Stock market rotation, also known as sector rotation, has emerged as one of the defining themes of 2025, reshaping investor portfolios and market dynamics.

After several years dominated by mega-cap tech giants, funds, sentiment, and economic conditions are shifting towards value, cyclical, and international assets.

In this comprehensive guide, we'll explore the latest data, trends, and strategies investors need to understand and act on this evolving opportunity.

What Is Stock Market Rotation?

Stock market rotation refers to the shifting of investor capital from one sector, industry, or asset class to another in response to macroeconomic changes, earnings cycles, inflation expectations, or changes in monetary policy.

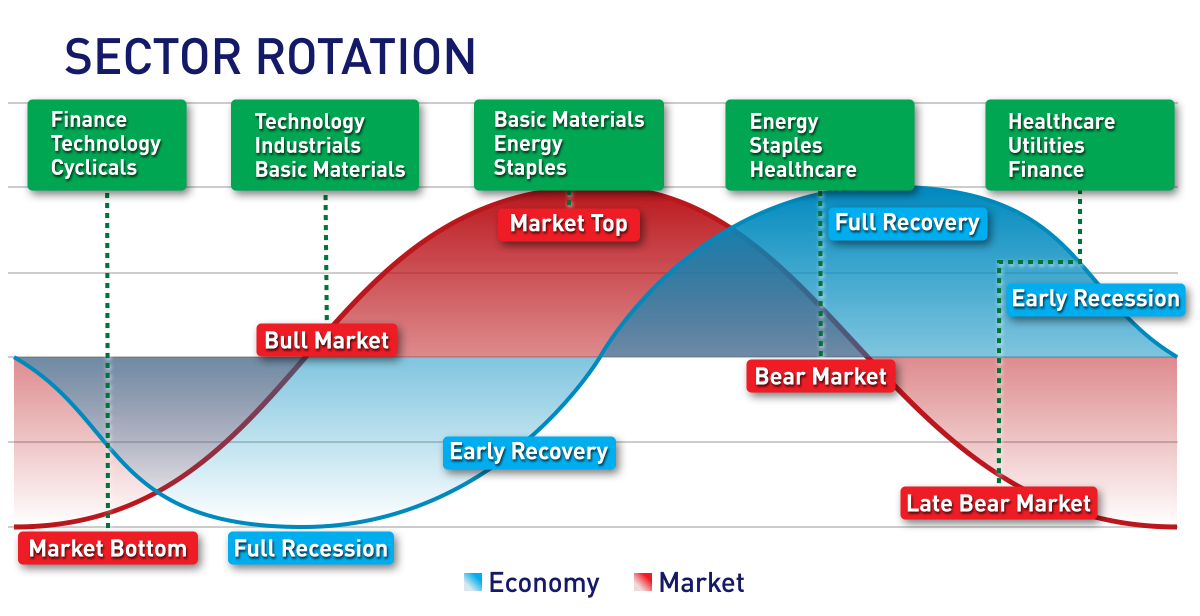

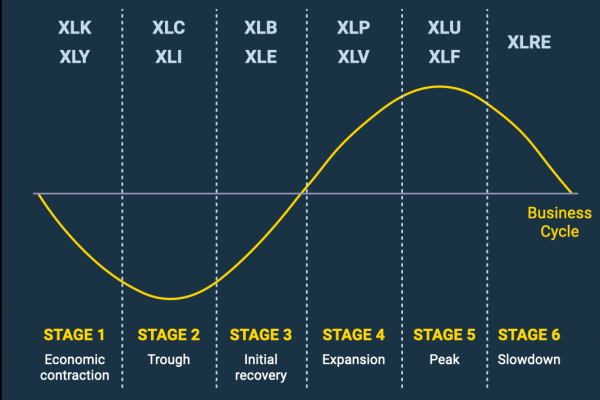

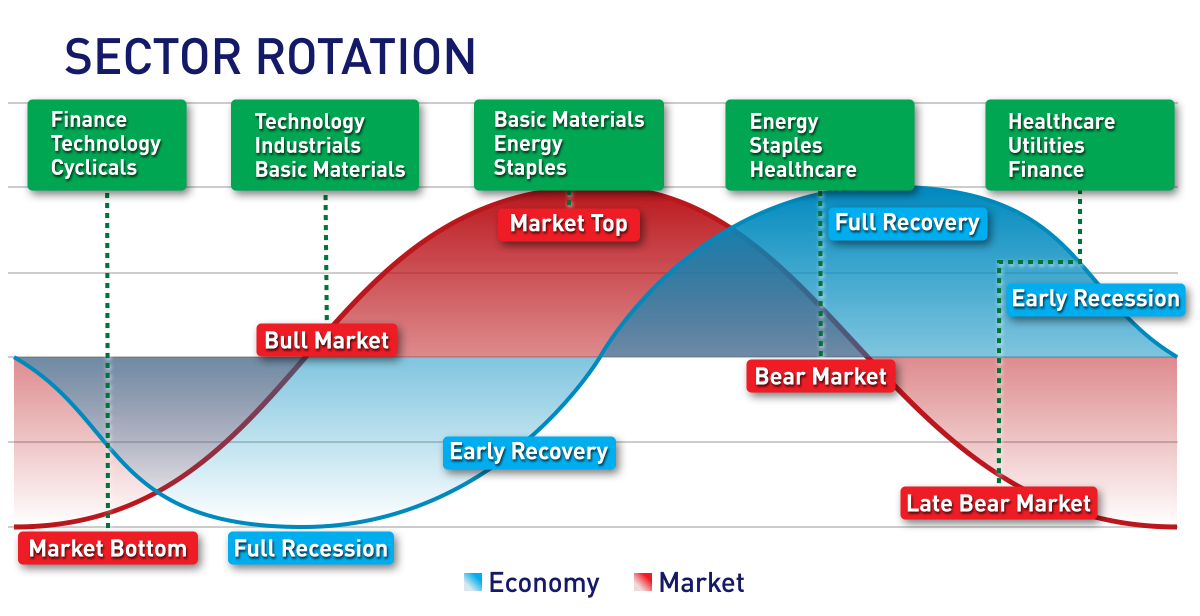

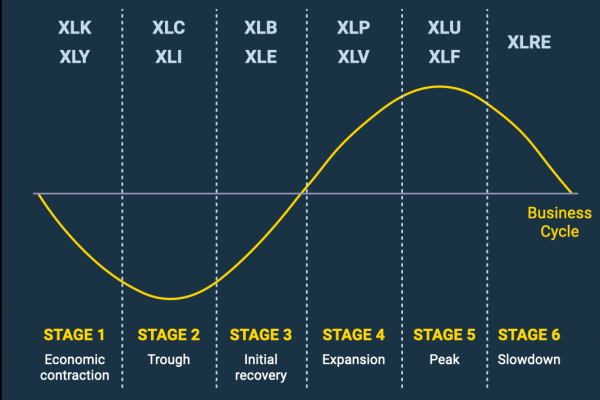

This movement is not random. It often follows a predictable pattern, tied to the business cycle and market sentiment. At different points in the economic cycle, certain sectors outperform while others lag, prompting institutional investors and fund managers to rotate their capital accordingly.

For example, in 2025, the rotation away from growth (especially tech) toward value, cyclical, and overseas markets has gained momentum. Macroeconomic elements, including tariff regulations, inflation rates, interest rate fluctuations, and evolving investor attitudes, have fueled this change.

Phases of the Business Cycle and Sector Rotation

1. Recovery (Early Expansion)

The economy begins to grow after a recession.

Interest rates are low, and consumer confidence improves.

Leading sectors: Consumer non-essential goods, finance, and tech sectors.

2. Expansion (Late Growth Phase)

GDP growth accelerates.

Inflation may increase, and central banks may tighten monetary policy.

