Understanding buy limit vs buy stop is essential for traders who want to navigate price movements with precision. These two types of pending orders might sound similar, but they serve very different purposes and are triggered in opposite market conditions.

Whether you are entering positions conservatively or chasing a breakout, knowing when and how to use each order can impact your results significantly.

Both order types are tools designed to automate entry into a trade, allowing you to avoid constant monitoring. They are commonly used in forex, commodities, and equities trading. However, the key lies in knowing the price level at which each becomes active, and what market behaviour you are trying to capture.

What Is a Buy Limit Order?

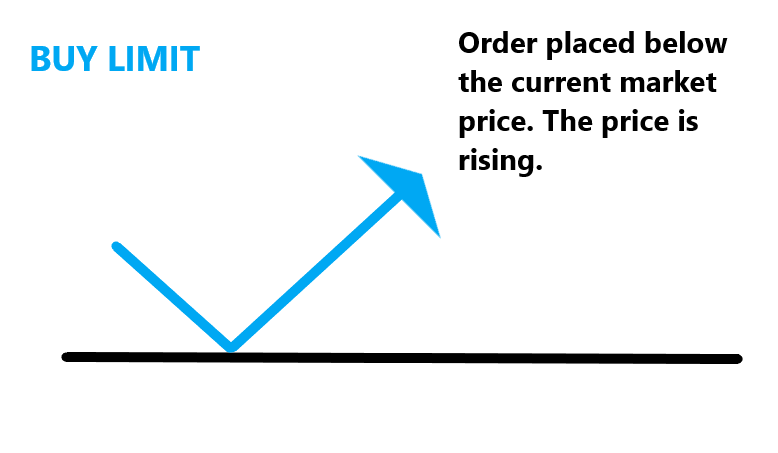

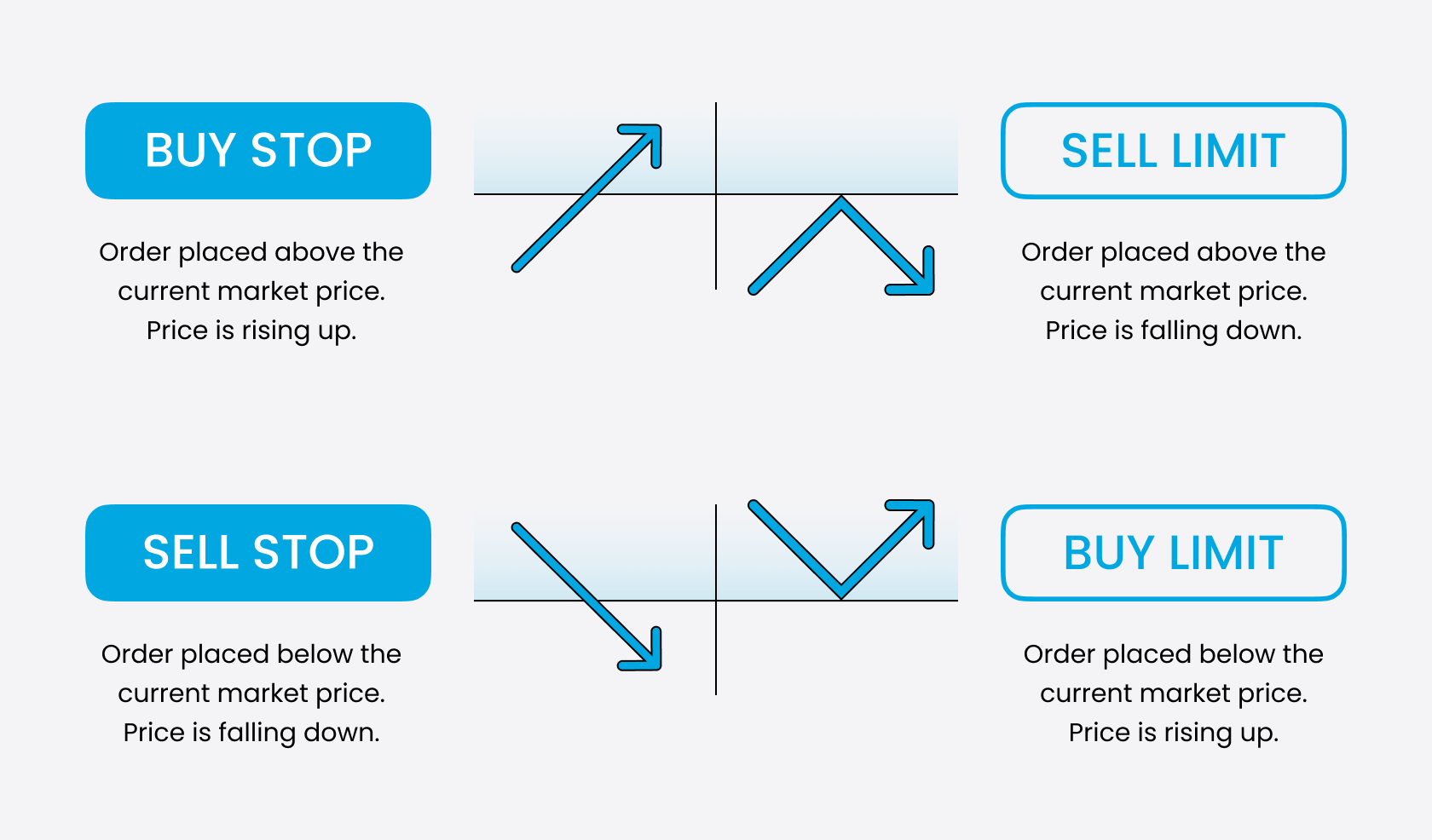

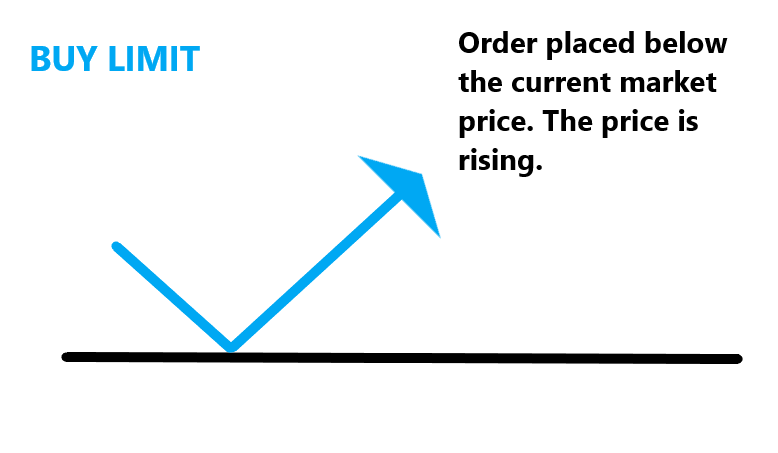

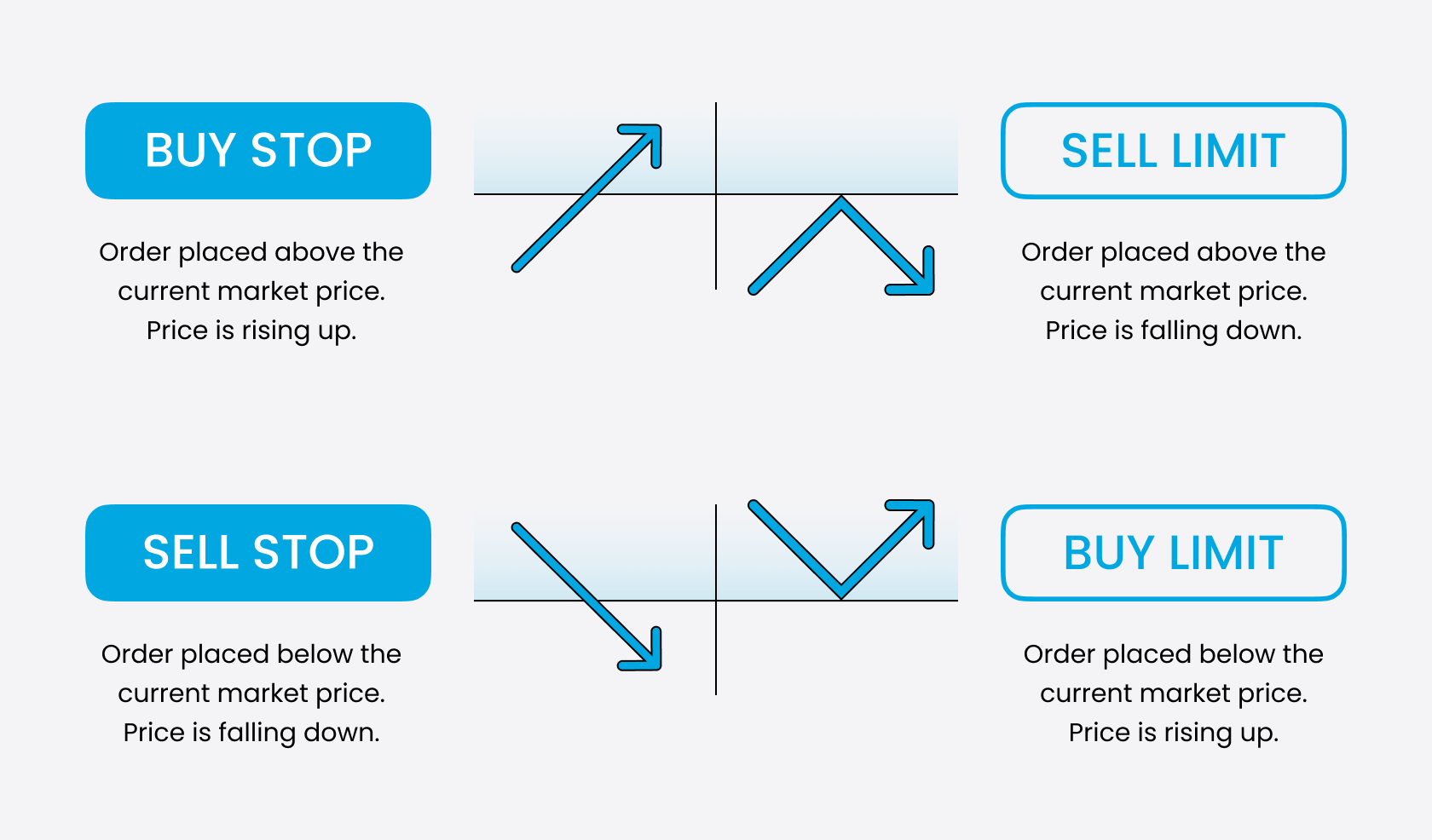

A buy limit order is used when you believe the price will decline to a certain level before reversing and moving upward. In this case, the order is placed below the current market price. The objective is to buy low, anticipating that the asset's value will rebound after hitting a support zone.

For example, if gold is trading at $1,950 and you believe it will drop to $1,930 before climbing again, you would set a buy limit order at $1,930. If the price touches or dips below that point, your order will be triggered, and your position entered automatically.

This type of order is ideal for traders who want to catch retracements or dips in an uptrend. It reflects a more patient, value-driven approach to entering the market.

What Is a Buy Stop Order?

A buy stop order is the opposite. It is placed above the current market price and is used when you expect the price to continue climbing once it breaks through a certain resistance level. In this scenario, the order is activated only if the price rises to the specified point.

Suppose a currency pair is trading at 1.1200, and you expect a breakout once it hits 1.1250. Placing a buy stop order at 1.1250 would ensure you enter the market only if upward momentum is confirmed. If the price never reaches that level, the order remains pending and unfilled.

