Wall Street's three main indexes scored record high closes on Tuesday as a

downward payrolls revision supported expectations the Fed will soon cut interest

rates to shore up economic growth.

Financial markets have priced in a 25-bp cut at the central bank's policy

meeting next week, and futures trading suggests a nearly 10% chance of a 50 bps,

according to CME's FedWatch tool.

US companies are planning to buy back shares at a historic pace, a sign of

Corporate America's confidence in the economy, with Nvidia being the latest to

add its name to the long list of repurchase plans.

Nvidia reported stronger-than-expected Q2 results, extending its run as the

world's dominant supplier of AI semiconductors. The company said that it

recorded no H20 sales to China during the quarter.

A measure of aggregate equity positioning by Deutsche Bank has slipped over

the last three weeks but remains modestly above neutral. The options market also

is signalling concerns about the rally, at least in the near term.

The so-called skew for ETFs tracking the S&P 500 and the Nasdaq 100 is

steep, while the same measure for ETFs trading the small-cap Russell 2000 is

flat, according to Cboe Global Markets data.

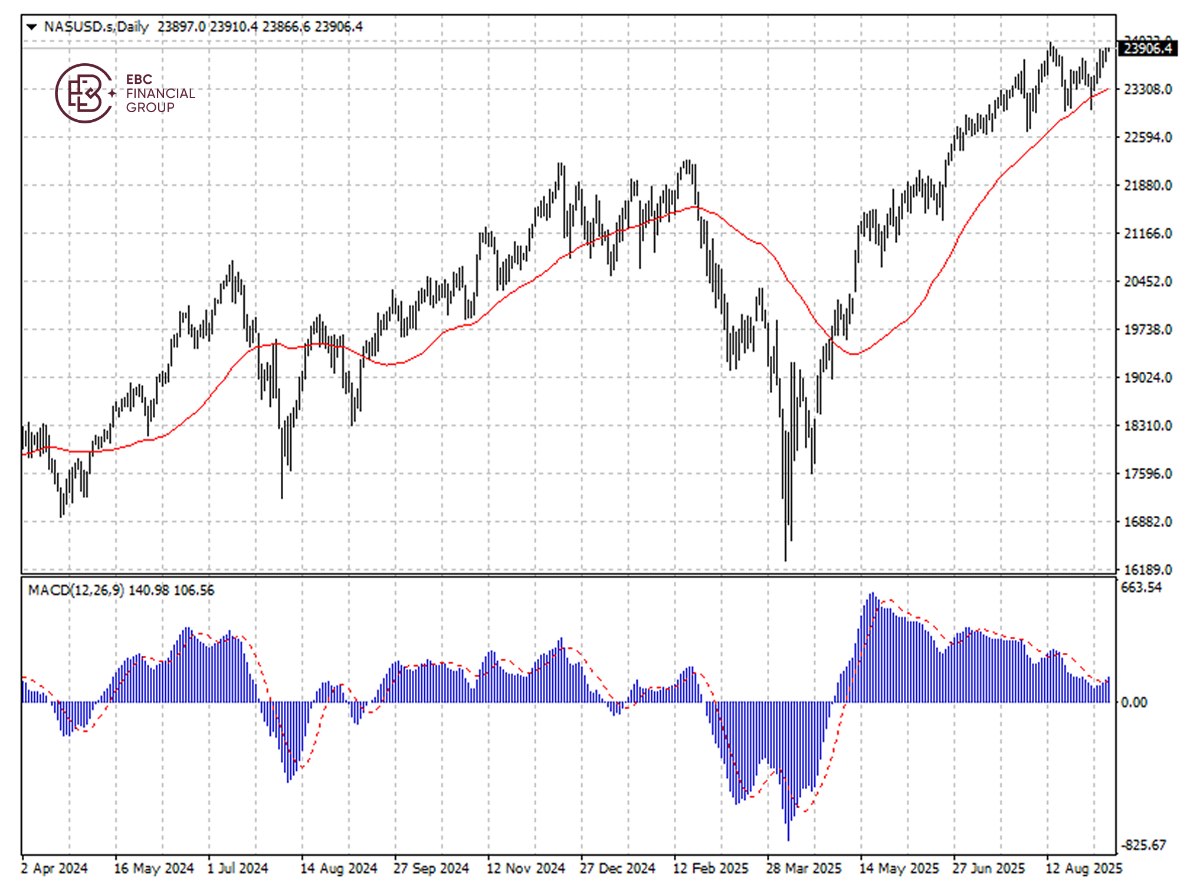

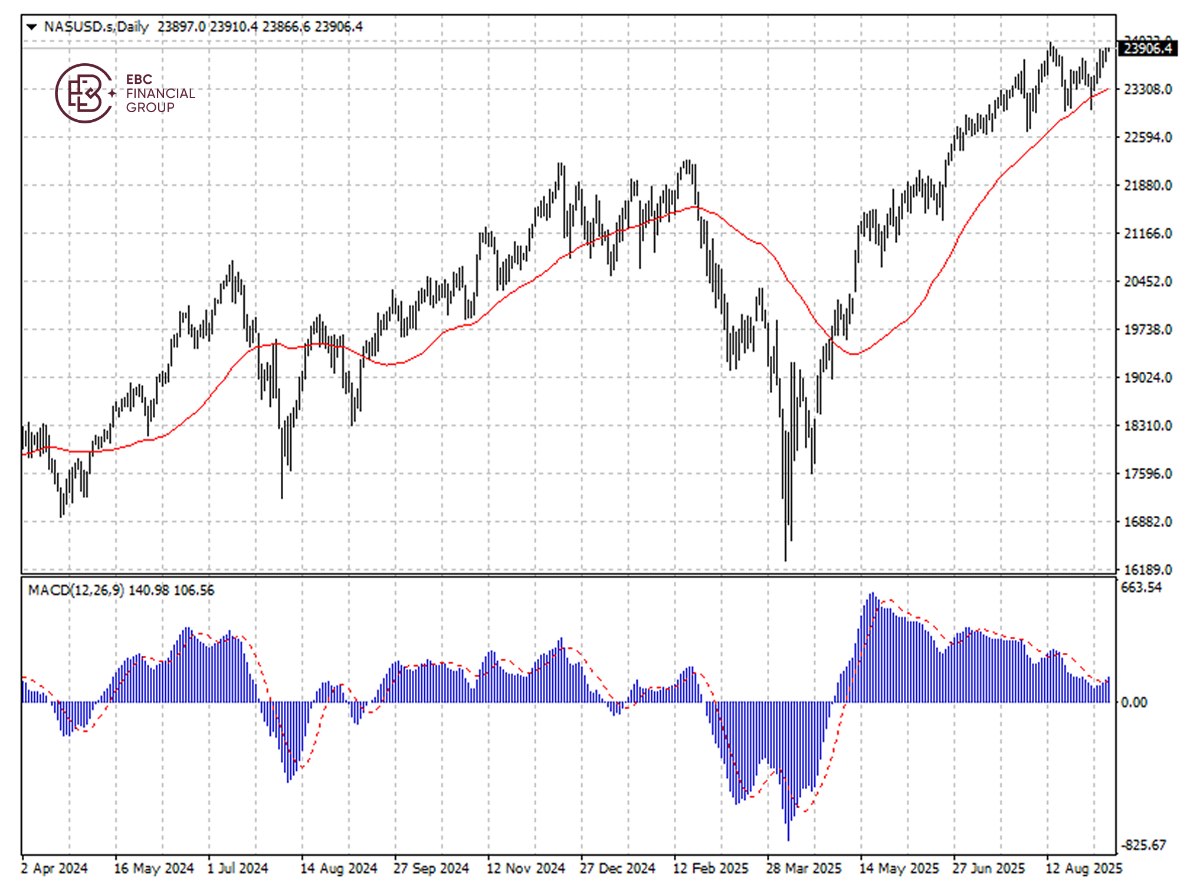

The Nasdaq 100 seems to be on shaky footing given MACD bearish divergence,

but 50 SMA could put a floor under the potential pullback.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.