In stock market trading, support and resistance lines are important technical

analysis tools that can help traders formulate entry and exit strategies. This

article will introduce what support and resistance lines are, how to use them,

and how to draw effective support and resistance lines.

What are resistance lines and support lines?

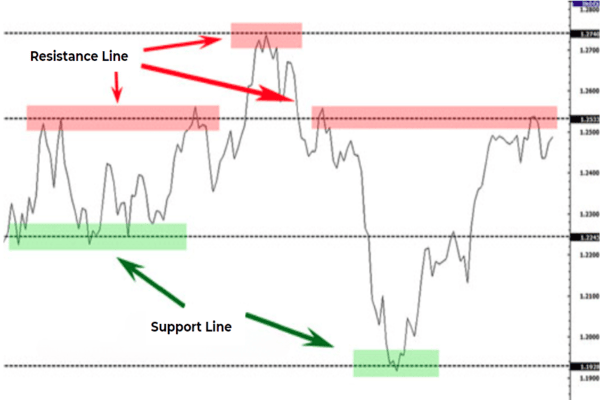

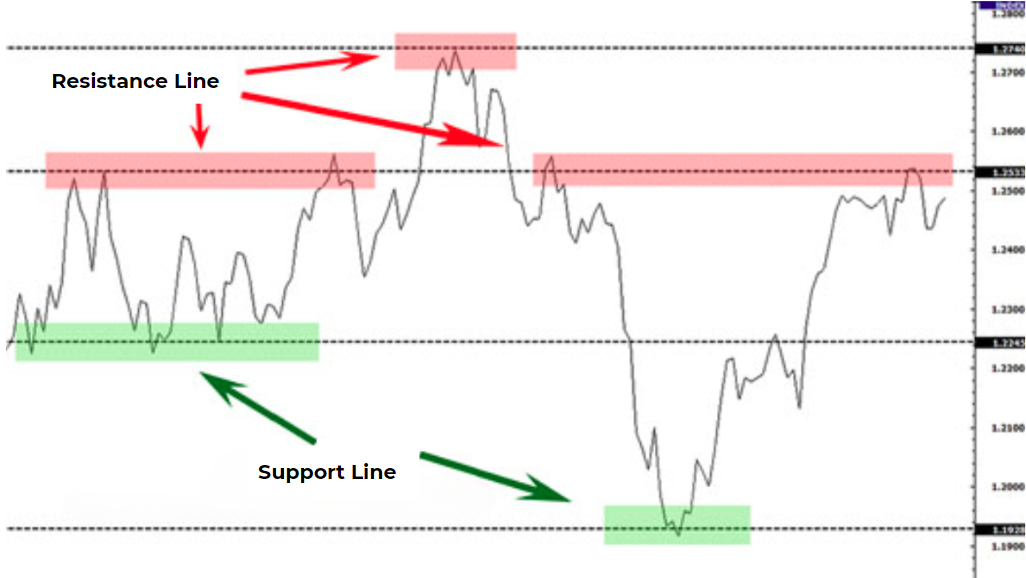

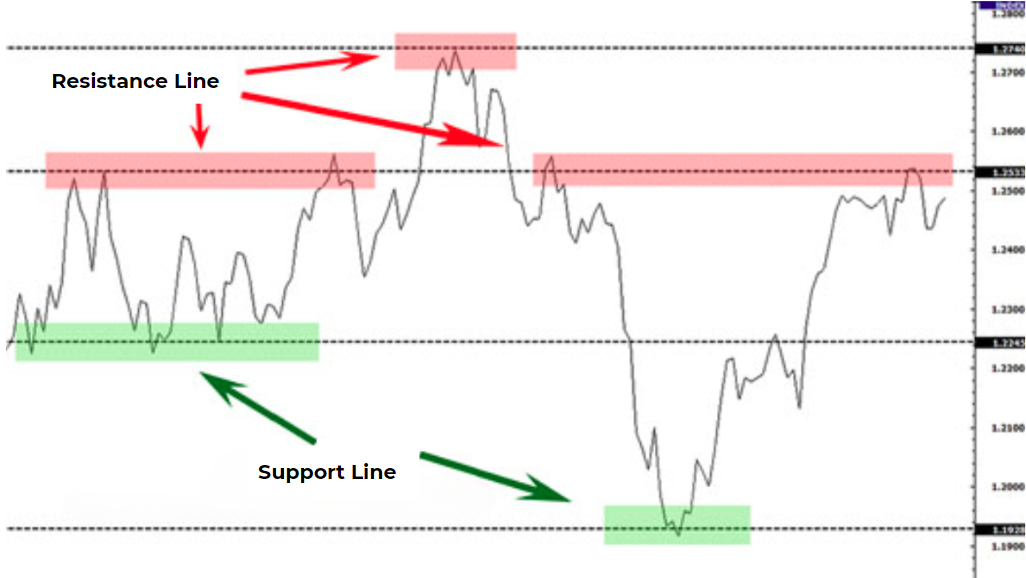

The resistance line refers to the price level that the stock price has

repeatedly attempted to break through but failed to exceed, and this position

becomes the resistance point of the stock price. To effectively draw resistance

lines, it is necessary to connect at least two or more price points.

