In the rapidly evolving technology sector, investors have numerous options for gaining exposure.

The First Trust Cloud Computing ETF (SKYY) offers a niche focus on cloud computing, while broader technology ETFs provide diversified exposure across software, hardware, and internet companies.

As a result, SKYY may offer higher growth potential but comes with greater sector concentration and volatility.

This article examines how SKYY compares to other technology ETFs, exploring portfolio composition, performance, dividends, risks, and strategic considerations to help investors make informed decisions.

SKYY in the World of Technology ETFs

The First Trust Cloud Computing ETF (SKYY) offers investors targeted exposure to the rapidly growing cloud computing sector. Launched in July 2011. it was the first ETF to focus exclusively on cloud computing, tracking the ISE Cloud Computing Index.

While SKYY represents a specialised niche within the technology space, broader technology ETFs such as XLK, VGT, and QQQ provide diversified exposure to the wider technology sector, encompassing software, hardware, semiconductors, and internet companies.

Comparing SKYY to these broader ETFs helps investors understand the trade-offs between specialisation and diversification, as well as the potential for growth, income, and risk.

Niche vs Broad Exposure: Investment Focus

SKYY: A Cloud-Only Specialisation

SKYY concentrates on companies whose business revolves around cloud computing services, including software providers, data storage solutions, and networking infrastructure.

This focus allows investors to directly participate in the growth of cloud technology but comes with increased sector concentration risk.

Broad Technology ETFs: XLK, VGT, QQQ

In contrast, broader ETFs track the entire technology sector, including giants like Apple, Microsoft, Nvidia, and Alphabet.

This diversity spreads risk across multiple sub-sectors, cushioning investors against volatility in any single area, but it may dilute exposure to high-growth niches like cloud computing.

