The MetaTrader 4 (MT4) platform remains a top choice for traders worldwide, thanks to its balance of simplicity, power, and flexibility. Launched in 2005, MT4 is now trusted by over 30 million users.

It's particularly known for supporting expert advisors (EAs), technical indicators, and one-click execution—all key features for both beginners and seasoned professionals.

Top MT4 forex brokers enhance the platform with tighter spreads, faster execution, and value-added tools. Whether you trade USD/JPY, EUR/USD, or gold, selecting the right MT4 broker can greatly impact your profitability.

Top Features Offered by Leading MT4 Forex Brokers

MT4 brokers do more than provide access to the trading platform—they give you tools to refine and automate your trading strategies. Here are the most valuable features that leading MT4 brokers such as EBC bring to the table:

Expert Advisors (EAs) to automate trades based on coded strategies.

Custom indicators and templates tailored for different styles, from scalping to swing trading.

Lightning-fast trade execution, often under 0.1 seconds.

These features streamline decision-making and reduce manual errors.

Account Types and Leverage Options

MT4 brokers offer various account types tailored to traders at different experience levels:

Demo Accounts: Simulate real trading without risking funds.

Micro Accounts: Trade with as little as $10—perfect for beginners.

Standard Accounts: Suitable for regular traders with $100–$500 starting balances.

ECN Accounts: For advanced traders seeking tighter spreads and lower latency.

Leverage options vary as well. Most brokers offer up to 1:500 for forex pairs. However, while high leverage increases potential profits, it also raises risk exposure—so it should be used with caution.

Why Regulation Matters When Choosing an MT4 Forex Broker

Trust and safety are non-negotiable in forex trading. The best MT4 brokers are regulated by reputable financial authorities such as the FCA (UK) and ASIC (Australia).

Regulation ensures that:

Client funds are held in segregated accounts.

The broker adheres to fair trading practices.

You have access to dispute resolution channels in case of any issues.

In 2023, regulated MT4 brokers processed over $2 trillion in monthly forex transactions, according to global trading data. Always verify a broker's licence before funding your account.

How to Choose the Best MT4 Forex Broker

Here's a simple checklist to help you make an informed decision:

Regulation: Look for FCA, ASIC, or equivalent oversight.

Trading Costs: Compare spreads and swap fees.

Platform Tools: Test indicators and EAs.

Leverage Options: Choose what aligns with your risk profile.

Customer Support: Ensure fast and accessible help when needed.

Start with demo accounts from brokers like EBC to experience real trading conditions risk-free. Use this time to evaluate spreads, execution speed, and platform stability.

Getting Started: A Quick Guide

Starting with MT4 forex brokers is simple:

Choose a Regulated Broker: Compare spreads, tools, and support.

