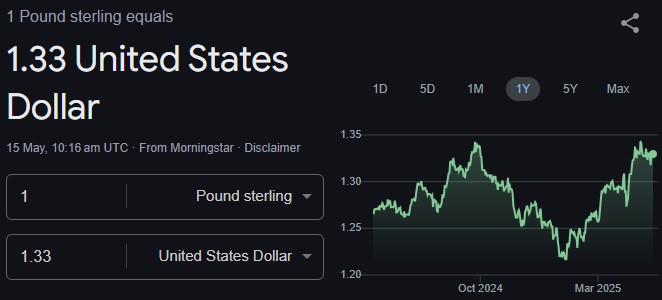

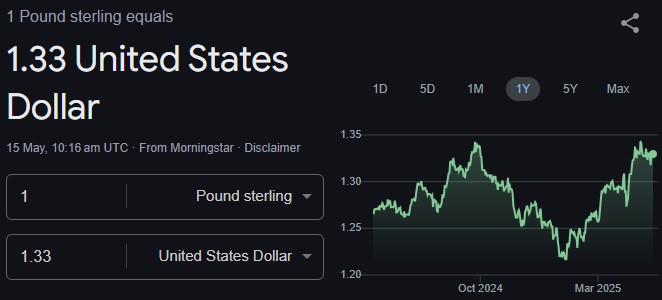

The GBP to USD exchange rate, known as "cable, remains one of the world's most closely watched currency pairs. As we move through 2025, traders and investors are keenly focused on where the pound-dollar rate is headed next.

With shifting economic fundamentals, diverging central bank policies, and evolving political landscapes, the outlook for GBP/USD is both complex and full of opportunity. Here are the top predictions and key factors shaping the GBP to USD forecast for 2025 and the years ahead.

GBP to USD: Where Are We Now?

As of mid-May 2025, GBP/USD trades around 1.24, having experienced notable volatility over the past year. The pair fell sharply in late 2024 following Donald Trump's US presidential victory and ongoing global trade uncertainties.

Despite a brief rally, the pound has struggled to regain momentum, with the Bank of England (BoE) signalling a dovish outlook and the US Federal Reserve maintaining a cautious stance.

