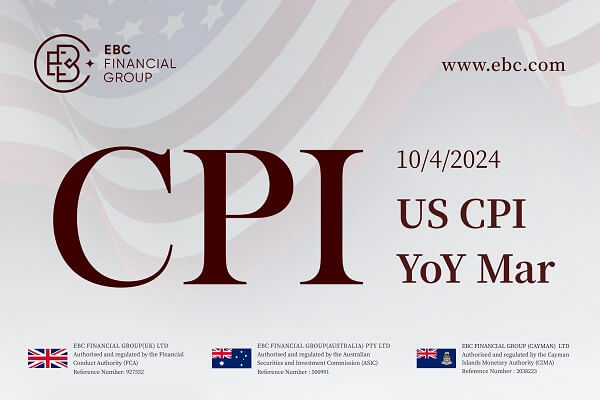

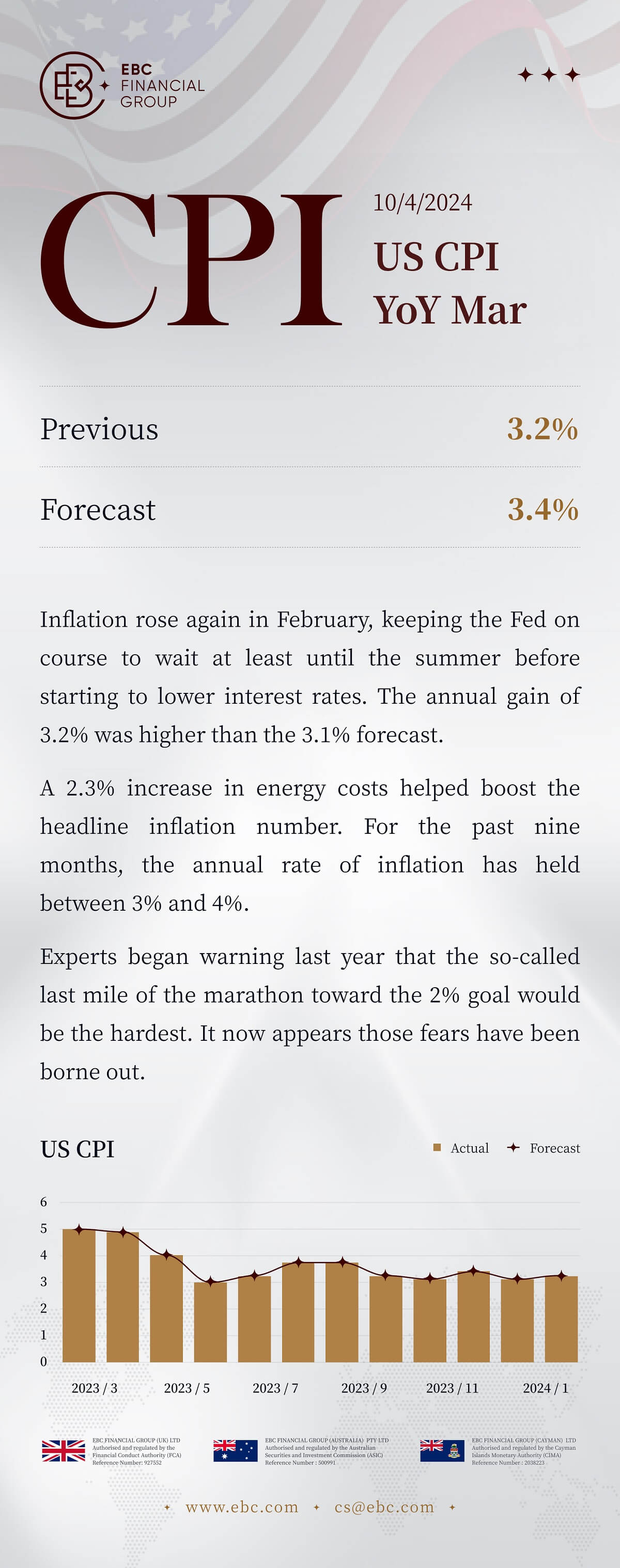

US CPI YoY Mar

10/4/2023 (Wed)

Previous: 3.2% Forecast: 3.4%

inflation rose again in February, keeping the Fed on course to wait at least until the summer before starting to lower interest rates. The annual gain of 3.2% was higher than the 3.1% forecast.

A 2.3% increase in energy costs helped boost the headline inflation number. For the past nine months, the annual rate of inflation has held between 3% and 4%.

Experts began warning last year that the so-called last mile of the marathon toward the 2% goal would be the hardest. It now appears those fears have been borne out.

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction or investment strategy is suitable for any specific person.

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction or investment strategy is suitable for any specific person.

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction or investment strategy is suitable for any specific person.

Disclaimer:This material is for general information purposes only and is not intended as(and should not be considered to be)financial,investment or other advice on which reliance should be placed.No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction or investment strategy is suitable for any specific person.