For investors, the financial statement issued by a company every year is a crucial source of information. This is because it not only forms the basis of the company's sound development but also provides investors with important clues to gain insight into the company's soundness. And among them, there are a few more important ratios that are indicators that require special attention because they can help investors understand the meaning behind the financial data. The accounts receivable turnover ratio, for example, reveals a company's operational flexibility and robustness. Now, let's take a good look at the fluctuation and application of the accounts receivable turnover ratio to analyze it.

What is the Accounts Receivable Turnover Ratio?

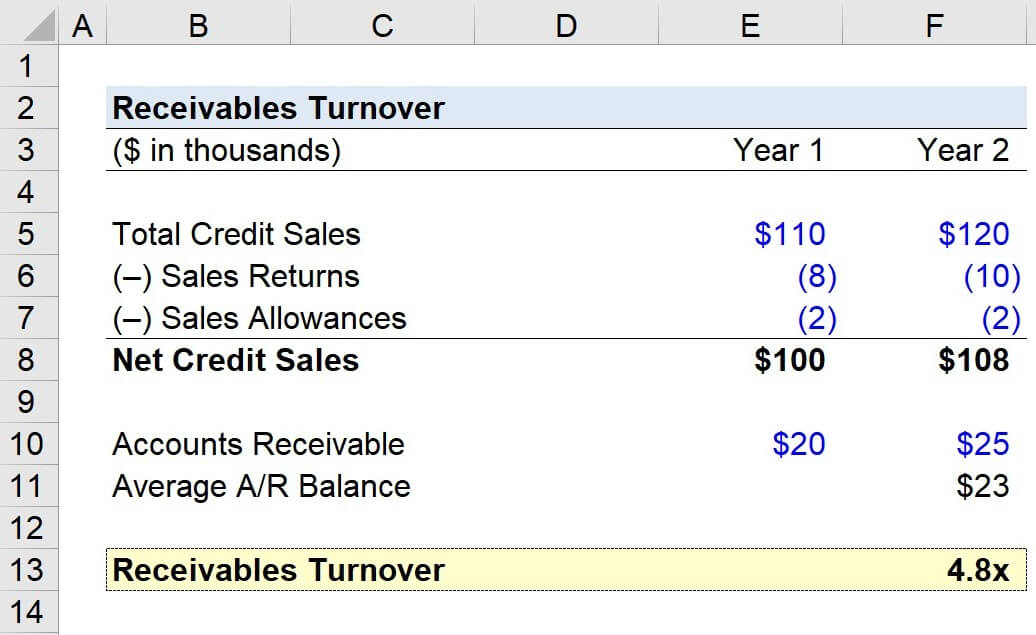

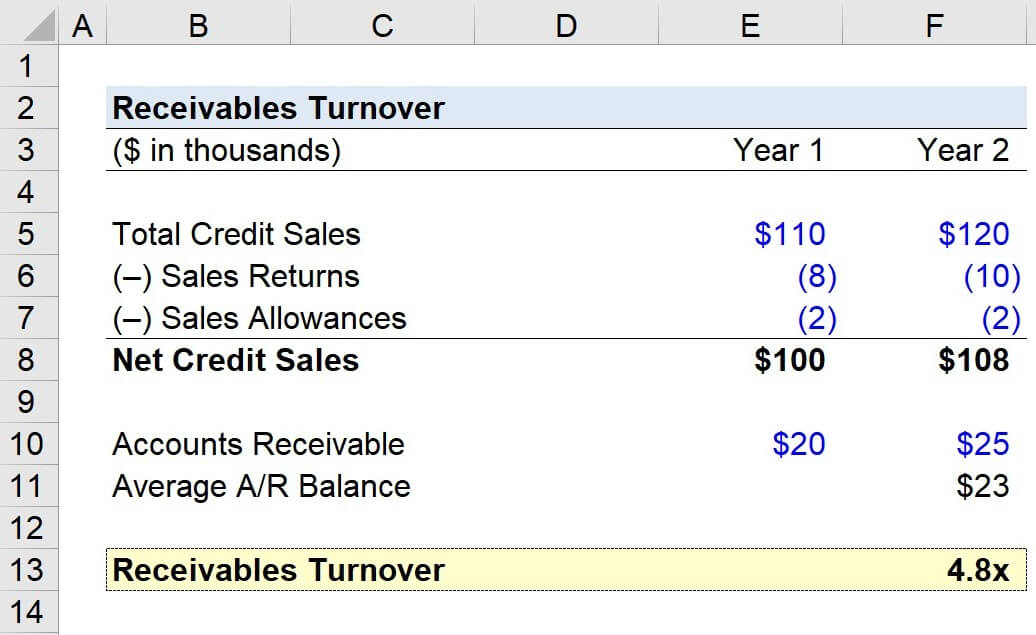

It indicates the number of times accounts receivable are collected during an accounting period. It is used to measure the rate of turnover of accounts receivable in a business, i.e., the rate of collection of accounts receivable. It is the ratio of a business's net credit sales revenue to its average accounts receivable balance over a given period of time and can be used to assess a business's efficiency in collecting money owed to it as well as its ability to manage its cash flow.

