The long legged doji is a unique candlestick pattern that traders watch closely for signs of market indecision and possible reversals. By learning how to interpret the long legged doji, you can gain an important tool to understand when the market is uncertain, which can help improve your trading decisions.

This article explains what the long legged doji represents, how to recognise it on your charts, and the best ways to use it in your trading strategy.

Understanding the Long Legged Doji Pattern

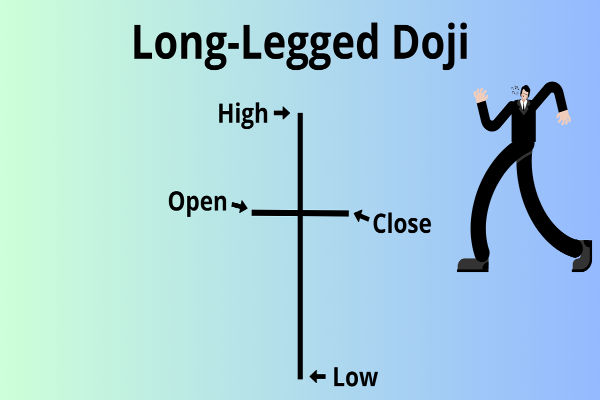

At its core, the long legged doji is a candlestick that shows the opening and closing prices are almost identical, resulting in a very small or nonexistent real body. However, what makes it stand out are the long upper and lower shadows.

These shadows reflect a tug-of-war during the trading session, where buyers pushed prices high but sellers also forced the price down significantly, before it settled near the opening price. This pattern is a clear visual representation of uncertainty within the market.

