In the financial market, too much or too little money may cause a series of problems, just as in nature, too much rain will cause floods and too little rain will cause droughts. Therefore, in order to avoid these problems, it is necessary to build a tool like a reservoir to regulate the flow of funds to ensure the stability of the financial market and the healthy development of the economy. And this is open market operations, just like a reservoir that stores water in the rainy season and releases it in the dry season, to ensure that the financial market does not flood or dry up. Let us now recognize the role of open market operations and their characteristics.

What does Open Market Operation mean?

What does Open Market Operation mean?

It is also called Open Market Operations (OMO for short). It refers to the operation of central banks (e.g., the Federal Reserve, the People's Bank of China, etc.) to regulate the money supply and market interest rates by buying or selling financial instruments such as government bonds.

This system originated in the 1950s, with the United States as the representative of the developed countries in Europe, and the United States began to use open market operations for macroeconomic regulation and control. In the United States, open market operations are used to regulate the level of money supply and interest rates to achieve the purpose of stabilizing economic growth and controlling inflation.

In China, the history of open market operations is relatively short. Since April 1996. when China reopened the trading of government bonds, open market operations have been gradually introduced to implement monetary policy. By buying and selling government bonds and other securities, China's central bank regulates market liquidity and money supply in order to influence money market interest rates and the overall economic environment.

The open market is an open and transparent financial market where marketable securities such as government bonds can be traded freely and where transaction information is displayed publicly, ensuring fairness and transparency in the market. Through open market operations, the central bank can flexibly regulate liquidity and money supply in the market, thereby affecting money market interest rates and the overall economic environment. It also helps the central bank respond more effectively to fluctuations in the economic cycle and maintain financial stability and economic growth.

For example, when the central bank wishes to tighten the money supply, raise market interest rates, or curb inflation, it will reduce liquidity in the market by selling financial instruments such as government bonds, thus driving up market interest rates and lowering the supply of funds. On the contrary, when the central bank tries to stimulate economic growth, promote employment, or cope with recession, it will increase liquidity in the market by purchasing financial instruments such as government bonds, thus lowering the market interest rate and increasing the supply of funds.

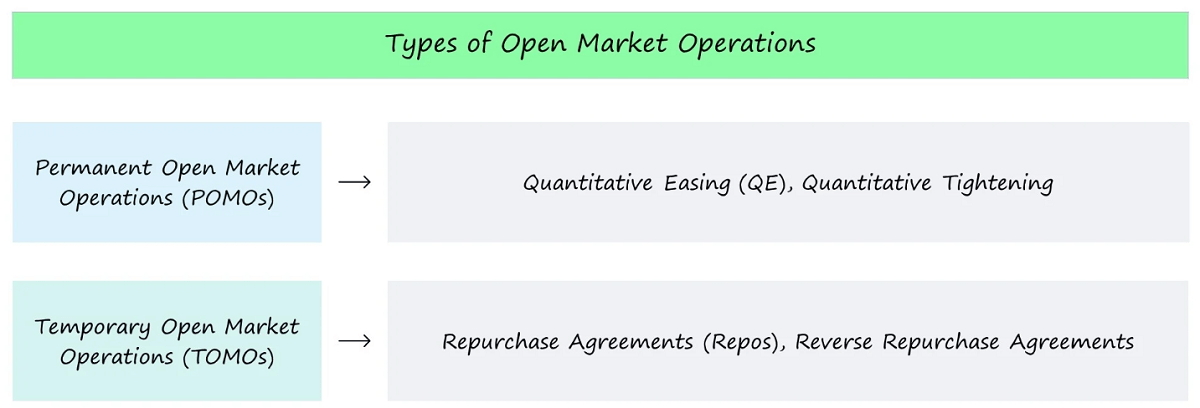

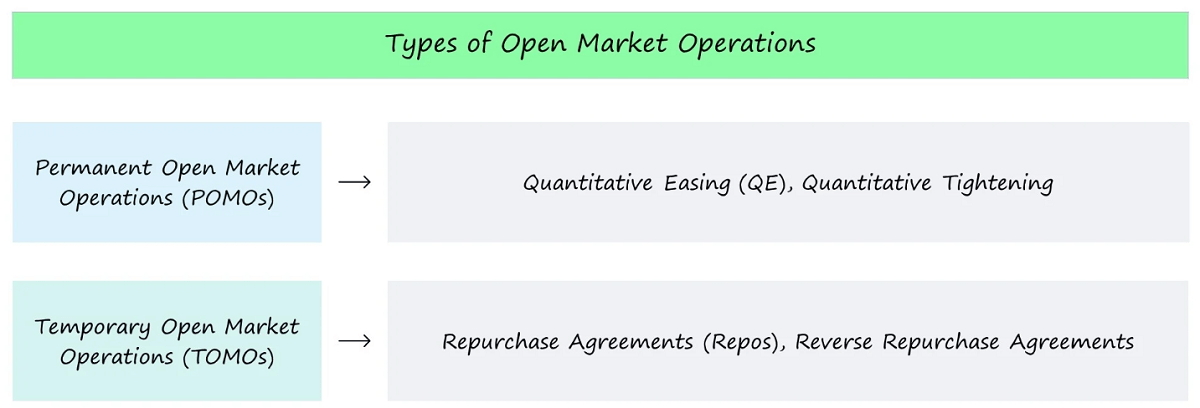

Open market operations are monetary policy instruments in which the central bank buys or sells marketable securities on the open market to regulate the money supply and market liquidity. This tool includes positive repo, reverse repo, central bank bills (central bank notes), short-term liquidity adjustment tools (SLOs), and central bank bill swaps (CBS).