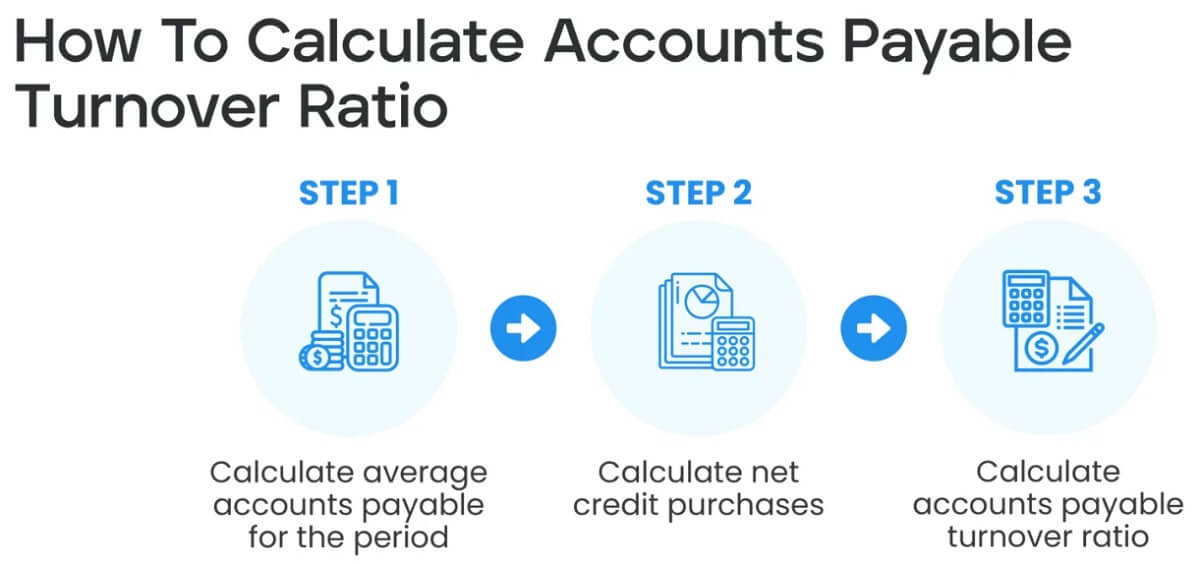

It is calculated by dividing the average accounts receivable by the credit sales and multiplying by 365 days. Net sales revenue is the net amount of revenue generated by a company from the sale of goods or the provision of services during a specific period of time, after deducting sales discounts, sales returns, and sales concessions. The average accounts receivable balance, on the other hand, is the value obtained by adding accounts receivable at the beginning of the period to accounts receivable at the end of the period and dividing by two.

For example, if a company's total credit sales in a year are $1 million and its accounts receivable at the beginning and end of the year are $300.000 and $100.000. respectively, the company's average accounts receivable is ($300.000 + $100.000)/2 = $200.000. The accounts receivable turnover ratio is 200.000 divided by 1.000.000 and multiplied by 365 days, resulting in 73 days.

A high turnover rate reflects the good collection efficiency and liquidity of the business, which contribute to cash flow flexibility and efficiency. On the contrary, a low turnover ratio may imply that a business is facing liquidity difficulties and needs more time to collect its receivables, which may lead to capital constraints and disrupt day-to-day business activities.

