An underlying asset is one of the most essential concepts for understanding derivatives and structured financial products. It helps traders identify what a contract is based on and how its value changes.

For beginners, learning what an underlying asset is provides clarity when exploring options, futures, CFDs, and other markets where traders do not buy the asset directly but trade based on its price movement.

Definition

An underlying asset is the financial instrument, commodity, index, currency, rate, or measurable economic variable upon which a derivative contract is based.

Its price, value, or performance determines the value of the associated derivative. When traders say they are “exposed to” or “long” an underlying, they refer to the asset whose price behaviour ultimately drives their profit or loss.

How Traders Use Underlying Assets

To understand what influences the value of a derivative

To analyze price behavior before entering trades

To assess risk based on the volatility of the asset

To choose appropriate strategies for options, CFDs, or futures

To plan entries and exits by studying the underlying market trend

Understanding the underlying asset helps traders avoid confusion and choose products that match their goals.

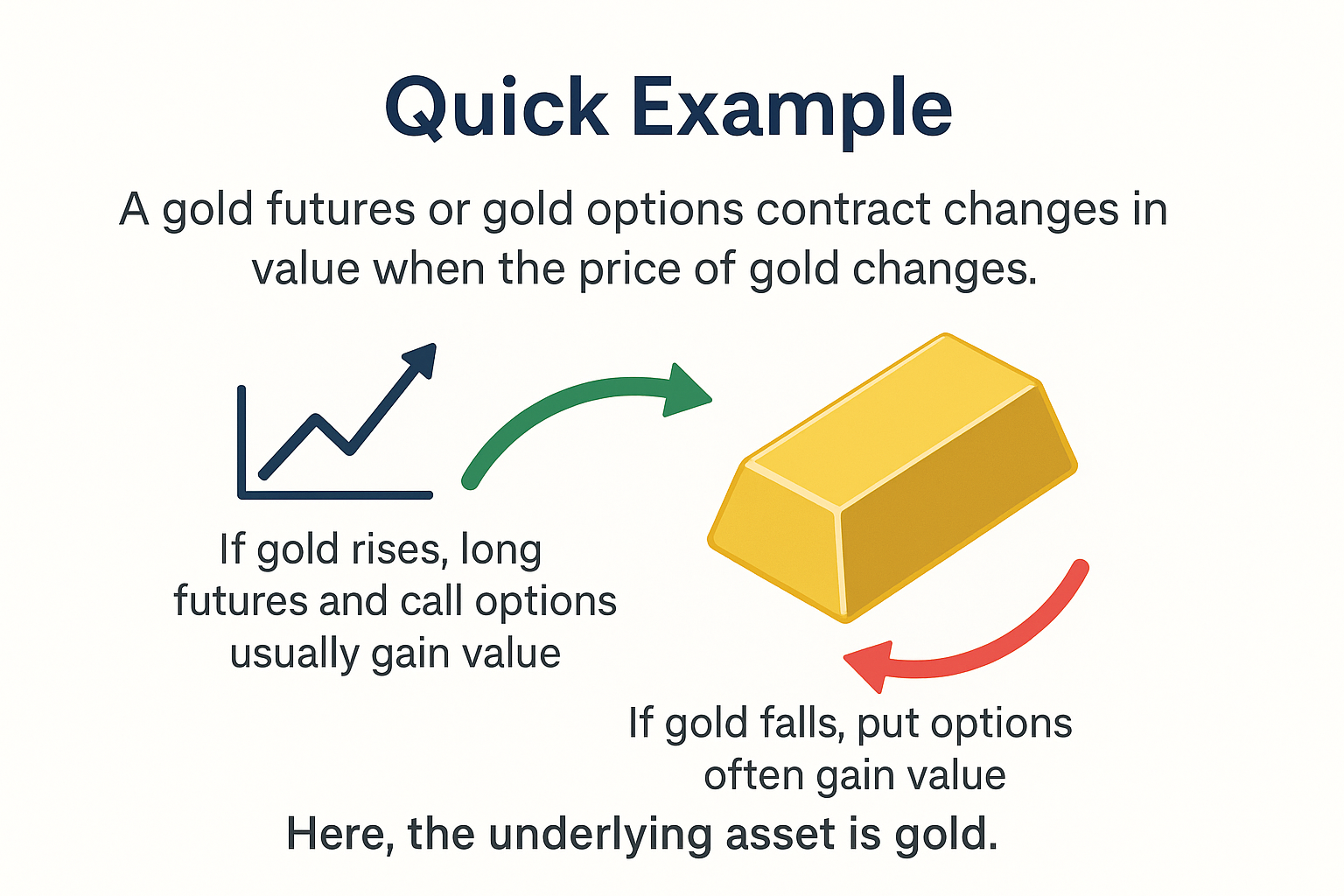

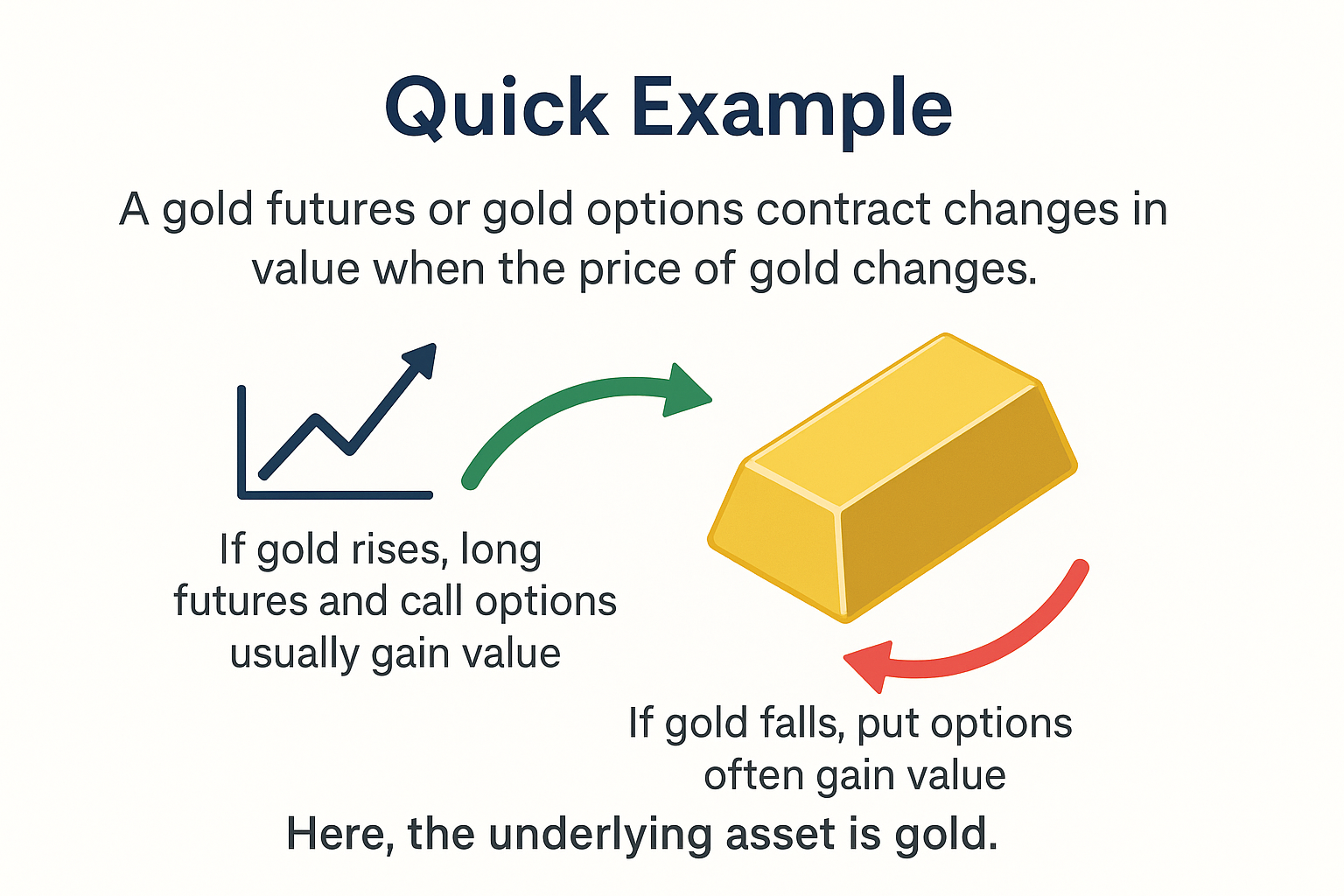

Quick Example

Imagine you are looking at a gold futures or gold options contract. These contracts don’t have value on their own - their value comes from the price of gold.

If the price of gold goes up, people holding long futures or call options usually make money, because their contracts become more valuable.

If gold goes down, put options typically become more valuable instead.