A positive repo is the sale of marketable securities by the central bank to a primary dealer, which it repurchases at a specific future date, usually with maturities of 7. 14. 28. and 91 days. Such transactions allow the central bank to temporarily repatriate liquidity, regulate the supply of money in the market, and influence the level of liquidity and interest rates in the money market. Its flexible maturity options allow the central bank to adjust the repo transaction according to its policy needs to achieve its monetary policy objectives.

A reverse repo is a transaction in which the central bank purchases marketable securities from primary dealers and sells them back to primary dealers at a specific date in the future, usually with a maturity of 7 days, 14 days, 28 days, and 91 days. This operation allows the central bank to inject liquidity into the market, regulate the money supply, and influence the level of liquidity and interest rates in the money market in order to achieve its monetary policy objectives. The flexibility of its maturity allows the central bank to adjust the reverse repo transactions to market changes as needed.

Central bank bills are debt instruments issued to commercial banks to regulate their excess reserves, usually with maturities ranging from three months to three years. These notes are issued to influence the level of commercial banks' reserves, thereby regulating the money supply and liquidity, and to have an impact on money market interest rates in order to achieve the monetary policy objectives set by the central bank.

Short-term liquidity adjustment tools (SLOs) are tools used in the event of temporary liquidity fluctuations in the banking system, with shorter maturities than repo transactions, usually ranging from two to six days. Through the use of SLOs, the central bank can flexibly regulate the short-term liquidity of the banking system to respond to temporary funding needs or fluctuations and maintain the stability of the financial market.

The Central Bank Bill Swap (CBS) instrument allows open market primary business dealers to use their holdings of eligible bank-issued perpetual bonds to exchange for central bank bills from the central bank to ease the capital constraints of commercial banks. In this way, commercial banks can obtain central bank bills by exchanging perpetual bonds with the central bank, thus increasing their liquidity in the central bank's assets, helping them to better cope with capital requirements, and maintaining the stable operation of the financial system.

Overall, open market operations play an important role in modern monetary policy. Relying on an open and transparent market environment, they provide central banks with powerful tools to manage the money supply and the level of interest rates in order to promote sound economic growth.

Purpose of Open Market Operations

Purpose of Open Market Operations

By buying and selling government bonds or other marketable securities, the central bank can regulate the money supply and liquidity in the market, thereby influencing market interest rates and economic activity to achieve the objectives of monetary policy. These objectives may include regulating the money supply, smoothing the level of interest rates, maintaining financial stability, improving asset prices, etc., with the ultimate goal of maintaining a stable and healthy economy.

It is important to realize that open market operations will have a direct impact on the monetary base. This is because the central bank will conduct open market operations through the purchase or sale of government bonds and other financial assets, which will affect the deposit and loan behavior of banks and thus affect the flow of funds and economic activities of the entire economic system.

For example, the purchase of bonds injects money into the market, increasing the monetary base, while the sale of bonds recovers money from the market, reducing the monetary base. This process helps the central bank achieve its monetary policy objectives, such as controlling inflation or stimulating economic growth.

Also, open market operations can affect the level of interest rates in the market by changing the price of bonds in the market and, hence, the level of interest rates in the market. This is because the purchase of bonds increases the price of bonds, which reduces their yield (interest rate). This effect may spread to other interest rates because bond rates usually have an effect on other market rates.

When liquidity in the market is skewed toward excess or insufficiency, the central bank can adjust it through open market operations. This is because by purchasing or selling financial assets such as government bonds, the central bank can inject or absorb liquidity into the market to meet the demand for funds in the market or to adjust the supply of funds in order to maintain the stable operation of the money market.

The central bank can utilize open-market business operations to respond to changes in the economic cycle and fluctuations in the financial market. For example, in times of recession, the central bank can increase liquidity to stimulate economic activity and promote credit and investment. And in times of rising inflationary risks, the central bank can curb inflationary pressures by tightening monetary policy and reducing liquidity in the market. In this way, the central bank can adjust liquidity in the market to prevent excessive volatility in the financial market and maintain financial stability and economic growth.

By purchasing or selling financial assets, the central bank can influence asset prices and thus promote the healthy development of the market while preventing the emergence of a bubble in the prices of non-performing assets. By purchasing financial assets, central banks can provide additional liquidity support, promote healthy market functioning, and provide stability in the event of market stress.

Conversely, by selling financial assets, central banks can reduce excessive liquidity in the market, prevent unreasonable asset price bubbles, and help return the market to a reasonable level. Such operations help maintain financial market stability and avoid excessive risk exposure to support sustainable economic growth.

