A great CFD broker blends transparency, technology, and trust — three essentials that define the difference between mere market access and genuine trading excellence. EBC Financial Group stands out by aligning strong regulatory credentials with cutting-edge infrastructure and a client-first approach.

Bringing together compliance, precision execution, and informed service, EBC demonstrates what a modern CFD brokerage should embody.

This article breaks down the key qualities of a reliable CFD broker, explores EBC Financial Group's regulatory and operational framework, and reviews how its technology, execution quality, and service standards position it as a trusted partner in global CFD trading.

What Makes a Reliable CFD Broker

A first-class CFD broker does three things exceptionally well: protects client assets, executes trades efficiently, and communicates transparently.

| Core Pillars of Excellence |

Why It Matters to Traders |

| Regulatory Oversight |

Ensures compliance and safeguards client funds. |

| Execution & Pricing Quality |

Affects how close you get to your intended entry/exit prices. |

| Breadth of Market Access |

Allows diversification across multiple asset classes. |

| Technology & Platform Reliability |

Determines speed, stability, and overall trading experience. |

| Transparency & Support |

Builds confidence through clear communication and guidance. |

A broker that meets these conditions consistently earns trust — a rare commodity in the leveraged trading world.

EBC Financial Group: Company Background and Market Presence

EBC Financial Group (EBC) operates as a globally regulated financial services provider offering CFDs across multiple asset classes. The company positions itself at the intersection of traditional finance discipline and modern digital market access.

Highlights of EBC's Corporate Profile

1) Headquarters and Global Footprint:

Presence in key financial hubs, enabling regional support and compliance.

2) Regulatory Standing:

Authorised under multiple jurisdictions including the UK's FCA, Australia's ASIC, and Cayman Islands' CIMA, which adds depth to its risk management framework.

3) Industry Recognition:

Recipient of distinctions such as Best CFD Broker and Most Trusted FX Broker (2023–2025), reflecting positive third-party assessment.

4) Philosophy:

Emphasises integrity, transparency, and client-centric service as pillars of sustainable growth.

EBC's cross-border operational structure allows it to serve a broad client base — from retail traders seeking access to global markets, to professionals who value execution precision.

The Foundation of Trust — Regulation and Client Protection

In leveraged trading, safety begins with governance. EBC Financial Group's regulatory model integrates multi-layered oversight with clearly defined client fund safeguards.

EBC's Compliance Framework

Multi-Jurisdictional Regulation – Licensing across several authorities ensures that the firm adheres to international standards of conduct.

Segregated Client Accounts – Client deposits are held separately from operating capital in Tier-1 banking institutions.

Professional Indemnity and Dispute Resolution – External protection mechanisms provide additional assurance for clients.

Regular Audits and Reporting – Routine compliance checks help maintain financial transparency.

These mechanisms work together to strengthen operational integrity — the foundation of any long-term trading relationship.

