Understanding XAUUSD and Its Significance in Trading

XAUUSD might look like a random string of letters at first glance, but it simply represents the price of gold measured in US dollars. "XAU" is the international code for one troy ounce of gold, and "USD" is, of course, the US dollar. Gold has always had a reputation as a safe-haven asset, especially in times of uncertainty. That's why traders and investors all over the world keep a close eye on XAUUSD—it tends to move in interesting ways when global events shake up the markets.

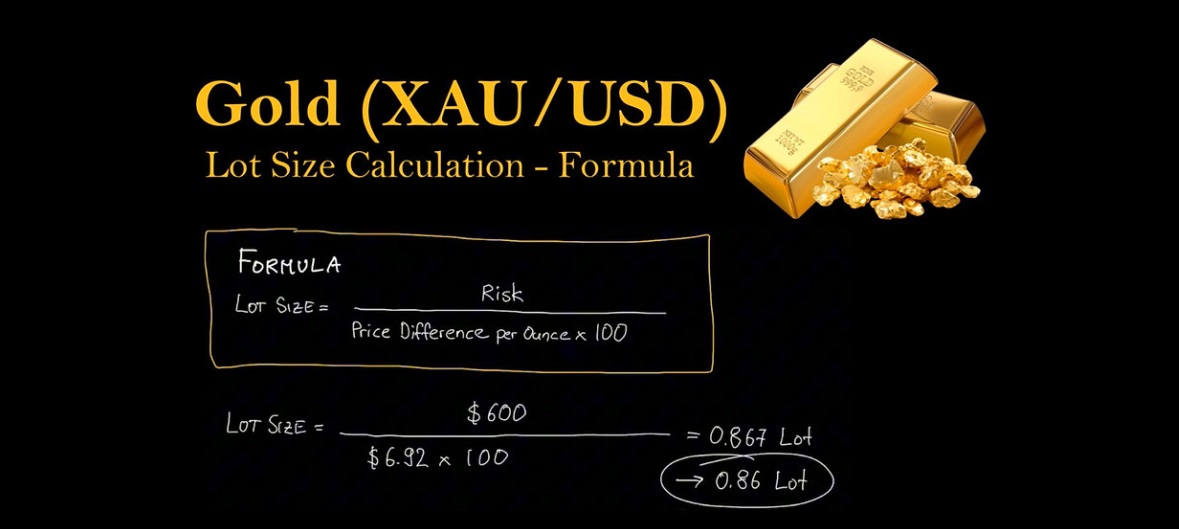

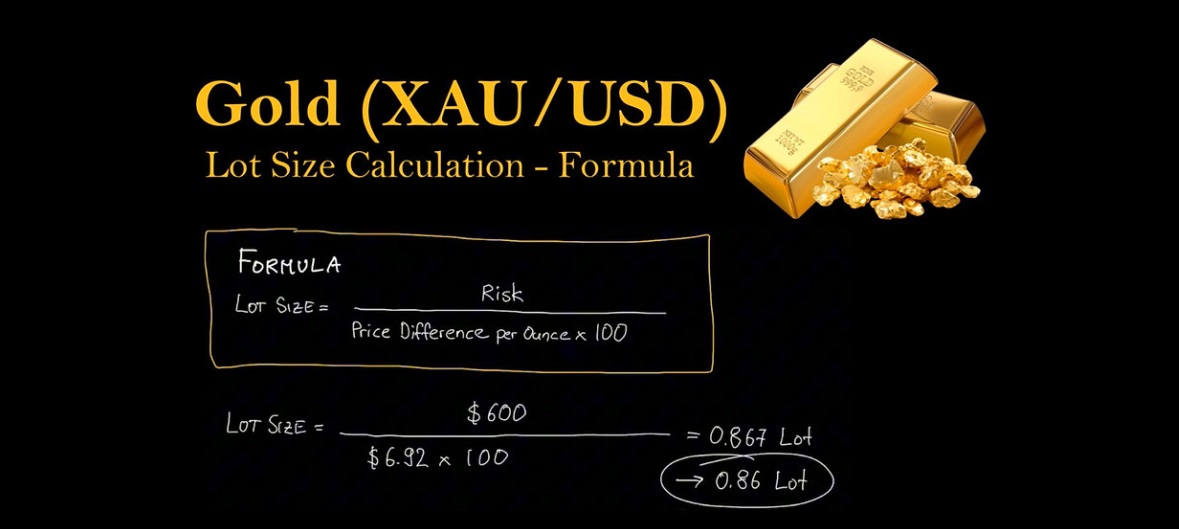

As a trading pair, XAUUSD is known for its volatility. That's great for traders looking for opportunities, but it also means risks are higher. And that's where calculating your lot size becomes absolutely essential. Without the right position size, even the best trade idea can turn into a costly mistake.

