Yes, VOO pays dividends. It takes the dividends earned from the S&P 500 companies it holds and pays them out in cash once per quarter. Over the last year, that has added up to around 7 dollars per share, which works out to a dividend yield of roughly 1-1.3% based on recent prices.

On its own, that yield will not replace a salary. The real value is that these payments arrive consistently, follow a clear schedule, and can be reinvested to buy more shares every quarter.

That steady cycle of dividends and reinvestment is one of the main reasons long-term holders of VOO have seen strong growth in their account balances over the past decade.

Does VOO pay dividends?

Yes. VOO currently:

Pays dividends in cash, not automatically reinvested inside the fund

Pays on a quarterly schedule (four times a year)

Has a trailing 12-month dividend yield of roughly 1.1-1.3% of the fund price

Over the past year, VOO has paid about 7.0 USD per share in total dividends.

That means if you held 100 shares, you would have received roughly 700 dollars in cash distributions over the last 12 months, before any taxes.

How often does VOO pay dividends?

VOO follows a regular quarterly pattern. Recent history shows ex-dividend dates in:

Late March

Late June

Late September

Late December

For example, recent payouts include:

| Ex-Dividend Date |

Dividend per Share |

Pay Date |

| 29 Mar 2025 |

1.81 |

31 Mar 2025 |

| 30 Jun 2025 |

~1.74–1.75 |

2 Jul 2025 |

| 29 Sep 2025 |

1.74 |

1 Oct 2025 |

The next declared ex-dividend date (for the final 2025 payment) is in late December 2025, with the payment expected shortly after.

What this means in practice

If you own VOO on the ex-dividend date, you are entitled to that quarterly dividend. The price will usually drop by roughly the dividend amount on that date, which is normal: part of the fund’s value is being paid out in cash.

Some investors use these dates to time dividend reinvestment plans, but for most long-term holders, the important point is simply that the cash arrives reliably four times per year.

