European shares ended flat on Monday as caution prevailed, even as hopes grew

that Trump could opt for a softer approach with his tariff policies in the

coming weeks.

Nearly half of the strategists in a monthly Bloomberg survey have raised

their forecasts for the market with less than a third of respondents expecting a

pullback for the rest of the year.

The region is benefiting from several factors. German lawmakers passed a

landmark spending package last week, unlocking hundreds of billions of euros for

defence and infrastructure.

Besides markets expect two more interest-rate cuts from the ECB this year,

taking interest rate to 2%. That will keep a wide gap with the Fed, favouring

borrowers in Europe and drawing money into stocks.

A net 39% of respondents were overweight European equities relative to global

markets, up from 12% last month and the biggest overweight position since

mid-2021, according to the latest BofA fund manager survey.

A meeting between Russian and US officials on a partial ceasefire in Ukraine

ended after 12 hours of negotiations in saudi arabia, Russian state media

reported, with a joint statement expected later today.

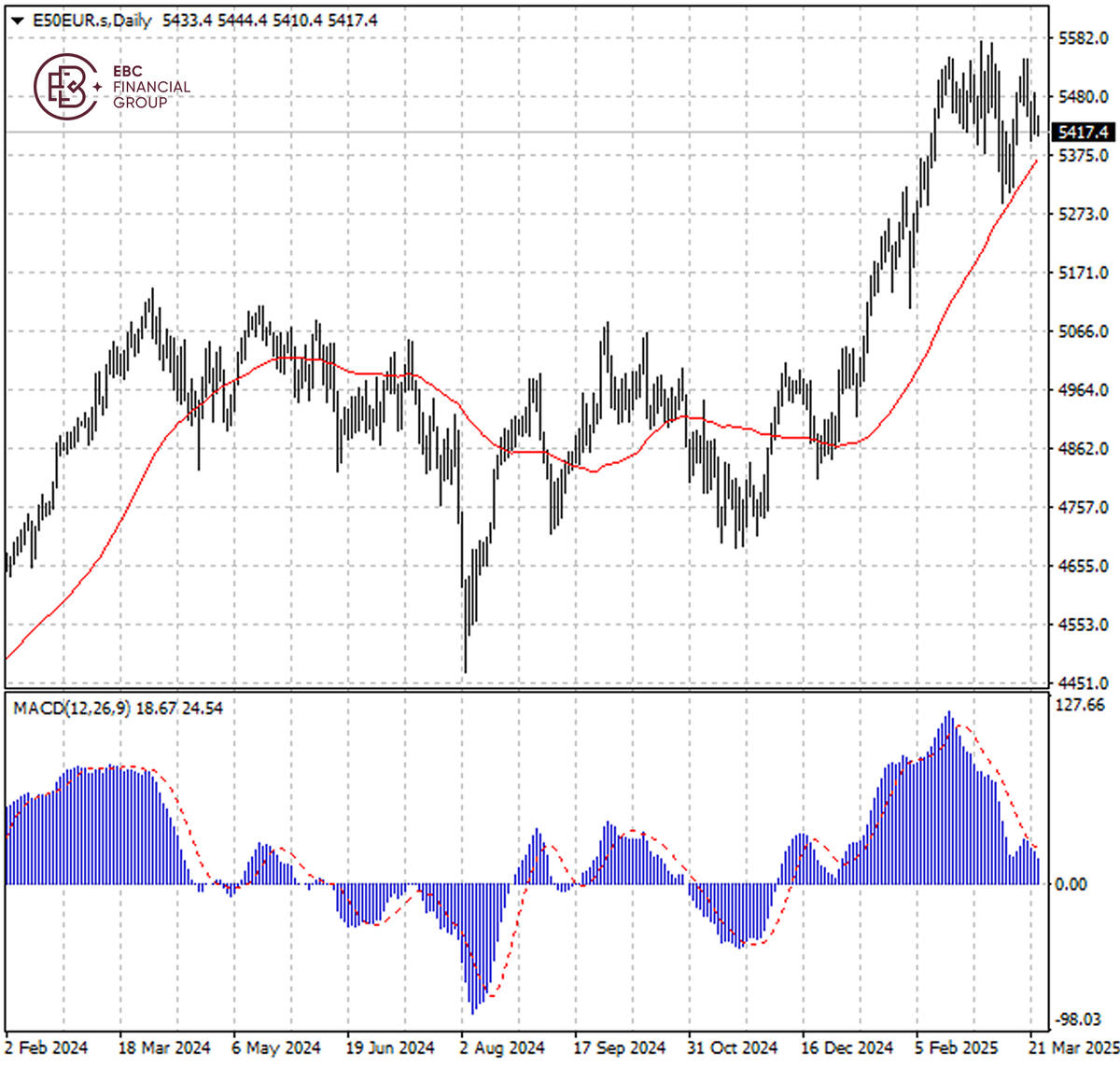

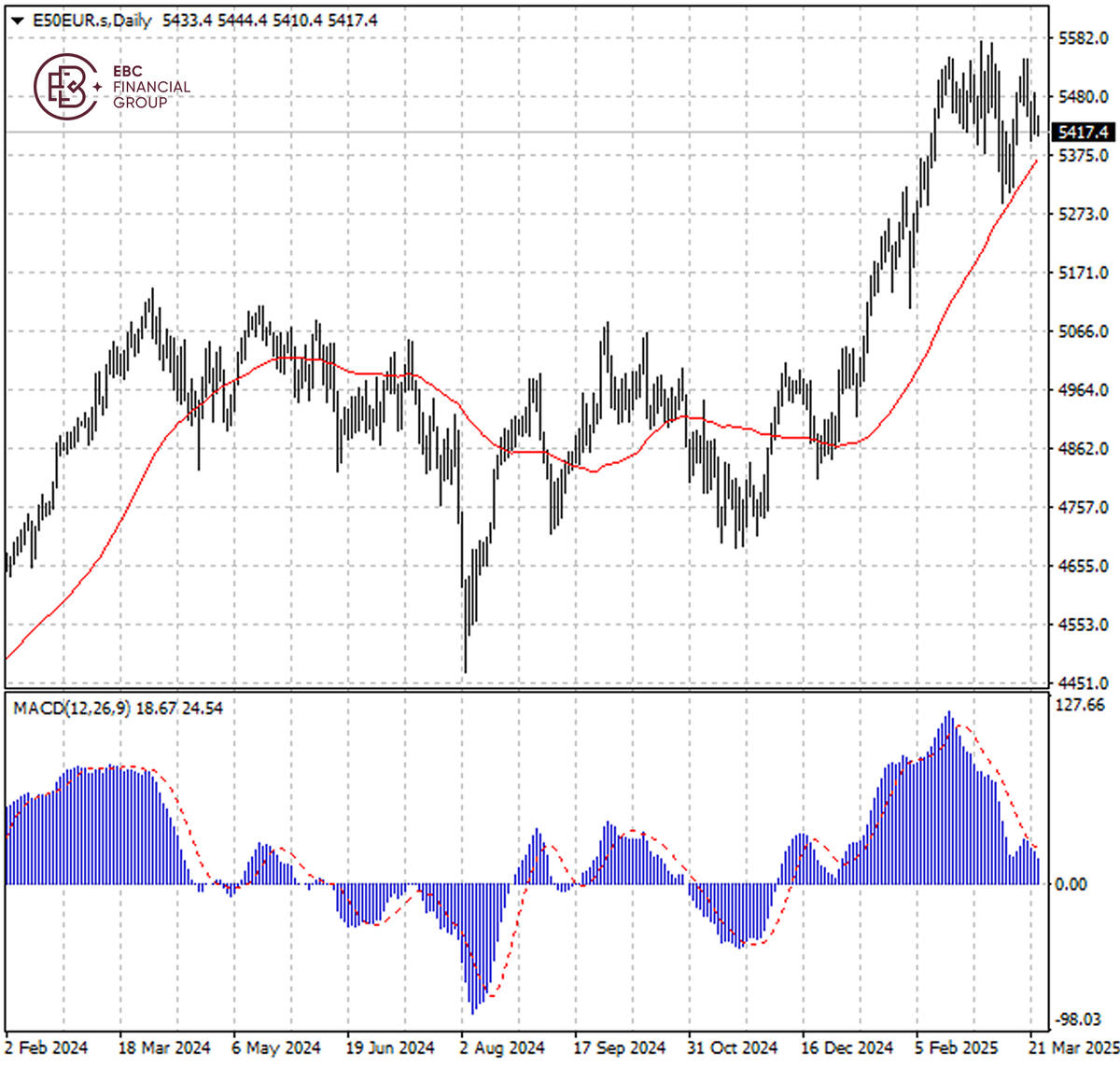

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the

upside momentum has eased. As such the index could dip below 5,400 in the

following sessions.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.