The Art of Reflecting on Money offers timeless insights into how human behaviour shapes markets, risk, and investment decisions.

By combining philosophy, humour, and real-world examples, André Kostolany teaches readers to approach money thoughtfully rather than mechanically.

This article will break down the key lessons from the book, including market psychology, risk and reward, asset strategies, cycles, and practical applications for modern investors.

Thinking Through The Art of Reflecting on Money

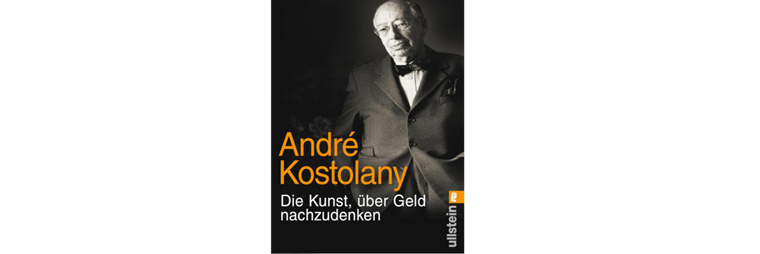

The Art of Reflecting on Money by André Kostolany is more than a book on finance; it is a guide to understanding the human side of money.

Kostolany encourages readers to step back from numbers and charts, cultivating reflection, patience, and perspective. The book emphasises that thoughtful reflection on financial decisions is often more valuable than blindly following formulas or short-term trends.

Kostolany blends philosophy, humour, and market commentary to show that speculation and investing are deeply tied to psychology.

This mindset forms the foundation of The Art of Reflecting on Money, providing lessons that are relevant for both professional investors and everyday savers.

Money & Markets — Insights from The Art of Reflecting on Money

In The Art of Reflecting on Money, Kostolany presents markets as living entities influenced by human behaviour rather than purely logical forces.

Prices often move unpredictably because fear, greed, and herd instincts dominate. Kostolany famously likened market fluctuations to a dog running ahead of its owner, illustrating that prices often deviate from reality but eventually return to balance.

He also underscores a key principle from The Art of Reflecting on Money: "anything is possible—even the opposite." By highlighting the uncertainty inherent in markets, he urges readers to recognise opportunity in crises, when others may act impulsively or irrationally.

Risk, Pain & Reward — Lessons in The Art of Reflecting on Money

A central theme in The Art of Reflecting on Money is the relationship between risk and reward. Kostolany stresses that financial participation inevitably involves pain before profit: losses are part of the journey, and resilience is essential.

He warns against chasing trends, emphasising that patience and discipline are far more valuable than short-term gains. For Kostolany, the reflective investor maintains composure during volatility and understands that emotional control is as critical as financial knowledge.

Strategy & Temperament — Guidance from The Art of Reflecting on Money

The Art of Reflecting on Money distinguishes between investment and speculation. Kostolany describes speculation as a disciplined activity requiring four key resources: an idea, conviction, money, and patience.

The reflective investor understands when to act decisively and when to wait, avoiding overconfidence and the lure of guaranteed returns.

This strategic mindset, central to the book, encourages readers to develop their own approach rather than follow popular narratives blindly.

Gold, Currencies & Assets — Perspectives in The Art of Reflecting on Money

Kostolany's approach to assets in The Art of Reflecting on Money is philosophical. He viewed gold as "dead capital," offering security but little economic contribution.

Currencies, inflation, and diversification are explored with a focus on reflection rather than speculation. Kostolany's guidance helps investors weigh broader economic context while maintaining flexibility in asset allocation.

Understanding Patterns in The Art of Reflecting on Money

Markets move in cycles, and The Art of Reflecting on Money provides insights into recognising these phases. Kostolany shows how understanding bull and bear markets, corrections, and exaggerations can prevent hasty decisions.

The book includes historical examples, demonstrating how reflective analysis can reveal opportunities overlooked by those who react emotionally.

Learning from The Art of Reflecting on Money

One of the hallmarks of The Art of Reflecting on Money is its memorable aphorisms. Kostolany blends humour and paradox to convey lessons that are both practical and thought-provoking.

Quotes like "2 + 2 is never 4 in the stock market" capture the unpredictability of finance and encourage readers to adopt independent thinking.

Applying The Art of Reflecting on Money Today

The Art of Reflecting on Money remains relevant in modern markets. Its emphasis on reflection, patience, and psychological awareness equips readers to approach financial decisions thoughtfully.

By conducting a personal audit of beliefs, fears, and habits, investors can apply Kostolany's timeless principles to contemporary market challenges.

Frequently Asked Questions

Q1: Is The Art of Reflecting on Money a practical guide?

No. It focuses on reflection, psychological insight, and strategy rather than strict step-by-step instructions.

Q2: Are the lessons in The Art of Reflecting on Money still relevant today?

Absolutely. Human behaviour, cycles, and market psychology remain unchanged despite modern financial instruments.

Q3: How does the book view gold and other assets?

Gold is "dead capital" and should not dominate a portfolio. Reflection on asset allocation and liquidity is emphasised throughout.

Q4: How can beginners use The Art of Reflecting on Money effectively?

Read slowly, reflect on anecdotes, and integrate insights into personal financial decisions rather than following rules blindly.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.