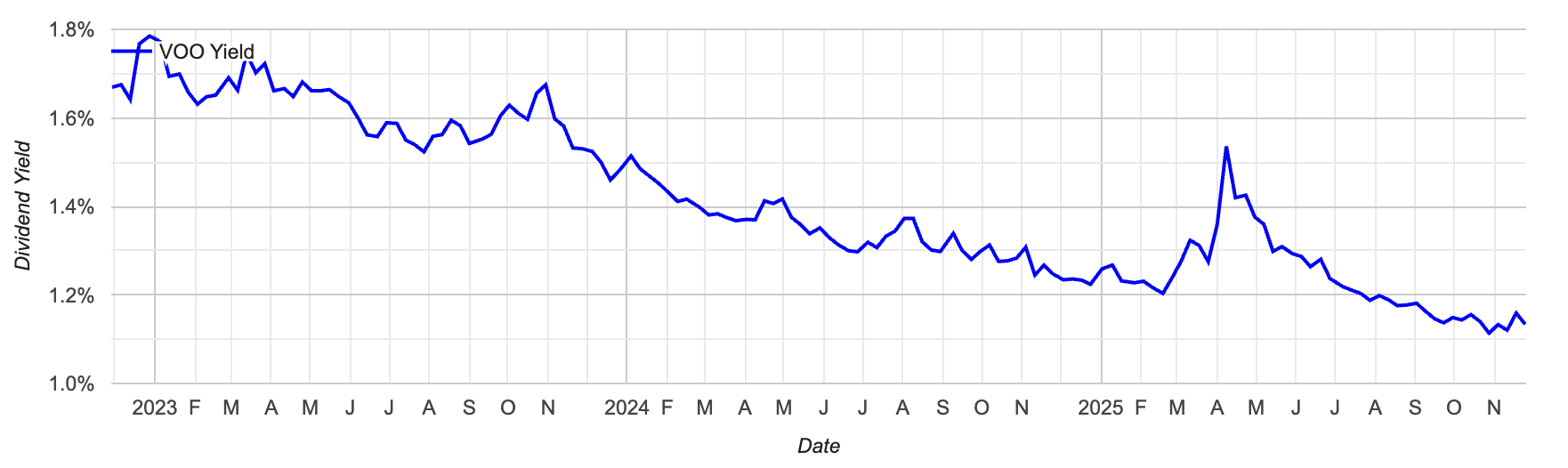

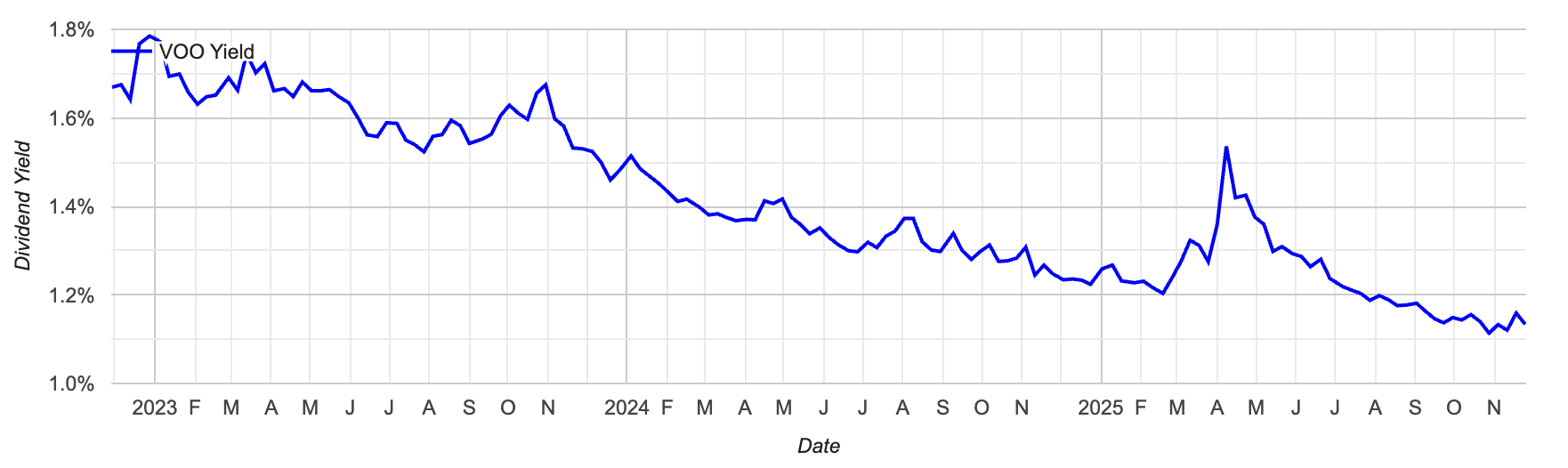

What is VOO’s current dividend yield?

Dividend yield is the total dividends over the past 12 months divided by the current price.

Recent data shows:

Trailing 12-month dividend per share: about 7.0 dollars

Dividend yield: roughly 1.1 -1.3%

This is very close to the current S&P 500 dividend yield, which sits around 1.1-1.2% as well.

So, if you buy VOO today, you can reasonably expect a cash yield a little above 1% per year, assuming payouts stay in the same range. That level will move over time as:

The share price rises or falls

The underlying companies change their dividend policies

The economy moves through different cycles

The key point is that VOO is designed to mirror the S&P 500’s dividend yield, so its yield will typically sit close to the index average.

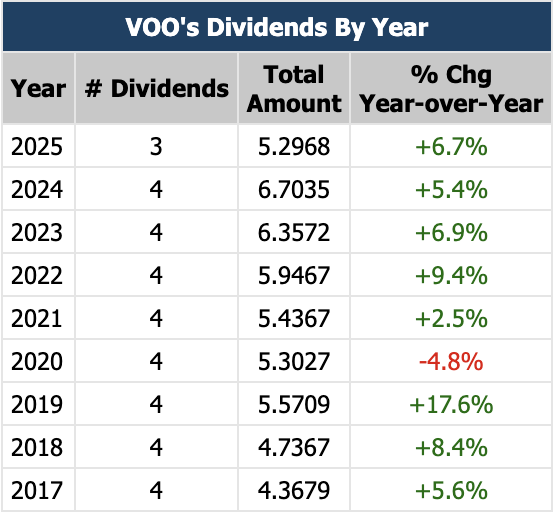

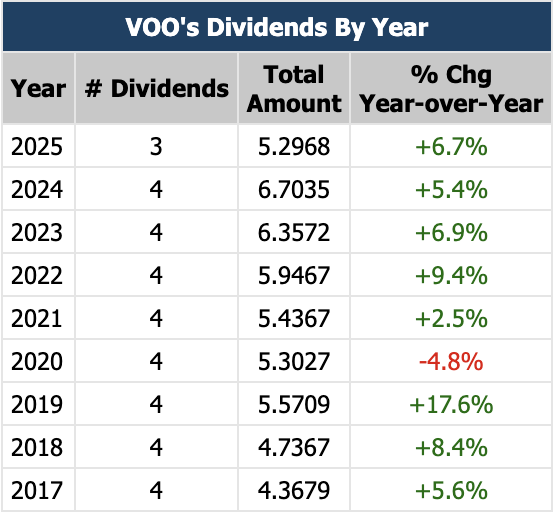

Has VOO’s dividend been growing?

Yes. Over the last few years, the total dividend per share has been trending upward. One public dataset, summarizing dividends by year, shows:

2023: about 6.36 dollars per share paid

2024: about 6.70 dollars per share

2025 (first three payments): about 5.30 dollars per share so far, already above the same point last year

That implies:

This pattern fits the wider backdrop of US large-cap stocks, where dividends tend to rise gradually over time, even if individual quarters move up and down with earnings and cash flow.

