The US dollar to Pakistani rupee (USD to PKR) exchange rate is a key indicator for anyone sending money, trading, or investing between the United States and Pakistan.

With IMF-backed reforms and tighter monetary policy helping curb pressure, the currency’s next moves will hinge on inflation trends and global dollar strength.

Here's a detailed look at today's USD to PKR rate, recent history, and what trends to expect for the rest of the year.

USD to PKR: Today's Exchange Rate

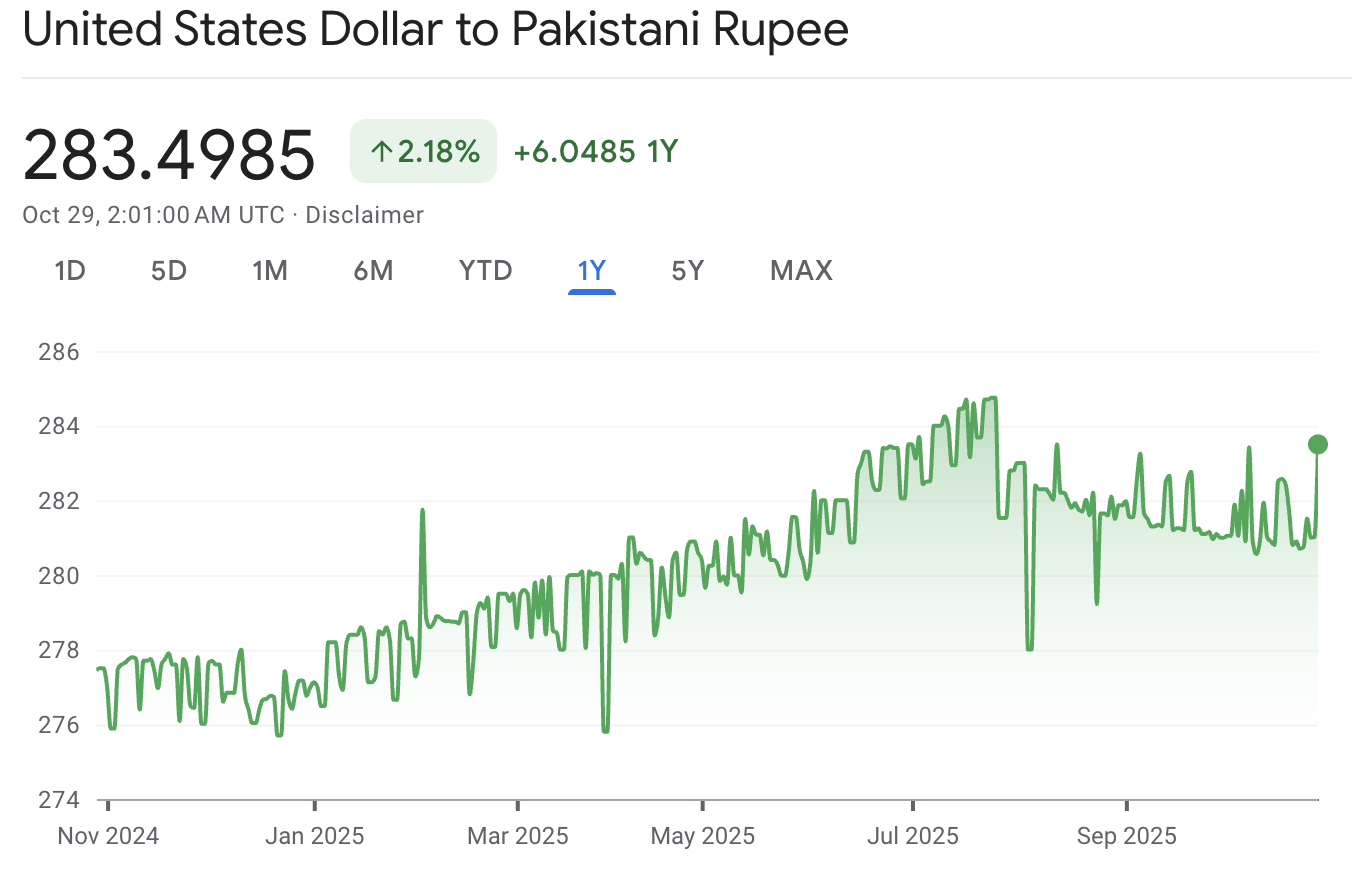

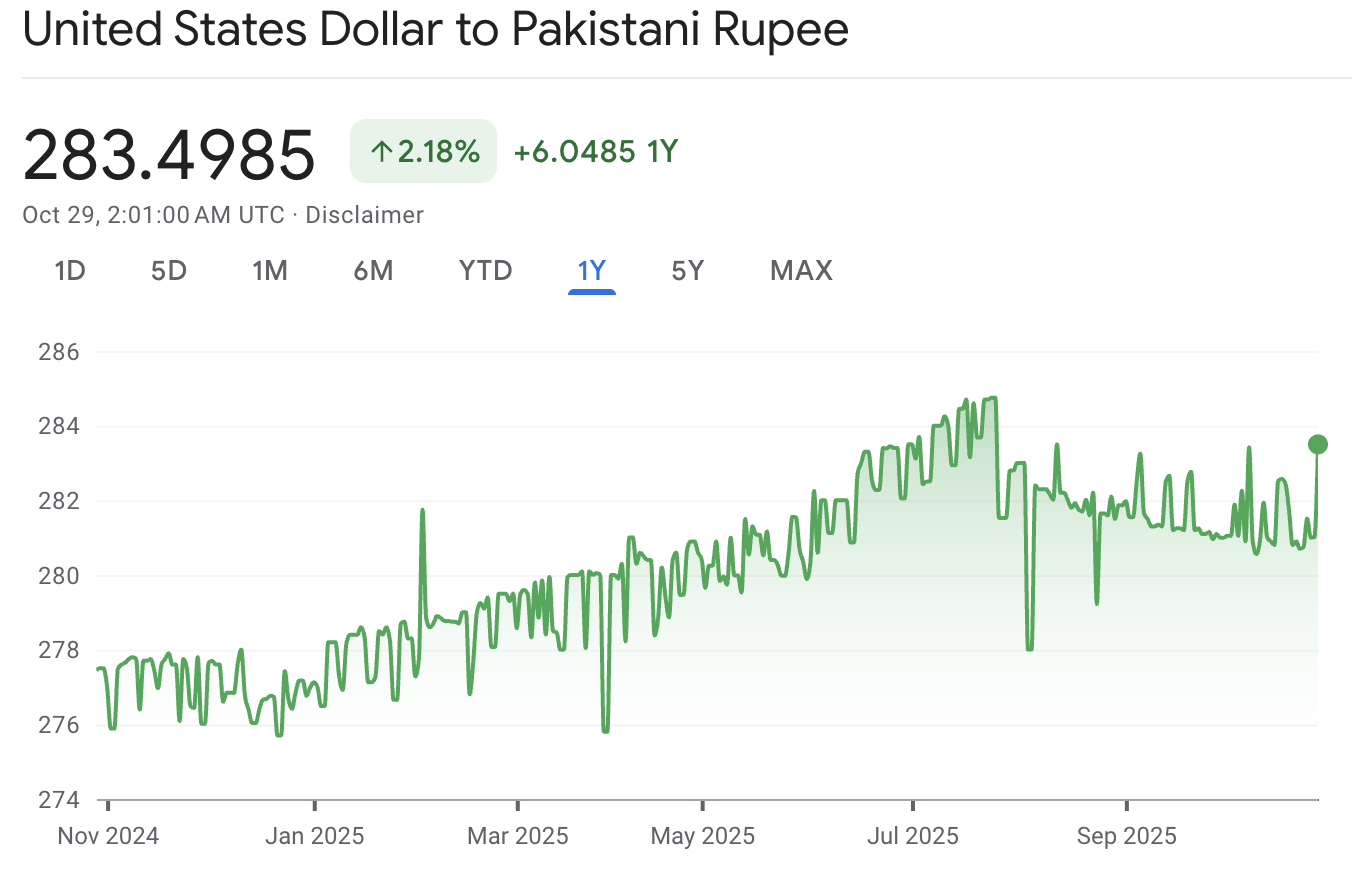

As of 29 October 2025, the USD to PKR exchange rate stands at ₨283.49 per US dollar. This rate reflects a relatively stable trend over recent weeks, with only minor fluctuations since the start of the year.