Execution Quality, Pricing Structure, and Market Coverage

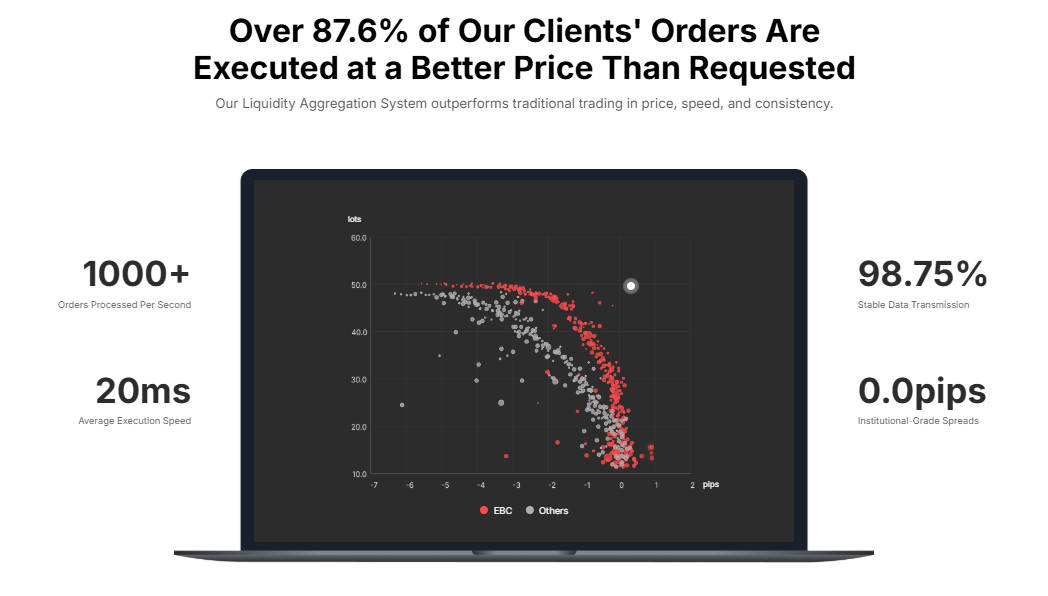

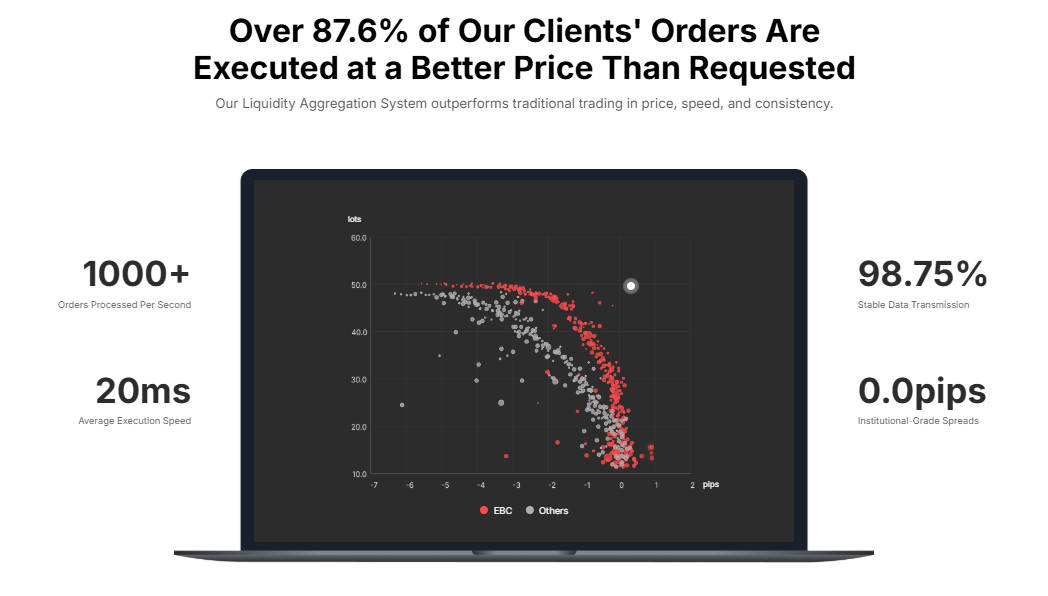

EBC promotes its trading environment as being designed for speed, fairness, and reliability.

Execution Infrastructure

Ultra-Low Latency: Orders processed within milliseconds through liquidity aggregation.

Intelligent Routing: Orders are directed to the best available liquidity pool to minimise slippage.

Tight Spreads: Transparent pricing without hidden mark-ups.

Real-Time Order Monitoring: Ensures order accuracy during volatile conditions.

Product Offering Overview

| Asset Category |

Available CFD Instruments |

Purpose for Traders |

| Forex |

Major, minor, and exotic pairs |

Short-term and hedging strategies |

| Indices |

Global stock indices |

Broad market exposure |

| Commodities |

Metals, energy, agriculture |

Inflation hedging and diversification |

| Equities & ETFs |

Company shares and thematic ETFs |

Long-term speculation or portfolio balancing |

EBC's approach to execution and pricing is designed to balance institutional-level infrastructure with accessibility for retail participants.