Understanding the purpose of a central bank's adoption of a particular open market operation can help us more accurately predict the future direction of monetary policy and thus better plan investment strategies for individuals and institutions. At the same time, for central banks, understanding the purpose of open market operations can also help them achieve their monetary policy objectives more effectively and maintain the stability of the financial market and the healthy development of the economy.

Advantages and Disadvantages of Open-Market Operations

By regulating the money supply and liquidity in the market and influencing market interest rates and economic activities, open market operations can realize the objectives of monetary policy. However, as a central tool of the central bank's monetary policy, it has certain advantages but also has its disadvantages.

Its advantage is its high operational flexibility, which allows the central bank to quickly adjust the quantity and frequency of buying and selling government bonds according to economic conditions and policy objectives. This flexibility enables the central bank to respond to changes in the economy and market fluctuations in a timely manner and take the necessary monetary policy measures. By flexibly adjusting the quantity and frequency of buying and selling government bonds, the central bank can effectively manage the money supply, stabilize the financial market, and achieve the objectives of monetary policy, such as controlling inflation or promoting economic growth.

Compared with other monetary policy tools, open market operations are relatively easy to operate, have lower execution costs, and can respond quickly to market changes and shocks. The high degree of liquidity and transparency of its transactions in the financial market enables the central bank to adjust the level of liquidity and interest rates in the market more flexibly in order to achieve its monetary policy objectives. In contrast, other monetary policy tools may be more complicated to implement, and their effects may lag behind. Thus, open market operations have unique advantages among the central bank's monetary policy tools.

Moreover, it is conducted in the open market, where transaction information is open and transparent and market participants can understand the central bank's operations in real time, increasing market transparency and predictability. This transparency can help market participants better understand the central bank's monetary policy intentions and expected actions so that they can more effectively formulate investment and trading strategies, which promotes the stability and healthy development of the market.

At the same time, the scope of influence of open market business operations is indeed very wide. By influencing the interbank market interest rate, the central bank can indirectly affect the lending rate and investment behavior of the whole economy. When the central bank increases liquidity by purchasing bonds, the interbank market interest rate may fall, thus lowering banks' borrowing costs and boosting lending activity and investment demand.

Conversely, when the central bank tightens monetary policy by selling bonds, interbank market interest rates may rise, leading to an increase in banks' borrowing costs and dampening lending and investment activity. Thus, by affecting market interest rates, open market operations can have a direct impact on the credit and investment environment of the economy as a whole, thus having a profound effect on economic activity and growth.

However, it is not without its drawbacks. First of all, its effects are usually not immediately apparent but take some time to be transmitted to the real economy, a lag known as the transmission lag. This is because open market operations operate first through the impact of market interest rates to affect the bank's lending and investment activities, and then only through the bank's lending and investment activities to affect the real economy's consumption, investment, and production behavior.

This transmission process can take several months or even longer, as it takes time for various sectors of the economy to adapt and react to changes in the central bank's monetary policy. As a result, central banks usually need to closely monitor economic data and market changes and adjust monetary policy in a timely manner to ensure that it has the desired impact.

At the same time, open market operations may give rise to some criticisms that excessive intervention in the market by such operations may undermine free competition in the market and lead to distortion of market prices, thereby distorting the allocation of resources. Some critics are concerned that the central bank's influence on market interest rates and money supply through the purchase or sale of financial assets may interfere with the market's self-regulatory mechanism, resulting in the market failing to effectively reflect supply and demand.

In addition, excessively frequent or erratic open market operations may also trigger market volatility and increase investor uncertainty, thereby affecting the stability and healthy development of the market. Therefore, central banks need to carefully weigh the pros and cons when conducting open market operations and take appropriate measures to minimize the adverse impact on the market.

Therefore, accurate market analysis and judgment are crucial to the central bank's open-market business operations. If the central bank's information is inaccurate or its judgment is wrong, it may lead to an unstable or even out-of-control situation in the market. This may trigger market panic, leading to a decline in investor confidence, sharp asset price fluctuations, and even a financial crisis.

Finally, operational errors, market reactions beyond expectations, or inappropriate frequency of operations may lead to financial market volatility and undesirable consequences. For example, if the central bank's operations are not in line with market expectations, this may lead to increased uncertainty among investors about the market, which in turn may lead to market volatility. In addition, if the central bank carries out operations frequently or if the scale of operations is too large, it may interfere with the normal operation of the market or even trigger market failure.

To summarize, open market business operation as a monetary policy tool has the advantages of flexible operation and market transparency, but it also has the disadvantages of conduction lag, market intervention, information asymmetry, and potential risks. Therefore, the central bank needs to carefully consider the market reaction when conducting open market operations and take appropriate measures to reduce potential risks.

The role of open market operations and their characteristics

| Role |

Features |

| Regulating the money supply |

Operational flexibility |

| Influence market interest rates |

Transparent market information |

| Maintaining financial stability |

High market liquidity |

| Stimulate economic growth. |

Low execution costs |

| Control inflation |

Quick response to market changes |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What does Open Market Operation mean?

What does Open Market Operation mean?

Purpose of Open Market Operations

Purpose of Open Market Operations