The AED, or United Arab Emirates Dirham, is the official currency of the United Arab Emirates (UAE). Known for its economic stability, oil-backed wealth, and strategic global trade connections, the UAE and its currency play a vital role in the Middle East and international finance.

This guide provides a comprehensive look into the AED's history, its importance in global markets, expert forecast and trading tips, and why it is considered one of the more stable currencies in the region.

What Is AED Currency?

The AED stands for "Arab Emirates Dirham," and it is denoted by the symbol د.إ or the ISO code AED. The currency was introduced in 1973, replacing the Qatari riyal and the Bahraini dinar, which were used in different parts of the UAE before unification. One dirham is subdivided into 100 fils.

The dirham is issued and regulated by the Central Bank of the UAE, which manages its monetary policy and ensures economic stability.

AED Currency History

Before 1971, the Trucial States (now the UAE) used many currencies, including the Gulf rupee, Indian rupee, and Bahraini dinar. After gaining independence and forming the United Arab Emirates in 1971, a national currency became essential for unifying its economy.

1973: The UAE dirham was officially introduced.

1978: The dirham was pegged to the IMF's Special Drawing Rights (SDR).

1997: The dirham was officially pegged to the US dollar, which remains the case today.

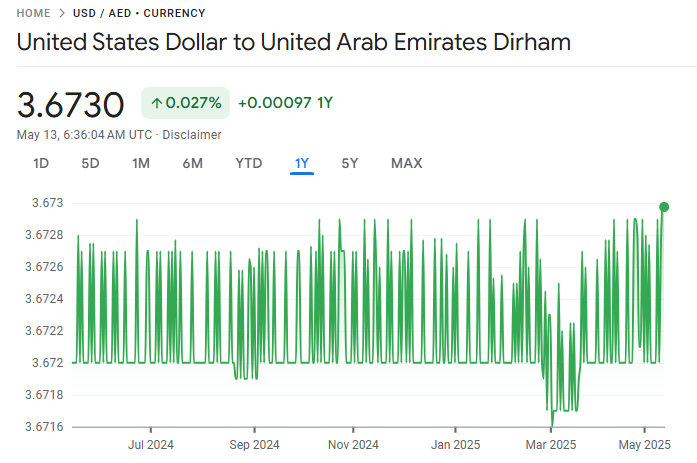

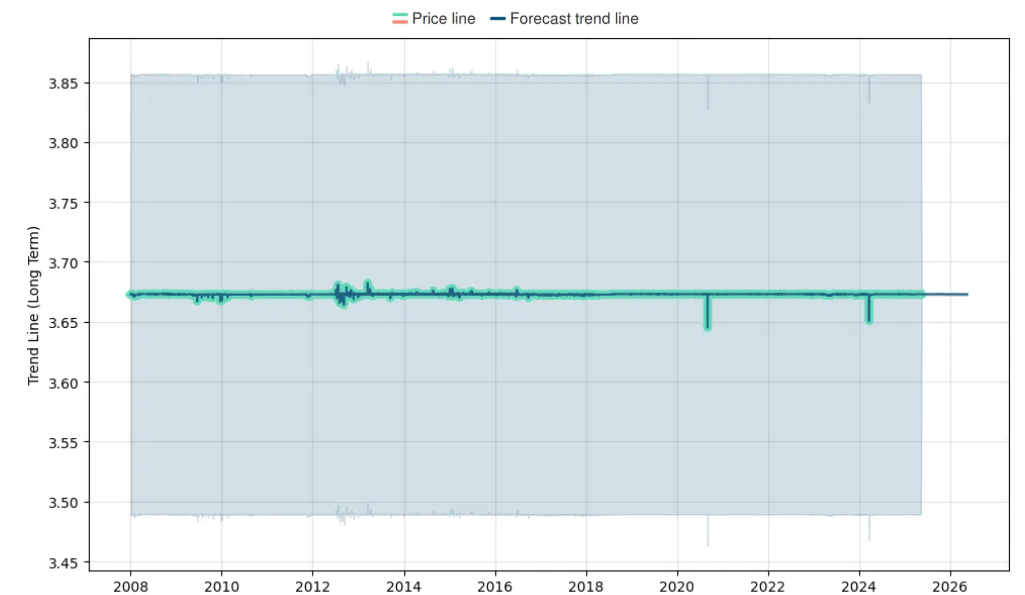

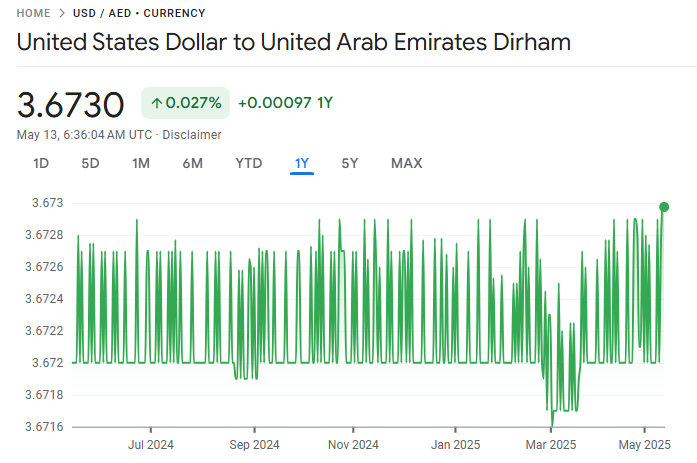