Technology and Trading Platforms — Where Precision Meets Access

EBC's technological environment supports multiple trading styles — from day trading to algorithmic execution.

Platform Features

Supported Systems: Integration with industry-standard platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Cross-Device Continuity: Seamless switching between desktop and mobile trading.

Data Consistency: Real-time market updates and accurate quote feeds.

Automation & Analytics: Support for Expert Advisors (EAs) and advanced charting tools.

These platforms enable traders to manage complex strategies with efficiency and stability, crucial in markets that move within milliseconds.

Service, Education, and Transparency

EBC distinguishes itself through an emphasis on clarity and continuous client engagement.

Customer and Educational Support

Multilingual Assistance: Available across time zones, ensuring prompt support for global clients.

Educational Hub: Articles, webinars, and tutorials that cover everything from basic CFD concepts to risk management.

Open Communication: Transparent disclosures about spreads, overnight financing, and account policies.

Compliance Accessibility: Clients can verify regulatory documents and complaint procedures directly through official channels.

By focusing on education and transparency, EBC contributes to a more informed trading community — an approach that aligns with responsible market participation.

Operational Overview — EBC at a Glance

| Dimension |

EBC Financial Group Key Strengths |

| Regulatory Coverage |

Overseen by FCA, ASIC, and CIMA for different regional operations. |

| Client Protection |

Segregated funds and professional indemnity insurance. |

| Execution & Pricing |

Aggregated liquidity, low latency, tight spreads. |

| Product Breadth |

CFDs in forex, indices, commodities, equities, ETFs. |

| Technology Infrastructure |

MT4/MT5 with advanced analytics and EA support. |

| Client Support & Transparency |

24/5 multilingual assistance and detailed disclosures. |

Each of these dimensions reflects an operational standard aligned with the expectations of modern CFD traders.

Key Considerations for Traders

While EBC demonstrates several strengths, prudent traders should still conduct due diligence before committing funds.

Checklist for New Clients:

Verify which EBC entity will hold your account and under which regulator it operates.

Review all fee schedules and funding conditions, including swaps and withdrawal processes.

Test platform performance through a demo or micro account.

Familiarise yourself with leverage rules and risk warnings applicable in your jurisdiction.

Keep records of correspondence and regulatory documents for clarity and accountability.

Such practices not only protect your capital but also ensure a fair evaluation of EBC’s services within your trading objectives.

Frequently Asked Questions (FAQ)

1. What does EBC Financial Group offer to CFD traders?

EBC Financial Group provides access to Contracts for Difference (CFDs) across forex, indices, commodities, equities, and ETFs. Its structure supports both retail and professional clients through advanced platforms such as MT4 and MT5.

2. Is EBC Financial Group a regulated broker?

Yes. EBC operates under multiple regulatory bodies including the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cayman Islands Monetary Authority (CIMA).

3. How does EBC ensure the safety of client funds?

Client funds are held in segregated accounts within Tier-1 banks, fully separated from company operating funds. EBC also maintains professional indemnity insurance and adheres to strict audit and reporting standards.

4. What trading platforms does EBC support?

EBC supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both offering advanced charting, automation features, and compatibility across desktop and mobile devices.

5. What types of accounts are available?

EBC typically provides standard and professional account options, with variable spreads, adjustable leverage (subject to regulation), and access to all supported instruments.

Conclusion

A reliable CFD broker balances transparency, technology, and trust — three factors that define trading success as much as market skill.

EBC Financial Group demonstrates clear progress toward that standard, supported by regulatory oversight, advanced execution systems, and transparent communication.

While traders should always verify each operational claim independently, EBC's combination of structure, recognition, and service makes it a noteworthy participant in the evolving CFD landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.