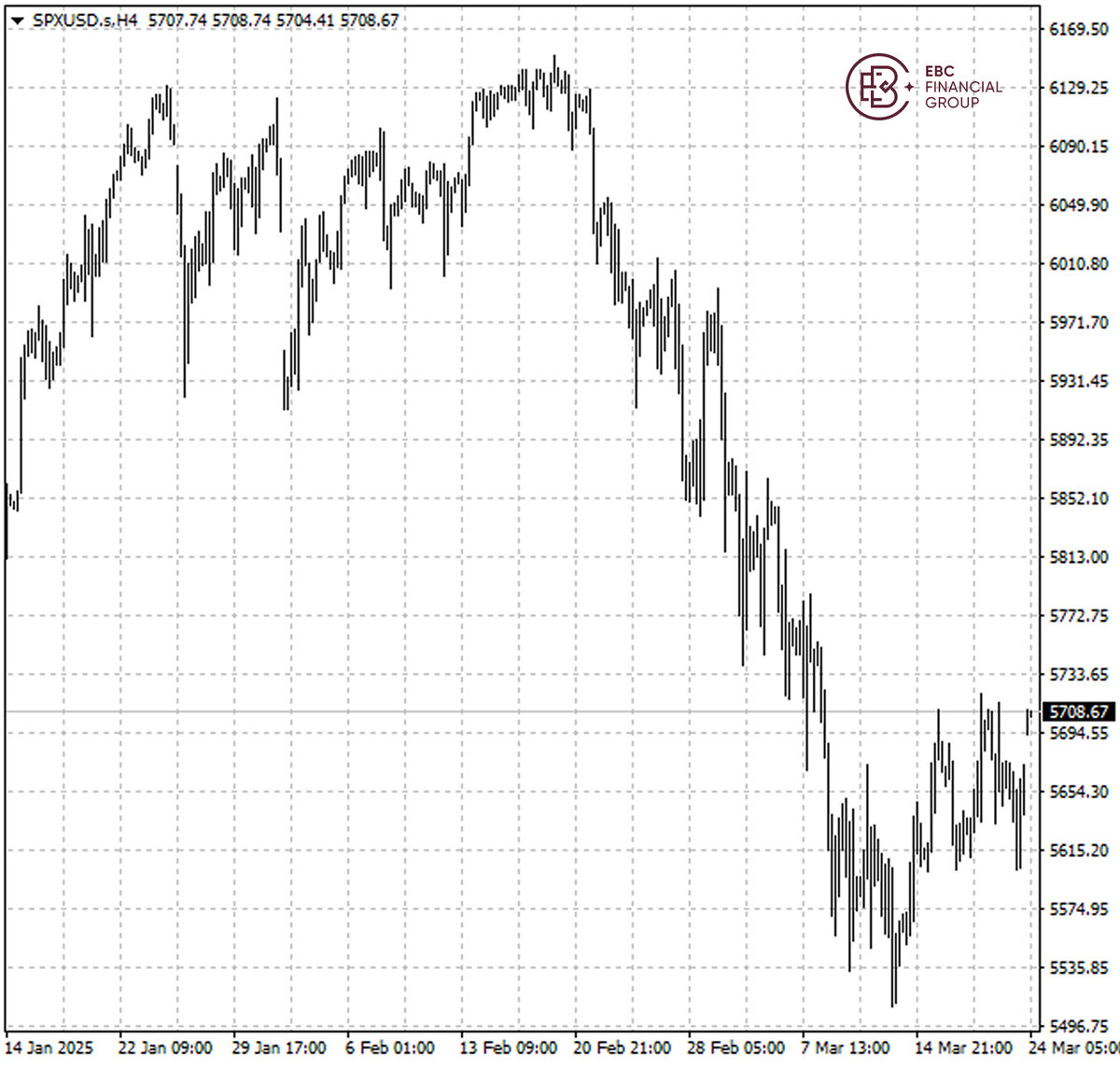

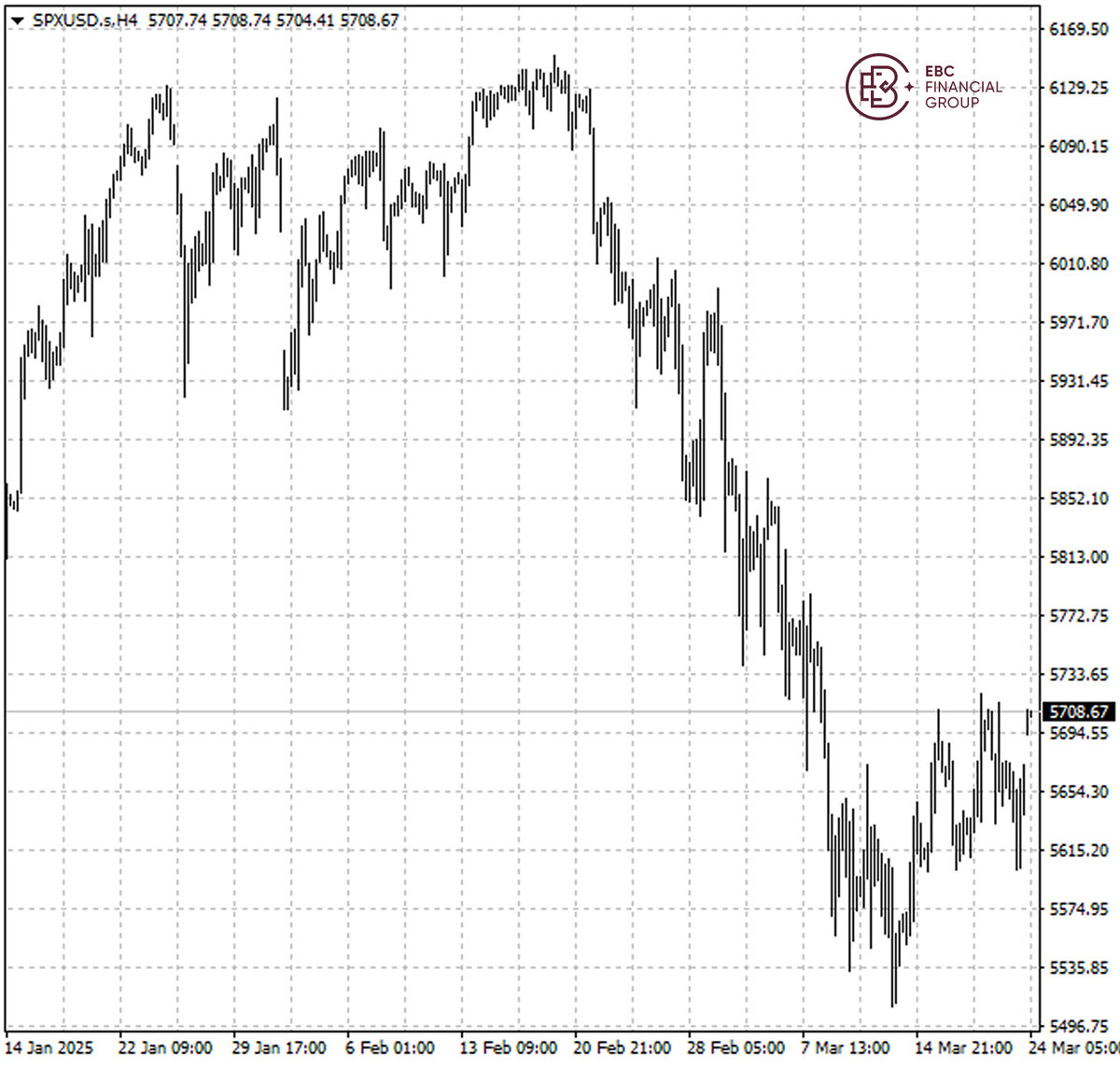

The S&P 500 posted a modest weekly gain, snapping a four-week streak of

declines. The index fell into a correction earlier this month by ending down

over 10% from its February record high.

A number of reports in the coming week will give a fresh read into the

economy, including releases on consumer confidence, after the Fed downplayed

recession risks at last week's meeting.

The recent ructions for both US stocks and the greenback came as Trump's

tariff game has shaken global financial markets and sparked concerns about the

trajectory of the world's biggest economy.

Hedge funds added more bearish positions than bullish ones in March than at

any time since 2020, doubling down on bets that US stocks have further to fall,

according to a Goldman Sachs note.

Their exposure to tech and media stocks hit a five-year low, with some now

shorting the sector, while others have added bearish bets on AI-related shares.

Nvidai was down over 12% year to date.

However, this dynamic was not apparent in Europe and Asia, where hedge funds

simply exited losing trades and stayed away from them, the bank added.

The S&P 500 was stuck in a tight range in the past week, so the risk is

tilted towards the downside as it is trading around the upper end of the

range.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.