In the world of trading, understanding the tools at your disposal is crucial for making informed investment decisions. One such tool is the limit order, a fundamental aspect of trading that can significantly enhance your trading strategy. In this article, we will delve into what a limit order is, how it works, and tips for using it effectively to maximize your trading outcomes.

What is a Limit Order at a Specified Price and How Does it Work?

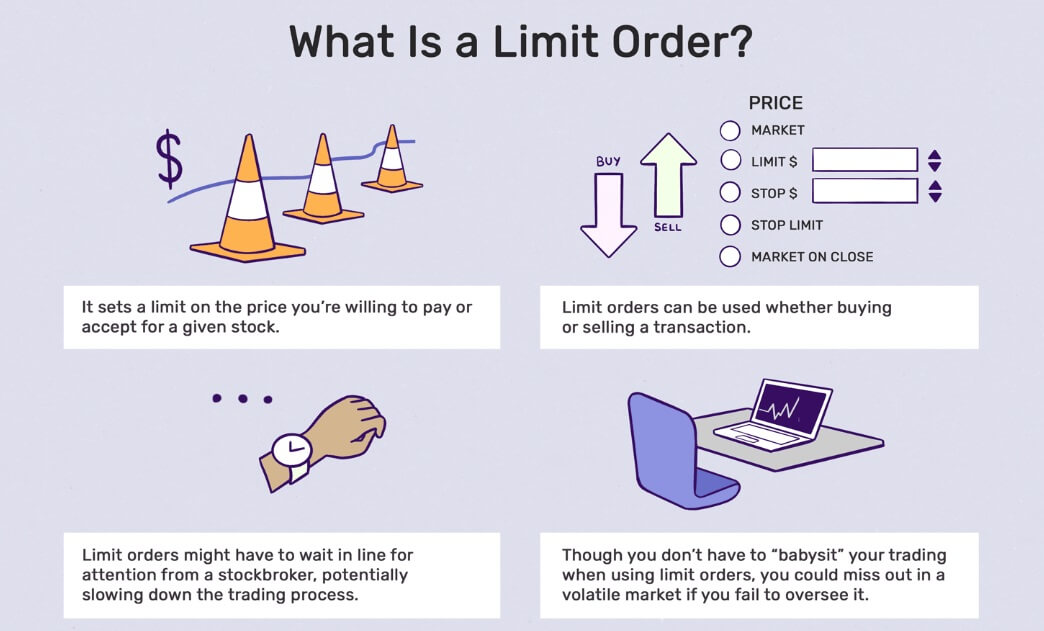

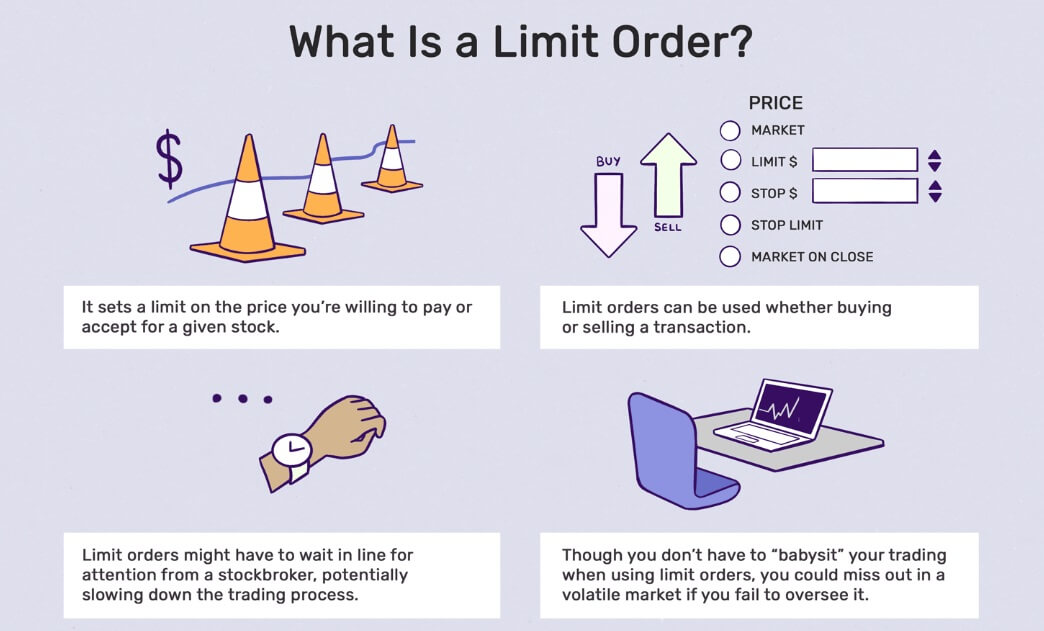

A limit order is a type of order to buy or sell a security at a specified price or better. Unlike market orders, which execute immediately at the current market price, limit orders are not executed until the market price reaches the specified limit price, which can be above or below the current price. This provides traders with more control over the prices at which they buy or sell securities.

When you place a limit order, you set the maximum price you are willing to pay for a security (in the case of a buy limit order) or the minimum price you are willing to accept for selling (in the case of a sell limit order). The bid price is the price at which an asset can be sold, and it plays a crucial role in determining the execution of sell limit orders.

Buy Limit Order: If you want to buy shares of a company at $50, you would set a limit order at that price. If the stock’s price falls to $50 or below, your order will be executed.

Sell Limit Order: Conversely, if you own shares and want to sell them for at least $75, you would set a sell limit order at that price. A sell order is initiated when you want to sell a stock at a price that meets or exceeds your specified limit price. Your order will execute only if the stock reaches $75 or higher. This ensures that a sell trade is opened automatically when the market price reaches the specified limit.