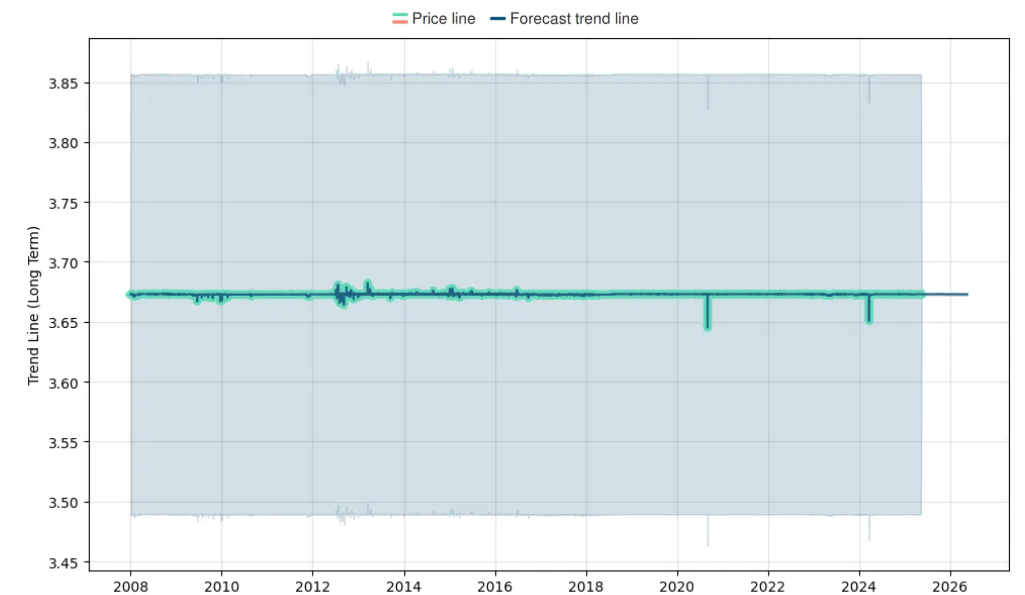

The peg to the US dollar is set at approximately 3.6725 AED per 1 USD, providing significant exchange rate stability.

Overview of AED in 2025

The UAE dirham (AED) remains one of the most stable currencies globally in 2025. This stability is largely due to its fixed peg to the US dollar at a rate of approximately 3.6725 AED to 1 USD, a policy in place since 1997. The peg ensures predictability in foreign exchange and fosters investor confidence, especially given the UAE's status as a major energy exporter and financial hub.

This fixed exchange rate means that for nearly three decades, the AED has had little volatility against the US dollar — a massive advantage for international investors and businesses.

Recent exchange rates (2024 averages):

EUR/AED: ~3.90

GBP/AED: ~4.60

INR/AED: ~0.045

CNY/AED: ~0.51

Despite global economic fluctuations and rising geopolitical tensions, the AED has held firm, backed by the UAE's massive sovereign wealth fund reserves, steady oil revenues, and low-inflation environment.

AED vs Other Regional Currencies

The AED is considered one of the most stable currencies in the Gulf Cooperation Council (GCC). While some neighbouring countries have floated their currencies or adjusted pegs, the UAE has maintained a fixed rate for nearly three decades. It has made the AED a preferred choice for expatriates and businesses across the Middle East.

Compared to:

Saudi Riyal (SAR): Also pegged to the dollar.

Kuwaiti Dinar (KWD): The most valuable currency globally, but more volatile.

