André Kostolany was a legendary speculator and market thinker, celebrated for his deep understanding of investor behaviour and the psychology that drives financial markets.

Unlike typical analysts, he combined wit, intuition, and contrarian insight to interpret market cycles and guide investors through turbulent times.

His approach was not limited to numbers or charts; Kostolany saw speculation as an art, where patience, courage, and a clear understanding of human emotion were often more important than technical analysis.

This philosophy allowed him to navigate financial crises, benefit from market recoveries, and leave behind timeless lessons for investors worldwide.

This article explores Kostolany's life, key investment principles, notable case studies, and the lessons investors can still apply today.

From Paris to Wall Street: An Adventurous Career

Kostolany's life was as colourful as his aphorisms. Originally trained in philosophy and art history in Budapest, he was sent to Paris in the 1920s to learn the financial trade.

There, he joined a brokerage firm and quickly developed a taste for speculation. He lived through the crash of 1929. which confirmed for him that markets are driven not just by numbers but by waves of human fear and greed.

During the Second World War, Kostolany fled occupied France and relocated to the United States.

In New York he worked as president of a financing company and built connections in American markets. After the war he returned to Europe, settling mainly in Paris and later in Munich and the Côte d'Azur.

His career was not without hardship. He endured bankruptcies and heavy losses, yet always managed to recover. This personal roller-coaster reinforced his belief that speculation is an art of patience, nerve, and timing rather than a mechanical science.

The Mind Behind the Madness: Kostolany's Philosophy

Contrarian Thinking and Metaphors

Kostolany had a unique gift for expressing financial truths through simple images. Perhaps his best-known analogy is that of the dog and its owner: the owner, walking steadily, represents the economy; the dog, running ahead or lagging behind, represents the stock market.

In time, the dog always returns to its owner, just as markets eventually realign with fundamentals after periods of speculation.

Another of his favourite sayings was: "Anything is possible—even the opposite." It was his way of warning against overconfidence in predictions.

Shaky Hands and Firm Hands

A central theme in his thinking was the contrast between "shaky hands" (zittrige Hände) and "firm hands" (hartgesottene).

Shaky hands are investors who panic when markets fall and rush to sell, while firm hands are those who have the strength to hold or even buy when others are fearful. According to Kostolany, market cycles are largely driven by the shifting balance between these two groups.

Market Cycles and Time Horizons

Kostolany stressed that markets move in cycles of correction, adjustment, and overshooting. In the short term, price movements often seem irrational and chaotic, but in the medium to long term, they align more closely with the real economy.

He therefore urged investors to cultivate patience, emphasising that time is the most valuable ally of the stockholder.

Views on Gold and Monetary Policy

He was outspoken in his criticism of the gold standard. In his view, tying currencies to gold limited economic flexibility and treated gold as "dead capital".

He preferred liquidity, interest rate policy, and the careful management of credit as more powerful tools shaping the fate of stock markets.

The Role of Speculation

Kostolany embraced speculation but not recklessness. He argued that one should only speculate with money one could afford to lose, recognising that losses are inevitable.

He often joked that his formula was "49 per cent losses, 51 per cent wins"—suggesting that success lies in having a small but consistent edge, combined with endurance and resilience.

The Voice, the Writer, and the Sage

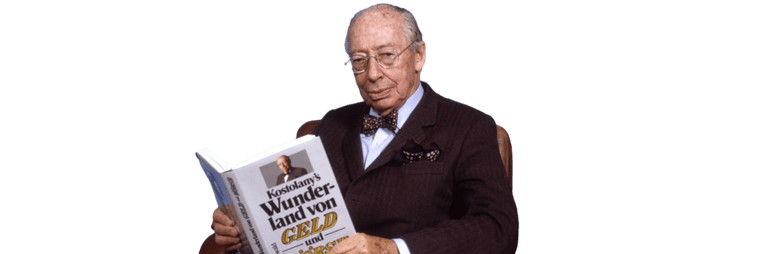

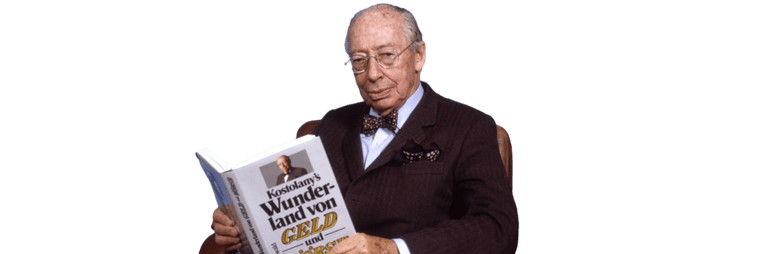

Kostolany was not only an investor but also a prolific communicator. He wrote more than a dozen books in French and German, many of which became classics in Europe. For years he contributed a column to the German magazine Capital, publishing over four hundred articles.

His writing style was witty, aphoristic, and rich in anecdotes. He often gave public lectures and seminars, where he combined financial education with humour and storytelling.

This personal charm, coupled with his practical wisdom, earned him the reputation of a financial sage, especially in Germany.

His legacy is not a strict system of formulas but a philosophy that values psychology, patience, and contrarian courage. In many ways, he anticipated what later came to be called behavioural finance.

Case Studies and Anecdotes

Kostolany's career offers many instructive stories. He made bold bets during the crash of 1929. and although not all were successful, they deepened his conviction about market psychology.

After the Second World War, he invested heavily in German reconstruction, benefiting from the "economic miracle" that followed.

Yet he also suffered serious losses at times, showing that even seasoned speculators are not immune to error. What distinguished him was his ability to recover, learn, and continue. He often reminded his readers that speculation without risk is an illusion.

Applying Kostolany Today

Though markets have changed with technology, globalisation, and regulation, many of Kostolany's lessons remain highly relevant.

Stay calm amid volatility. When prices fluctuate wildly, patience is more effective than panic.

Know your temperament. Identify whether you are a "shaky hand" or a "firm hand" and invest accordingly.

Use time wisely. Long-term horizons allow the market to correct short-term mispricing.

Speculate with discipline. Never risk more than you can afford to lose, and avoid overleveraging.

Balance fundamentals with psychology. Numbers matter, but human behaviour often dominates in the short run.

Frequently Asked Questions

1. Was André Kostolany a value investor or a speculator?

He cannot be classified neatly. He was primarily a speculator but with a deep respect for fundamentals. His approach was hybrid: intuition and sentiment blended with economic reality.

2. What does the "shaky hands and firm hands" idea mean?

It describes the psychology of investors. Shaky hands panic and sell at the first sign of trouble, while firm hands withstand pressure, often reaping rewards by doing the opposite of the crowd.

3. Why did Kostolany criticise gold as an investment?

He believed gold tied up capital unproductively. He preferred assets that contributed to growth and argued that modern economies required flexible monetary systems, not rigid ties to gold.

4. Are Kostolany's strategies relevant today?

Yes, but they must be adapted. While his aphorisms about psychology and patience remain timeless, modern markets involve high-frequency trading, global flows, and complex instruments. His lessons on discipline and investor behaviour, however, are as applicable as ever.

Conclusion

André Kostolany was more than a market participant; he was a storyteller who turned speculation into a form of philosophy. His colourful metaphors, contrarian spirit, and emphasis on psychology continue to resonate with investors seeking guidance in uncertain times.

His life—marked by losses, recoveries, and enduring wit—reminds us that markets are ultimately human creations, full of irrationality but also opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.