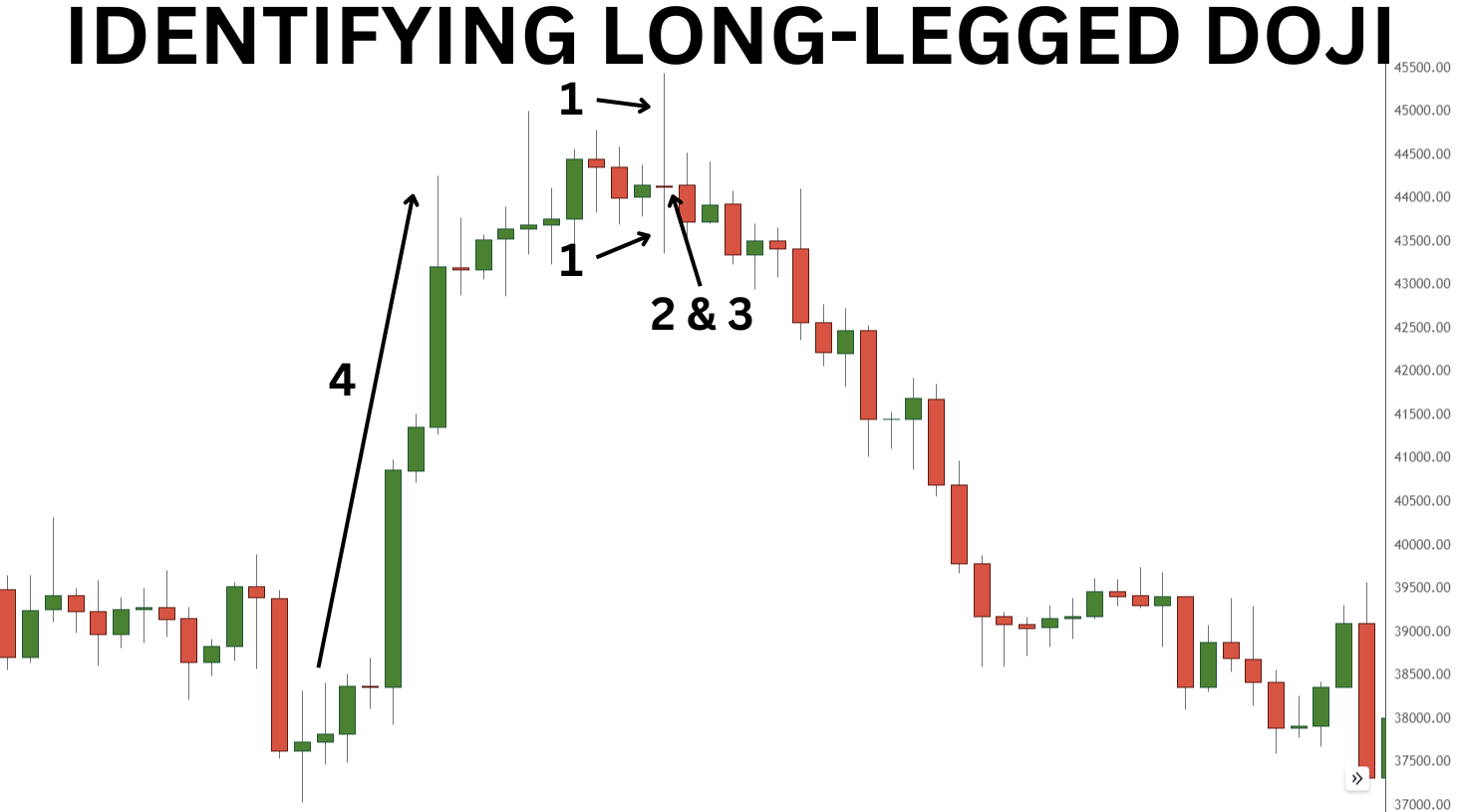

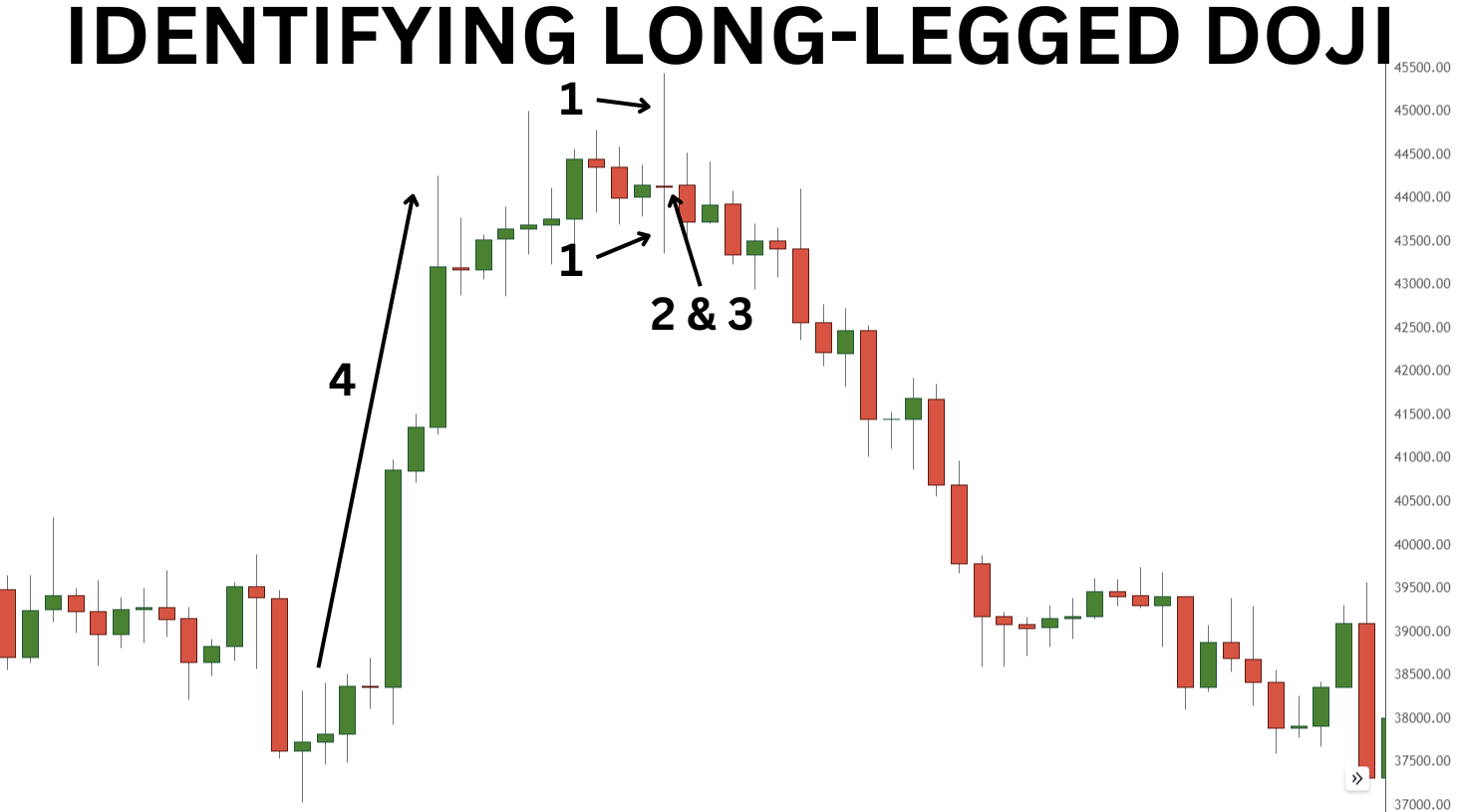

The long legged doji often appears after strong price trends, either up or down. Its presence suggests that the momentum behind the prevailing trend may be weakening. Because the market is indecisive, the pattern often warns traders to pause and look for additional confirmation before entering new positions.