Portfolio Composition: Who's in the Mix

SKYY Holdings

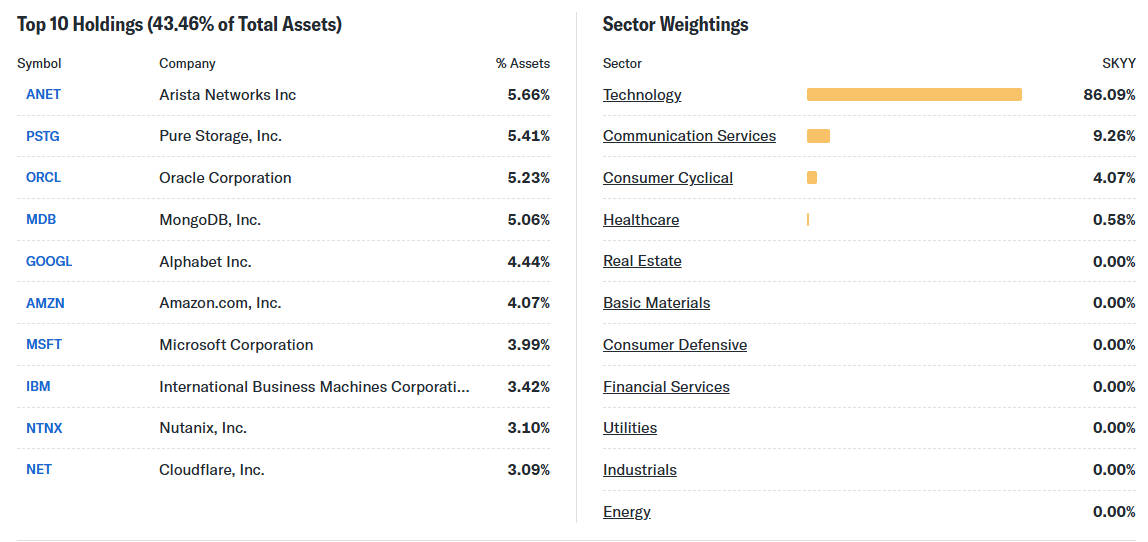

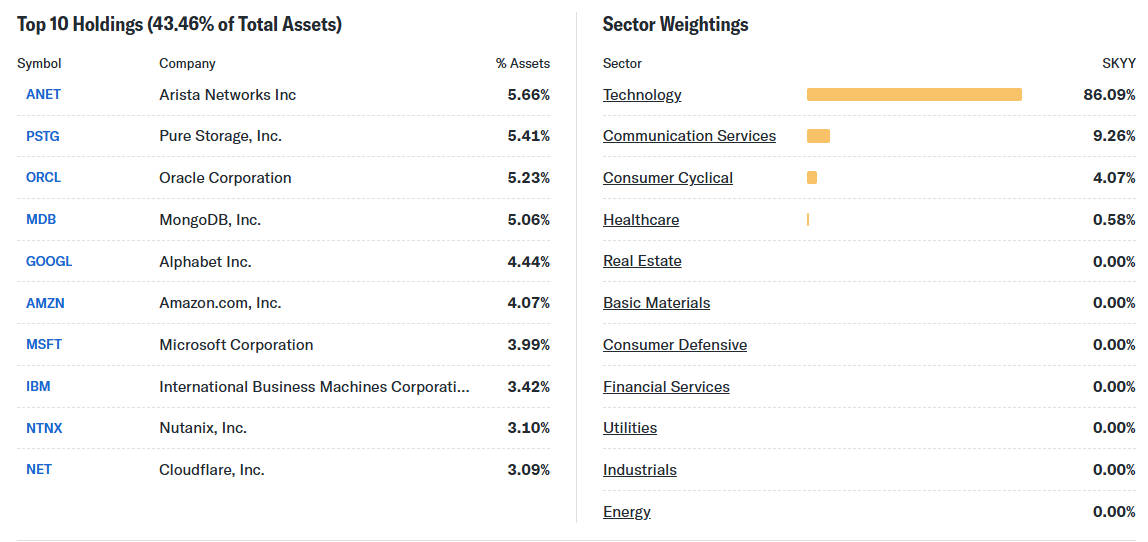

As of recent data, SKYY's top holdings include:

Arista Networks – 5.66%

Pure Storage – 5.41%

Oracle Corporation – 5.23%

MongoDB – 5.06%

Alphabet – 4.44%

The fund is heavily weighted towards companies directly involved in cloud infrastructure, which can lead to higher volatility but potentially higher returns if the sector performs well.

Broad Tech ETFs

For comparison, XLK, VGT, and QQQ typically feature top holdings like:

Apple

Microsoft

Nvidia

Alphabet

These ETFs include a mix of software, hardware, and internet companies, providing a more balanced approach to the technology sector. The diversification reduces concentration risk but may slightly limit upside from niche high-growth areas.

Performance Metrics: Returns and Volatility

Historical Performance

SKYY has delivered strong historical returns, reflecting the rapid growth of the cloud computing industry. Since inception, it has averaged approximately 14% annual return, though its performance can fluctuate significantly due to sector concentration.

Comparative Performance

Over the past year, SKYY has achieved returns around 35%, similar to or sometimes outperforming broader technology ETFs, depending on market conditions.

However, during periods of tech sector correction, SKYY tends to experience greater swings, highlighting the trade-off between focused growth and volatility management.

Risk Profile

Investors should note that SKYY is more volatile than broad technology ETFs, which include larger, diversified companies. While broader ETFs may provide steadier returns, SKYY offers higher potential upside in bull markets concentrated on cloud computing.

Dividends and Income Potential

SKYY provides a distribution yield of 1.33%, with quarterly payouts. Its income is modest, reflecting its growth-oriented nature, whereas broader technology ETFs often provide similar or slightly higher dividend yields due to exposure to established tech giants.

Investors seeking regular income may prefer diversified tech ETFs, while those prioritising growth may find SKYY more attractive.