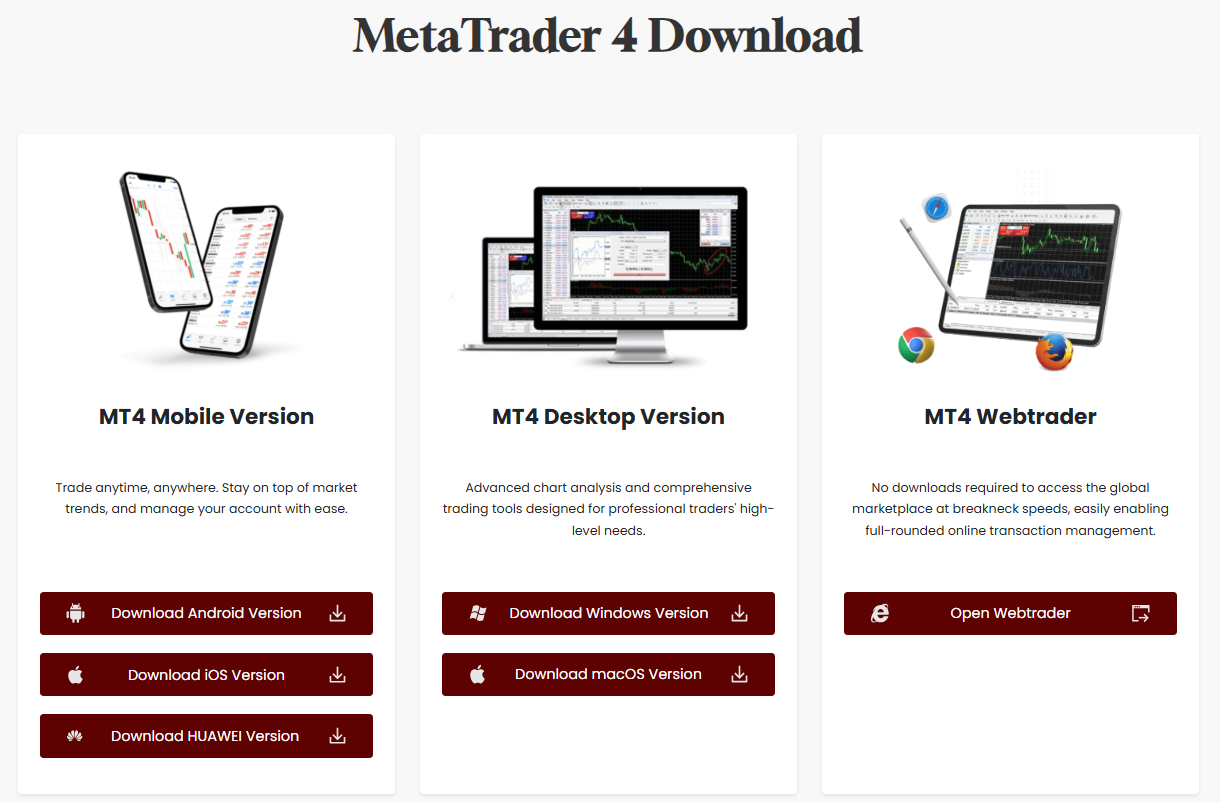

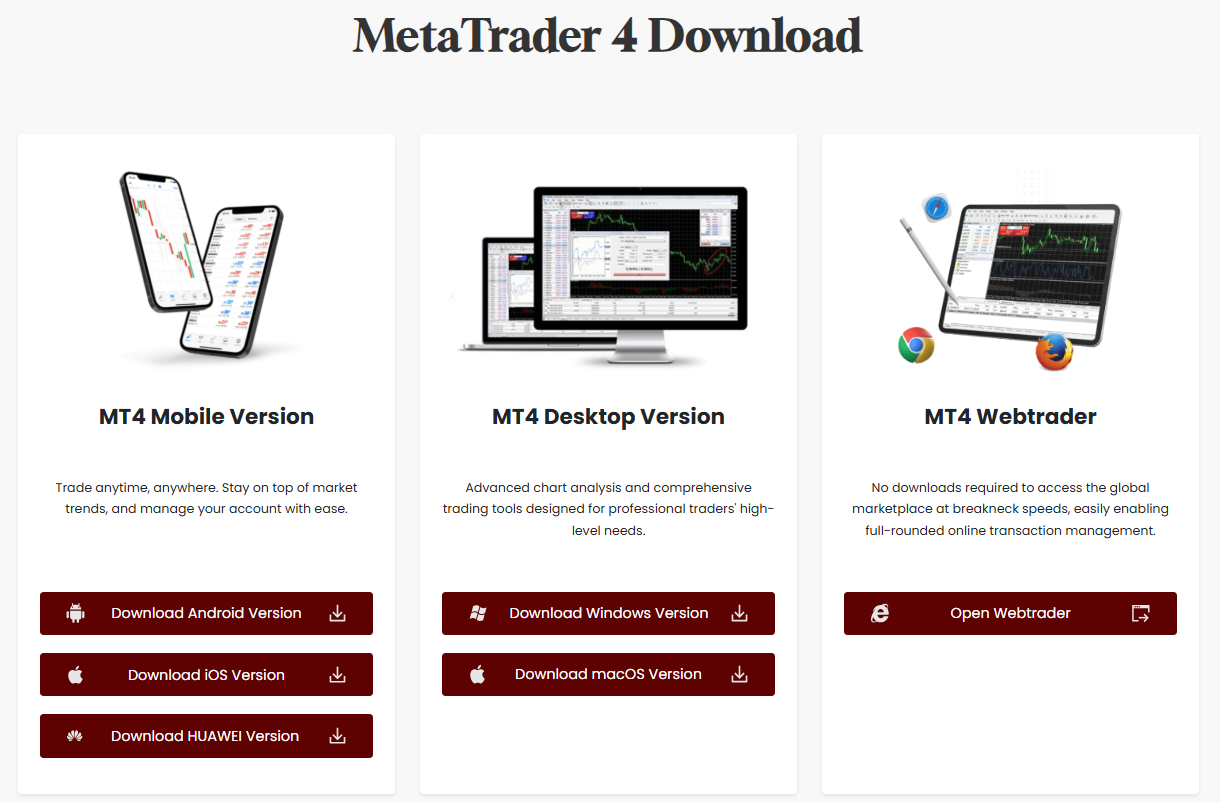

Download MT4: Available for Windows, Mac, iOS, and Android.

Open a Demo Account: Practice with $20,000–$50,000 virtual funds.

Test Trading Tools: Try various indicators and tools.

Go Live: Deposit a minimum of $100 to $250 when ready.

Track your progress, adjust strategies, and scale gradually.

Conclusion

In conclusion, MT4 forex brokers remain the foundation of the retail trading landscape in 2025. Their simplicity, combined with advanced tools like Autochartist, EAs, and tight spreads, makes them the ideal choice for traders looking to build and refine their strategies.

Whether you're scalping USD/JPY, swing trading gold, or testing new algorithms, choosing a regulated and well-equipped broker can transform your trading outcomes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.