In this scenario, gold is the underlying asset because it is the thing that all these contracts depend on. Traders watch the gold price closely because it guides how they hedge, what risks they take, and how the contracts are settled.

Key Types of Underlying Assets

1. Stocks

Shares of individual companies used as the base for options, CFDs, and equity futures.

2. Indices

Broad market measures like the S&P 500 used for index options, futures, and ETFs.

3. Commodities

Physical goods such as oil, gold, silver, and agricultural products used for futures and commodity options.

4. Currencies

Foreign exchange pairs used in forex markets and currency derivatives.

How Underlying Assets Influence Derivative Pricing

Underlying assets affect several pricing components.

For example, when the underlying stock becomes more volatile during earnings season, implied volatility in options tends to rise, increasing premiums even if the spot price remains stable.

| Pricing Input |

Influence of Underlying Asset |

| Spot Price |

Direct determinant of intrinsic value in options and futures |

| Volatility |

Higher volatility raises option premiums, influencing hedging cost |

| Dividends/Yields |

Impact forward pricing and option parity relationships |

| Correlation |

Important in multi-asset derivatives or pair trades |

Common Mistakes Beginners Make

Confusing the derivative with the underlying asset: New traders often think they own the underlying itself when they only hold a contract based on it.

Ignoring the volatility of the underlying: Every derivative’s risk level depends heavily on how the underlying behaves.

Not analyzing the underlying market before trading: Trading a derivative without studying the base asset leads to poorly timed decisions.

Assuming all derivatives behave the same: Even similar products can react differently depending on the underlying’s price movement.

Underlying Asset vs Derivative