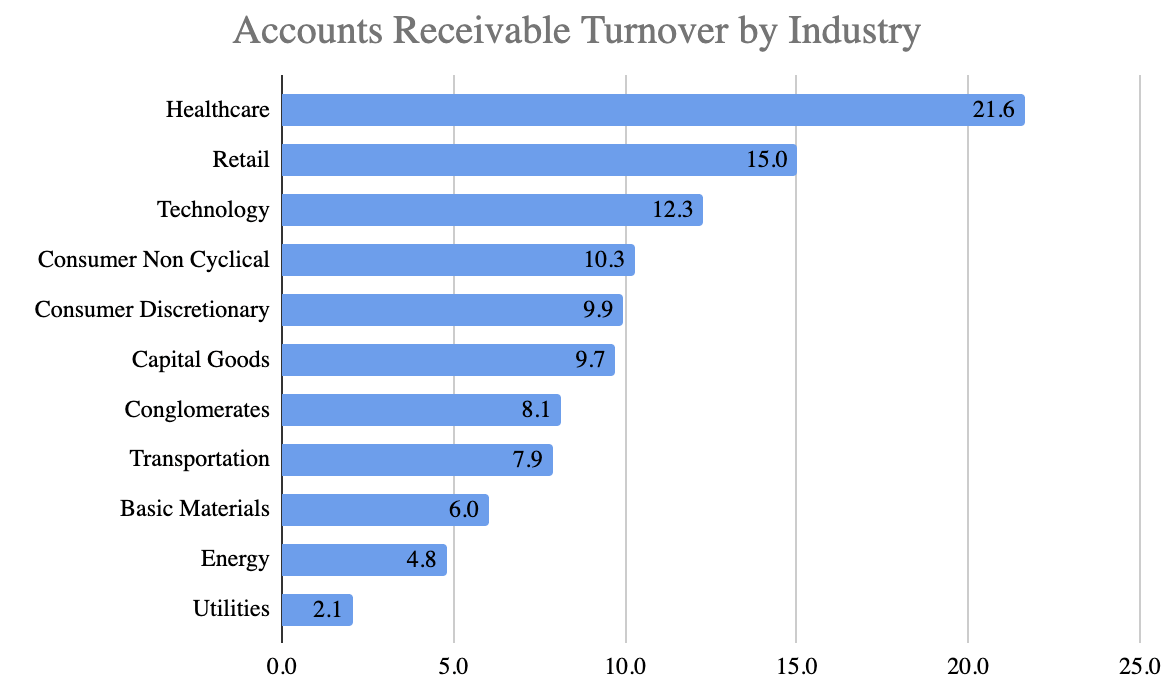

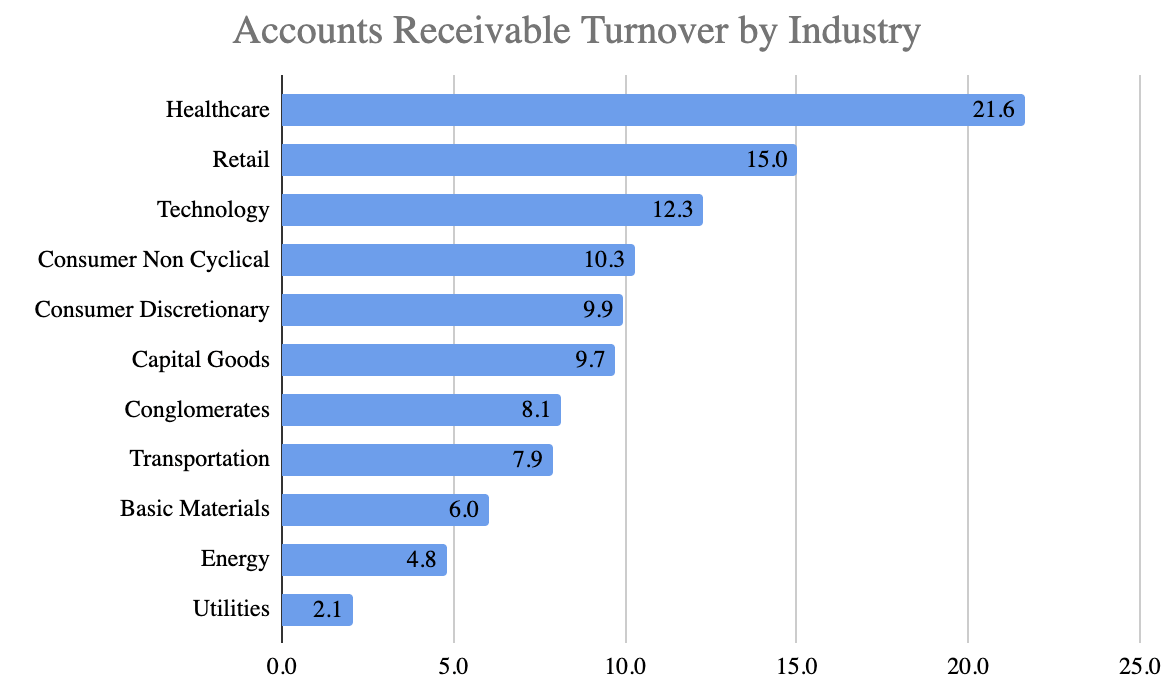

Of course, it is important to note that different benchmarks for accounts receivable turnover exist for different industries. Therefore, when applying it, care must be taken to compare it within the same industry. For example, the turnover rate in the retail industry is usually higher because sales are usually in cash or short-term credit, while the manufacturing industry may be lower because of the longer product production and sales cycle.

Assume that the average accounts receivable issue turnover rate for a manufacturing business is 6 times per year, while the actual turnover rate for the business is 8 times per year. This indicates that the enterprise has performed well in collection management and is able to collect its accounts receivable more quickly, which may reflect its efficient customer relationship management and collection measures.

If a firm's turnover of accounts receivable is only four times per year, which is lower than the industry average, this may warrant a review of its credit policy and customer management. Such a low turnover rate may be indicative of delayed payment by customers or other potential problems, such as insufficient payment capacity of customers or poor customer relationship management.

Accounts receivable turnover is an important indicator of management and operational efficiency for organizations. A high turnover rate means that receivables can be converted to cash quickly, which helps to maintain the flexibility and efficiency of capital flow and reflects a good customer reputation. A low turnover ratio may imply difficulty in liquidity and affect daily operations. Therefore, companies usually improve their turnover rate and maintain their financial health by optimizing credit policies, strengthening customer relationship management, and implementing collection measures.

As for investors, the accounts receivable turnover ratio is an important indicator to assess the operational efficiency and financial health of an enterprise. A high turnover rate reflects a company's good collection management and liquidity, which helps to maintain a solid cash flow and improve profitability. On the contrary, a low turnover ratio may imply that a business is facing liquidity difficulties, which may affect day-to-day business activities. Investors can analyze the turnover ratio to better understand a company's financial condition and operational efficiency and make investment decisions accordingly.