The rate is consistent across major sources, including XE, Wise, and Exchange Rates UK, confirming its reliability for those needing to make conversions or international transfers.

Recent USD to PKR Exchange Rate History

The Pakistani rupee has remained relatively steady through 2025, trading mostly between ₨281 and ₨285 over the past several months.

Here’s a summary of its performance so far this year:

Lowest point: ₨278.48 (January 2025)

Highest point: ₨289.90 (August 2025)

Average for 2025: Around ₨283.10

As of 29 October 2025, the USD to PKR rate stands near ₨283.49, reflecting a 2.1% depreciation year-to-date.

While the rupee continues to face mild pressure from inflation and global dollar strength, its overall movement has been far more stable than in previous years, supported by IMF-backed fiscal discipline and improving foreign reserves.

USD to PKR Investor Outlook 2025

Market analysts and forecasting models point to a gradual upward trend in the USD to PKR exchange rate through the final quarter of 2025.

Short-Term Outlook: The rupee is expected to trade between ₨281 - ₨282 in the coming weeks, with limited movement tied to fresh economic data and global dollar strength.

End-of-Year Projections: Estimates place the exchange rate between ₨285 – ₨290, though some models suggest a possible rise toward ₨317 if import demand or fiscal pressures increase.

Volatility: Market activity remains contained, with realized volatility below 0.2% in recent months signaling a relatively stable trading band.

Example: Exchanging $1,000 today could yield roughly ₨288,000 if the rate climbs to ₨288 by November 2025, a notional gain of ₨6,760, excluding bank fees and transfer costs.

Key Factors Influencing USD to PKR in 2025

The USD/PKR exchange rate continues to be shaped by several key forces, each with implications for investors, remitters, and businesses alike.

1. External Financing & IMF Support

International Monetary Fund–backed reforms have reduced immediate pressure on the rupee. Pakistan’s access to IMF programs has helped shore up reserves and build investor confidence.

2. Foreign Exchange Reserves & Current Account Balances

A stronger reserve buffer means less need for sharp currency moves. Pakistan’s recent reports of improved reserves and a smaller current-account gap have helped stabilise the rupee.