Leading sectors: Industrials, basic materials, energy.

3. Peak

Growth slows, and inflation may be high.

Market experiences heightened volatility as earnings strain intensifies.

Leading sectors: Commodities may outperform briefly; defensives start gaining.

4. Contraction (Recession)

Economic activity slows or contracts.

Interest rates may fall as central banks ease policy.

Leading sectors: Utilities, essential goods and medical care

This cyclical behaviour forms the foundation of sector rotation models used by fund managers and savvy retail investors.

Case Study: 2020–2022 Rotation Cycle

The COVID-19 pandemic triggered a dramatic and rapid sector rotation.

Early 2020: Markets crashed, and investors fled to defensives like healthcare and consumer staples.

Mid to Late 2020: Aggressive monetary policy sparked a rally in tech and growth stocks. Work-from-home trends drove capital into software and semiconductors.

2021: As economies reopened, rotation shifted into cyclicals—industrials, energy, and financials—benefiting from rising interest rates and demand recovery.

2022: Inflation concerns and Federal Reserve rate hikes caused rotation out of growth and into value and commodities.

This sequence illustrates how macro events drive rotation, which then sets the stage for broader market trends.

What's Fueling the Stock Market Rotation in 2025?

1. Tariffs, Stagflation, and Economic Policy

Tariffs introduced in April and evolving U.S. trade policy triggered a sharp crash in April, followed by a rotation toward defensive, value-sensitive industries.

2. Investor Sentiment Reaches Extreme Highs

Bank of America found cash levels at a 12-year low (3.9%), triggering a contrarian "sell" signal. But instead of exiting, many are rotating within the market toward undervalued sectors.

3. Macro Trends & Geopolitical Risks

Shifts in the global economy, such as the attention on China and emerging markets, suggest a diminished focus on U.S. dominance and greater diversification. Meanwhile, rising Treasury yields and inflation raise the appeal of financials, utilities, and energy.