Of course, dividends are not guaranteed, and they can be cut in severe downturns, but history so far shows a steady upward direction for VOO’s annual distributions.

How important are VOO dividends for long-term growth?

From an economist’s point of view, the headline dividend yield on VOO looks modest. Around 1 -1.3% per year does not sound dramatic. But the real impact comes from reinvestment.

Dividends and total return

Total return combines:

Since launch in 2010, VOO has delivered roughly 14 -15% average annual total return, including reinvested dividends.

Over the last five years alone, total return has been around 100%, meaning 1,000 dollars invested became about 2,000 dollars when dividends were reinvested.

In broad S&P 500 data, research shows that:

VOO is simply a modern wrapper around that same index income stream. So, even though the headline yield is low, those quarterly cash flows play an important role in:

Smoothing returns over time

Adding extra shares when reinvested

Compounding wealth during long holding periods

Reinvestment vs spending

If you reinvest the dividends (through an automatic plan or by manually buying more shares), you are essentially using them to buy extra slices of the S&P 500 at different prices through the cycle.

If you spend the dividends, VOO still gives you a modest income stream while keeping most of your return coming from capital growth.

For long-term savers, the first path (reinvestment) usually makes more sense. For retirees or people drawing income, the second path may be more important.

Why is VOO’s yield “only” around 1%?

Many investors are surprised when they first see the yield. Historically, the S&P 500 dividend yield averaged closer to 3 -5% in much older data, but it has stayed below 2% for most of the past few decades.

There are three main reasons:

Share buybacks: Many large US companies return cash via buybacks instead of higher dividends. That lifts earnings per share and supports price growth, but it keeps the dividend yield lower.

High valuations: When share prices rise faster than dividends, the yield ratio falls, even if the cash payout is growing.

Stable but cautious policies: Many companies aim for steady dividend growth, not sharp hikes, so payouts tend to climb slowly.

VOO mirrors these underlying choices. It is less of a high-income product and more of a total-return, growth-plus-income instrument.

How are VOO dividends taxed?

Tax treatment depends on where you live and what type of account you use. In very broad terms:

-

In a taxable investment account, VOO’s cash dividends will usually:

- Be taxed in the year you receive them

- Possibly benefit from reduced tax rates if your system distinguishes between “qualified” and “ordinary” dividends

-

In a tax-advantaged account (such as some retirement accounts), the tax impact may:

-Be deferred until withdrawal, or

- Be sheltered, depending on local rules

Cross-border investors often face withholding tax on US-source dividends, which can reduce the net yield they receive.

Because tax rules are complex and country-specific, this is an area where you should check the details with a professional adviser in your jurisdiction.

Who should care about VOO’s dividends?

| Investor Type |

Key Considerations |

How VOO Dividends Matter |

| Growth-focused long-term |

Core equity holding, reinvest dividends, focus on total return |

Dividends add a steady, expanding contribution to long-term performance and fuel compounding, even with a modest yield. |

| Income-conscious |

Part of a blended income strategy, receive cash quarterly, pair with higher-yield assets |

Quarterly payouts are small but reliable, offering predictable income to sit alongside higher-yielding holdings. |

| Risk-aware |

Track dividend history as an earnings signal; watch for cuts in downturns |

Dividend patterns mirror index health; reductions can hint at stress, though payouts historically remain resilient. |

For these investors, the combination of steady income and broad diversification can be more important than chasing high-yield instruments that carry much higher risk.

Frequently Asked Questions

1. Does VOO pay dividends?

Yes. VOO pays cash dividends four times a year, passing on the income it collects from the S&P 500 companies in its portfolio.

2. How often does VOO pay dividends?

VOO pays quarterly, with ex-dividend dates typically in late March, late June, late September and late December, and payments a few days later.

3. What is VOO’s dividend yield right now?

Recent data shows a dividend yield of about 1.1 -1.3%, based on roughly 7 dollars per share paid over the last 12 months.

4. Has VOO’s dividend been growing?

Yes. The total annual dividend per share has increased over recent years, with 2023 and 2024 payouts higher than prior years and 2025 on track to show further growth, reflecting rising dividends across the S&P 500.

5. Are VOO dividends enough for retirement income?

On their own, VOO’s dividends (around 1% of the fund value per year) are usually not enough for investors seeking high income. Many people use VOO as a growth core and combine it with other holdings or planned withdrawals.

Final Thoughts

VOO does pay dividends, and even though the headline yield is low, those regular quarterly payments play a quiet but important role in its strong long-term return record.

Treated as part of a broader plan and reinvested consistently, they help turn a simple index tracker into a powerful compounding engine over time.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.