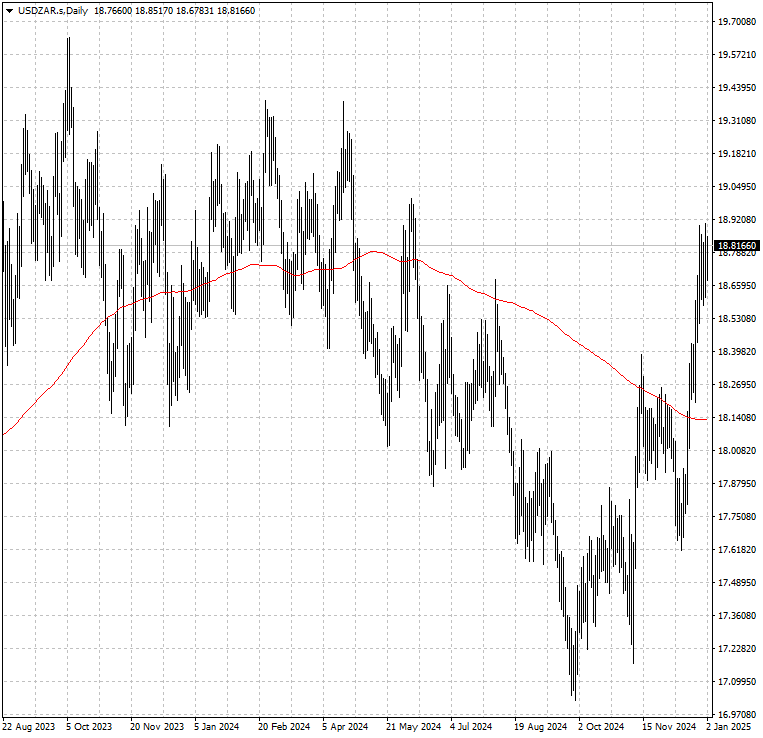

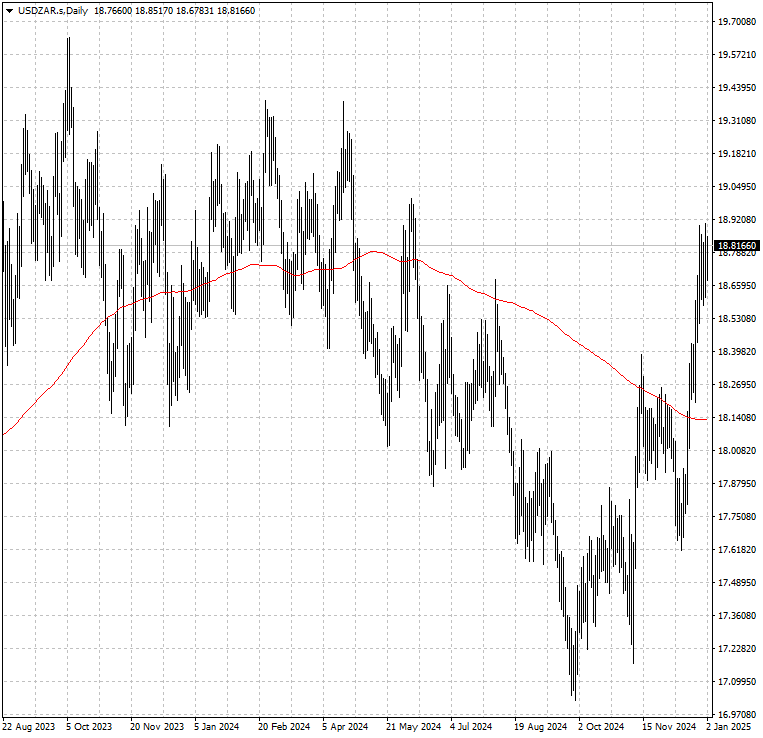

The South African rand pared all its earlier gains on Thursday, extending its

weak performance from December. Hovering around the weakest level since May's

elections, it could stage a rally according to the option market.

Six-month risk reversals were at the lowest on record last week, while one-

and three- month tenors are close to their record lows. That means the cost of

hedging against further rand declines was very cheap.

For the first time since 2016, the currency finds itself among the five

best-performing emerging-market currencies of 2024 — and there may be more to

come, according to analysts at Credit Agricole SA.

The bank forecasts an exchange rate of 16.40 rand per dollar by the end of

2025 as fixed-investment projects in the country was booming last year. It is

more bullish than the median of 18.07 in a Bloomberg survey.

Annual inflation rose 2.9% in November on an annual basis, around the lowest

level in more than a decade. The SAPB has already lowered borrowing costs by 50

bps by September.

Emerging market currencies struggled in 2024 as robust US economic growth

bolstered the dollar. But the rand's relative resilience has been aided by

rising investment levels, lower inflation and structural reforms.

The rand inched close to the low around 19 hit in early June. Whether it can

break below the level might be the key to its next direction. If that happens,

we see a decline towards 19.4.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.