Gold prices have surged to record highs in September 2025. driven by a combination of factors including expectations of U.S. Federal Reserve interest rate cuts, a weakening U.S. dollar, and heightened geopolitical uncertainties.

Gold Prices Reach Record Highs

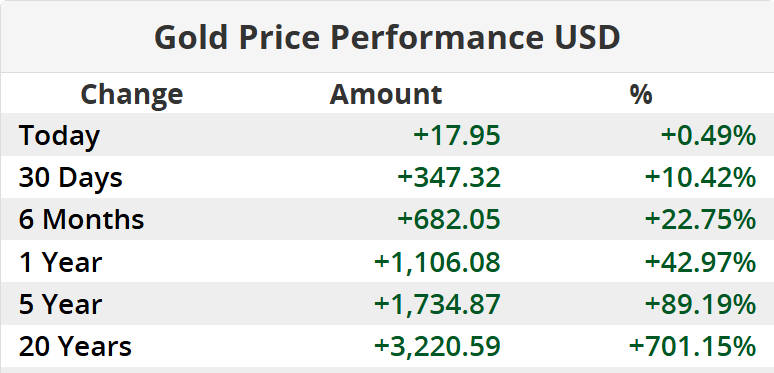

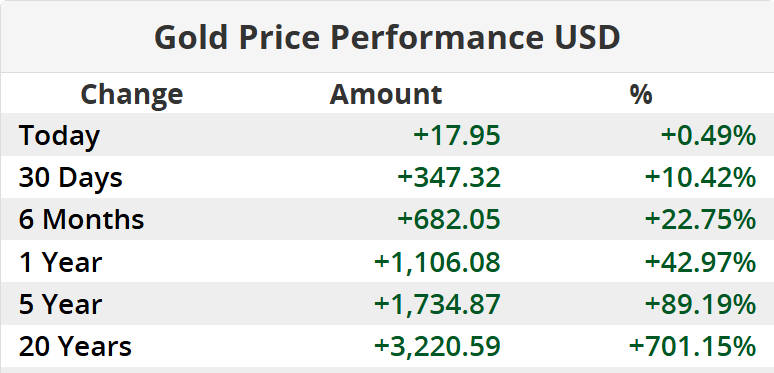

As of September 16. 2025. spot gold prices reached $3.697.12 per ounce, marking a significant increase from the previous year. U.S. gold futures for December delivery remained steady at $3.720.10.

This surge in gold prices is attributed to a weakening U.S. dollar and mounting expectations that the Federal Reserve will cut interest rates at its upcoming policy meeting. Analysts suggest that a dovish Fed stance could propel gold prices even higher.

Key Factors Influencing Gold Prices

1) Anticipated Federal Reserve Rate Cuts

Market participants are anticipating a potential interest rate cut by the Federal Reserve, possibly by 25 basis points, with a slim chance of a 50-basis-point reduction.

A lower interest rate diminishes the opportunity cost of holding non-yielding assets like gold and pressures the dollar, making gold more attractive to investors using other currencies.

2) Weakening U.S. Dollar

The U.S. dollar has weakened, contributing to higher gold prices. A weaker dollar makes gold less expensive for holders of other currencies, thereby increasing demand.

3) Geopolitical Uncertainties

Ongoing geopolitical tensions have heightened demand for gold as a safe-haven asset. Investors seeking to protect their portfolios from potential risks are turning to gold, further driving up its price.

Market Outlook

Analysts suggest that while gold prices are experiencing a strong upward trend, a short-term correction of 5-6% is possible before gold continues its ascent toward breaching $4.000 per ounce in 2026. Some forecasts place it above $4.200. Gold's status as a hedge in times of economic and political instability, thriving particularly in low-interest environments, supports its long-term bullish outlook.

Silver's Performance

Silver has also benefited from gold's rally, with prices reaching $42.50 per ounce, the highest level in 14 years. The surge is attributed to heightened geopolitical instability and growing demand from the semiconductor sector, where silver is valued for its superior conductivity.

Investment Considerations

Investors interested in gaining exposure to gold may consider exchange-traded funds (ETFs) such as the SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and VanEck Gold Miners ETF (GDX). These ETFs offer various benefits based on cost-efficiency, performance, and trading ease.

Conclusion

The current surge in gold prices is driven by expectations of Federal Reserve rate cuts, a weakening U.S. dollar, and heightened geopolitical uncertainties. While a short-term correction may occur, the long-term outlook for gold remains bullish, supported by its role as a safe-haven asset in times of economic and political instability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.