As a trading pair, XAUUSD is known for its volatility. That's great for traders looking for opportunities, but it also means risks are higher. And that's where calculating your lot size becomes absolutely essential. Without the right position size, even the best trade idea can turn into a costly mistake.

The Importance of Accurate Lot Size Calculation

Trading gold can be rewarding, but if you jump in without knowing how much you're really putting at risk, you're basically gambling. Lot size, which refers to the number of units you're buying or selling, directly affects your profit and loss. In other words, it determines how much money you stand to make—or lose—for each price movement.

If your lot size is too large for your account balance or risk tolerance, a small move in price could wipe out a significant portion of your capital. On the other hand, if it's too small, you might miss out on meaningful gains even when you've correctly predicted the market direction. So, finding that balance is key.

An accurate lot size calculation helps you manage your risk sensibly. It ensures that no single trade can damage your account too badly, even if it goes against you. For traders who want to stay in the game long-term, this step isn't optional—it's foundational.

Step-by-Step Guide to Using a Calculator

Now that you know what's needed, let's break down how to actually use a Lot Size Calculator for XAUUSD. Thankfully, most tools are very user-friendly—even if you're completely new to trading.

Step 1: Open a trusted calculator like the one on Myfxbook or Babypips.

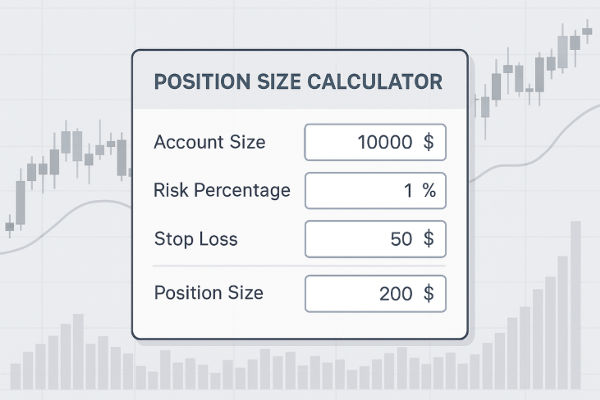

Step 2: Enter your account size. For example, type in "5000" if you have $5.000 in your Trading Account.

Step 3: Set your risk percentage. If you're aiming for 1%, type in "1". The calculator will use this figure to determine your dollar risk.

Step 4: Input your stop-loss distance. Say you're placing your stop-loss 150 pips away from your entry—type in "150".

Step 5: Choose the currency of your account, and select "XAUUSD" as your trading instrument.

Step 6: Click "Calculate". The tool will instantly show you how many lots you should be trading to stay within your chosen risk level.

That's it. The result might be something like "0.12 lots," meaning you should trade 0.12 standard lots on this particular setup. If you change your stop-loss or risk percentage, the calculator adjusts accordingly.

How to Interpret the Results

The number that appears at the end of the calculation tells you exactly how big your position should be in order to keep your risk under control. If you see "0.10 lots," for example, that means you're trading 10 ounces of gold.

The key here is consistency. Once you know your ideal lot size, don't be tempted to ignore it and go bigger just because the trade "looks good." Sticking to your calculated lot size ensures that you're not risking too much on any single trade, even when markets get unpredictable.

It's also worth understanding that smaller lot sizes don't mean smaller profits—they mean calculated profits. If the trade goes in your favour, you'll still gain, and most importantly, you'll avoid unnecessary losses if things go wrong.

Tips for Beginners Using Lot Size Calculators

If you're just starting out, here are a few things to keep in mind to get the most out of your XAUUSD lot size calculator:

Always use a stop-loss. The calculator assumes you'll set one—without it, you can't control your risk.

Double-check your figures before hitting "Calculate", especially if you're switching between different accounts or currency pairs.

Update your account balance regularly, especially after wins or losses. Your lot size will change as your balance changes.

Be honest about your risk tolerance. It's easy to choose 5% when you're confident, but smaller percentages are safer in the long run.

Practice with demo accounts first. Before risking real money, test your lot size strategies in a risk-free environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

As a trading pair, XAUUSD is known for its volatility. That's great for traders looking for opportunities, but it also means risks are higher. And that's where calculating your lot size becomes absolutely essential. Without the right position size, even the best trade idea can turn into a costly mistake.

As a trading pair, XAUUSD is known for its volatility. That's great for traders looking for opportunities, but it also means risks are higher. And that's where calculating your lot size becomes absolutely essential. Without the right position size, even the best trade idea can turn into a costly mistake.