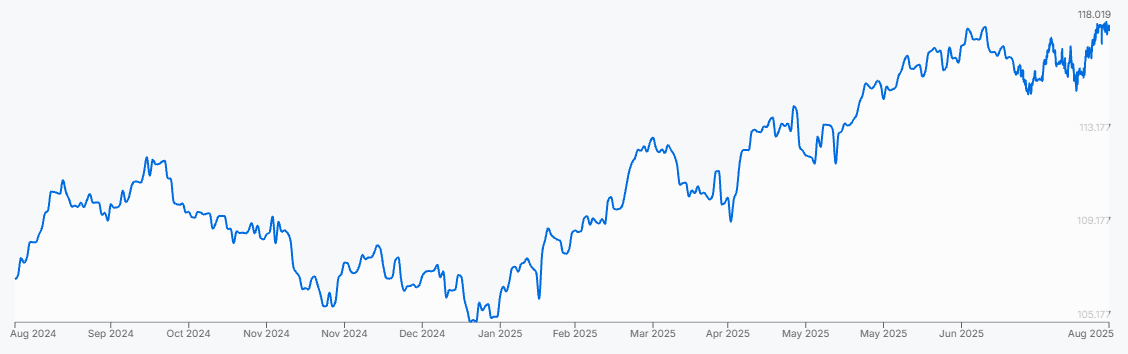

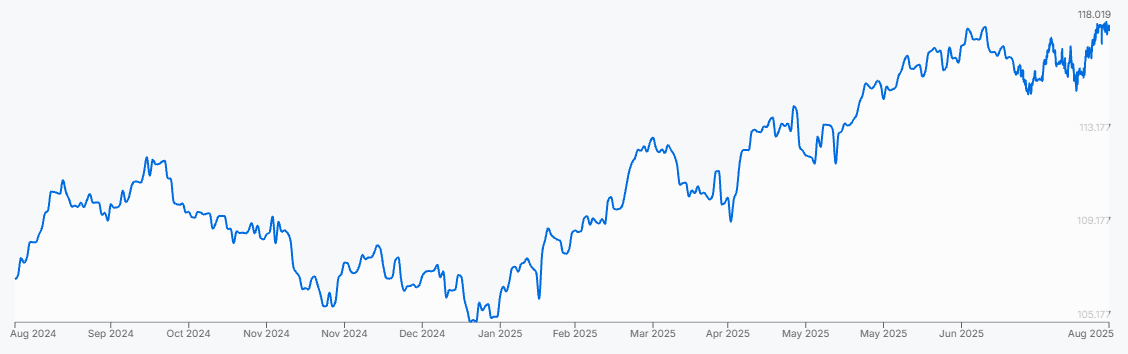

Current GBP–INR Rate Snapshot

As of mid-August 2025. the British pound is trading around ₹117.81. having moved within a tight range between ₹117.50 and ₹118.05 over recent days. This stability reflects a balance of factors: the pound is buoyed by steady UK economic data and cautious optimism about upcoming monetary policy, while the rupee benefits from India's solid growth and ongoing capital inflows. Global uncertainties, however, have kept volatility in check, with market participants adopting a wait-and-see approach ahead of major events.

