In the world of technical analysis, few candlestick patterns are as visually striking and psychologically revealing as the Three Line Strike. This rare four-candle formation, though often overlooked, can serve as a compelling signal of trend strength—especially when markets appear to be stalling or reversing.

At first glance, the pattern seems to contradict itself: three strong candles in the direction of the trend are suddenly engulfed by a single, forceful candle moving the opposite way. Yet rather than marking a true reversal, this bold move often precedes a continuation of the prevailing trend.

Such deceptive simplicity is what makes the Three Line Strike so fascinating—and potentially valuable—for traders who understand how to read it in context.

What is the Three Line Strike?

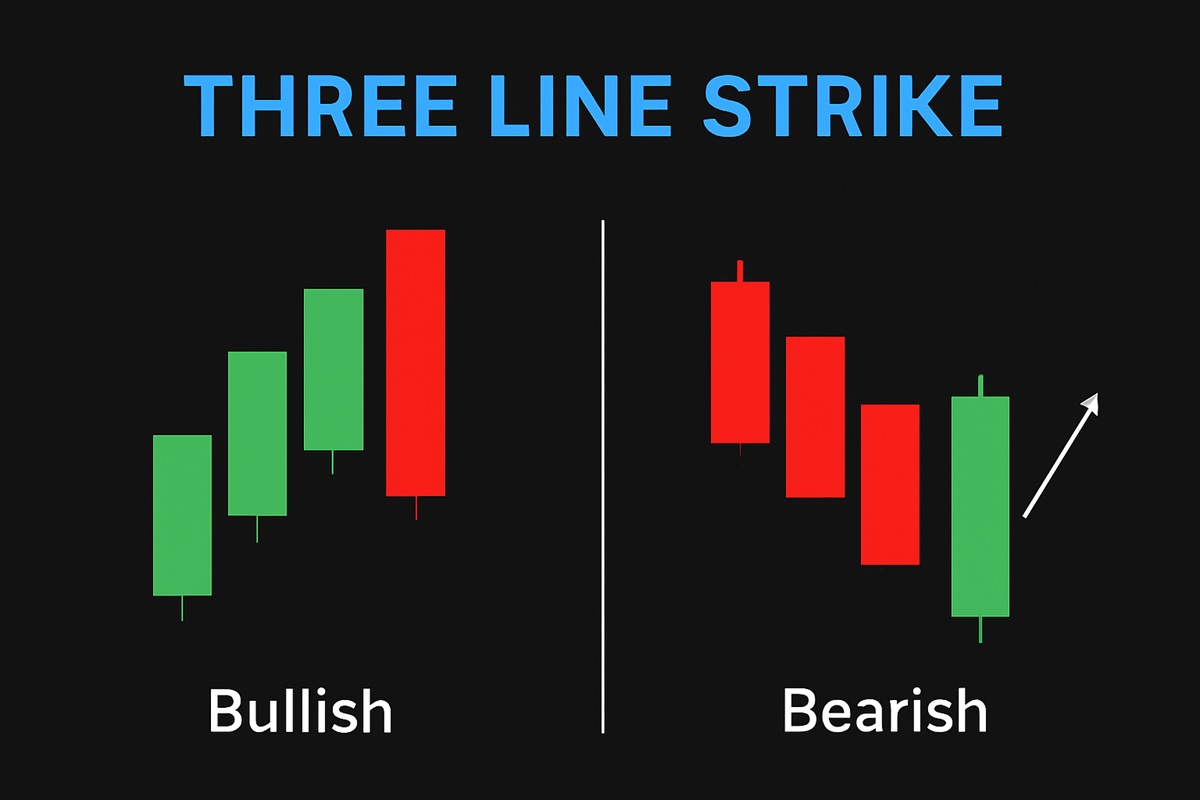

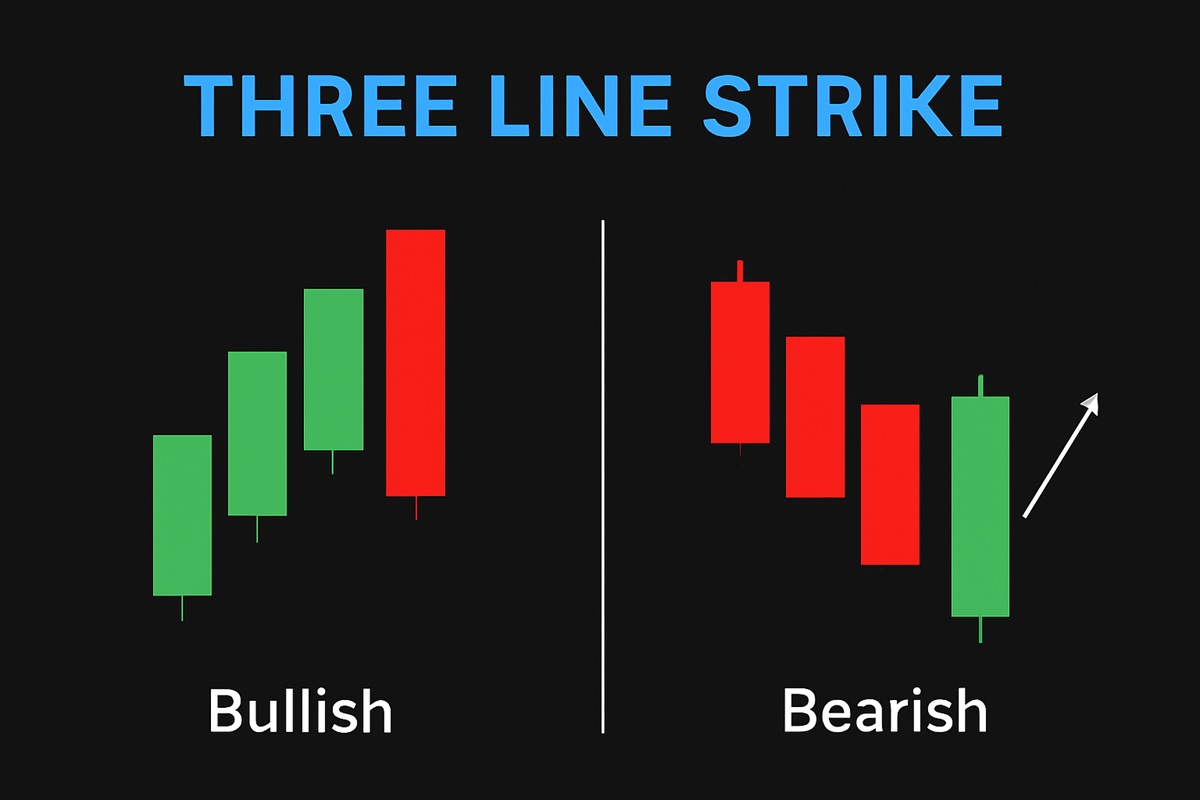

The Three Line Strike is a relatively rare but visually bold four-candle pattern that appears during established uptrends or downtrends. It consists of:

Candles 1 to 3: These show strong momentum in the direction of the prevailing trend. In a bullish setup, they are three rising candles, each closing higher than the last. In a bearish setup, they are three declining candles with consecutively lower closes.

Candle 4: The fourth candle is a dramatic move in the opposite direction. It opens above (or below) the third candle's close but closes beyond the first candle's open, engulfing all three previous candles.

At first, this final candle may appear to signal a reversal. But in many cases, it acts more like a springboard—pulling back sharply only to launch the trend further.

Decoding the Bullish and Bearish Faces of the Three Line Strike

Like many candlestick formations, the Three Line Strike appears in both bullish and bearish variations:

Bullish Three Line Strike

Appears in an uptrend.

The first three candles are bullish, each closing higher than the last.

The fourth candle is a large bearish candle that opens above the previous close but closes below the first candle's open.

Despite the engulfing nature of the candle, the trend often continues upward after this formation.

Bearish Three Line Strike

Appears in a downtrend.

The first three candles are bearish, with lower closes.

The fourth candle is a strong bullish candle that opens below the third candle but closes above the first candle's open.

Again, rather than reversing, the trend often continues downward.

This contradictory structure is what makes the Three Line Strike fascinating—it appears to break the trend, only to reinforce it.

Inside the Trader's Mind: Psychology Behind the Three Line Strike

Understanding the psychology behind the pattern is key to unlocking its meaning:

The first three candles reflect growing confidence among trend-followers—bulls in an uptrend, bears in a downtrend.

The fourth candle appears as a bold counter-move. It suggests that the opposing side is making a comeback—buyers taking profits in a bearish trend or sellers fading the bullish move.

But this is often short-lived. The pattern frequently fails to attract sustained participation from the opposing side, and the original trend resumes, catching emotional traders off guard.