What do High and Low Accounts Receivable Turnover Ratios Indicate?

What do High and Low Accounts Receivable Turnover Ratios Indicate?

Both high and low turnover rates may imply that there are some problems in the enterprise, and investors need to accurately identify the reasons for the abnormal turnover rate and make investment decisions based on a comprehensive consideration of the enterprise's internal and external environmental factors. Through a thorough understanding of a company's financial situation, business model, and industry environment, investors can more comprehensively assess the potential risks and growth potential of a company and thus make a wise investment choice.

In general, excessive accounts receivable turnover may be influenced by seasonal factors, especially in certain industries. However, if it is beyond the normal range of seasonal fluctuations, there may be other underlying issues such as poor sales strategies, a lack of fund management, or customer relationship problems, all of which may have an impact on the long-term health of the business.

It could also mean that the company is adopting extreme collection policies, such as forcing customers to pay immediately or resorting to overly aggressive collection tactics. This could lead to customer dissatisfaction or even attrition, which could affect the long-term customer relationship and reputation of the business. In this case, although the turnover rate may increase, the enterprise may be exposed to greater credit risk and the risk of customer churn, which in turn may affect its long-term operational stability and sustainable development.

Excessive turnover may also be the result of improper practices by the sales team to achieve performance targets, such as excessive discounting or extending the billing period to capture higher sales. While such practices can increase the turnover rate, they may lead to a strained capital chain, a decline in profits, or even the risk of bad debt.

It may also be the result of poor capital turnover, as companies are in dire need of cash flow to meet their daily operating capital needs and therefore adopt various means to collect their accounts receivable as quickly as possible. Although this practice can improve the turnover rate, it may also lead to deterioration of customer relationships and loss of customers, which in turn may affect the long-term development of the enterprise.

