Bernard Arnault, often nicknamed "the Wolf in Cashmere", is one of the most powerful figures in modern business. Known for his refined style and relentless ambition, Arnault built the world's largest luxury group, LVMH, through a series of bold acquisitions and strategies.

But what does the wolf in cashmere mean? It reflects a leader who looks polished and sophisticated on the outside, yet operates with the predatory instincts of a dealmaker.

Today, Bernard Arnault, sometimes misspelt as Bernard Arnold, stands at the top of global wealth rankings, rivalling tech titans with his empire of fashion houses, champagne labels, and jewellery icons.

This article explains why Bernard Arnault is referred to as the Wolf in Cashmere, his ascent from humble origins, and the implications of his business path for investors.

Who Is the Wolf in Cashmere?

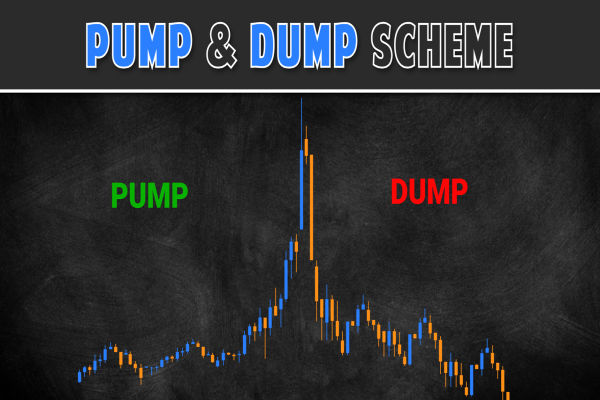

The phrase "Wolf in Cashmere" perfectly captures Arnault's dual nature: an elegant French gentleman with the instincts of a ruthless corporate predator. While he may appear soft-spoken and refined, Arnault's rise is built on aggressive business moves, often involving hostile takeovers and shrewd acquisitions. [1]

It is why the nickname Bernard Arnault Wolf in Cashmere persists; it symbolises how he combined charm with uncompromising tactics to dominate the luxury world.

Bernard Arnault's Journey: The Birth of a Legacy

1) Early Life and Family Business Roots

Born in 1949 in Roubaix, France, Bernard Arnault grew up in a family that owned a construction company. After studying engineering at École Polytechnique, Arnault joined his father's company, Ferret-Savinel, where he helped shift the business focus toward real estate.

During these early years, Bernard Arnault learned the fundamentals of management but soon realised that the biggest opportunities lay not in construction, but in fashion and prestige-driven industries.

2) The Turning Point: Acquiring Dior

Arnault's journey into luxury began in 1984 with the acquisition of the struggling textile company Boussac, which happened to own Christian Dior. At the time, Dior was considered a fading brand, but Arnault recognised its potential as the cornerstone of a global luxury empire.

This bold acquisition not only revived Dior but also marked the moment when Bernard Arnault became known as the Wolf in Cashmere. According to Bloomberg, this deal became the foundation of LVMH's eventual dominance in the luxury sector. [2]

3) The Birth of LVMH and Expansion Strategy

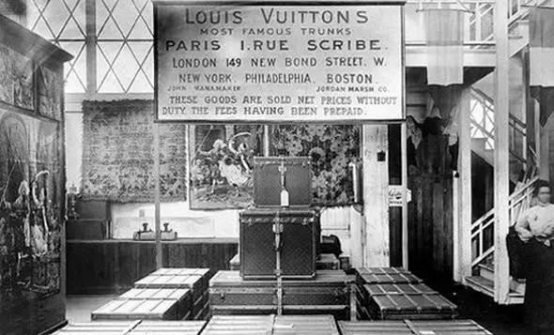

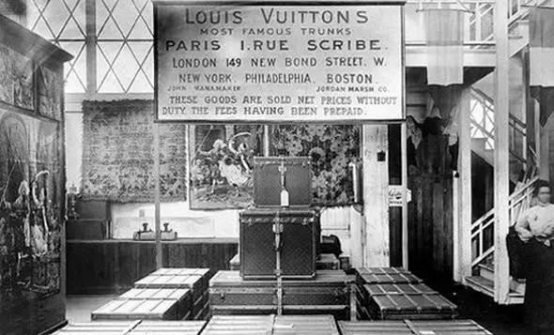

In the late 1980s, Arnault engineered a takeover of Louis Vuitton and Moët Hennessy, merging them into the conglomerate known today as LVMH. His strategy was straightforward: identify undervalued heritage brands, acquire them, and modernise operations without losing their exclusivity.

From Louis Vuitton trunks to Dom Pérignon champagne, Arnault's acquisitions turned LVMH into the ultimate luxury powerhouse. As Harvard Business Review notes, Arnault's method relied on creating synergies across brands while letting each house retain its creative independence.

4) Global Luxury Empire

Under Arnault's leadership, LVMH expanded into China, Asia, and the United States, where demand for luxury surged. Today, the group owns over 75 brands, including Tiffany & Co., Bulgari, Sephora, and Hennessy.

Through this expansion, Bernard Arnault and LVMH positioned themselves at the crossroads of fashion, lifestyle, and culture. Arnault not only captured Western markets but also tapped into the explosive growth of Asia's luxury consumers, which now represent nearly half of global luxury spending.

The Wolf in Cashmere's Legacy and Its Relevance Today

With an estimated fortune exceeding $200 billion, Arnault's Wolf in Cashmere legacy is undeniable. Forbes frequently ranks him as the richest person in the world, often trading places with Elon Musk and Jeff Bezos.

For many, the phrase Bernard Arnault Wolf in Cashmere is not just a nickname but a legacy of resilience, precision, and vision in building an empire of timeless brands.

Today, Arnault's path strikes the balance between elegance and predatory instincts when seizing opportunities.

Frequently Asked Questions

1. What Is Bernard Arnault's Current Net Worth and Ranking Among the World's Billionaires?

As of mid-2025, Forbes estimates Bernard Arnault's net worth to be between US$172 billion and US$178 billion, positioning him among the top wealthiest individuals globally. [3]

2. What Does the "Wolf in Cashmere" Nickname Mean in Relation to Bernard Arnault?

"Wolf in Cashmere" is a metaphor that captures the dual nature of Bernard Arnault's persona and business style: on the outside, polished, elegant, refined, on the inside, aggressive, strategic, opportunistic.

3. How Does the "Wolf in Cashmere" Strategy Reflect in Long-Term Investment?

Arnault's approach is evident in several organisational choices, such as long-term investment even during volatility. For example, opening new factories, investing in durable assets, and retaining strong cash flow.

Conclusion

In conclusion, Bernard Arnault's transformation from the son of a construction businessman to the Wolf in Cashmere who built LVMH is a testament to vision, resilience, and relentless drive. His story proves that luxury is not just about fashion, it's about strategy, timing, and global expansion.

As investors study his journey, one lesson stands out: appearances may be refined, but true success requires the instincts of a predator in a world of opportunities.

Explore more insights on global markets and investing strategies here at EBC.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.ft.com/content/21f64410-9117-11e9-aea1-2b1d33ac3271

[2] https://www.bloomberg.com/news/articles/2024-06-25/luxury-brands-dior-louis-vuitton-celine-tiffany-are-key-to-lvmh-empire

[3] https://www.forbes.com/billionaires/