This brief tug-of-war gives the Three Line Strike its unique quality—momentary panic followed by reaffirmed conviction.

Is the Three Line Strike a Reversal or a Continuation Signal?

While the fourth candle appears to signal a change in direction, backtests and price action analysis often suggest the opposite. The Three Line Strike pattern tends to act as a continuation rather than a reversal in most cases.

However, this depends on context:

In strong trends, especially those supported by volume and broader market alignment, the pattern confirms trend strength.

In weak or sideways markets, the same pattern may fail to deliver and instead behave as a true reversal.

The key is not just the pattern itself, but where it occurs and how the next candle behaves. A confirmation candle moving in the direction of the original trend provides strong validation.

How to Trade the Three Line Strike: Entry, Exit, and Risk Tactics

Trading the Three Line Strike requires more than just recognition—it demands precision and context awareness.

Entry Strategy

Wait for the next candle after the fourth one.

If the price resumes in the direction of the original trend (up after bullish, down after bearish), consider entering at the close of that confirmation candle or on a slight pullback.

Stop-Loss Placement

Take-Profit Targets

Use a 2:1 or 3:1 risk-reward ratio.

Identify previous support/resistance zones, moving averages, or Fibonacci levels to define logical take-profit areas.

Trailing stops can also help you stay in strong trends for longer gains.

Proper execution turns the Three Line Strike from a visual cue into a strategic trading opportunity.

When the Three Line Strike Fails: Limitations and Smart Confirmations

Despite its reliability, the Three Line Strike is not infallible. Like all patterns, it needs context, discipline, and smart confirmation to be truly effective.

Common Pitfalls

Confirmation Tools

RSI: Helps identify whether the market is overbought or oversold.

MACD: Confirms momentum and can support the trend continuation idea.

Moving Averages (20 or 50 EMA): Help define the overall trend and reduce noise.

Volume analysis: Strong moves backed by volume are more trustworthy.

Multi-timeframe analysis: A Three Line Strike pattern on multiple timeframes strengthens the signal's reliability.

Using these tools not only validates the pattern—it helps you build confidence and discipline in real-time trading.

Final Thoughts: Reading Between the Candles

The Three Line Strike may not be the most common pattern, but its impact can be significant when used in the right conditions. Its deceptive structure—three strong candles followed by an engulfing opposite move—offers a unique insight into trader psychology and momentum.

For those who understand its context, the Three Line Strike can offer well-timed opportunities in trending markets. But as with any technical pattern, it performs best when combined with thoughtful risk management and supporting analysis.

In trading, it's not just about spotting a pattern—it's about reading the market's intentions behind it. The Three Line Strike tells a story of temporary doubt followed by reaffirmed strength. The question is: are you listening closely enough?

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.