Failure by an enterprise to adequately assess the credit risk of its customers may perhaps result in a large backlog of accounts receivable. In order to reduce the backlog, enterprises may adopt overly aggressive collection measures, such as frequent collection or severe collection tactics, which may affect customer relationships and lead to customer churn. This may increase the speed of accounts receivable collection in the short term, but it may damage the reputation of the enterprise, increase the risk of bad debts, and have a negative impact on long-term development.

When the market is too competitive, pressure may force companies to resort to unconventional means to facilitate transactions, such as offering extreme payment terms or excessive discounts, in order to attract customers and maintain market share. Such behavior may result in an unusually high accounts receivable turnover as the business takes overly aggressive measures to collect payments quickly. However, in this case, the business may sacrifice profitability or face higher risks, as excessive discounts may affect the profitability and financial health of the business.

A low accounts receivable turnover ratio, on the other hand, means that a business struggles to collect sales accounts and convert them into cash in a timely manner, which may lead to illiquidity and affect the day-to-day operations and growth of the business. The business may be under pressure to pay suppliers, employee salaries, and other operating expenses and may not even be able to invest in development projects or respond to unexpected capital needs in a timely manner.

If there are credit problems in the business's customer base, such as delayed payment or the inability of some customers to pay their accounts, it can make it difficult for the business to collect sales accounts in a timely manner. This situation will lead to a backlog of accounts receivable, increasing the risk of bad debts and affecting the enterprise's cash flow and capital turnover.

And when an enterprise's sales strategy is too conservative or inappropriate, such as setting prices too high, having too strict payment terms, or having a poor sales process, it may also affect customers' willingness to buy, leading to a decline in sales, which in turn reduces the turnover rate of accounts receivable.

If a company has a serious inventory backlog, it will result in products not being able to be sold in a timely manner, which then delays the collection of payments and, in turn, reduces the turnover rate of accounts receivable. A long-term inventory backlog not only increases the cost of capital utilization but also may lead to product obsolescence, quality degradation, and other problems, which in turn affect the profitability and competitiveness of the enterprise.

And when the enterprise's collection measures are not in place or the collection team is not performing well, it will lead to long-term delinquency of accounts receivable, thus reducing the turnover rate of accounts receivable. This situation will affect the enterprise's cash flow and increase the difficulty of capital turnover, which in turn will affect the daily operation and development of the enterprise.

There is also the fact that in a competitive market environment where customers have more options, they may consider the timing of payment more carefully or choose to turn to competitors for better trading terms. In this case, firms may experience more delays in payment, leading to a lower turnover of accounts receivable.

Factors such as lack of market demand and declining consumer confidence may also lead to poor sales and a weakening of customers' willingness to buy, thus prolonging the collection cycle of accounts receivable and making the turnover rate of accounts receivable lower. Under such circumstances, enterprises may face difficulties in capital turnover, affecting their daily operations and development.

Investors need to pay attention to an accurate accounts receivable turnover ratio because it may reflect problems in the internal and external environments of the business. A low turnover rate may stem from challenges in management, market competition, or customer credit, while a high turnover rate may suggest that a business is adopting poor strategies for short-term profits. Therefore, investors need to combine various factors to comprehensively assess the overall situation of a company and make rational investment decisions.

How to Analyze the Accounts Receivable Turnover Ratio?

How to Analyze the Accounts Receivable Turnover Ratio?

Carefully analyzing the accounts receivable turnover ratio can provide investors with a better understanding of the business situation so that they can make more informed investment decisions. As shown above, both too high and too low turnover ratios can reflect some of the company's problems. And observing the trend of historical data can help investors better assess a company's business performance and trends.

For example, if the turnover ratio shows an upward trend, it means that the company's accounts receivable management efficiency has been improved and customers are paying more promptly, which is usually a positive sign. On the contrary, if the turnover ratio is trending downward, it may indicate that the company's collection efficiency has been reduced and customers' payment cycles have been lengthened, which may adversely affect the company's financial flows.

Assuming that a manufacturing company's accounts receivable turnover ratio increases from four times per year to six times per year, a combination of factors may be behind this. First, the enterprise may have accelerated its accounts receivable turnover by adjusting its credit policy and tightening its payment terms to induce customers to pay more quickly. Second, by optimizing the collection process and increasing the efficiency of collection, companies may have improved the efficiency of accounts receivable collection, further increasing the turnover rate.