Five-Day Forecast: Sterling Gains Momentum on Robust Labour Market Data

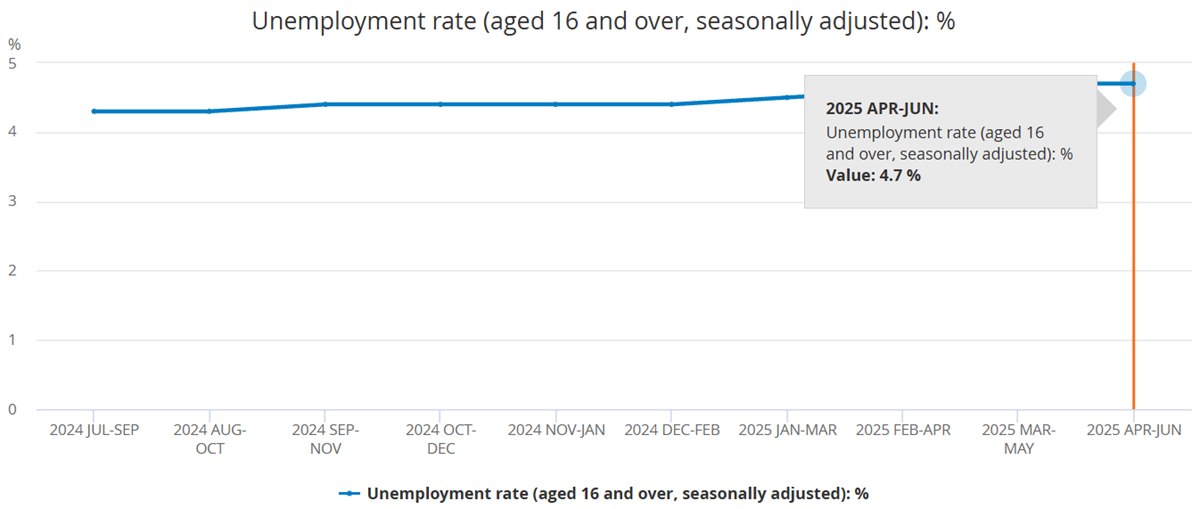

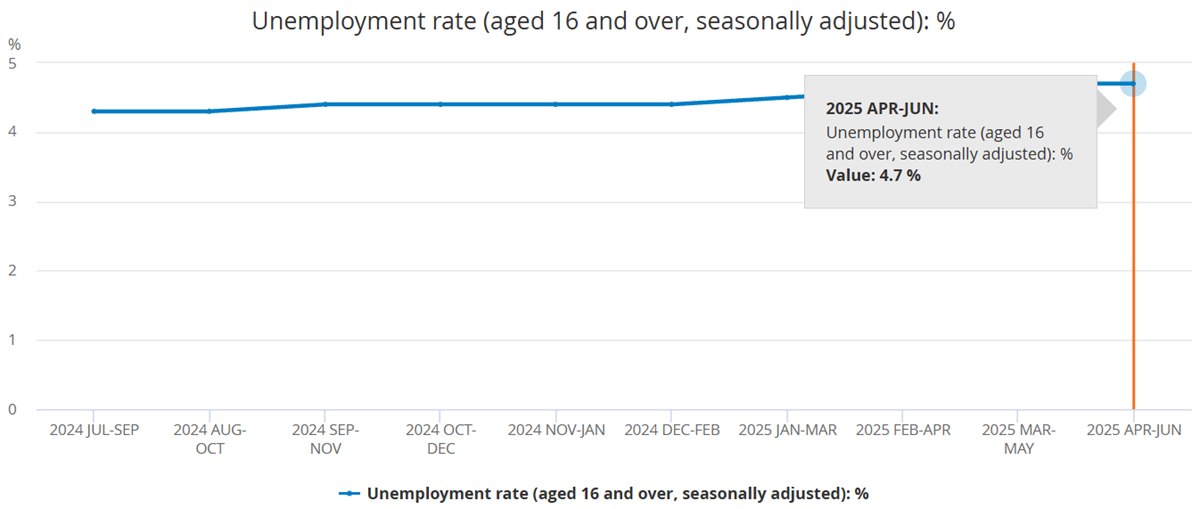

The pound is poised to strengthen modestly over the next five days, potentially rising toward ₹118.30. Recent data from the UK's Office for National Statistics revealed strong labour market growth for the second quarter, with 239.000 new jobs added—substantially higher than earlier months' figures. This robust employment expansion counters prior concerns that rising employer National Insurance contributions might dampen hiring enthusiasm.