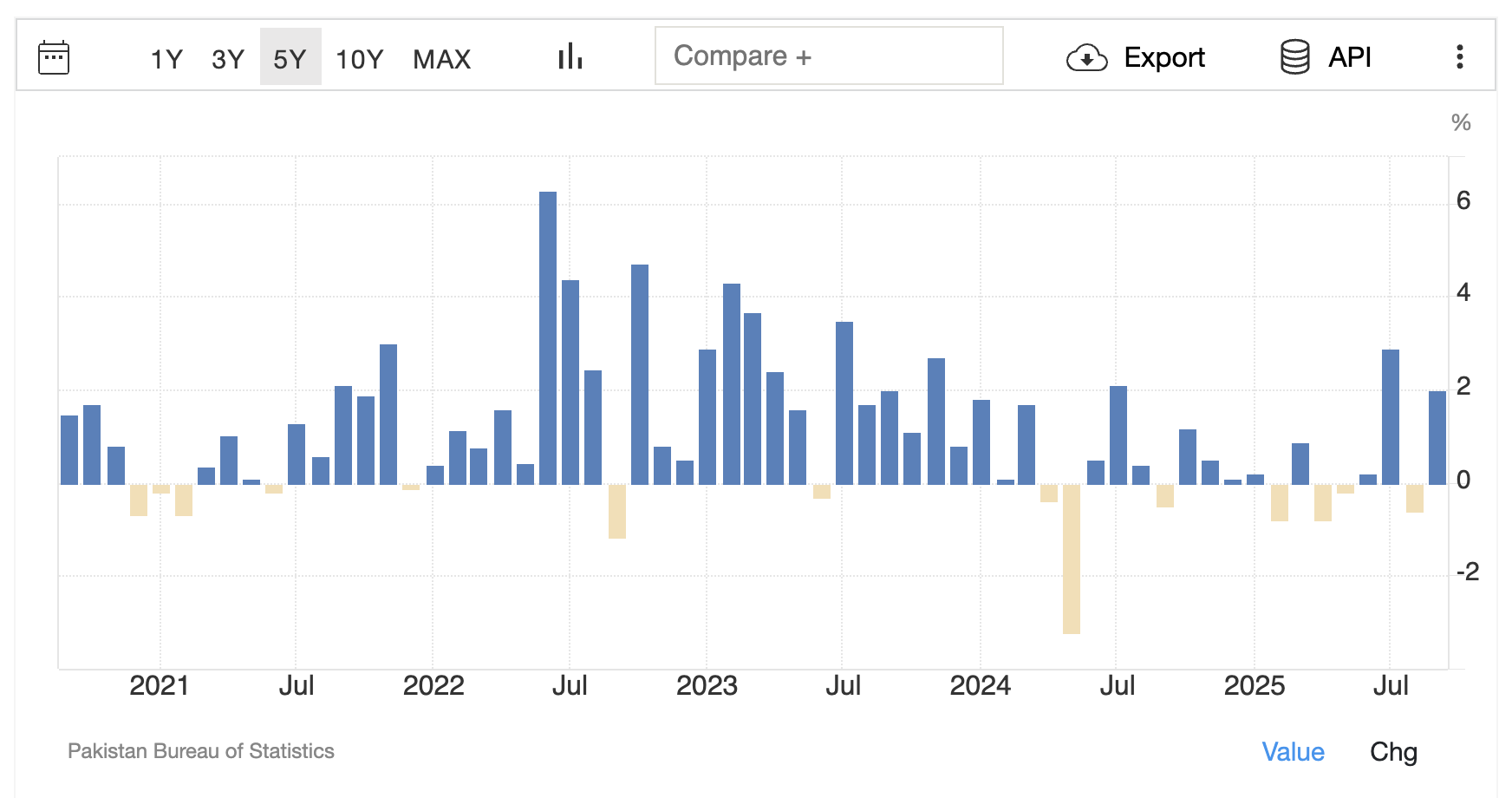

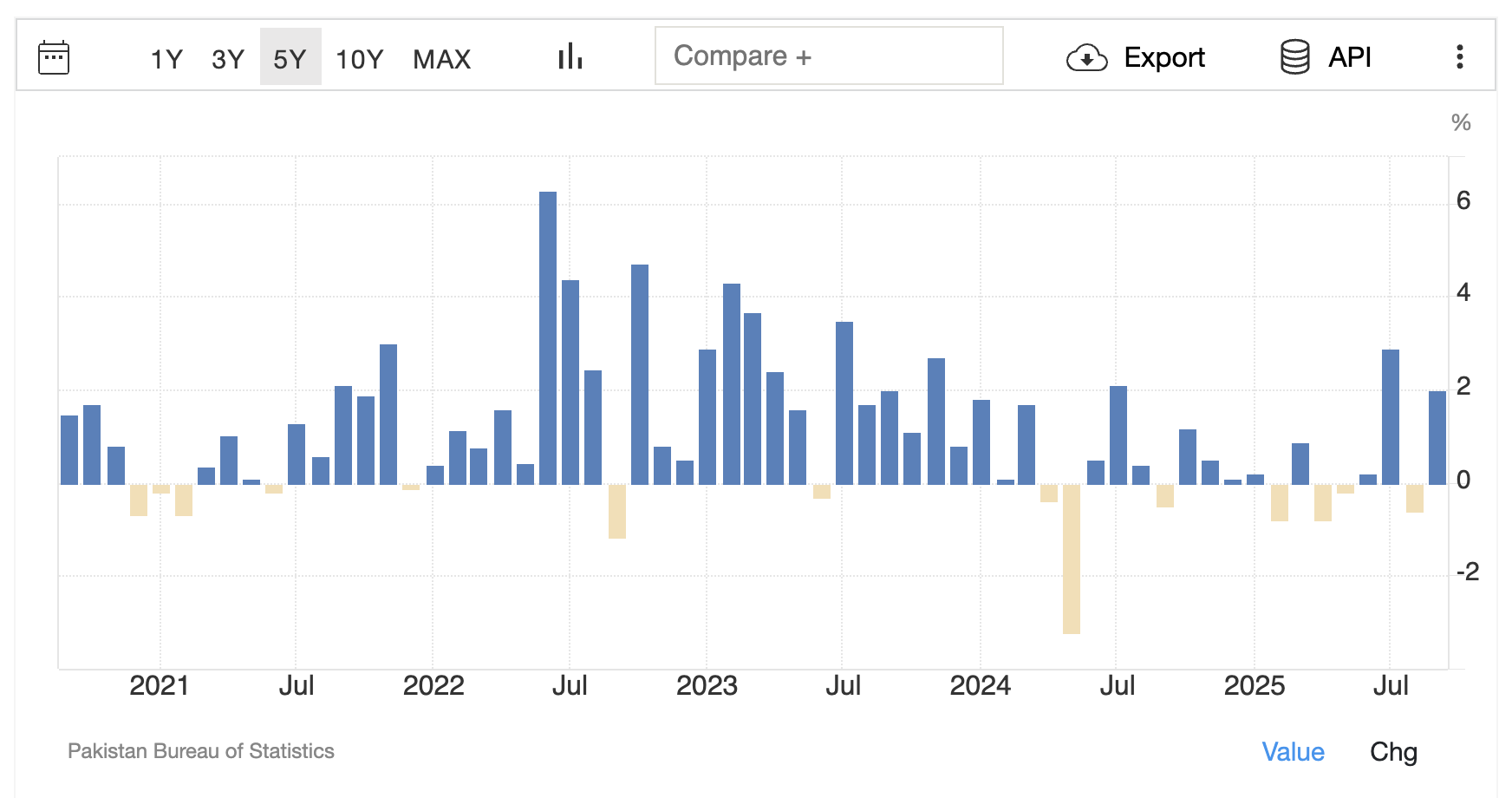

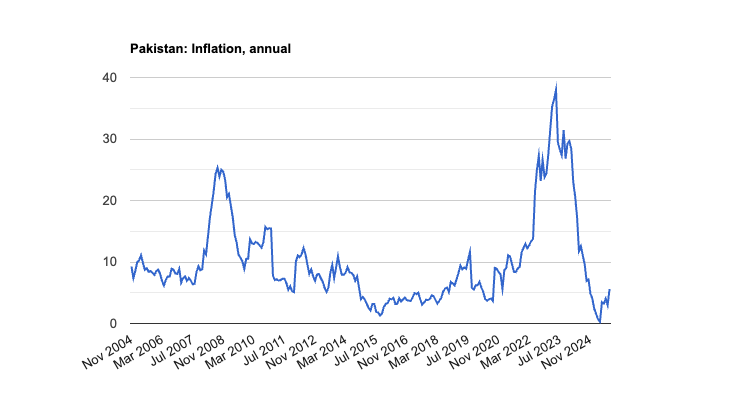

3. Inflation and Monetary Policy

Inflation pressures weaken the rupee because they erode purchasing power. At the same time, higher domestic interest rates can support the currency by attracting foreign inflows.

4. US Dollar Strength & Global Market Sentiment

Movements in the US dollar affect the rupee indirectly. A strong USD generally makes emerging-market currencies like the PKR more vulnerable because imports cost more and capital flows out.

5. Remittances, Trade Flows & External Demand

Remittances from overseas Pakistanis and improved export performance provide foreign currency inflows, supporting the rupee. When these inflows are strong, they reduce reliance on dollar borrowing and help ease depreciation

6. Political & Structural Risks

Fiscal policy shortfalls, external debt servicing pressures, and structural reforms (particularly in energy and state-owned enterprises) all matter. Delays or setbacks in policy implementation can prompt investor concern and currency weakness.