Stock Market Rotation Examples in 2025

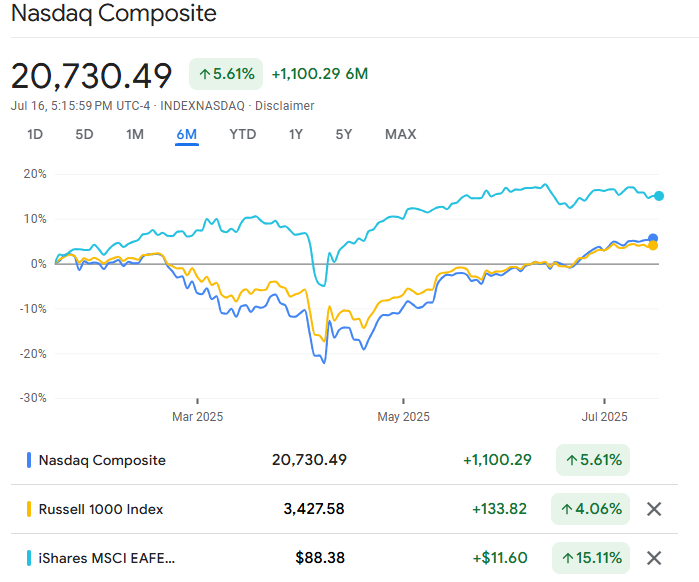

Growth Fades While Value and Foreign Markets Gain

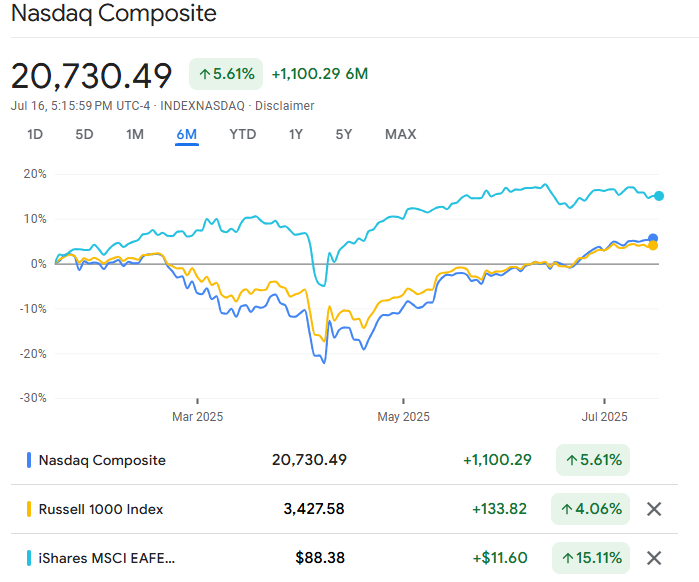

Growth under pressure: The Nasdaq, propelled by major technology stocks, has increased approximately 5–6% since the start of the year, concluding a multi-year growth driven by the "Magnificent 7".

Value holds strong: The Russell 1000 Value index is up about 1.9%, while the MSCI EAFE (international stocks) surged roughly 11% through early March.

Secondary rotation map: Among U.S. sectors, energy, utilities, financials, and industrials have experienced a robust recovery, with some increasing 7–10% in Q1 compared to the S&P 500's decline.

Detailed Sector Dynamics

Technology

Mega-cap leadership fading: The "Magnificent 7" still heavily influence markets, but are giving way to broader participation. Equal-weighted indices trail market-cap peers by ~2% YTD.

Financials, Energy & Industrials

Beyond tech: Industrial and cyclical sectors have gained momentum. Boeing, military suppliers, and energy firms have excelled at the beginning of 2025.

Utilities

Defensive appeal: As interest rates remain well above historical lows, dividend-heavy utilities benefit from steady cash flows. Experts rate the sector as "Market Perform".

International & Emerging Markets on the Rise

International stocks have climbed roughly 10% in the first half of 2025, responding to valuations, cyclical rotation, and growth slowdown in the U.S. Yet U.S. portfolios still heavily favour domestic equities—an opportunity for diversification.

What Investors Should Do During Stock Market Rotation?

Strategy 1: Rebalance to Reflect Rotation

Shift allocations toward diversified value and international ETFs or mutual funds, such as those with exposure to energy, financials, and global equities.

Strategy 2: Blend Growth and Value

Sustain a foundation of quality growth (e.g. technology and artificial intelligence) while decreasing overreliance on mega-cap stocks. Incorporate mid/small-cap value allocation for balance.

Strategy 3: Use Tactical Tools

Sector ETFs and options instruments (such as defensive sector puts) enable tactical, short-term positioning to take advantage of rotation.

Strategy 4: Diversify Globally

Allocate a baseline of 20–30% of equity exposure to international markets—Europe, Asia, and emerging economies—to hedge U.S.-centric risks.

Forecast & Outlook

Analysts expect this rotation to persist through late 2025. Profits are expected to expand beyond major technology companies, although policy and macroeconomic factors remain mixed.

As sentiment-driven volatility ebbs, opportunities within value, cyclical sectors, and emerging markets could continue to reward diversified investors.

Risks and Caveats

1) Valuation Stretch

Despite rotation, overall equity valuations remain high—with forward P/E ratios near cycle highs—even after the April crash.

2) Trade & Policy Uncertainty

Tariffs remain fluid; renewed escalations could spark new volatility, especially in sensitive sectors such as autos and consumer discretionary.

3) Concentration Risks

Large-cap tech volatility still looms—while rotation is underway, about 40% of the S&P 500's value remains in just 10 stocks.

Conclusion

In conclusion, the 2025 market rotation marks a pivotal shift from narrow, tech-led rallies to broader-based economic participation across value, cyclical, and global assets.

Although risks persist in valuation, trade policy, and sentiment extremes, the present situation offers a favourable opportunity for investors to rebalance, diversify, and implement tactical approaches.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.