Key Drivers Shaping the 2025 Outlook

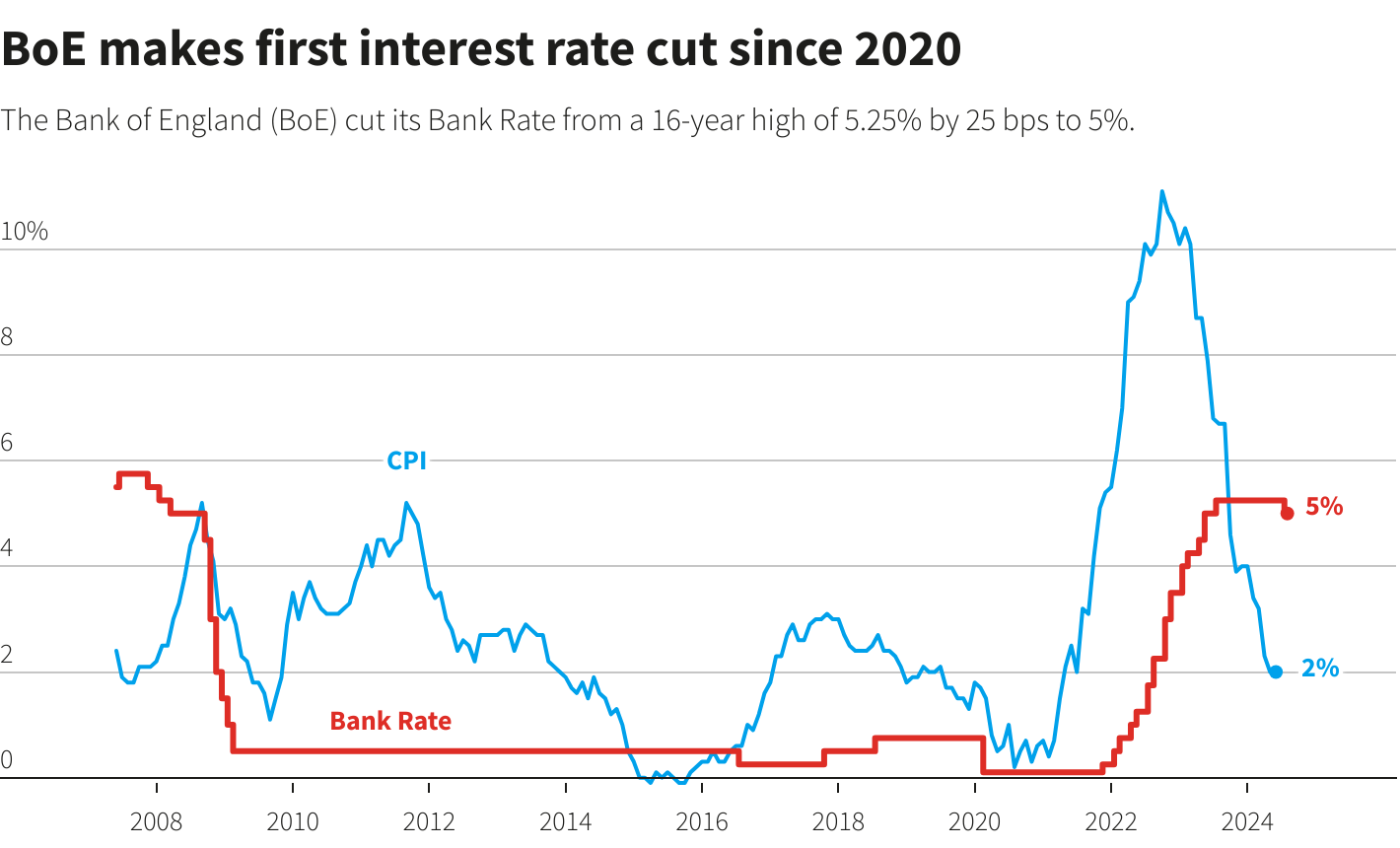

1. Diverging Central Bank Policies

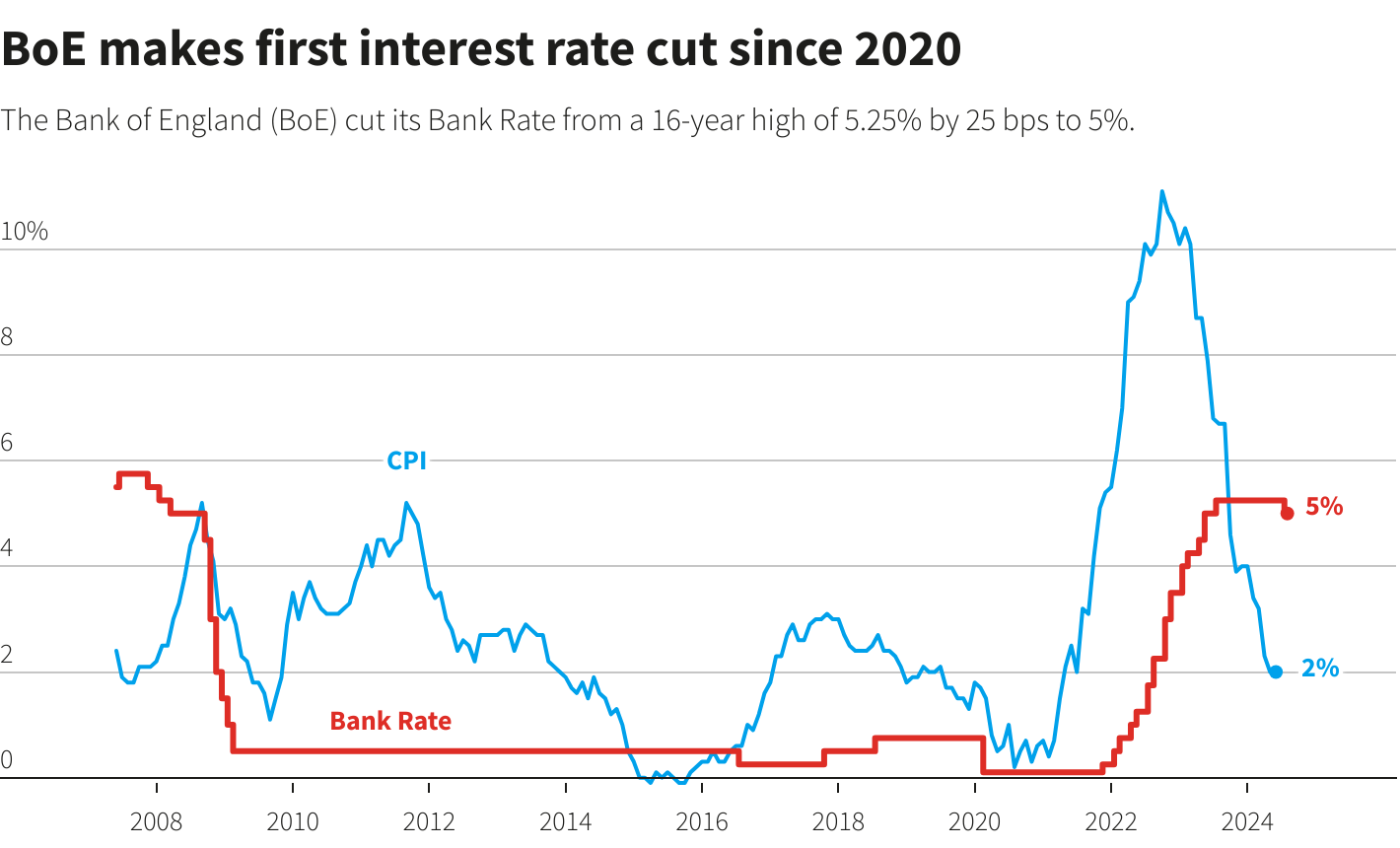

The BoE is expected to cut interest rates by 50–75 basis points in 2025, aiming to support a fragile UK economy. In contrast, the Fed is likely to cut rates only modestly, with a hawkish bias if inflation persists. This policy divergence has weighed on the pound, as lower UK rates reduce its yield appeal compared to the dollar.

2. US and UK Economic Growth

The International Monetary Fund forecasts US GDP growth to slow to 1.8% in 2025, while the UK is expected to see a modest rebound to 1.7%. Stronger UK growth, combined with wage gains and a new industrial strategy, could lend some support to the pound, but trade policy risks and lingering Brexit effects remain headwinds.

3. Political and Trade Developments

Donald Trump's return to the White House has brought renewed protectionist policies, including tariffs on key trading partners. This has increased global uncertainty and at times supported the safe-haven US dollar. Meanwhile, the UK's focus on trade openness and attracting foreign investment has helped offset some pound weakness.

4. Technical and Sentiment Factors

From a technical perspective, GBP/USD faces resistance at 1.29 and support at 1.20, with further downside possible if bearish momentum persists. The Relative Strength Index (RSI) and moving averages suggest the pair could remain under pressure unless there is a sustained break above 1.25–1.26.

GBP to USD Forecast: 2025 and Long-Term Predictions

Short-Term (2025)

FXStreet: Expects further downside, with possible tests of 1.20 and even 1.15 if bearish momentum continues. Recovery attempts may stall below 1.29 unless fundamentals shift.

