By 2030, the "dollar to peso" story may define how emerging markets handle U.S. monetary power. From Mexico’s steady peso to Argentina’s runaway inflation, each tells a unique tale of resilience or struggle.

The dollar to peso forecast is shaping up as one of the key currency stories heading into 2030.

With Mexico’s peso holding firm, the Philippine peso gradually softening, and Argentina’s sliding fast, the path of each reflects its own economic reality.

Understanding how rates, inflation, and capital flows drive these moves is crucial for traders, investors, and global businesses alike.

Current Exchange Landscape & Trends

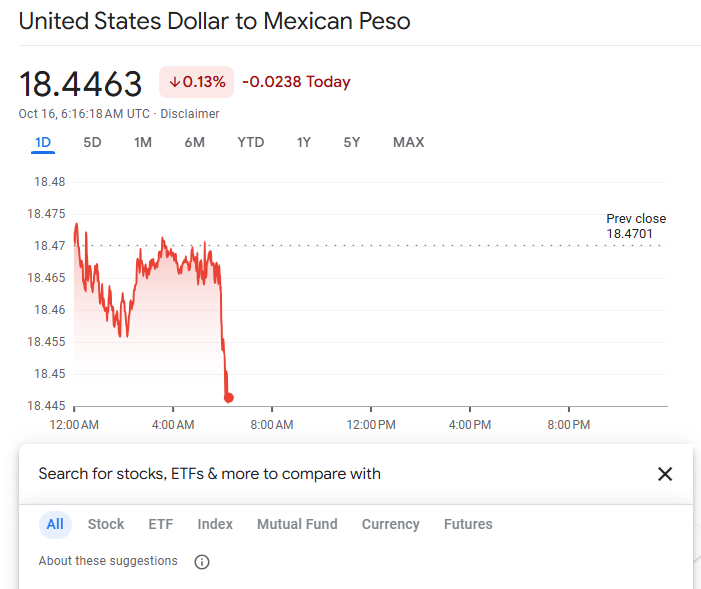

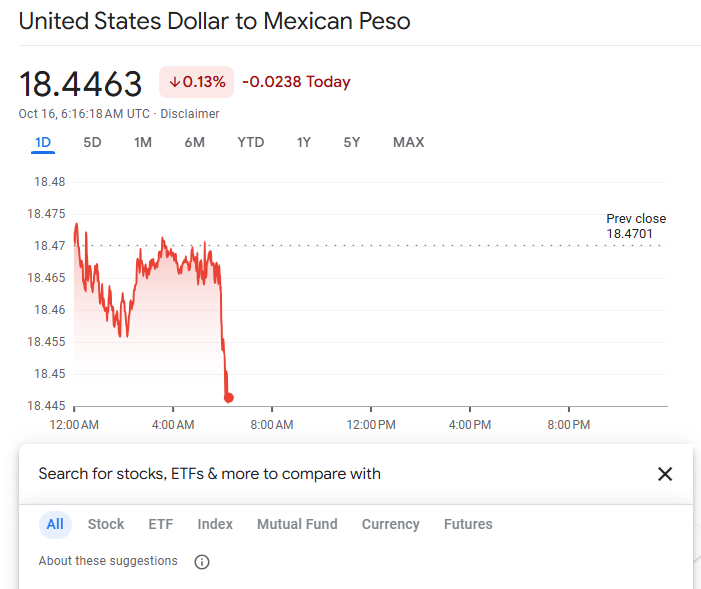

As of mid-October 2025, USD/MXN stands at ~ 18.4580 pesos per dollar, with the peso having strengthened slightly from earlier months.

USD/PHP trades near ₱58.21 per dollar, reflecting modest depreciation in 2025 so far.

The Argentine peso is much weaker and more volatile, trading around ₱1,348.5 per USD with high inflation and capital flight pressures.

Recent forecasts for USD/MXN suggest it could reach ~19.35 by 2030. For USD/ARS, long-range models (e.g., via Gov.Capital) project very large depreciation for example ~14,082 ARS per USD by mid-2030.

Forecast Table: USD: Pesos (2025–2030)

The table below shows the 2030 forecast for the three countries utilizing the pesos. Forecasts are updated regularly as central banks adjust policy and global liquidity shifts.

| Year |

USD / MXN Forecast |

USD / PHP Forecast |

USD / ARS Projection |

| 2025 |

~18.5 → 19.5 |

~₱58.2 → ₱60 |

~₱1,350 – ₱2,000 |

| 2026 |

19.5 – 20.5 |

₱60 – ₱62 |

~₱2,000 – ₱3,000 |

| 2027 |

19.0 – 20.5 |

₱62 – ₱65 |

~₱3,000 – ₱5,000 |

| 2028–2030 |

~19 – 21 |

₱65 – ₱70+ |

~₱10,000 – ₱14,000 |

Note: These forecasts are based on analyst projections and subject to macro shocks. Use them as directional guidance, not guaranteed values. PHP forecasts are directional; long-term consensus is weaker peso if inflation and monetary policy diverge.

What Usually Drives Currency Value Changes

Exchange rates move for many reasons, both financial and psychological.

Supply and demand: when investors want a currency, it rises; when demand fades, it drops.

Interest rates often drive that demand. Higher returns pull investors in and lift the currency, while lower rates push them away.

Inflation quietly eats at buying power. Countries with faster price growth usually see their currencies slip.

