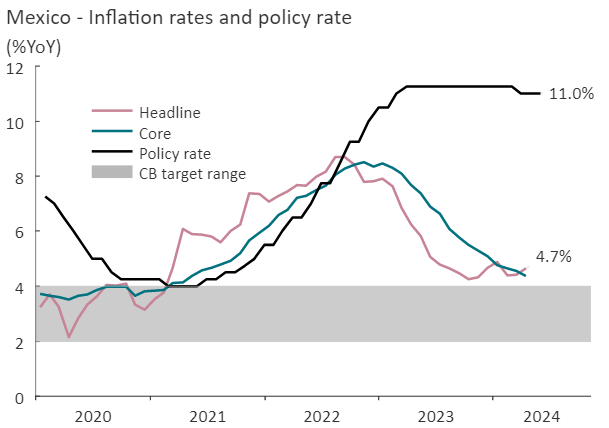

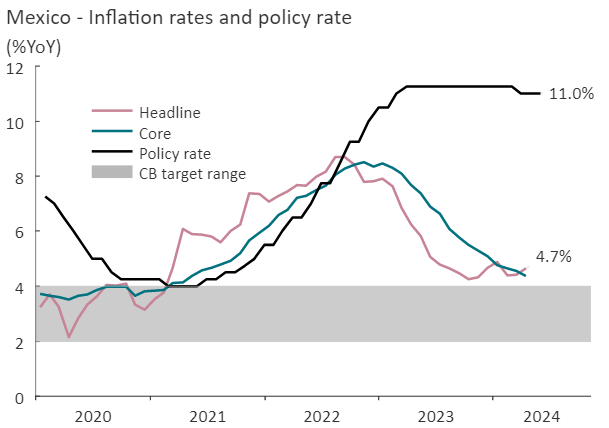

Monetary policy: Mexico's central bank recently held interest rates at approximately 11%, significantly above U.S. rates, supporting the peso amid global carry flows.

Oil dependency: Mexico is a leading oil exporter, so oil price recovery strengthens fiscal and trade accounts—benefiting MXN.

U.S.–Mexico trade dynamics: Stability around tariffs helped stabilise the peso in mid‑2025.

Global risk sentiment: During periods of aversion, the strength of the USD negatively impacts emerging currencies like the MXN; when sentiment is enhanced, the peso usually gains value.

Outlook: What Lies Ahead for USD/MXN

Central bank direction and market agreement suggest the peso will remain strong in the short term, although challenges persist.

A Reuters survey (April 2025) predicts the peso will drop to ₱20.55/USD in six months, experiencing minor depreciation owing to possible new tariffs from the U.S.

Analysts predict the upcoming actions of the U.S. Federal Reserve will increase U.S. yields, bolstering the USD and causing strain on the MXN.

Continued high oil prices and strengthened fiscal signals in Mexico would support the peso, potentially stabilising it in the ₱18.9–19.5 range for the remainder of 2025.

Political risk remains: U.S. elections or trade tensions could reverse gains.

Through 2026, forecasts anticipate modest depreciation to ₱20.8/USD under a base-case scenario (stable global conditions and responsive central banks).

Recommended Trading Strategies

1. Carry Trade Strategy: Take Advantage of Rate Differentials

Why It Works

Mexico's interest rates remain among the highest in major emerging markets—around 11%, while the U.S. Fed holds closer to 5.25%. It creates a powerful positive carry if you're shorting USD and going long MXN.

How to Execute

Go long MXN, short USD via forex spot or forward contracts.

Hold the position to collect daily rollover interest (swap rate), especially effective in low-volatility environments.

Use tight stop-losses near technical levels to reduce drawdowns from unexpected USD spikes.

Risk

Sudden U.S. rate hikes or peso-specific shocks (e.g., political events) could unwind the trade.

2. Fade the Rally Strategy: Sell into Strength Above 19.50

Why It Works

The peso has consistently traded under 19.0/USD throughout Q2 2025, but gains often falter around ₱19.50–20.00, particularly during times of rising oil prices or doubts about local policy reliability.

How to Execute

Use technical indicators like RSI or Bollinger Bands to identify overbought conditions above ₱19.50.

Short USD/MXN with a near-term take-profit at ₱18.90–19.10.

Set stop-loss around ₱20.00 to protect against geopolitical or trade-driven spikes.

3. Mean Reversion Strategy: Trade Inside the Range

Why It Works

USD/MXN has shown predictable mean-reverting behaviour in the ₱18.80–19.50 zone through most of 2025.

How to Execute

Buy USD/MXN near ₱18.80–18.90, targeting a move back to ₱19.30–19.50.

Short near ₱19.50, targeting ₱19.00.

Confirm entries with MACD, Fibonacci retracements, or moving average convergence.

4. Event-Driven Trading: React to Policy and Data Releases

Why It Works

USD to MXN tends to spike sharply after Banxico meetings, Fed announcements, and U.S. CPI or jobs data.

How to Execute

Use a calendar (like Trading Economics) to anticipate high-volatility events.

Pre-position using straddles (buying call and put options) or hedge using micro-futures on platforms that support emerging markets.

Use tight post-news trailing stops to lock in gains.

Conclusion

In conclusion, the question, "How much is the dollar in Mexico?" opens the door to understanding one of the most dynamic currency pairs in global markets.

In 2025, the dollar typically trades between 18 and 20 pesos, but this range reflects a much deeper economic story. Future direction relies on the global rate environment, local politics, and energy dynamics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.