The Vietnamese dong (VND) has depreciated in 2025 due to a mix of external and internal factors.

For example, a stronger U.S. dollar and higher U.S. real yields, mild but persistent inflation and monetary easing expectations in Vietnam, import growth and rising demand for foreign currency, volatile portfolio flows, corporate FX needs, and a managed-float regime where the State Bank of Vietnam (SBV) adjusts the band to smooth the market.

While Vietnam still posts trade surpluses and rising FDI, those strengths have been offset by heavy import growth, currency mismatches in corporate balance sheets, and global rate differentials, leaving the VND down several per cent year-to-date and testing record lows versus the dollar.

How Weak Is the Current Vietnamese Currency?

As of October 2025, the USD/VND spot hovered around ≈26,340–26,430 VND per USD, near the historically low levels observed in August and September 2025.

Data services noted intraday highs in August exceeding 26,400 dongs per dollar, with year-to-date depreciation at approximately 3–4%.

Key data points to know:

1) Inflation:

Consumer Price Index (CPI) in Vietnam was roughly 3.3% YoY in September 2025, with core inflation tracking slightly lower, relatively tame but enough to shape monetary policy debates.

2) FX Reserves:

Vietnam's foreign exchange reserves remain sizeable but below the 2022 peak. Public series display reserves estimated between ~$70–80 billion by mid-2025 (not reaching the 2022 peak of ~$109B). That gives the SBV room to intervene but not unlimited firepower.

3) Trade & FDI:

The trade turnover is substantial, with goods trade reaching approximately $680 billion in the first nine months of 2025 and a goods trade surplus of about $16.8 billion during this period.

Foreign direct investment also rose (~$28.5B YTD through Sept 2025). These are advantages, but import growth exceeded exports in certain months, putting pressure on FX demand. [1]

The Bottom line: Vietnam still runs a healthy trade and FDI picture, but the VND's weakness reflects a more complex mix of global pressures, local policy, and balance-sheet effects.

Why Is the Vietnam Currency So Weak? External and Internal Drivers

3 External Drivers Pushing VND Lower

1. Strong U.S. Dollar & Higher U.S. Real Yields

When the U.S. dollar rallies and U.S. real interest rates rise, EM currencies typically weaken. In 2025, the dollar experienced times of strength linked to shifting Federal Reserve expectations and safe-haven inflows.

Higher U.S. yields increase the carry costs for emerging markets as capital seeks better or safer returns in dollar-denominated assets, putting downward pressure on the VND.

2. Global Risk & Commodity Shocks

Global shocks, trade disputes, fluctuations in commodity prices, or geopolitical threats alter risk premiums and drive investors towards the dollar.

Vietnam is export-dependent and import-sensitive (raw materials, energy), so commodity spikes or supply-chain shocks increase import bills and FX demand, weakening the dong.

3. Portfolio Flows and Passive Index Shifts

Capital flows into emerging markets are fickle. Passive rebalancing, sudden outflows from EM equity/credit funds, or shifts in global risk appetite can quickly reverse FX flows.

Even as FTSE flagged an upgrade for Vietnam's market status (a long-term positive), short-term portfolio churn can pressure the currency.

5 Domestic Factors Depreciating VND Value

1. Monetary Policy Stance and Interest Rate Differentials

The State Bank of Vietnam (SBV) manages domestic liquidity and sets policy rates that influence VND yields.

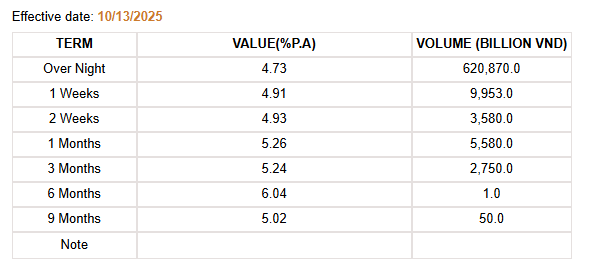

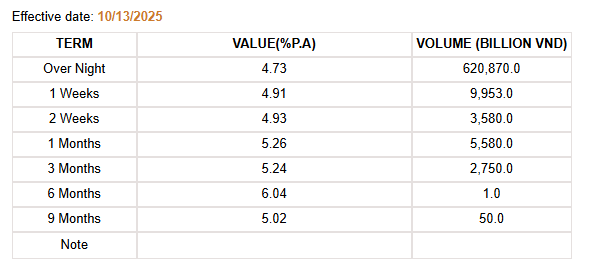

In October 2025, SBV market rates were around 4.8–5.1% based on published windows, indicating a relatively loose approach compared to global counterparts.