Recognising the Long Legged Doji in Charts

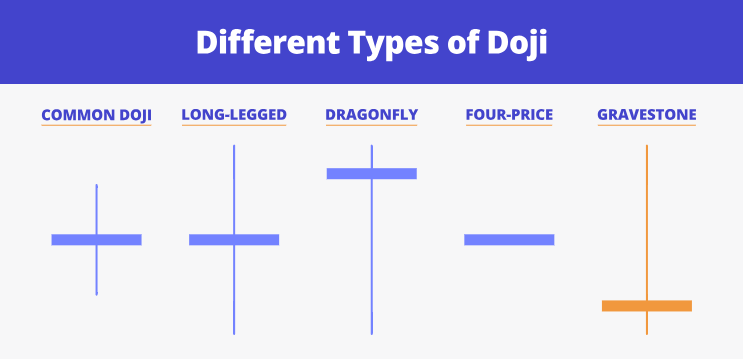

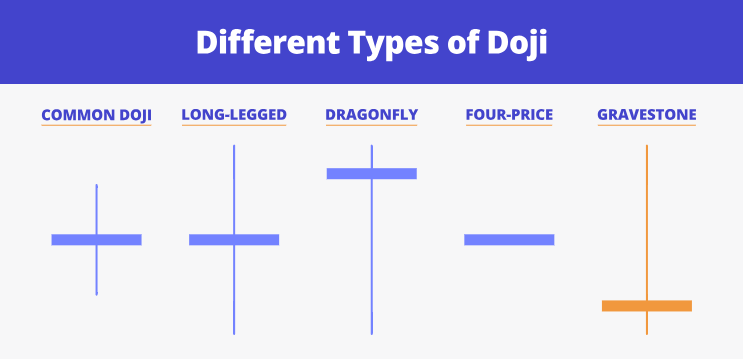

Spotting a long legged doji on your chart involves looking for very specific features. Unlike other types of doji patterns, such as the gravestone or dragonfly doji which have long shadows only on one side, the long legged doji has long wicks both above and below the body. These shadows should be roughly symmetrical and significantly longer than the tiny real body.

The long shadows indicate high volatility during the session, with intense struggles between buyers and sellers. When you see this pattern, it is a signal that neither side has taken control, leading to a stalemate situation.

What Does the Long Legged Doji Mean for Traders?

When the long legged doji forms, it signals that the market is uncertain about its next move. This indecision can suggest a few different possibilities. One common interpretation is that a trend reversal may be on the horizon. For example, if the market had been trending strongly upwards, the appearance of the long legged doji might indicate that buying pressure is fading and sellers could soon take over.

Alternatively, the long legged doji may simply represent a pause or consolidation within the current trend, especially if it forms in the middle of a sideways market. In such cases, the pattern indicates that traders are gathering momentum before pushing prices in either direction.

Because the long legged doji is a warning signal rather than a confirmation, it is essential to wait for further clues before making trading decisions based on this pattern alone.

Incorporating the Long Legged Doji into Your Trading

To use the long legged doji effectively, it is crucial to consider it alongside other market indicators and price action. Volume can be an important factor to observe. A long legged doji accompanied by high trading volume may indicate a stronger signal of indecision, as more traders participate in the struggle for control.

Traders also look for confirmation candles that follow the long legged doji. For instance, if a bullish candle appears after the doji in a downtrend, it might confirm a reversal to the upside. Conversely, a bearish candle following the pattern could validate a continuation or reversal downward.

Another critical consideration is the location of the long legged doji on the chart. If the pattern forms near major support or resistance levels, the chance of a meaningful price reaction increases. This makes the pattern especially valuable when combined with well-established technical levels.

Avoiding Common Pitfalls

New traders often make the mistake of assuming that every long legged doji guarantees a trend reversal. In reality, the pattern simply reflects uncertainty and should not be traded in isolation. It is important to integrate other tools such as trend analysis, momentum indicators, and fundamental context to avoid false signals.

Immediate action following the appearance of a long legged doji without confirmation can lead to poor trading outcomes. Patience is key; waiting for subsequent price movements and supporting evidence helps increase the probability of a successful trade.

Comparing the Long Legged Doji to Other Doji Patterns

The long legged doji is just one member of the doji family, each with its own trading implications. The gravestone doji, for example, has a long upper shadow and little to no lower shadow, usually signalling bearish sentiment. The dragonfly doji, on the other hand, has a long lower shadow and minimal upper shadow, often indicating bullish potential.

What makes the long legged doji unique is its balanced, symmetrical shadows, which embody the concept of equal forces battling it out. This balanced nature suggests a higher level of indecision than other doji types, often leading to more cautious trading decisions.

Real-Life Example

Imagine a currency pair that has been rising steadily over several sessions. Suddenly, a long legged doji forms on the daily chart, showing that traders are uncertain whether to push prices higher or lower.

The following day, a bearish candle closes lower, signalling that sellers are gaining ground and a reversal might be underway. Traders who spotted the long legged doji would then consider entering short positions or closing long trades to avoid losses.

Final Thoughts

The long legged doji is a valuable tool for any trader aiming to understand market sentiment and identify moments of indecision. Its long shadows and small body paint a clear picture of a struggle between buyers and sellers. While it does not guarantee a market reversal, when combined with volume analysis, confirmation candles, and key support or resistance levels, the long legged doji can significantly enhance trading decisions.

Approaching this pattern with patience and context allows traders to avoid false signals and position themselves to take advantage of market shifts. Incorporating the long legged doji into a broader technical analysis strategy will improve your ability to read price action and manage risk effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.