Trade flow shapes pressure too. Exporters bring in foreign money, keeping their currency firm, while import-heavy nations face the opposite pull.

Public debt, politics, and investor trust all matter. Markets reward stable policy and transparency, but punish chaos or overspending.

When global nerves rise, traders rush into “safe” currencies like the U.S. dollar; when calm returns, funds drift back into emerging markets.

What Drives Peso Behavior Across Mexico, Argentina, and Philippines

Key Drivers Across the Three Pesos

Understanding peso dynamics means tracking how each economy handles rates, inflation, and risk sentiment.

Rate Differentials & Yield Attraction

If U.S. rates remain elevated relative to local rates, USD will attract capital. Mexico’s central bank has already cut rates, narrowing the spread.

Inflation & Real Yields

Currencies with better inflation control tend to resist depreciation. Mexico’s inflation (~3.7%) is manageable; Argentina’s is runaway, undermining confidence.

Capital Flows & External Balances

Trade, foreign investment, and remittances matter. Mexico’s deep trade ties with the U.S. and the Philippines’ reliance on remittances give them different exposures. Argentina suffers capital flight under stress.

Political / Policy Risk

Elections, fiscal deficits, and currency reforms often lead to abrupt moves. For example, Argentina’s new trading band regime may constrain extremes.

-

Global Risk Sentiment

In times of stress, USD strengthens; pesos (especially ARS) tend to collapse. When risk appetite revives, peso currencies may recover.

Will the Dollar (USD) Go Up in Mexico, the Philippines, and Argentina (Peso)?

With those forces in mind, here’s how the dollar to peso forecast plays out across Mexico, the Philippines, and Argentina.

-

Mexico (USD/MXN):

The dollar may climb modestly against the Mexican peso through 2030 as rate gaps narrow and growth cools. Mexico’s stable inflation limits sharp moves, but a stronger U.S. economy or delayed Fed cuts could lift USD/MXN toward 19~20 in the medium term.

-

Philippines (USD/PHP):

The U.S. dollar is likely to stay firm against the peso if Philippine inflation stays above target or the Bangko Sentral softens policy. USD/PHP could test the upper 50s to low 60s range as the U.S. keeps its rate advantage and trade pressures persist.

Argentina (USD/ARS):

The dollar’s advance in Argentina remains steep as inflation and policy uncertainty erode confidence. Even with reforms, USD/ARS could surge beyond ₱10,000 in the coming years, reflecting structural weakness rather than short-term volatility.

Risks and Potential Dollar Scenarios

In the current dollar to peso forecast, risks lean toward a softer U.S. dollar if the economy slows or rates drop faster than expected. Inflation or fiscal surprises in Mexico or the Philippines could lift their pesos instead.

Argentina still faces the threat of policy shocks or currency controls that can spark quick losses.

The upside for the greenback remains if global interest rates stay high, inflation rises locally, or markets retreat into safer U.S. assets.

What the Dollar to Peso Forecast Means for Forex Traders

For traders, the dollar to peso forecast is both an opportunity and a warning. Pairs like USD/MXN and USD/PHP react sharply to shifts in global sentiment, making them prime setups for tactical positioning.

When U.S. rates stay high, traders often lean long on USD against emerging currencies; but if inflation cools or risk appetite returns, pesos can recover fast. Watching central bank signals is key rate gaps that often decide direction.

Liquidity also matters. The Mexican peso remains the most traded Latin American currency, ideal for intraday trading. The Philippine peso trades thinner, reacting more to macro headlines than technical levels.

As for Argentina’s peso, most forex brokers limit access due to capital controls and volatility, so traders typically use synthetic exposure or ETFs instead. Staying alert to inflation reports, oil prices, and U.S. economic data helps traders anticipate pressure points before the crowd reacts.

The core principle is simple: volatility in the dollar to peso forecast isn’t random. It mirrors policy shifts, interest rate cycles, and investor mood. Traders who read those signals early stand to profit from swings others only notice later.

Practical Insights for the Dollar to Peso Forecast

Timing matters more than prediction. Importers should hedge early, investors must factor in currency drag, and exporters or overseas workers gain when the dollar strengthens, if they time conversions well.

Exporters and overseas workers benefit when the dollar rises, but smart conversion timing can boost earnings even more.

Frequently Asked Questions (FAQ)

1.Will the U.S. dollar keep rising against the Mexican peso?

It may climb modestly if Mexico cuts rates faster than the U.S. or if global investors return to dollar assets. Stable inflation keeps large swings unlikely.

2.Why is the Philippine peso weakening?

Higher U.S. yields and local inflation pressure are key factors. The peso could stay near ₱60 per dollar unless the Philippines tightens policy again.

3.Is the Argentine peso likely to stabilize soon?

Unlikely in the short term. Persistent inflation and fiscal risk mean USD/ARS could remain on a steep upward track beyond ₱10,000 by 2030.

4.What’s the safest way to hedge peso exposure?

Forward contracts and options remain the most direct methods. Currency ETFs or diversified holdings across MXN and PHP can reduce volatility impact.

Final Thoughts

The dollar to peso forecast through 2030 paints three distinct stories: Mexico’s steady climb, the Philippines’ gradual drift, and Argentina’s relentless slide.

These paths reflect deeper forces such as rates, inflation, and investor trust. Whether you trade daily or plan long-term investments, reading the signals behind these moves will define your results far more than guessing the next rate number.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.