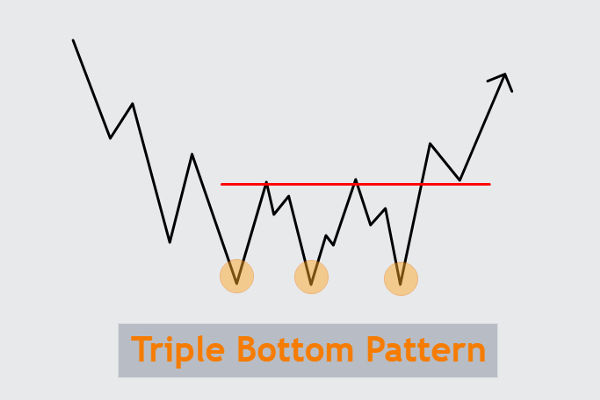

The support line refers to the price position where the stock price has

repeatedly attempted to fall below but failed to break through, which becomes

the support point. Like the resistance line, to form an effective support line,

it is also necessary to connect at least two or more price points.

Application of support and resistance line transformations

There is an important relationship between support and resistance lines. When

the stock price breaks through the resistance line, this resistance line will

become a support line. When the stock price returns to that position again, this

support line will serve to support the stock price. On the contrary, when the

stock price falls below the support line, the support line will become a

resistance line, affecting the rise of the stock price. Therefore, understanding

this transformation is crucial for effective trading.

Strength and effectiveness of support and resistance

The strength and effectiveness of support and resistance lines are related to

the number of price points connected. The support and resistance lines that

connect more price points are usually stronger and more effective. This means

that a resistance line connecting four price points is more effective than a

resistance line connecting two price points, so support and resistance lines

should be considered as regions rather than a single line. When the stock price

approaches the support or resistance zone, there is usually a rebound in the

price.

Support and resistance at different time levels

Drawing support and resistance lines at different time levels has different

effects. Drawing support and resistance lines at large time scales is usually

clearer, simpler, and more effective. Drawing support and resistance lines using

large-scale charts, such as weekly and monthly charts, can help traders better

identify important levels of support and resistance. In this way, traders do not

need to draw a large number of support and resistance lines, as long-term level

lines have more reference value.

Trading strategies using support and resistance lines

Next, two entry strategies using support and resistance lines and one exit

strategy will be introduced.

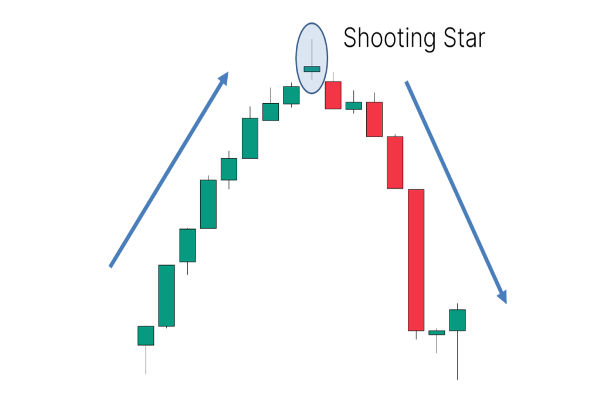

Breakthrough buying method: When the stock price breaks through the

resistance line, it indicates that the stock price has overcome an important

obstacle. At this point, you can consider buying, as it usually comes with more

gains. The advantage is that it can timely capture the upward trend, but the

disadvantage is that if a false breakthrough occurs, it may buy at a high

level.

Callback buying method: When the stock price breaks through the resistance

line, wait for the stock price to fall back to a supportive position before

making a purchase. This strategy is relatively stable and safe, but sometimes

Stock Prices may rise directly and miss opportunities.

Exit Strategy: You can use the support line to set the stop loss point, and

set the stop loss point below the support line. In this way, the stock price

must challenge the support line in order to reach the stop-loss point.

Techniques and insights for drawing support and resistance lines

When drawing support and resistance lines, the following points should be

noted:

The support and resistance lines can be drawn on physical prices or dashed

lines, mainly depending on the number of price points touched.

Large-time-level charts are usually more suitable for drawing support and

resistance lines.

Different colors, such as cyan, can be used to distinguish between support

and resistance lines at large and small time levels.

In practical operation, it is important to avoid drawing too many support and

resistance lines to avoid confusion.

Comparison between support line and resistance line

|

Support Line |

Resistance Line |

| Definition |

Price level where attempts to break lower have failed multiple times |

Price level where attempts to break higher have failed multiple times |

| Formation Method |

Connects two or more price points |

Connects two or more price points |

| Transformation Usage |

A breakout above resistance becomes support, and vice versa |

A breakout above support becomes resistance, and vice versa |

| Strength and Effectiveness |

Correlates with the number of connected price points, more points usually make it stronger |

Correlates with the number of connected price points, more points usually make it stronger |

| Impact on Different Timeframes |

Clearer, simpler, and more effective on higher timeframes |

Clearer, simpler, and more effective on higher timeframes |

| Trading Strategies |

Breakout Buying, Pullback Buying, Exit Strategies |

Breakout Buying, Pullback Buying, Exit Strategies |

| Drawing Techniques and Insights |

Choose between solid or dashed lines, use different colors to differentiate timeframes, avoid cluttering with too many lines |

Choose between solid or dashed lines, use different colors to differentiate timeframes, avoid cluttering with too many lines |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.