Types of Limit Orders

Limit orders can be classified into several types, each with its own unique characteristics and uses. Understanding these types can help you tailor your trading strategy to better meet your investment goals.

Buy Limit Order: A buy limit order is an order to purchase a security at a specified price or lower. This type of order is used when you want to enter a long position or buy a security at a specific price. For instance, if you want to buy a stock at $50, you set a buy limit order at that price. The order will only execute if the market price drops to $50 or below.

Sell Limit Order: Conversely, a sell limit order is an order to sell a security at a specified price or higher. This is useful for entering a short position or selling a security at a specific price. For example, if you own shares and want to sell them at $75, you set a sell limit order at that price. The order will execute only if the market price reaches $75 or higher.

Stop-Limit Order: A stop-limit order combines the features of a stop order and a limit order. It is used to buy or sell a security at a specific price or better, but only after a specified stop price has been reached. This type of order provides more control over the execution price once the stop price is triggered.

Trailing Stop-Limit Order: A trailing stop-limit order is a dynamic type of stop-limit order that adjusts the stop price as the market price moves in favor of the trade. This allows traders to lock in profits while still providing a safety net if the market price reverses.

By understanding these different types of limit orders, you can choose the one that best fits your trading strategy and market conditions.

Limit Orders vs. Other Order Types

Limit orders are often compared to other types of orders, such as market orders and stop orders. Understanding the key differences can help you decide which order type to use in various trading scenarios.

Market Orders: Market orders are executed immediately at the current market price. They prioritize speed over price, ensuring that the trade is completed quickly. In contrast, limit orders are executed at a specified price or better, providing more control over the execution price but potentially taking longer to fill.

Stop Orders: Stop orders are triggered when the market price reaches a specified stop price. Once triggered, a stop order becomes a market order and is executed at the current market price. Limit orders, on the other hand, are executed at a specified price or better, offering more precision in execution.

Stop-Limit Orders: Stop-limit orders combine the features of stop orders and limit orders. They are triggered when the market price reaches a specified stop price, but the execution occurs only at a specified limit price or better. This provides a balance between the immediacy of stop orders and the price control of limit orders.

By comparing these order types, you can better understand when to use limit orders versus market orders or stop orders, depending on your trading objectives and market conditions.

Advantage of Using Sell Limit Order

Using a sell limit order can really enhance your trading strategy in several ways. One of the biggest advantages is that it gives you price control. You can specify the exact price at which you want to sell, ensuring you don't end up with less than you expect. This level of control also allows for more strategic execution; you can wait for the right market conditions, which means you have better entry and exit points in your Trading plan.

Another great benefit is that limit orders help reduce slippage. Slippage happens when a trade is executed at a different price than intended, usually because of market fluctuations. With a sell limit order, you can minimize this risk. Plus, you have the flexibility to set multiple limit orders for different securities, which means you can automate your trading strategy without constantly watching the market.

How to Use Limit Orders Effectively

To make the most of limit orders, keep a few tips in mind. First, always analyze market conditions before placing a limit order. Understanding where the market is headed can help you set a realistic limit price. Using technical analysis can also guide you; by looking at indicators and Chart Patterns, you can figure out key support and resistance levels for pricing your limit orders.

Patience is key when using limit orders; they might not execute right away. So, it's important to wait for the market to hit your specified price. Also, be sure to regularly review and adjust your limit orders based on the latest market data, as conditions can change quickly. And remember, combining limit orders with other types of orders—like stop-loss orders—can create a more comprehensive trading strategy that helps manage risk effectively.

Managing Risk with Limit Orders

When it comes to risk management, limit orders are incredibly useful. By setting a limit price, you can control how much you're willing to pay or the minimum amount you’ll accept when selling. This is a smart way to protect yourself against potential losses if the market turns against you. You can also use stop-limit orders for extra protection. By defining both a stop price and a limit price, you ensure your orders execute only at prices that work for you, offering a safety net against unfavorable market movements.

Finally, limit orders can help you scale in and out of trades, which lowers the risk of significant losses. For instance, you could set multiple buy limit orders at different price points to gradually build your position, or set multiple sell limit orders to exit a position step-by-step. This way, you can reduce the impact of market volatility and make more informed trading decisions.

Common Mistakes to Avoid

While limit orders offer many advantages, there are common mistakes that traders should avoid to ensure effective use of this tool:

Setting a Limit Price Too Close to the Current Market Price: If your limit price is too close to the current market price, your order may be executed at an unfavourable price due to market fluctuations. It’s important to set a realistic limit price based on market analysis.

Not Setting a Stop-Loss Order: Failing to set a stop-loss order can result in significant losses if the market price moves against your trade. Combining limit orders with stop-loss orders can help manage risk and protect your investments.

Not Monitoring the Order: Once a limit order is placed, it's crucial to monitor it regularly. Market conditions can change rapidly, and an unmonitored order may be executed at an unfavourable price or not executed at all. Regularly reviewing and adjusting your orders based on the latest market data can help avoid this pitfall.

Limit orders are a powerful tool for traders looking to enhance their investment decisions. By understanding how to set and use limit orders effectively, you can take control of your trading strategy and navigate the markets with greater confidence. As with any trading tool, it's important to continue learning and adapting your approach based on market conditions and your trading objectives.

At EBC Financial Group, we strive to provide traders with the resources and insights needed to master trading tools like limit orders. By incorporating limit orders into your trading strategy, you can improve your chances of making successful trades and achieving your investment goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.