CAPEX: Sees GBP/USD consolidating, with support at 1.25 and resistance at 1.28. Short-term weakness is likely, but the pair may hold within this range for the next few months.

LongForecast: Projects a price range of $1.194–$1.345 for 2025, with moderate volatility and a year-end close near 1.416 if positive sentiment returns.

Gov.Capital: Forecasts a gradual climb to 1.43–1.44 by year-end, with bullish scenarios if the UK economy outperforms and US trade tensions persist.

Medium to Long-Term (2026 and Beyond)

HSBC: Predicts GBP/USD will hover around 1.32–1.34 through the end of 2025, supported by UK rate hikes and dollar weakness.

Goldman Sachs: More bullish on the dollar, with GBP/USD possibly falling to 1.28 if US inflation moderates and political risks ease.

ING Bank: Sees GBP/USD reaching 1.36 in early 2026, driven by structural improvements in the UK economy.

Traders Union: Suggests a potential drop to 1.10 over the next five years if the UK faces stagflation or further economic shocks.

What Should Traders Watch?

Central bank meetings and rate decisions from the BoE and Fed

US and UK economic data (GDP, inflation, employment)

Political developments in the US and UK, especially trade policy

Technical levels such as 1.20 (support) and 1.29 (resistance)

Market sentiment and capital flows into UK assets

Final Thoughts

The GBP to USD forecast for 2025 and beyond is shaped by central bank policy divergence, economic growth prospects, and shifting political dynamics. Most analysts expect continued volatility, with the pound struggling to break higher unless the UK economy surprises to the upside or US dollar strength fades.

Traders should watch key data releases, policy shifts, and technical levels to navigate this ever-changing market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.