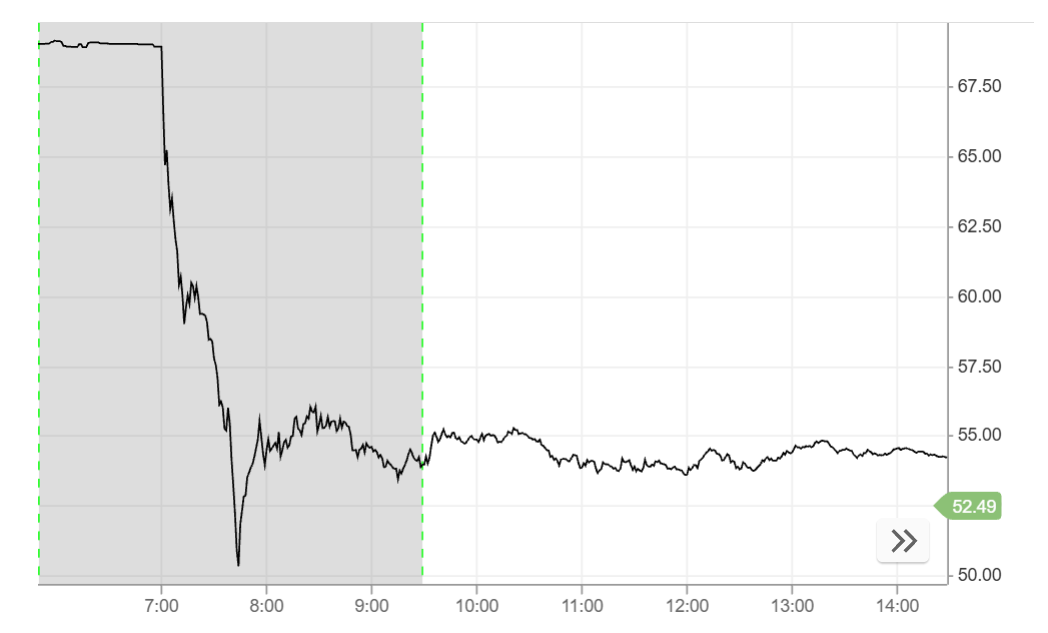

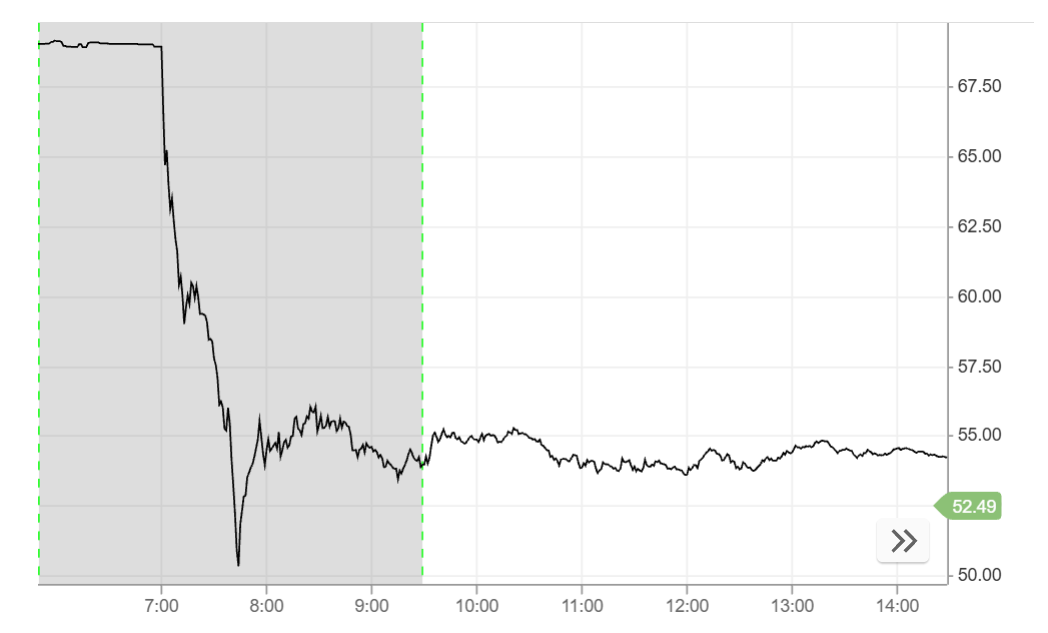

NVO.US stock price fell dramatically on Tuesday as Danish pharmaceutical giant Novo Nordisk announced a major executive shake-up alongside a sharp downgrade to its full-year financial guidance. The company's shares plunged as much as 26% during the trading session before settling at a 23% loss by the close in London.