| Feature |

Underlying Asset |

Derivative |

| Meaning |

The real asset being traded or measured |

A contract whose value comes from the underlying |

| Examples |

Stocks, gold, currencies, indices |

Options, futures, CFDs |

| Value Source |

Determined by supply and demand |

Determined by movements of the underlying asset |

| Trader Focus |

Studying price trends and fundamentals |

Managing leverage, premiums, and contract terms |

| Purpose |

Core investment asset |

Tool for trading, hedging, or speculation |

Related Terms

Derivative: A financial contract whose value is based on an underlying asset.

Options Contract: A derivative giving the right, but not the obligation, to buy or sell the underlying.

Futures Contract: An agreement to buy or sell the underlying asset at a set date and price.

Frequently Asked Questions (FAQ)

1. What are examples of underlying assets?

Examples of underlying assets include stocks, indices, commodities like gold or oil, or currencies. These assets are the basis for derivatives such as options, futures, and CFDs.

2. Can any financial item be an underlying asset?

Yes, as long as its price can be traded or measured, it can act as one.

3. Do traders always own the underlying asset?

No. Many derivative products allow traders to speculate without owning the underlying.

Summary

An underlying asset is the financial instrument that forms the basis for a derivative’s value. It can be a stock, currency, commodity, or index.

Understanding the underlying asset helps traders analyze price movement, manage risk, and choose the right trading strategies.

Studying its trend, volatility, and market conditions is essential for anyone trading derivatives, since these products depend entirely on how the underlying behaves.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.