How to Stop Earnings and Losses in Stock Investment?

Stock investment not only competes with hidden opponents, but also with oneself, mainly reflected in the ability to control emotions and desires. How to strictly execute one's investment strategy and avoid being dominated by greed? The techniques for stopping gains and losses in stock investment are as follows.

1. Use important historical data of Stock Prices as a stop loss point. Investors can obtain many key information from historical data of stock prices, such as the highest and lowest prices. Investors can choose two important high and low points from the historical data of stock prices as their stop loss points based on the specific situation of stock trends.

2. Set specific price ranges based on one's risk tolerance to serve as a stop loss point. When investors acquire a stock, they set a stop profit value, such as 10%. When the stock earns 10%, they immediately sell.

At the same time, investors also need to set stop loss points based on their actual risk tolerance, and what is the maximum loss they can accept. After reaching this maximum loss, do not hesitate, do not have illusions, and immediately take action. For example, the maximum acceptable loss is 5%, and when the stock price drops to this maximum stop loss point, it immediately takes action.

3. For short-term operators, the time cycle stop loss method can be set. After investors acquire a stock, they set a specific time period. If the stock does not experience significant fluctuations, does not rise significantly, or does not fall significantly after reaching this time period, they can also sell.

If one is reluctant to let go, short-term operations may become long-term operations, passively holding for a long time, and passively becoming a value investor. In the long run, funds are likely to be trapped and become long-term shareholders.

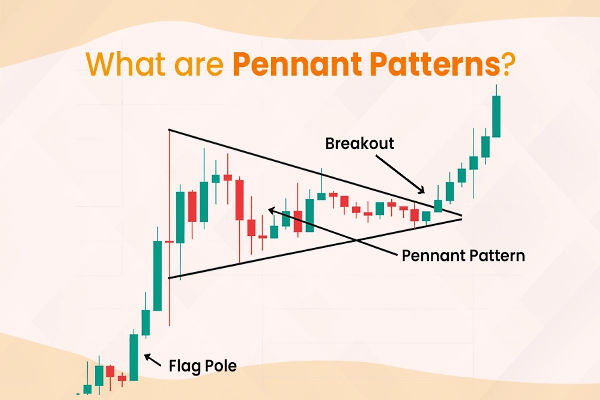

4. Choose important pressure and support levels, or trend lines and moving averages as a reference for stopping gains and losses. When the stock falls below the support level, don't hesitate and get out immediately. When the stock rises to a certain level, the shipment leaves the market.

Four Best Methods to Stop Earnings in Stocks

The first type is mobile stop profit, which is based on profit reduction and stop profit. For example, if you buy a stock and increase it by 5 points to reduce your position by 20%, 10 points to reduce your position by 4%, 15 points to reduce your position by 6%, batch reduction, and mobile stop profit. Many retail investors, especially beginners, like to buy and sell out at full positions, which often leads to either being short or being trapped. Finally, you have a mentality of worrying about gains and losses, and are very conflicted. When you have profits, in fact, your mentality should be good, We should not be too greedy or too greedy. We should use our positions to manage profits, rather than using emotions to manage our positions. We should move to reduce positions and stop profits, and not be greedy or too greedy.

The second method is to set a specific profit target, such as 8 points. Once the profit target is reached, firmly stop the profit, which is an important means to overcome greed. Many investors are always worried about selling and always want a higher selling price. This situation objectively exists, and in practical operations, there are often situations where there is still a higher selling price after selling. However, if investors greedily try to earn every penny of profit, it is unrealistic and the crisis is significant.

The static stop profit position is the so-called psychological target position, and the way it is set depends on investors' understanding of the trend and long-term observation of individual stocks. The determined stop profit position is basically static and unchanging, which can be near the high point of the previous band. When the stock price rises to this level, profits are immediately taken.

This method of stopping profits is suitable for medium to long-term investors, who have a stable investment style. For beginners who have not entered the stock market for a long time and have weak ability to analyze the market, it is usually necessary to appropriately lower the standard of the stop profit position and improve the safety of operations.

The third method is to control the withdrawal and stop the profit. If you are currently floating for 20%, then you are allowed to withdraw up to 12%. If you are floating for 30%, then you are allowed to withdraw up to 15%. However, this number is determined based on your trading habits.

The fourth method is to use the Moving Average system to move the stop profit, which means that you can rely on the moving average to carry out the stop profit. For example, the moving averages of the 60th, 30th, 20th, and 10th are also set according to your trading habits. When your floating profit is getting higher and higher, then at this time, you can stop the profit based on the moving average. If you don't break the moving average, you won't let any stocks!

EBC Platform Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.