This strategy is often used by breakout traders who want to avoid entering too early and prefer confirmation of strength before committing capital.

Buy Limit vs Buy Stop: Key Strategic Differences

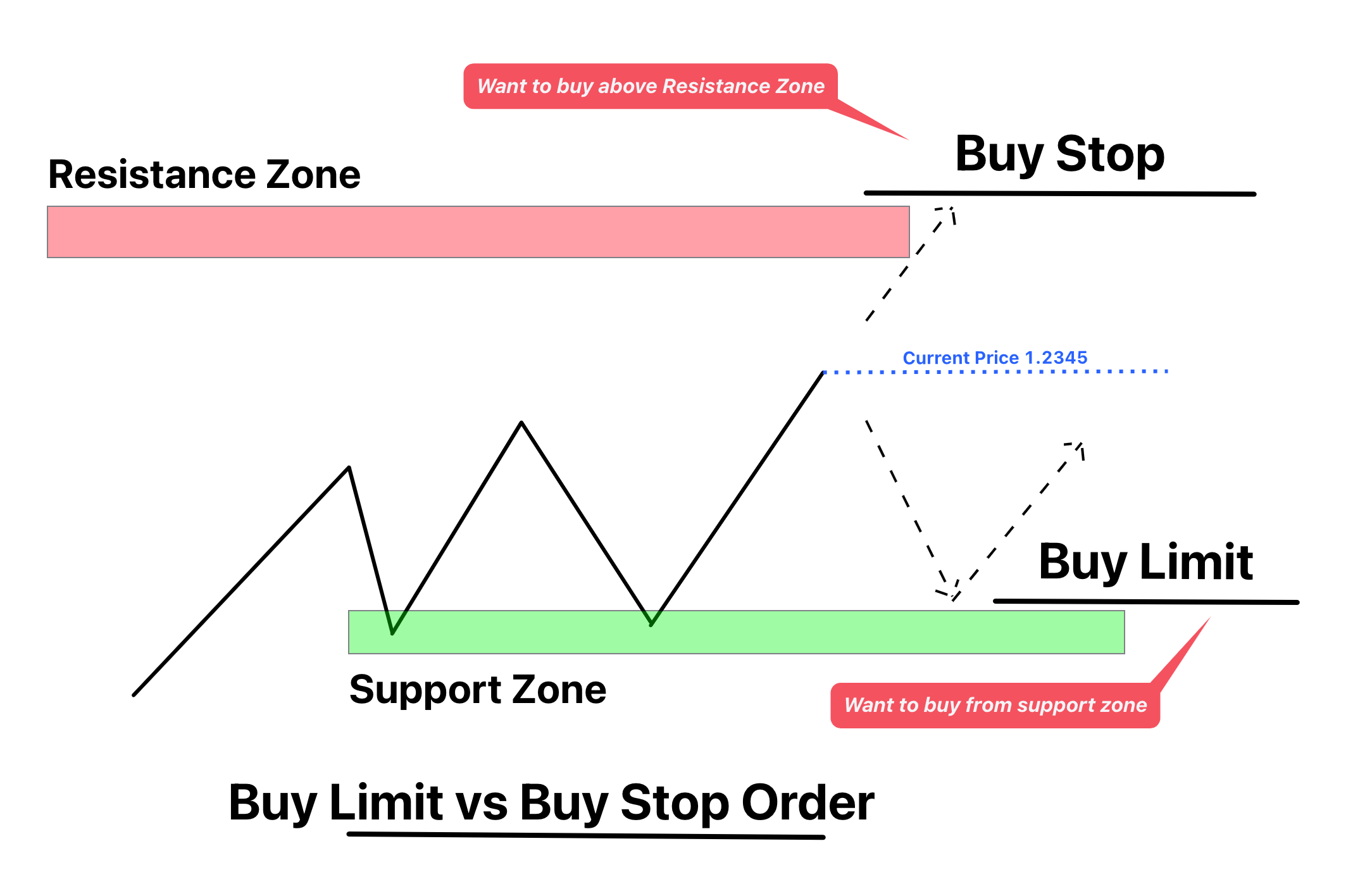

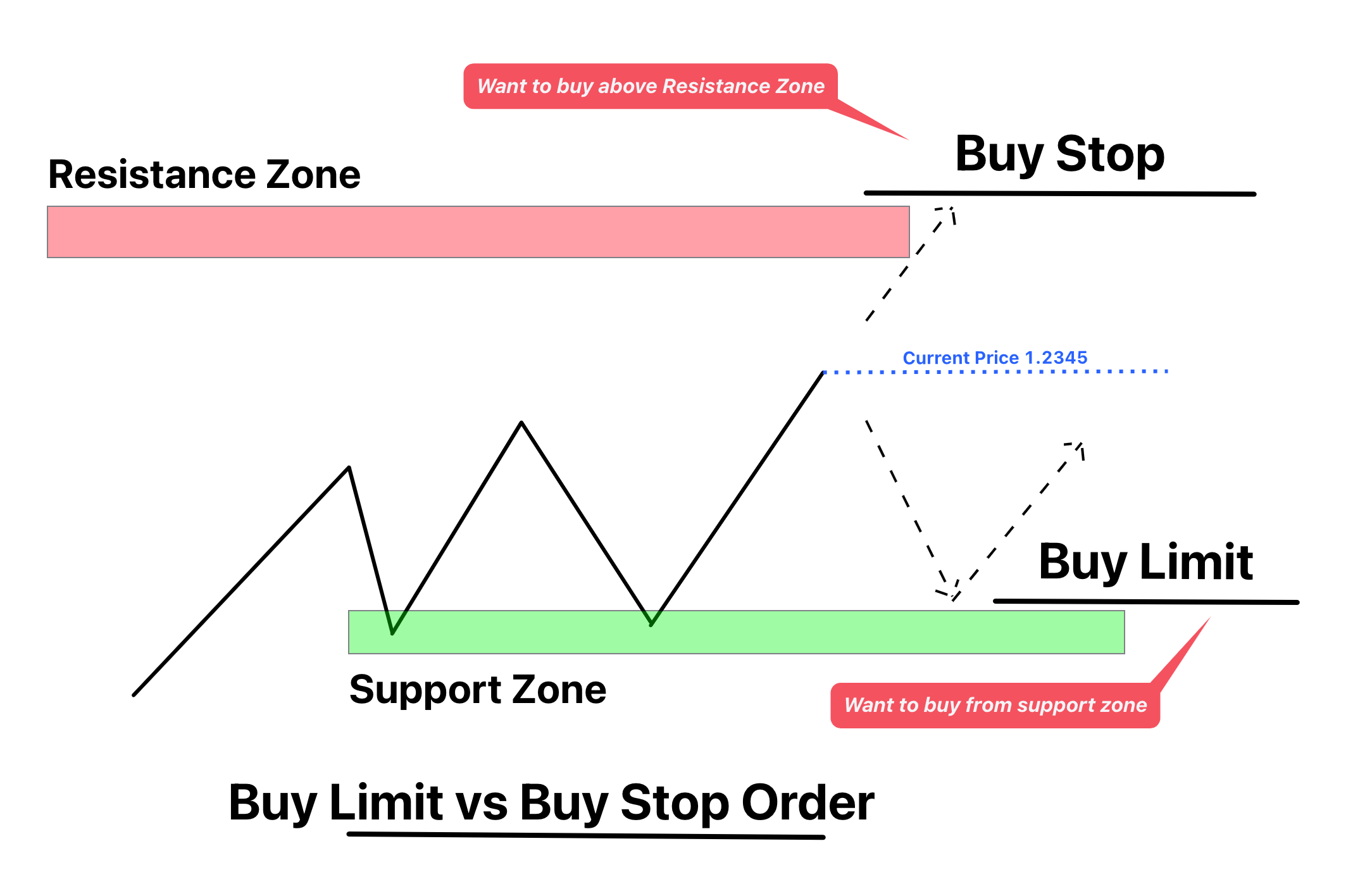

The core distinction between buy limit vs buy stop lies in the price positioning relative to the current market level. A buy limit anticipates a dip and recovery, while a buy stop anticipates a continuation of upward momentum after a breakout.