The abrupt market reaction was triggered by two key developments: the surprise appointment of a new Chief Executive Officer and a warning of softer-than-expected growth in the company's core U.S. market for obesity and diabetes treatments.

Leadership Transition Amid Strategic Headwinds

Novo Nordisk named Maziar Mike Doustdar as its new President and CEO, replacing Lars Fruergaard Jørgensen, who was ousted in May. The new appointment is set to take effect on 7 August. Doustdar, a veteran of the company since 1992. most recently served as Executive Vice President of International Operations and brings with him a broad base of experience across Europe and Asia.

In a statement accompanying the announcement, Chairman Helge Lund praised Doustdar as "the best person to lead Novo Nordisk through its next growth phase." Doustdar himself vowed to lead with "urgency" and "a fierce determination" to expand innovation and reach more patients worldwide.

However, the leadership change also comes at a moment of heightened uncertainty, which investors appear to be interpreting as a signal of deeper strategic and operational challenges.

Full-Year Forecast Slashed on Weak U.S. Sales Outlook

In a parallel announcement, Novo Nordisk revised its full-year guidance downward, citing a deteriorating sales outlook for its blockbuster weight-loss drug Wegovy and diabetes medication Ozempic in the United States.

The company now expects 2024 sales growth of 8% to 14%, significantly lower than its prior forecast of 13% to 21% at constant exchange rates. Operating profit growth expectations have also been trimmed, now projected at 10% to 16%, down from an earlier range of 16% to 24%.

The revised guidance reflects several factors weighing on the U.S. performance of Wegovy:

Persistent use of compounded GLP-1 drugs, which remain widely available despite regulatory crackdowns.

Slower-than-expected market expansion, particularly in obesity treatment.

Increasing competition in the GLP-1 drug category, as rival pharmaceutical companies race to launch or scale up their own alternatives.

These headwinds had already surfaced earlier this year, when Novo Nordisk downgraded its 2025 forecast and posted disappointing Q1 results. The firm is scheduled to release its second-quarter earnings on 6 August, which will now be closely scrutinised by investors for signs of stabilisation—or further erosion—in its key revenue streams.

Impact on NVO.US Stock Price and Investor Sentiment

The NVO.US stock price, which tracks Novo Nordisk's U.S.-listed American Depositary Receipts (ADRs), bore the brunt of the selloff, reflecting shaken investor confidence. Tuesday's plunge represents one of the stock's sharpest single-day declines in recent memory.

So far in 2024. NVO.US has fallen over 42%, reversing the strong gains it enjoyed in previous years due to optimism over GLP-1 based treatments. The abrupt decline underscores the market's sensitivity to both executive leadership transitions and weakening forward guidance—especially from a company that had until recently been viewed as a top-tier growth story in global pharma.

Although Novo Nordisk has previously stated it expects some of these pressures to ease later in the year—particularly as access to compounded GLP-1 drugs declines following tighter U.S. regulations—investors remain cautious.

Competitive and Clinical Pressures Add to Uncertainty

Beyond immediate sales concerns, Novo Nordisk is also contending with growing competitive threats and clinical disappointments. The company's next-generation obesity treatment candidate, CagriSema, has faced a string of underwhelming trial results, raising questions about its long-term innovation pipeline.

Meanwhile, competitors like Eli Lilly and others continue to expand their footprint in both obesity and diabetes care, threatening to erode Novo Nordisk's first-mover advantage in the GLP-1 category.

These structural pressures may limit the company's pricing power and market dominance going forward, and suggest that the sharp fall in NVO.US stock price is not just a technical correction—but a reassessment of the firm's growth trajectory.

Conclusion: A Defining Moment for Novo Nordisk

The sharp decline in NVO.US stock price marks a defining moment for Novo Nordisk, a company that has long been heralded as a leader in innovative metabolic health solutions. With a new CEO stepping in during a period of strategic turbulence, the coming quarters will be critical in determining whether the firm can regain momentum.

The downward revision in guidance, coupled with persistent U.S. headwinds and rising competition, has clearly rattled the market. Whether Doustdar can realign strategy, restore investor confidence, and deliver renewed growth will be watched closely—not only by shareholders, but also by the wider pharmaceutical industry.

As the company prepares to report its next earnings on 6 August, all eyes will remain on Novo Nordisk's ability to convert promise into performance in an increasingly crowded and scrutinised therapeutic space.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.