Qatari Riyal (QAR): Pegged to the dollar but has faced geopolitical tensions.

Factors Supporting AED Stability

1. Oil Reserves and Energy Exports

The UAE is one of the top oil producers in the world. Revenue from oil exports provides a financial buffer for the government, helping maintain currency reserves and economic confidence.

2. Dollar Peg

Pegging the AED to the US dollar allows the UAE to benefit from global trust in the dollar. It also simplifies trade and investment, particularly in predominantly dollar-denominated oil markets.

3. Central Bank Policies

The Central Bank of the UAE maintains high foreign currency reserves, which protect against currency shocks and speculative attacks.

4. Diversified Economy

Although oil is still a major pillar, the UAE has significantly diversified its economy. Tourism, finance, logistics, and real estate have contributed to a broader, more stable economic base.

Expert Forecast and Tips for Trading AED in 2025

As of 2025, analysts expect the UAE dirham to remain firmly pegged to the US dollar, with no immediate signs of de-pegging or devaluation. The following trends support this forecast:

Strong dollar reserves by the UAE Central Bank.

Sustained GDP growth driven by non-oil sectors.

Infrastructure developments tied to long-term economic plans like Vision 2031.

The IMF and World Bank have highlighted the UAE's fiscal prudence and monetary stability, reinforcing confidence in the AED's future.

Tips

1) Monitor US Federal Reserve Policies

Since the AED is pegged to the USD, any changes in US interest rates or monetary policy directly affect AED valuation and interest rates in the UAE. It is crucial for investors in bonds or deposits denominated in AED.

2) Focus on Cross Pairs

Trading AED cross pairs like EUR/AED or GBP/AED can offer more movement than AED/USD, particularly during volatility in the euro or pound.

3) Use AED for Diversification

For long-term investors, exposure to AED can offer a regional hedge and reduce portfolio volatility, particularly for those with assets in emerging markets or energy-sensitive investments.

4) Leverage UAE's Strong Sovereign Credit

The UAE maintains a high credit rating (AA from S&P as of the latest rating), which adds confidence for long-term investments in AED. Traders can consider AED-denominated government bonds or Sukuk for stable returns with low currency risk.

Opportunities in Trading the AED

1. Low Volatility for Carry Trade Strategies

Because the AED is pegged to the USD, its volatility is minimal. This makes it an attractive leg for carry trade strategies when paired with higher-yielding, more volatile currencies like the Turkish lira (TRY) or South African rand (ZAR).

Investors borrow in low-volatility AED and invest in high-interest currencies to benefit from the interest rate differential.

2. Safe Haven for Regional Investors

Traders and investors in the Middle East and North Africa (MENA) region often move capital into AED when local currencies show instability. This increases forex volume and liquidity for AED pairs, especially against currencies like the Egyptian pound (EGP) or Pakistani rupee (PKR).

3. Stability in Oil-Linked Environments

The UAE's economy is still strongly tied to oil exports, and the AED benefits when global oil prices are elevated.

In 2025, Brent crude averaged around $80–$85 per barrel. This supports a strong fiscal position and adds confidence to forex traders considering AED exposure.

Risks of Trading AED

1. Limited Movement Due to Peg

The very stability that makes the AED appealing also limits potential for profit through speculative forex trading. Since the AED/USD rate rarely fluctuates, traders cannot rely on technical trends or momentum strategies that are effective with floating currencies.

2. US Dollar Dependence

Any weakness in the US dollar directly affects the AED. If the US faces a significant economic downturn or unexpected Fed policy shift, the AED could weaken in its perceived value versus other global currencies, even if local UAE fundamentals remain strong.

3. Geopolitical Risks

The UAE operates in a region with ongoing political tensions. Although the country is a neutral and safe zone, regional instability could still impact investor confidence and capital flows, especially if it affects oil supply routes or regional security.

4. Liquidity Limitations

While the AED is liquid in regional forex markets, it's less so globally. Traders outside the Middle East may find higher spreads and lower availability of AED pairs, which could pose challenges for short-term trading strategies.

Conclusion

In conclusion, the AED's long-term dollar peg, financial discipline, and strategic economic diversification make it one of the most trusted currencies in the region. Whether you're an investor or business owner, transacting in AED offers minimal currency risk and strong regulatory oversight.

For beginners, the AED presents a strong entry point into Middle Eastern markets. For seasoned investors, it provides a secure store of value, particularly in volatile times when emerging markets experience currency swings.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.