Traders using a buy limit are focused on value entry, often targeting support zones or retracements within an established trend. In contrast, traders using a buy stop are generally looking to join a strong price move as it accelerates, often triggered by news, volume spikes or breakout patterns.

While both order types aim to optimise entry points, they align with very different market expectations and levels of risk appetite. The buy limit order appeals to those seeking the best possible price, while the buy stop order targets confirmation over price efficiency.

Real-World Application in Volatile Markets

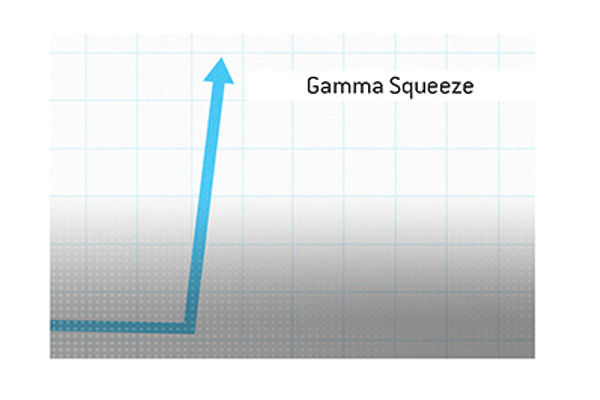

Understanding buy limit vs buy stop becomes even more critical in high-volatility markets. During fast price moves, manually entering trades can lead to slippage or hesitation. Automated orders like buy limit and buy stop allow traders to predefine conditions and remove emotion from execution.

Consider a major economic announcement such as a CPI report or central bank decision. A buy stop order could help you capture a price surge that occurs seconds after the release, assuming the result aligns with market expectations. Conversely, if you expect a brief panic drop before recovery, a buy limit order set lower might offer a more favourable entry.

By integrating these orders into your trading strategy, you can plan for various scenarios rather than react impulsively. It becomes a way to build discipline and structure into your trades.

Mistakes to Avoid

One of the common errors traders make is confusing the two order types, especially under pressure. Placing a buy limit order above the current price will not be executed unless the price drops first. Likewise, a buy stop order placed below the current level will not trigger at all, rendering the order ineffective.

Another mistake involves improper risk management. Setting a buy stop order too close to resistance can lead to false breakouts and slippage. On the other hand, setting a buy limit order too far below the current price may mean missing an opportunity altogether if the price never dips low enough to trigger it.

Traders should also be aware that neither order guarantees execution at the exact price in fast-moving markets. Sudden gaps or thin liquidity can result in a fill price that differs from what you expected. Always monitor key levels and adjust your orders accordingly.

Which Should You Use?

Choosing between buy limit vs buy stop depends on your market outlook. If you believe the price will retrace before climbing, use a buy limit. If you believe the price will break resistance and keep climbing, use a buy stop.

Your trading style also matters. Range traders typically prefer buy limit orders to capitalise on price oscillations, while momentum or news-driven traders lean toward buy stop orders to catch breakouts.

The timeframe of your trade is another consideration. Short-term traders might rely more heavily on buy stops for quick entries, while longer-term investors could favour buy limits to secure better value entries over time.

Final Thoughts

Understanding buy limit vs buy stop is vital for any trader aiming to approach the market with structure and strategy. These order types offer different advantages depending on your forecast, trading style, and risk profile. While the buy limit seeks value below current prices, the buy stop seeks confirmation above it. Both can improve trading outcomes when used correctly and with discipline.

By learning the differences between these two orders, traders can move away from guesswork and towards a more measured, strategic approach to entries. Whether in forex, stocks or commodities, placing the right type of pending order can be the difference between catching a profitable move or missing it entirely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.