John J. Murphy is best known as a pioneer of technical and intermarket analysis, whose work has shaped how traders read charts and connect global markets.

His ideas, from the "Ten Laws of Technical Trading" to sector rotation strategies, remain vital tools for understanding financial trends.

In this article, we will explore his career path, key publications, analytical style, professional recognition, and the practical applications of his methods, along with answers to common questions traders often ask about his legacy.

Early Life and Career Foundations of John J. Murphy

John J. Murphy began his career in the financial markets after completing his academic studies. His early years at large institutions such as CIT Financial and later Merrill Lynch introduced him to the practical challenges of analysing futures and financial instruments.

It was during this period that he developed a passion for charting and technical analysis, which would eventually define his professional life.

John J. Murphy as an Independent Analyst and Educator

After years of institutional work, John J. Murphy pursued a career as an independent market analyst, consultant, and educator. He taught at the New York Institute of Finance, where he influenced countless students and traders.

Through media appearances, including a role as a technical analyst for CNBC, Murphy gained widespread recognition, translating complex market ideas into clear, actionable insights.

The Intellectual Contributions of John J. Murphy

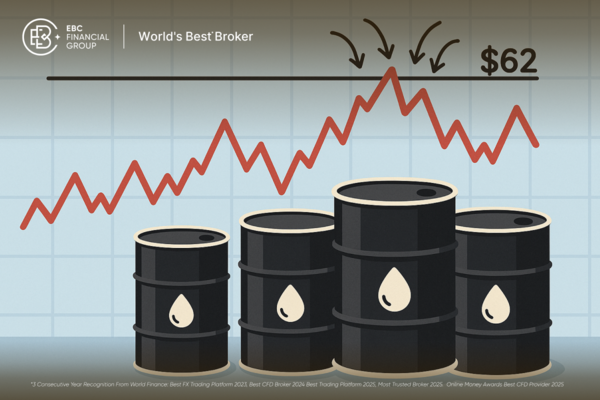

John J. Murphy's greatest contribution lies in his ability to combine markets and identify how movements in one asset class often precede changes in another.

1) Technical Analysis Principles:

He highlighted the use of price patterns, volume, and indicators as core decision-making tools.

2) Intermarket Analysis:

Murphy established the framework for understanding how equities, bonds, commodities, and currencies interact. This concept gave traders a broader perspective on risk and opportunity.

3) Sector Rotation and Relative Strength:

He applied these ideas through exchange-traded funds (ETFs), offering practical models for portfolio management.

4) The Ten Laws of Technical Trading:

His widely cited rules remain a reference point for developing trading discipline.

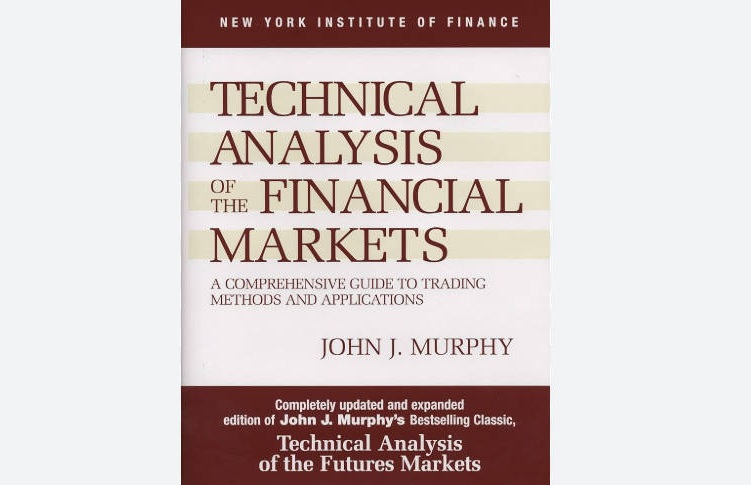

Major Publications by John J. Murphy

John J. Murphy's books have become standard references for students and professionals alike:

Technical Analysis of the Futures Markets introduced his early framework.

Technical Analysis of the Financial Markets expanded on these ideas and is now seen as the 'definitive guide" to charting.

Intermarket Analysis and Intermarket Technical Analysis formalised his approach to multi-asset thinking.

The Visual Investor made technical analysis more approachable for non-specialists.

Trading with Intermarket Analysis focused on applying his principles using ETFs in practical ways.

Each book has cemented Murphy's reputation as a writer who combines clarity with depth.

Analytical Style and Approach of John J. Murphy

Murphy's style is distinguished by its clarity and accessibility. He champions the use of charts as the most direct reflection of market behaviour.

Key features of his approach include:

Relying on price and volume as primary guides.

Using indicators such as moving averages and oscillators to confirm signals.

Applying multiple timeframes to align short-term and long-term views.

Emphasising discipline, patience, and psychological preparedness.

Recognition and Professional Affiliations of John J. Murphy

John J. Murphy's influence has been recognised by institutions such as the Market Technicians Association and the International Federation of Technical Analysts.

He has received awards and fellowships that underline his role in shaping technical analysis education. As Chief Technical Analyst at StockCharts.com, he has also provided tools and insights to a global audience.

Influence and Criticism of John J. Murphy

Murphy's ideas have influenced generations of traders and are now embedded in the curriculum of financial training programmes worldwide. While some critics argue that traditional charting can lag behind fast algorithmic trading methods, his principles remain relevant as a foundation.

The adaptability of intermarket analysis, especially when integrated with data science and quantitative approaches, shows how his ideas continue to evolve.

Practical Applications of John J. Murphy's Work

Murphy's methods can be applied in several practical ways:

Using intermarket relationships to anticipate stock market direction.

Employing ETF-based strategies for sector rotation.

Applying the Ten Laws of Technical Trading to maintain discipline.

Using relative strength to identify leadership in markets.

These applications make his framework versatile for both individual traders and institutions.

Summary and Future Outlook for John J. Murphy's Legacy

John J. Murphy has left an indelible mark on technical analysis and trading education. His blend of charting expertise and intermarket vision has provided traders with timeless guidance.

As markets evolve with algorithms, artificial intelligence, and vast datasets, Murphy's principles remain a practical and philosophical anchor for understanding market dynamics.

Frequently Asked Questions

Q1: Is John J. Murphy still relevant in markets dominated by quantitative trading?

Yes. His intermarket analysis framework remains applicable and can be integrated into quantitative models.

Q2: What is the difference between intermarket analysis and technical analysis?

Technical analysis focuses on individual securities, while intermarket analysis explores the relationships across asset classes.

Q3: Can John J. Murphy's Ten Laws apply to short-term trading?

Yes. While developed with broader trends in mind, the principles can be adapted to any timeframe.

Q4: Which John J. Murphy book is best for beginners?

Technical Analysis of the Financial Markets is often recommended as the most comprehensive starting point.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.