In addition, the improvement in the economic environment may have contributed to the improvement in the financial position of customers and their greater ability to make timely payments, which further contributed to the improvement in the turnover rate. Taking these factors into account, an enterprise can further optimize its accounts receivable management and take more effective measures to improve its financial health and operational efficiency.

And if an enterprise's accounts receivable turnover rate drops from six times per year to four times per year, this can reflect a variety of underlying issues. First, the lengthening of customer payment cycles, from an average of 60 days to 90 days, implies a decline in customers' ability to pay or a weakening of their willingness to pay, leading to a slowdown in business collections. Second, although the enterprise's sales revenue has increased, the proportion of credit sales has risen, resulting in a significant increase in accounts receivable balances, which further affects the decline in turnover.

Lastly, the deteriorating market environment may have led to a general cash crunch among customers, exacerbating payment delays. On balance, the company may need to strengthen the management of its internal collection team and its efforts to collect payments, while it should prudently assess the market environment and customers' ability to pay in order to improve its turnover ratio and facilitate the flow of funds.

Such an analysis helps investors gain a more comprehensive understanding of the company's financial condition and operations so that they can make more rational and accurate investment decisions. And beyond that, novice investors often overlook two common blind spots when applying the accounts receivable turnover ratio, leading to errors in the analysis.

First, the calculation of the accounts receivable turnover ratio is easily affected by seasonal factors. In some industries, such as retail or seasonal sales operations, sales may fluctuate significantly from season to season. During the peak season, sales may increase, while during the off-season, they may decrease.

This seasonal fluctuation can affect the rate of collection of accounts receivable, which in turn affects the turnover ratio calculation. If, during peak seasons, sales increase but accounts receivable fail to increase accordingly, the turnover ratio may be overstated, misleading the assessment of a company's ability to manage its liquidity.

Therefore, when applying the ratio, financial statements at different points in time, such as interim or full-year reports, should be scrutinized to see if the business's accounts receivable in different months are close to the calculated average. If it is not close, it is best to calculate the average using accounts receivable at multiple points in time to minimize the effect of seasonality.

Second, accounts receivable turnover may not be an appropriate metric for businesses that sell primarily in cash. These businesses usually involve little credit sales in the sales process because customers will pay directly by cash or credit card, etc., without delayed payment or credit.

As a result, the accounts receivable balances of such enterprises are relatively low, and the calculation of the turnover ratio may not be representative enough to effectively reflect the operational efficiency of the enterprises. Typical examples include the restaurant and retail industries, where transactions tend to be based on cash payments and accounts receivable have less impact.

It is for businesses that sell on credit, particularly in industries such as wholesale and manufacturing, that accounts receivable turnover is a more representative and valid indicator. These companies usually have long-term cooperation with their customers, and credit sales transactions are more common, so the management and collection of accounts receivable are crucial to their capital turnover and operational efficiency. Investors can use this to accurately assess their liquidity management capabilities and better understand the operational status and financial health of the business.

Overall, investors can use the accounts receivable turnover ratio as a reminder signal to pay extra attention when a company's turnover ratio is higher or lower and consider the blind spots mentioned above as well, so that they can effectively screen out companies with higher liquidity.

Analysis of the accounts receivable turnover application

|

Factors

|

Applied Analysis

|

|

Industry Benchmark Comparison

|

Evaluating the competitiveness of a company in its industry |

|

Historical Trend Watch

|

Forecasting the future performance of a company |

|

Seasonal Factors

|

Avoid seasonal variations that may cause misjudgment. |

|

High Turnover

|

Indicate good operations, but be wary of excessive credit tightening. |

|

Low Turnover

|

Focus on potential cash flow problems and management efficiency. |

|

Excessive Turnover

|

Be wary of impacting customer relationships and long-term stability. |

|

Too low turnover

|

Improve credit policy, the market, and payments. |

|

Balanced turnover

|

Reflects sound operations and good collection management. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What do High and Low Accounts Receivable Turnover Ratios Indicate?

What do High and Low Accounts Receivable Turnover Ratios Indicate? How to Analyze the Accounts Receivable Turnover Ratio?

How to Analyze the Accounts Receivable Turnover Ratio?