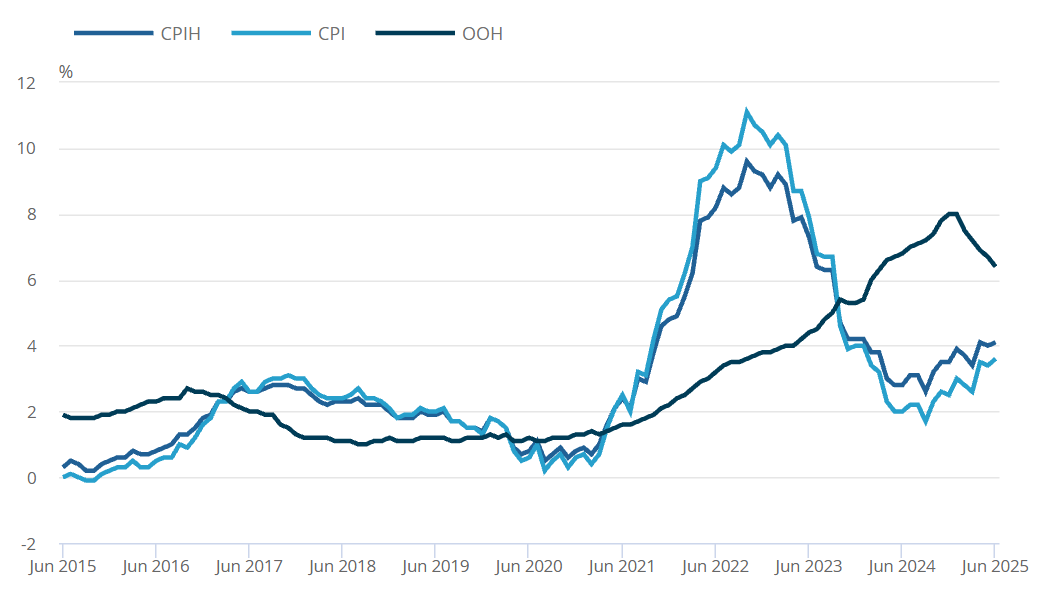

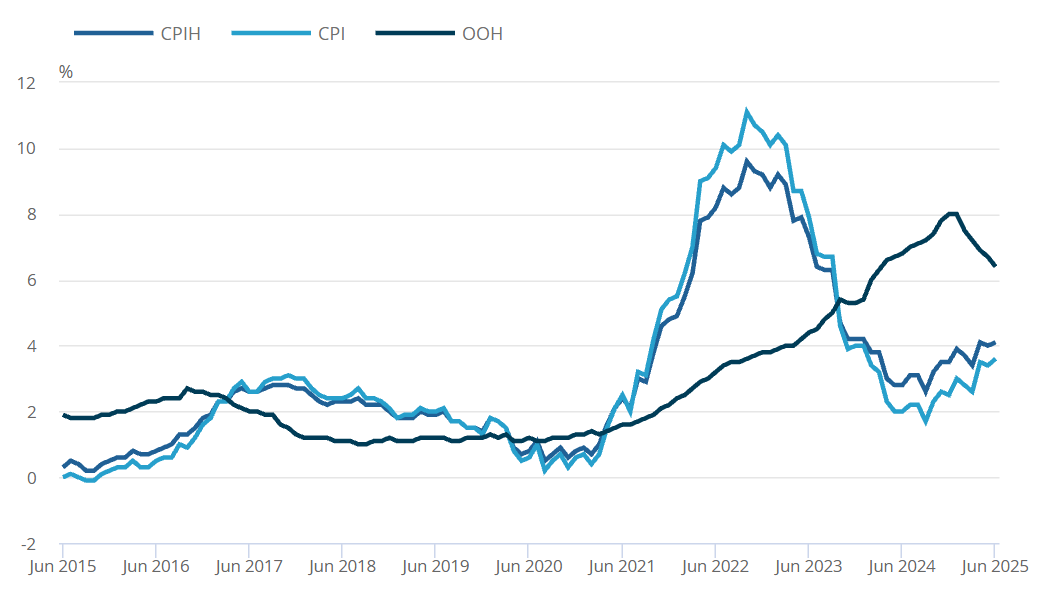

Meanwhile, the International Labour Organization's unemployment rate held steady at 4.7%, matching expectations, and new jobless claims unexpectedly declined in July. Although wage growth has shown slight moderation—average earnings excluding bonuses rose by 5% year-on-year, as expected, while total earnings including bonuses grew by 4.6%, slightly below forecasts—this tempered inflation pressure supports the Bank of England's cautious monetary stance.

Together, these indicators bolster confidence in sterling's near-term outlook, suggesting the BoE may maintain its "gradual and cautious" approach following last week's 25 basis point rate cut to 4%. Technical signals complement this view, with GBP/INR trading above key moving averages and showing room for moderate gains.

30- to 90-Day Outlook: Balancing Employment Strength and Monetary Policy Caution

Over the next one to three months, the pound's trajectory versus the rupee is expected to remain moderately positive but subject to careful monitoring of economic data and central bank decisions. The robust labour market data reduces recession fears and supports the Bank of England's capacity to keep monetary policy accommodative without further aggressive easing.

Consequently, GBP/INR may oscillate within the ₹117.50 to ₹120.00 range, with upside potential if employment trends remain strong and inflation remains manageable. However, any unexpected shifts—such as a spike in inflation or global risk shocks—could introduce volatility. India's consistent GDP growth and prudent Reserve Bank of India policies continue to underpin the rupee, balancing sterling's momentum.

Influential Factors Driving the Currency Pair

Timing Your Moves: Key Events to Monitor

Market participants should watch for:

Practical Strategies for Investors and Businesses

Set alerts near critical levels such as ₹117.50 and ₹119.50 to manage risk and capitalise on favourable movements.

Use limit orders to execute trades efficiently amid volatility.

Consider phased currency conversions to spread exposure.

Follow economic calendars closely to anticipate market moves.

Compare FX providers to secure competitive rates and reduce transaction costs.

Summary Table

GBP to INR Forecast with Integrated Insights

| Time Horizon |

Expected Range (₹) |

Key Influences & Market Dynamics |

| Spot |

~117.70 |

Supported by strong UK employment and stable INR fundamentals |

| 5 Days |

117.50 – 118.30 |

Positive sentiment from robust job data and cautious BoE policy |

| 1 Month |

117.50 – 120.00 |

Balanced by steady labour market and accommodative monetary policy |

| 3 Months |

118.00 – 120.50 |

Potential for moderate gains amid economic stability |

Conclusion

The pound is showing resilience against the rupee, underpinned by unexpectedly strong UK employment growth and a cautious yet accommodative Bank of England policy. While wage growth moderation tempers inflation fears, sterling's outlook remains cautiously optimistic over the short term. Coupled with India's steady economic fundamentals, this sets the stage for moderate sterling gains versus the rupee in the weeks and months ahead. Traders and businesses should stay alert to economic releases and central bank updates to navigate this evolving landscape effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.