7. Impact on Inflation and Imports

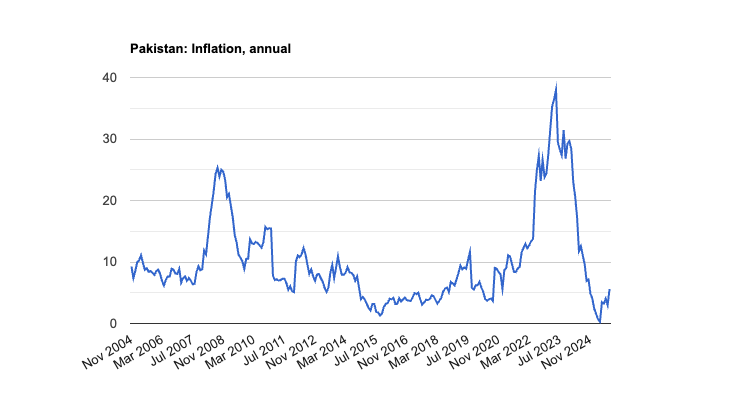

The USD to PKR exchange rate directly affects Pakistan’s cost of living and production. A stronger dollar makes imported goods such as oil, machinery, and raw materials more expensive, pushing up inflation.

As of late 2025, Pakistan’s inflation rate has averaged around 11.4%, with the State Bank of Pakistan (SBP) maintaining a tight monetary stance to contain price pressures.

Sectors most exposed to exchange rate movements include energy, automotive, and manufacturing, where dollar-denominated imports form a major cost component.

For households, currency weakness typically translates into higher prices for fuel and essential goods, which can influence public spending patterns and investor sentiment alike.

Historical Perspective: USD to PKR in Context

Over the past decade, the Pakistani rupee has steadily weakened against the U.S. dollar due to high inflation, persistent fiscal deficits, and periodic external shocks.

However, 2025 has shown signs of relative stability, with a slower pace of depreciation supported by improved policy coordination, IMF-backed reforms, and better current account management.

This moderation has given investors and households some short-term relief compared to previous years of rapid currency decline.

Practical Tips for Sending Money or Trading USD to PKR

Compare Providers: Review multiple transfer platforms to find the best conversion rates and lowest transaction costs.

Check for Fees: Avoid hidden charges or unfavorable rates from banks or money transfer companies.

Track Market Trends: Watch for inflation data, interest rate decisions, and global dollar movements before large transfers.

Set Rate Alerts: Use digital tools to get notified when the rupee reaches your preferred rate.

How to Hedge Against Currency Fluctuations

Both individuals and businesses can take steps to protect themselves from unpredictable exchange rate swings:

Forward Contracts: Lock in exchange rates for future transactions to avoid uncertainty.

Diversified Accounts: Maintain balances in multiple currencies if you frequently deal in foreign payments.

Smart Timing: Track seasonal remittance flows and macroeconomic announcements; transferring during stable periods often yields better value.

Use Regulated Platforms: Choosing licensed money transfer or trading providers ensures better rates and transparency.

For investors or SMEs, even simple hedging tools can stabilize returns when the PKR faces external pressure.

Frequently Asked Questions (FAQ)

1. Why is the rupee changing in 2025?

The rupee is changing in 2025 due to inflation, IMF reforms, and global dollar strength drive most movements.

2. What is the current USD to PKR rate?

As of 29 October 2025, the current USD to PKR rate is around ₨283.49 per US dollar.

3. Will the rupee weaken further?

Yes, analysts expect a mild drop toward ₨285–₨290 by year-end.

4. How can I get the best rate?

Compare providers, avoid hidden fees, and use rate alerts for better timing.

Final Thoughts

The USD to PKR exchange rate remains steady at around ₨283.49 as of late October 2025. While analysts expect a mild depreciation toward ₨285–₨290 by year-end, overall stability marks a positive shift compared to the sharp fluctuations seen in recent years.

For individuals and businesses, this steadiness offers a degree of predictability in remittances, trade, and investment planning.

Still, it’s important to stay alert to inflation trends, policy developments, and global dollar movements that could influence the rupee’s direction.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.