A lower or easing domestic stance versus a higher-yielding dollar environment widens interest rate differentials and weakens the currency.

2. Currency Management Regime: Managed Float & Reference Band

Vietnam operates a managed floating exchange rate with a state-set reference and allowable daily band. The SBV often adjusts the central reference point and occasionally uses spot interventions to smooth excessive volatility.

That approach can mean the currency moves in a controlled but sometimes stepwise fashion (the SBV lets the dong depreciate within bands to absorb market pressures).

3. Import Growth and Supply-Chain Composition

Vietnam's imports, including machinery, manufacturing intermediate goods, energy, and electronic components, saw a significant increase by 2025.

Over a few months, import growth surpassed that of exports, straining the foreign exchange supply-demand. Sectors with high imported input intensity (foreign-invested manufacturing) demand dollars to pay suppliers, which can lift USD/VND.

4. Corporate FX Mismatches and External Debt

Vietnamese corporates, especially in export manufacturing and property, often have foreign-currency exposures (hard-currency loans, supplier invoices).

When the VND weakens, FX conversion costs rise, and corporates may buy dollars for hedging or servicing debt, increasing pressure on the currency. Concerns about corporate external debt and repayments can magnify downward pressure during volatile months.

5. Inflation and Wage Pressures

Although the headline CPI in 2025 stayed moderate (~3.3% in Sept), some sectors experienced price pressures. If inflation reaccelerates, the SBV may face trade-offs between supporting growth and defending the currency.

The balance has led authorities toward measured interventions rather than aggressive hikes, which can leave the VND more exposed when external conditions tighten.

What the State Bank of Vietnam Can and Has Done?

1. FX Interventions and Reference Band Adjustments

The SBV uses its reserves to intervene and smooth volatility, and it periodically adjusts the central reference rate.

That approach aims to avoid chaotic market moves while preserving export competitiveness. Repeated minor interventions, though costly, deplete reserves; thus, SBV finds a balance between intervening and permitting gradual depreciation.

2. Interest Rate Settings and Special Measures

In 2025, policymakers introduced targeted measures to support liquidity and credit (e.g., SBV authorised special loans at 0% in some circumstances). [2]

The SBV's interest rate choices weigh inflation management against growth assistance, and this balancing act affects the exchange rate by altering carry differentials.

3. Macroprudential Steps & FX Risk Controls

Authorities have used tools (limits on FX lending to non-exporters, guidance on hedging) to restrain speculative FX demand.

That helps, but it can create distortions if firms cannot hedge commercially. Over time, deeper FX markets and hedging options would reduce volatility.

Vietnamese Dong Long-Term Outlook

As mentioned above, Vietnam's fundamentals, rising FDI, improving export sophistication, a strong manufacturing footprint, and a large domestic market, remain solid.

Structural reforms (capital market opening, FTSE upgrade) and continued trade relationships should attract investment over time. These factors advocate for medium to long-term backing of the VND.

However, currency normalisation will likely require one or more of the following:

A stable external environment (weaker dollar or lower U.S. real yields),

Continued SBV credibility and sufficient reserves to deter panic moves, and

Deeper domestic FX markets and hedging infrastructure so that shocks are absorbed without big currency moves.

In short, the VND's weakness in 2025 is more cyclical and policy-sensitive than structural. If macro tailwinds shift in Vietnam's favour, the dong can recover. If external headwinds persist or domestic policy remains too loose relative to global rates, the pressure could continue.

Frequently Asked Questions

1. Has Vietnam's VND Hit Record Lows in 2025?

VND reached record weak intraday prints around 26,400–26,436 per USD in August–September 2025.

2. Are Vietnam's FX Reserves Adequate to Defend the Currency?

Reserves (~$70–80B by mid-2025) provide the SBV with the ability to intervene, although they are below the 2022 high and are not inexhaustible.

3. Should Investors Hedge VND Exposure Now?

If you have significant VND exposure (equity or corporate), hedging makes sense until volatility subsides.

Conclusion

In conclusion, Vietnam's dong is weaker in 2025 due to global rate dynamics and USD strength, import-heavy growth, corporate FX needs, and a managed-float policy that tolerates measured depreciation, which have combined to outpace the offsetting forces of trade surplus and rising FDI.

If you're a trader, focus on SBV signals and U.S. rate moves for trade triggers.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://asemconnectvietnam.gov.vn/default.aspx?ID1=2&ID8=145084&ZID1=8

[2] https://english.luatvietnam.vn/legal-updates/from-october-15-2025-sbv-is-authorized-to-grant-special-loans-at-0-interest-rate-892-102982-article.html