Risk Considerations: Concentration vs Diversification

Sector Concentration

SKYY's performance is closely tied to the cloud computing niche, making it sensitive to shifts in technology trends, regulatory changes, or earnings surprises within the sector.

Market Volatility

All technology ETFs are affected by market volatility, but SKYY's narrow focus can amplify price swings compared with broader ETFs.

Expense Ratios

SKYY's expense ratio is 0.60%, slightly higher than many broad tech ETFs, which can range from 0.10% to 0.15%. While the cost reflects specialised management, it is an important consideration for long-term investors.

Strategic Use: When to Choose SKYY vs Broad Tech ETFs

1) Growth-Oriented Portfolios:

SKYY may be suitable for investors seeking high-growth exposure to cloud computing, understanding the associated risks.

2) Diversified Tech Allocation:

Broad ETFs like XLK or VGT are ideal for balanced technology exposure, offering steadier returns with lower concentration risk.

3) Complementary Approach:

Investors can combine SKYY with a broad technology ETF to capture niche growth while maintaining diversification.

Case Studies: SKYY vs Broader ETFs in Action

1) Bull Market Scenario:

In periods of rapid cloud adoption, SKYY has often outperformed broader ETFs due to its focused exposure to high-growth companies.

2) Correction Scenario:

During tech sell-offs, SKYY's concentrated holdings have led to steeper declines compared with diversified ETFs, highlighting the importance of risk management.

These examples illustrate the trade-off between potential growth and volatility, helping investors make informed allocation decisions.

SKYY ETF vs Broad Technology ETFs

| Aspect |

SKYY ETF |

Broad Tech ETFs (XLK, VGT, QQQ) |

Implications |

| Investment Focus |

Cloud computing sector only |

Entire technology sector (software, hardware, internet, semiconductors) |

SKYY is niche and high-growth; broad ETFs are diversified and balanced. |

| Top Holdings |

Arista Networks, Pure Storage, Oracle, MongoDB, Alphabet |

Apple, Microsoft, Nvidia, Alphabet |

SKYY's holdings are concentrated in cloud infrastructure; broad ETFs have major tech giants across sub-sectors. |

| Portfolio Diversification |

Low (sector concentrated) |

High (diverse tech companies across sub-sectors) |

Higher concentration risk for SKYY; broader ETFs reduce risk but may limit upside from niche growth. |

| Performance Potential |

High growth potential in bullish cloud market |

Moderate to high growth across overall tech sector |

SKYY can outperform in cloud-specific rallies; broad ETFs offer steadier returns. |

| Volatility / Risk |

Higher due to concentrated holdings |

Lower, but still exposed to tech sector fluctuations |

SKYY is more sensitive to cloud computing trends and market swings. |

| Dividend Yield |

~1.33%, paid quarterly |

Typically 1–1.5%, paid quarterly or semi-annually |

Both are primarily growth-focused; dividends are modest. |

| Expense Ratio |

0.60% |

0.10%–0.15% |

SKYY has higher expenses reflecting specialised management. |

| Best Use |

Growth-focused portfolios seeking cloud exposure |

Diversified tech allocation with lower concentration risk |

SKYY is for targeted growth; broad ETFs suit investors seeking balanced tech exposure. |

Frequently Asked Questions (FAQ)

1. How is SKYY different from broad technology ETFs?

SKYY focuses solely on cloud computing, whereas broad tech ETFs include multiple sectors like software, hardware, and internet services.

2. Does SKYY offer higher growth potential than general tech ETFs?

Yes, due to its niche focus on cloud computing, SKYY can achieve higher growth, but this comes with greater volatility and sector-specific risk.

3. What are the risks of investing in SKYY?

Risks include sector concentration, market volatility, and a higher expense ratio compared with broad tech ETFs. Performance is closely tied to cloud computing trends.

4. Can SKYY be used alongside other technology ETFs?

Absolutely. Combining SKYY with broader ETFs allows investors to capture niche growth while maintaining diversification, balancing risk and reward.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.