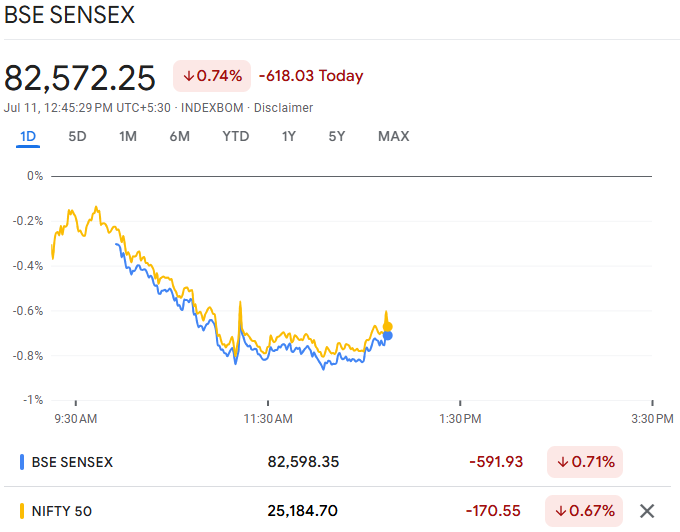

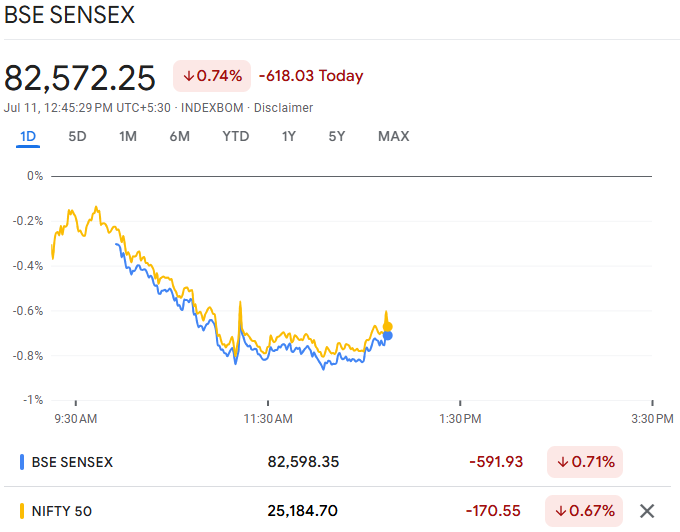

Indian financial markets faced significant pressure on 11 July 2025, with the rupee weakening to 85.86 per US dollar whilst equity indices posted sharp declines.

The Sensex tumbled 625.51 points and the Nifty fell 182 points, driven by disappointing earnings from Tata Consultancy Services and renewed global trade tensions.

The broad-based selloff reflected investor concerns over corporate performance and external headwinds affecting Asia's third-largest economy.

Indian Markets Today: Rupee and Equities Under Pressure

Rupee Weakens Amid Dollar Strength

The Indian rupee depreciated by 22 paise to close at 85.80 per US dollar on 11 July 2025, marking its weakest level in recent sessions. The currency faced headwinds from a stronger dollar index, which edged up 0.2% as President Trump hinted at raising blanket tariffs to 15-20% from the current 10% level.

The rupee's decline was exacerbated by foreign institutional investor (FII) outflows and concerns over India's current account deficit. Oil prices, whilst stabilising after recent volatility, remained elevated enough to pressure the import-dependent economy's currency.

Equity Markets Post Sharp Declines

Indian equity benchmarks suffered significant losses, with the Sensex dropping 625.51 points (0.75%) to close at 82,564.77 and the Nifty falling 182 points (0.72%) to 25,173.25. The decline marked the steepest single-day fall in over two weeks, reflecting broad-based selling pressure across sectors.

The selloff was led by information technology and automobile stocks, whilst fast-moving consumer goods (FMCG) and pharmaceutical sectors managed to outperform in an otherwise weak market environment.

TCS Earnings Disappoint, IT Sector Under Pressure

Tata Consultancy Services (TCS), India's largest IT services company, reported disappointing quarterly results that weighed heavily on market sentiment. The company's Q1 FY26 performance fell short of analyst expectations, raising concerns about the broader IT sector's growth prospects amid global economic uncertainties.

The Nifty IT index bore the brunt of the disappointment, declining more than 1.5% as investors reassessed valuations across the technology sector. Other major IT stocks, including Infosys and Wipro, also faced selling pressure as concerns mounted over demand from key markets, particularly the United States and Europe.

Sector Performance Breakdown

-

IT Services: Down 1.5%, led by TCS disappointment

-

Automobiles: Declined 1.2% on global trade concerns

-

Banking: Mixed performance with private banks underperforming

-

FMCG: Outperformed with gains of 0.3%

Pharmaceuticals: Rose 0.5% on defensive buying

Global Trade Worries Weigh on Sentiment

The market decline coincided with renewed global trade tensions as President Trump threatened to escalate tariffs further. The prospect of higher US tariffs on various countries, including potential impacts on India's export sectors, contributed to the risk-off sentiment in domestic markets.

India's export-oriented sectors, particularly textiles, pharmaceuticals, and IT services, face potential headwinds if trade tensions escalate. The country's merchandise exports, which have shown resilience in recent months, could face challenges if global trade conditions deteriorate further.

Currency Market Dynamics

The rupee's weakness against the dollar was influenced by several factors:

Domestic Factors:

-

FII outflows from equity markets

-

Concerns over corporate earnings growth

Rising import costs, particularly crude oil

Global Factors:

-

Strengthening US dollar index

-

Federal Reserve policy uncertainty

Geopolitical tensions affecting risk appetite

The Reserve Bank of India (RBI) has been monitoring currency movements closely, with intervention likely if volatility increases significantly. The central bank's foreign exchange reserves, whilst substantial, face pressure from defending the currency amid global uncertainties.

Economic Data and Policy Implications

Recent economic indicators have presented a mixed picture for India. Industrial production data showed modest growth, whilst inflation remains within the RBI's target range. However, concerns over global growth and trade disruptions have prompted caution among policymakers.

The RBI's monetary policy stance remains accommodative, with the central bank maintaining its focus on supporting growth whilst keeping inflation expectations anchored. Any significant escalation in global trade tensions could prompt policy adjustments to support the economy.

Market Outlook and Key Factors to Watch

Looking ahead, several factors will influence Indian market performance:

Domestic Catalysts:

-

Upcoming corporate earnings reports

-

Monsoon progress and agricultural outlook

-

Government policy announcements

RBI monetary policy decisions

Global Factors:

-

US trade policy developments

-

Federal Reserve policy signals

-

Global economic growth trends

Commodity price movements

The market's near-term direction will largely depend on how these factors evolve, with particular attention on corporate earnings quality and global trade developments.

Conclusion

The sharp decline in Indian markets on 11 July 2025, coupled with the rupee's weakness to 85.86 per USD, reflects a confluence of domestic and global challenges. TCS's disappointing earnings have raised questions about IT sector growth, whilst renewed trade tensions add to investor concerns. The market's ability to stabilise will depend on upcoming corporate results, policy responses, and the evolution of global trade dynamics.

Investors remain cautious as they navigate between domestic growth prospects and external headwinds, with currency stability and corporate earnings quality emerging as key themes for the remainder of the quarter.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.